FX20

PlusContext: Silver is currently trading within a Macro Range dated back from 2014 to now. This Range is based off monthly candles which suggest they are very wide apart. Currently, price is trading between 75% and 50% of the range. Recently, Silver breakout which seen a massive rise and is now facing some resistance at 17.50. There are 2 ways to get onboard the next...

Context: Gold is currently trading within a Macro Range dated back to 2011 to 2013. This Range is based off monthly candles which suggest they are very wide apart. Currently, price is trading between 75% and 50% of the range. Recently, Gold breakout which seen a massive rise and is now facing some resistance at 1750. There are 2 ways to get onboard the next...

Key levels Identified - Black line : Monthly Resistance - Maroon line : Monthly Open Weekly Timeframe - Third retest of Monthly Resistance level - Last week candle close as an inside bar suggests consolidation, Expansion might be coming soon Daily Timeframe - Confirmed Bearish Pinbar with a close below its low - Local 0.618 Fibonacci Retracement level Idea:...

Key Levels Identified * Blue line - Previous 5 Year Low * Maroon line - Monthly Open * Dotted Purple line - March's Low * Dotted Red line - Hourly Supply Weekly Timeframe - 3 Consecutive closes above Previous 5 Year Low - Last week candle close as a bullish pinbar Daily Timeframe - Daily candle unable to stay below March's Low. Price gets back above...

Forecast: I am expecting Bund to continue its uptrend going forward next 2 weeks. Currently, this week weekly candle close as an inside bar, suggesting consolidation period. Bund will either expand this coming week or next week. First: Expansion next week, How to get in? Trade entry: Long the Daily demand zone, with stop below Confirmation: Reclaim last week...

Forecast: BTC tends to consolidate and rally. Once it does rally, it has little to no pullbacks. Final stage, will be accelerated climb followed by a mid-term correction. Masses common reaction: - During consolidation period, wants BTC to dip lower to buy cheap BTC, - During rally, wants BTC to retrace to get a safe entry. - Only during accelerated climb, FOMO in...

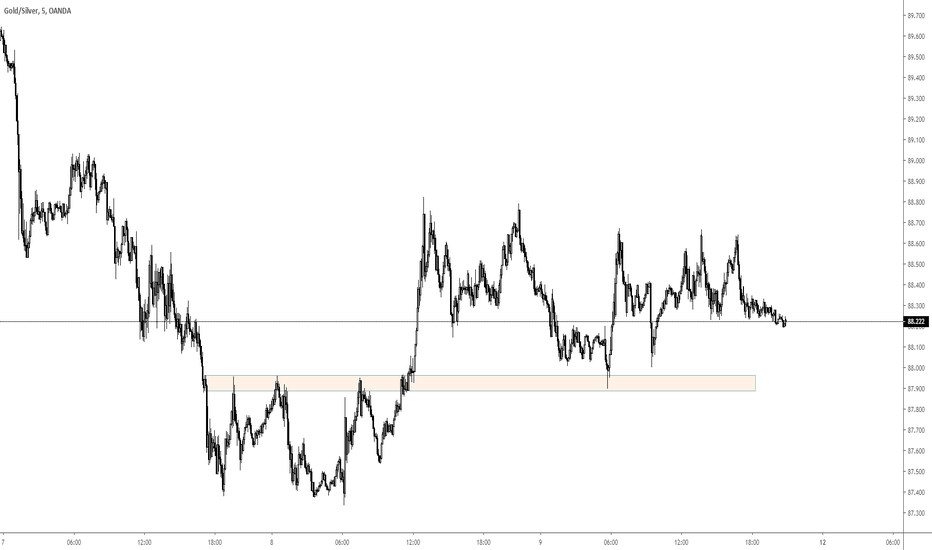

Some techniques i like to employed into my trading is: - Creating a range using Last week Price Action - Creating a range using Monday Price Action Key levels Identified: 1) Last Week High 2) Weekly Open 3) H4 Resistance turns support 4) Monday High

Macro trend: - Yearly/Monthly: Bullish, just broken out of consolidation with higher lows - Weekly: Bullish, Just broken out of 6 week consolidation 2 ways to get in on a trend: - Wait for the retracement and buy the retest - Buy near the bottom of the consolidation Key levels outlined: 1) Last week Range High 2) H4 consolidation (Mark the top and bottom) 3)...

- The setups shown in this video are all in Hindsight. I did not take all the setups detailed in the video. - Learn to train yourself to see these examples by going through Price Action from the past and you will be able to see these form in real time and react accordingly. Common names people give to thses setups: Supply and Demand, Support and Resistance,...

Check out: 1) Last week trade analysis for determining BTC bias - 2) CME BTC Quotes - www.cmegroup.com Key levels outlined: 1) 10609.5 - June Monthly Mid Range - Thick Black lines 2) 10800 - 3rd Quarter Open - Thick Blue line 3) 11513 - Previous weekly level 4) 11746.1 - Weekly Mid Range Confluence for trade idea: 1) June Monthly Mid range 2) 3rd Quarter...

What does July monthly candle close means? What will happen for the next couple months heading into 2020? How do you take advantage of this information? Thesis: Consolidation period in August and September. Mark up begins in October, creating the high of 2019, but not breaking above BTC All Time High. Reasons: 1) Key Monthly Level - 9900 (July candle retested...

In a strong trending market like GAS currently in, support and resistance flip happens very often. Although other chart setups might not be as clean as this example, this technique can be used for all markets. Broken Support turns into Resistance. Broken Resistance turns into Support. So how do we determine if a Support has been broken or not? 3 ways to view...

This is a mid-term short play that i spotted on S&P 500 that will most likely play out within a month. This is definitely not a scalp or swing trade. Key levels marked out on chart: 1) 2018 High 2) Quarterly Opens 3) Monthly Open 4) Grey box - Weekly block that provided support previously Bearish Bias: - Monthly Bearish Divergence : Price keep printing Higher...

Quick summary of how i usually view the markets. In terms of market movement, i tend to view them as either Ranging or Trending market environments. - Trending environment means that price has a general direction it is heading based on High Time Frames market structures. BULLISH Market structure refers to higher highs and higher lows, while BEARISH Market...

Thick pink line - High set in August of 2013 Weekly range - Refer to price oscillating within the range with no clear close above or below the range Last week range - Create another range using last week high and low Thick blue line - 3rd Quarter Open (July's Open) Liquidity pool - Refer to areas of interest, as i believe most people put their stops behind...

Dotted Horizontal - Key Monthly Level Daily pivot - Acted as resistance and support multiple times H4 Flag - Last H4 consolidation before taking out the highs, significant in my opinion I tend to view price in ranges, help me to better visualise where price is more likely to go. Enjoy and Peace!

Quasimodo pattern www.icmarkets.com

1) Long at 195.98 (Previous Weekly support + Daily Demand zone + 200 Daily Moving Average) - 3 Levels of confluence 2) Long at 229.7 (Latest Weekly Range Low + Daily Pivot - Acting as both support and resistance on the Daily chart) Take note: We should not be overly bullish as well as there is a shift in Market structure. - We finally put in a lower low on...