We discussed the 5-year bull cycle that starts off every 20-year cycle. We identified that the current 5-year bull cycle will be one of the wildest in the history of the DJIA market by virtue of the current energy level within the log expansion. We will start a new progressive series to discuss the current 20-year cycle in motion. First we will look closely at...

Meta target reached 746, the level in our previous post. The correction is currently in progress and by the numbers an aligning bottom within the growth sequence puts the bottom at 485 level. An extended bottom below 485 will see price bottoming at 413 or 385 levels. Trade safe

The top is not yet, one more heavy swing up soon buy more and hold The panic will end and all the bulls with step forward again soon Buy...

Sell for the short range, price is bound to make a bottom on the level indicated for a reverse bull trend that will last multi-months. Trade safe

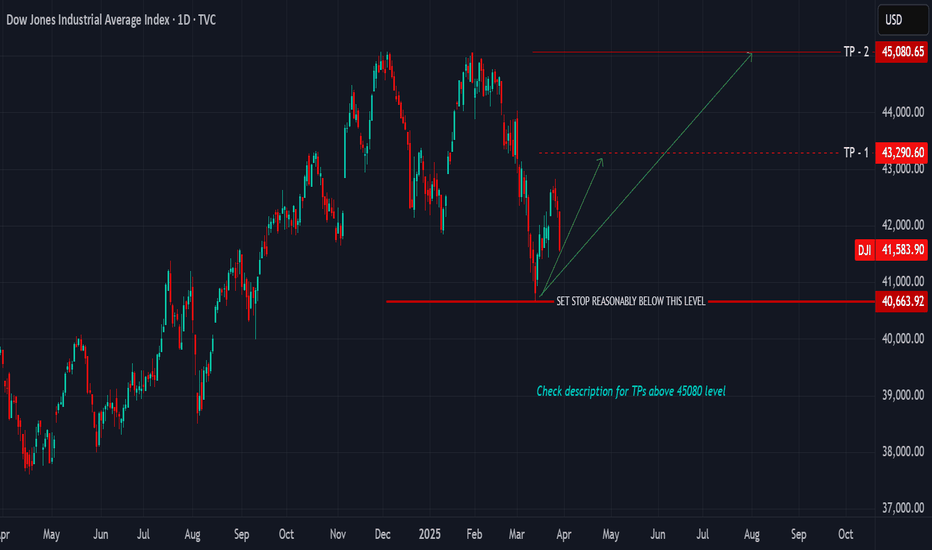

Buy the pivot level. hold for the last 7-month bull run until October 2025. Price and time cycles suggest that price will peak in October 2025 and a second swing high in March 2026 for the midcycle correction. We would look for the top at 26k Buy every big tech, buy the major stocks, buy, buy...... The 7-month cycle from March to October 2025 will be the second...

Tesla reached +487 points from the primary low, we made several publications about this level and what lies above and below it, the significance of this level and when they show up on time and price schedules. Below are some shots of this monster level We would take a tight long entries with targets at 385 price level. Manage risk responsibly

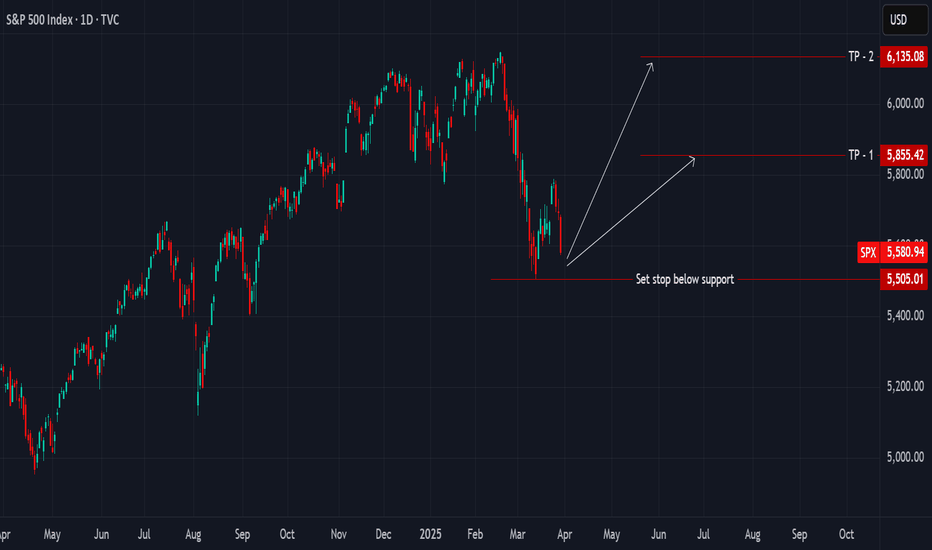

Price is scheduled to break above the current high for a 7-month run, price top is expected between 6588 and 6680 range for a steep correction. Tariffs and recession chants will have their day but history shows post war cycles never go south. Trade safe, good luck

There are the current turmoil by tariffs and perceived recession, yet, the cycles strongly support a further advance from the March lows until October 2025. The bottom in March 2020 formed the base for the 5 year bull cycle nested within the larger 13 year cycle. PRICE The 2020 crash low formed at 18213.65, the decline in 2022 formed a bottom at 28660.94. We...

Price on short reached a resistance level and is expected to make a minor correction within a Phi range. Use a reasonable stoploss rane, trade safe

Price has been trading tops and bottoms within well defined harmonic forms. The third major top was at 68997.75+/- level and corrected to a bottom at 15473.78 on 21/11/2022. From the primary bottom on 05/10/2009 to this bottom we have a timeline 685 weeks forming the horizontal x-axis and price change +689.9775 the vertical y-axis. 05/10/2009 - 21/11/2022 = 4795...

We had a previous post about the price levels above 4878, we also found the time and price subdivisions that connect the significant tops and bottoms in the past and what to expect forward. We also marked the 965 and 1545 levels as the variance of 1.0 and 1.618 expansion from the primary bottom. We made a top projection at 4106 level forward from the 1545 level...

We would look at the 20 year cycle in the stock market, there are two individual 20-year cycles running together at a time. One cycle defines tops and the other identifies the major market lows. We would also look at the 20- year periodicity of repeating market fractals and the 5-year bull cycle that commences at the beginning of each 20-year cycle. In subsequent...

On an hourly timeframe price is expected to make a small correction back to the TP level on Phi Trade safe, good luck

Price and time following a fractal from the past Trade safe, good luck

Discussing the 10-year cycle we have a beginning point in January of year x1, here year one will start from January 2021 to January 2022. The complete Decennial cycle ends in January 2031, a 10-year or 521 weeks cycle. There are significant subdivisions within this cycle that repeat consistently in all previous cycles, that will be for another discussion. Today...

Short to target level with reasonable stop loss Trade safe Good luck

One for the future, buy and hold for targets at 48.2+/- Price has completed one 13-year cycle and the first half of the next cycle will see a gradual bull trend completing the 7-year cycle. Trade safe, goodluck

Nothing much to say about this chart except that it is an interesting chart. The entire trend from the top is strikingly a repetition of the DJIA trend from 1966 to 1974 adjusted against inflation squeezed into a time function of 1 : 0.6 If ever battery cars will be a thing then PLUG is one of the main players position for massive growth. Buy more with cost...