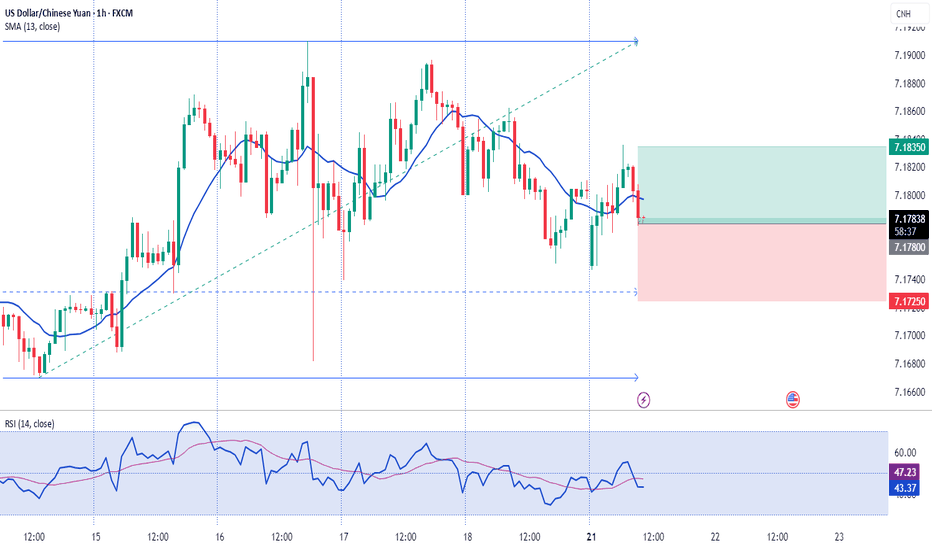

⬆️ Buy Entry: 7.17800 🟥 Stop Loss: 7.17250 🟩 Take Profit: 7.18350

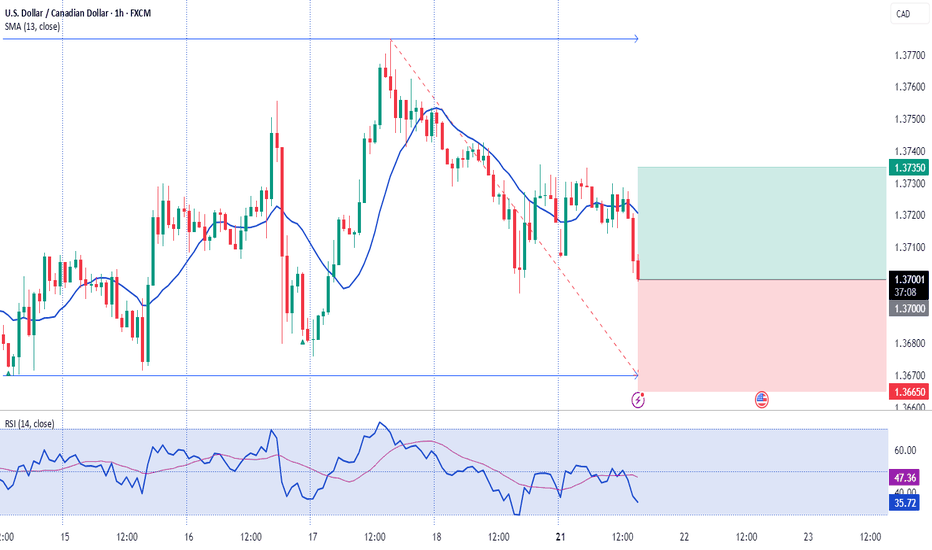

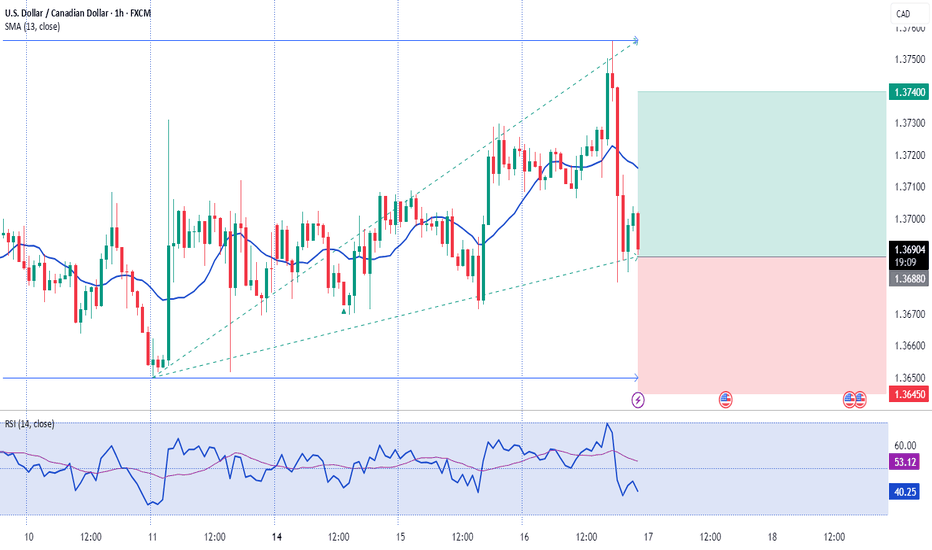

⬆️ Buy Entry: 1.37000 🟥 Stop Loss: 1.36650 🟩 Take Profit: 1.37350

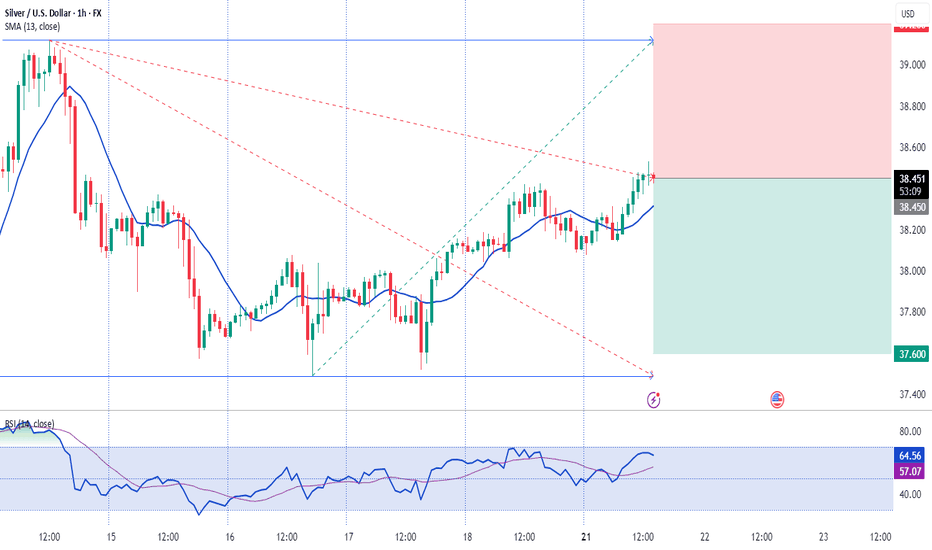

⬇️ Sell Entry: 38.4500 🟥 Stop Loss: 39.2000 🟩 Take Profit: 37.6000

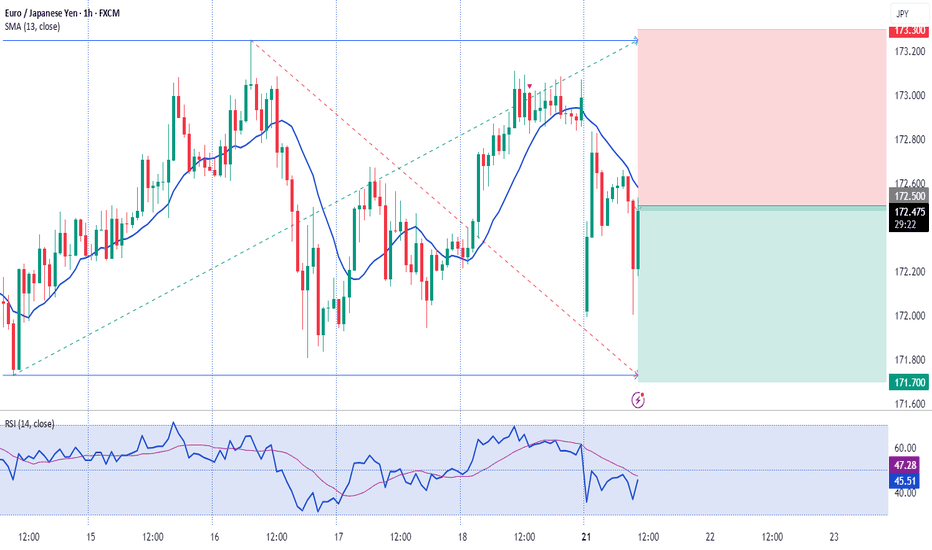

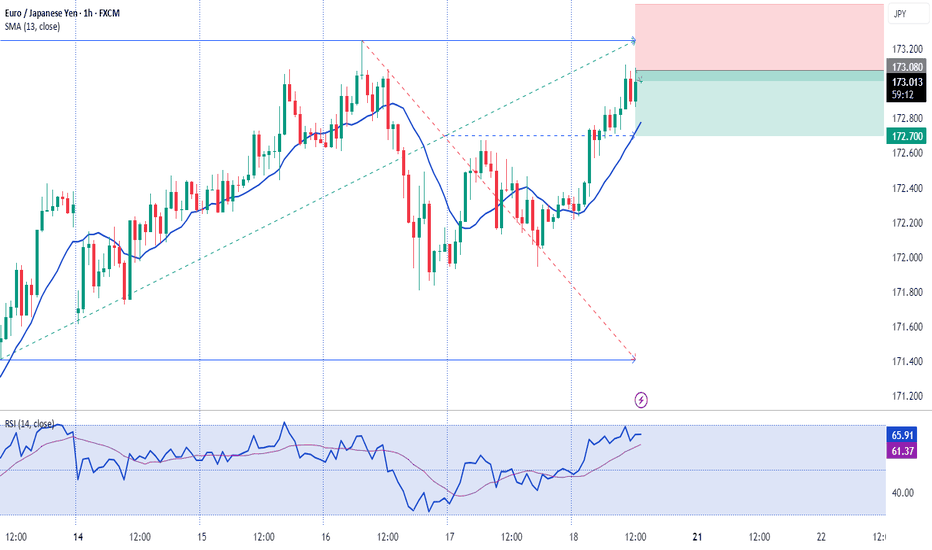

⬇️ Sell Entry: 172.500 🟥 Stop Loss: 173.300 🟩 Take Profit: 171.700

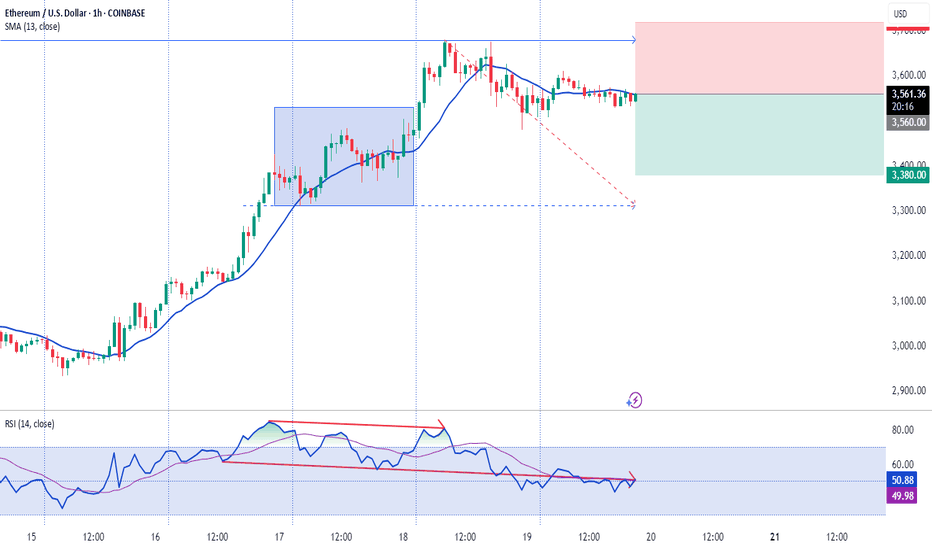

⬇️ Sell Entry: 3560.00 🔴 Stop Loss: 3720.00 🟢 Take Profit: 3380.00

SELL 173.080 | STOP 173.460 | TAKE 173.700 | Downward movement.

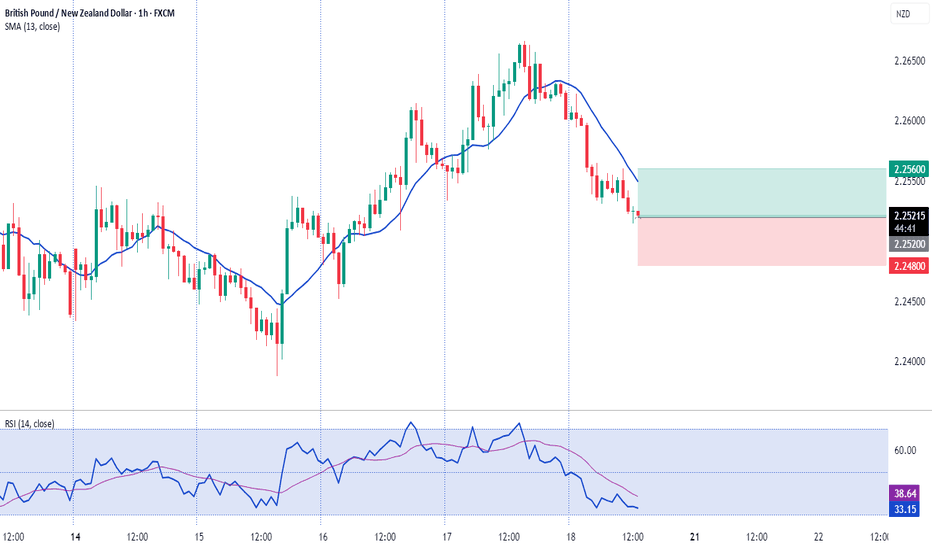

BUY 2.25200 | STOP 2.24800 | TAKE 2.25600 | Upward.

BUY 17.6800 | STOP 17.6300 | TAKE 17.7300 | Upward.

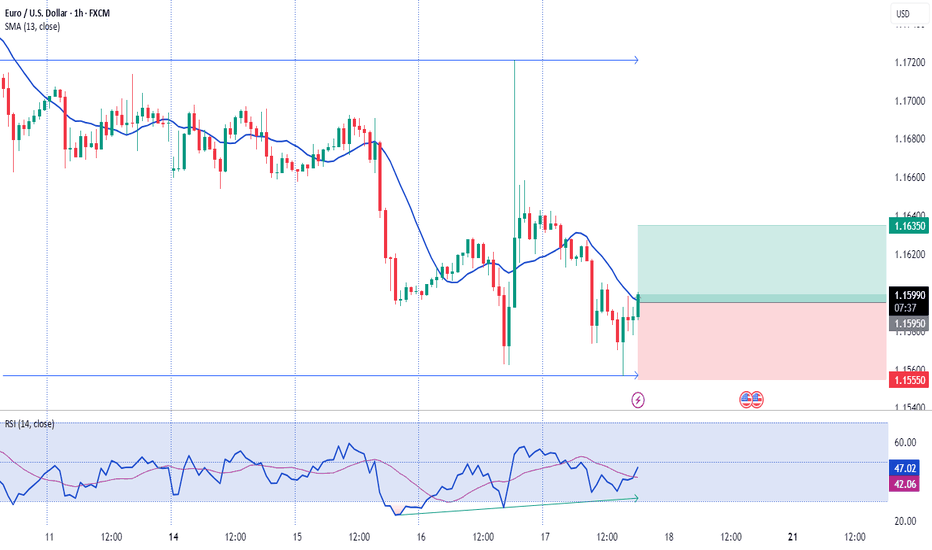

BUY 1.15950 | STOP 1.15550 | TAKE 1.16350 | Upward price movement.

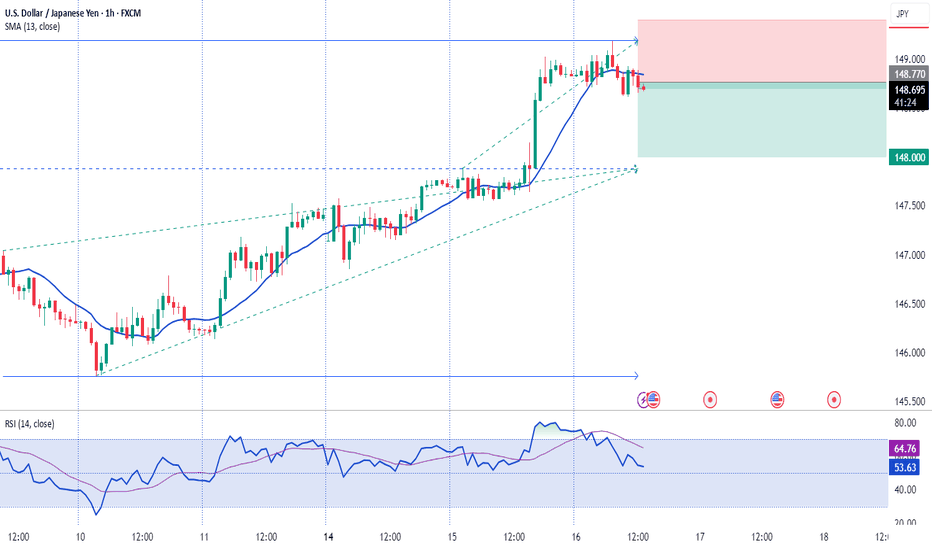

SELL 148.750 | STOP 149.250 | TAKE 148.250 | Downward price movement.

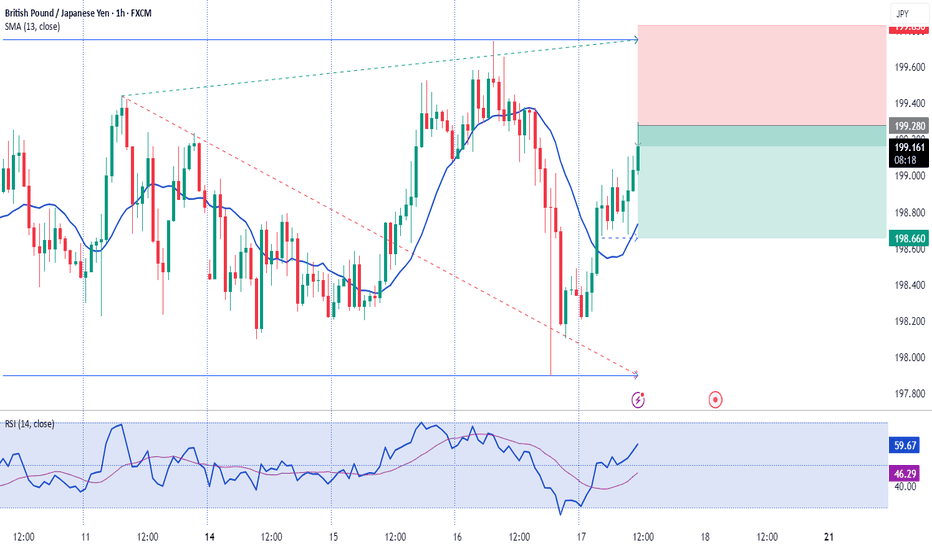

SELL 199.280 | STOP 199.830 | TAKE 198.660 | Downward price movement.

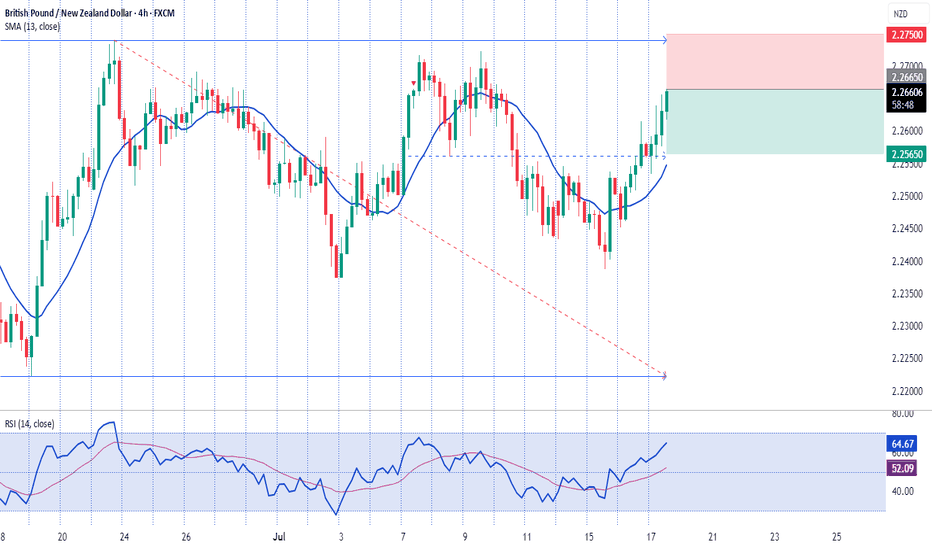

SELL 2.26650 | STOP 2.27500 | TAKE 2.25650 | Downward price movement.

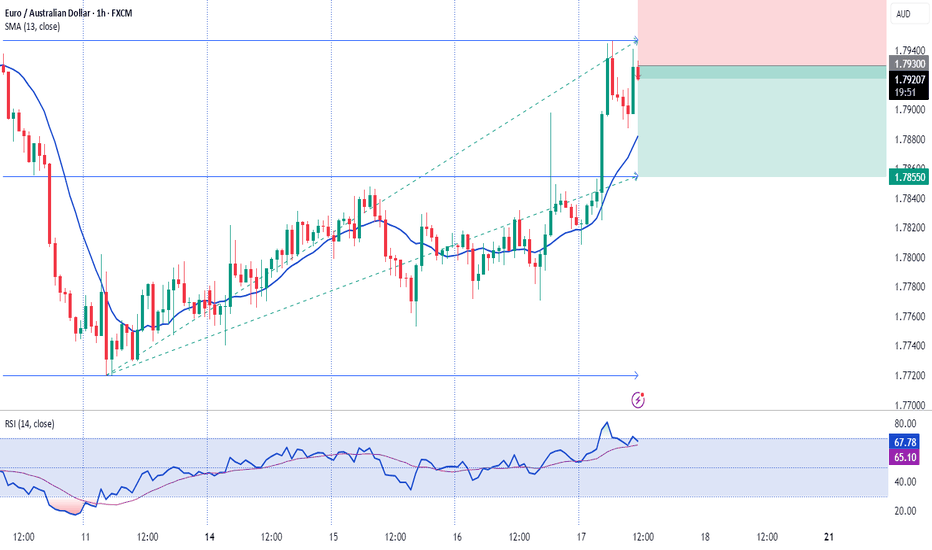

SELL 1.79300 | STOP 1.79930 | TAKE 1.78550 | Downward price movement.

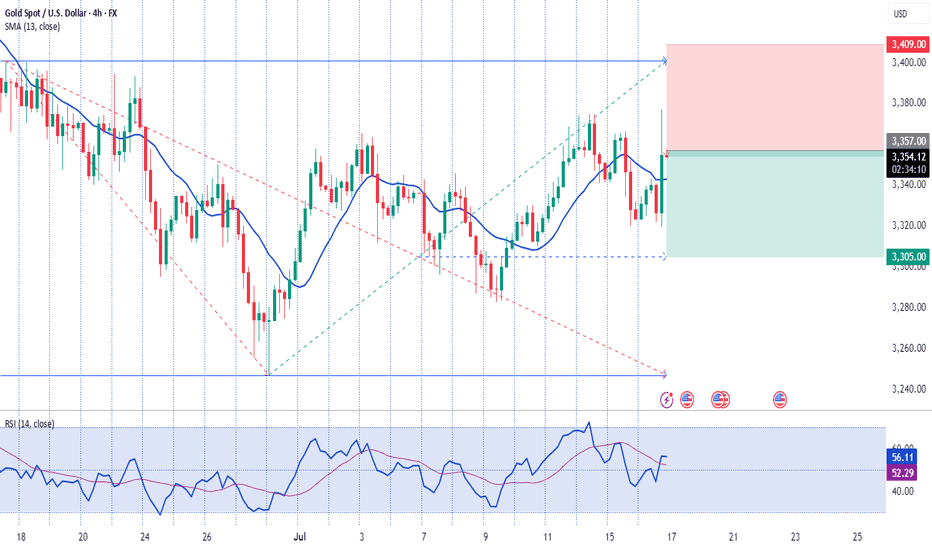

SELL 3357.00 | STOP 3409.00 | TAKE 3305.00 | Downward price movement.

BUY 1.36880 | STOP 1.36450 | TAKE 1.37400 | Upward price movement.

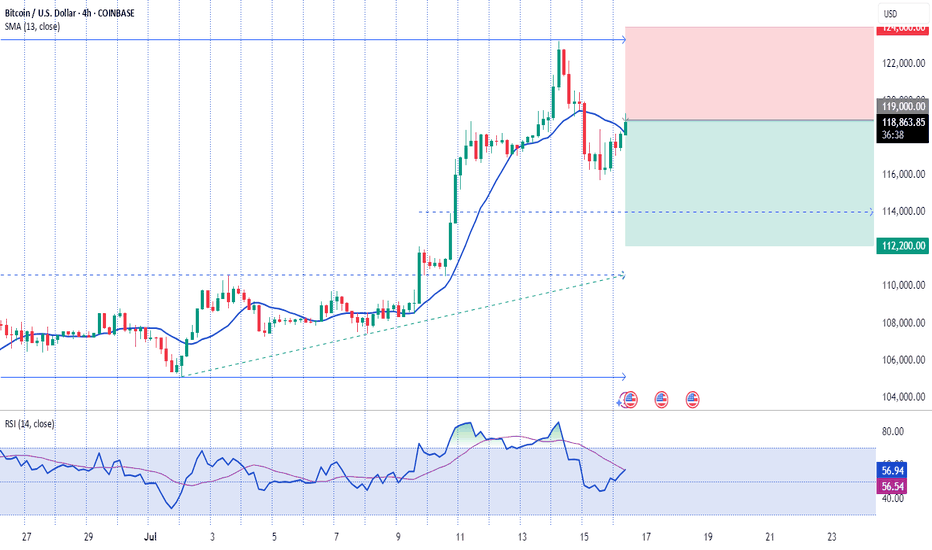

SELL 119000.00 | STOP 124000.00 | TAKE 114000.00 - 112200.00 | Downward price movement.

SELL 148.770 | STOP 149.400 | TAKE 148.000 | ⏳ Close the trade in profit or move Stop Loss to breakeven after the price passes +25 pips.

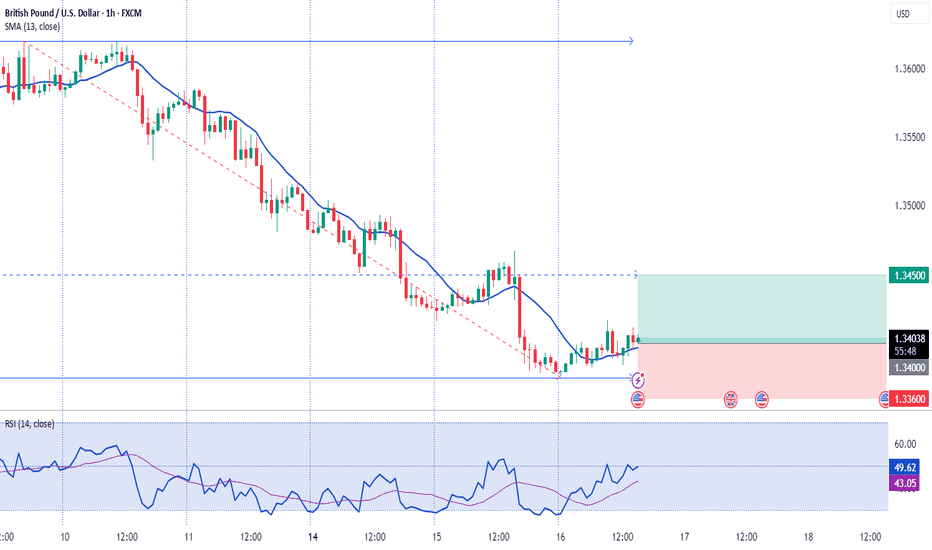

BUY 1.34000 | STOP 1.33600 | TAKE 1.34500 | ⏳ Close the trade in profit or move Stop Loss to breakeven after the price passes +25 pips.