Falcon-Trading-Signals

Gold faced significant resistance near the $3,500 psychological barrier, with intraday highs reaching $3,499 before a swift pullback of nearly $60. This sharp reversal reflects a classic overbought correction, suggesting that bullish momentum is fading and that the market may be entering a short-term consolidation or retracement phase. From a sentiment...

Gold continues its intraday slow upward trend, with price action now firmly above the psychological $3,400 level. This sustained bullish momentum suggests a potential extension toward the next technical resistance zone around $3,419. While the $3,419 level could act as a short-term cap, the strength of the prevailing trend may limit its effectiveness. In this...

Sentiment Misjudgment: A significant number of market participants misread the price action, anticipating a technical pullback based on historical precedent. However, gold defied expectations, breaking to fresh all-time highs, indicating a departure from traditional market behavior. Recent Price Performance: Gold has rallied from $2970 to $3380, registering a...

Gold is currently undergoing a technical pullback near the psychologically significant $3350 level. Historically, price action around major round-number thresholds—such as $2950, $3050, and $3250—has been followed by corrective moves, a pattern that appears consistent. If this correction concludes with another $150–$200 upside swing, it would reinforce the...

Market Structure Analysis: Reversal Signal: Gold recently surged to a new high of $3,357.6, then quickly reversed and broke below the early-session low, forming a classic “bull trap” or false breakout, suggesting a technical correction could follow in the short term. Historical Pattern Recurrence: The current price action mirrors the April 11 and April 3 market...

Market Structure: Gold has rallied toward the $3,275–$3,293 resistance zone, which may act as a distribution level, potentially signaling a short-term top. Cycle Timing: Today marks the 34th trading day since the rally began from $2,832 (Feb 28), and The 8th trading day since the leg from $2,956 (Apr 7) — both are typical cycle inflection points, increasing the...

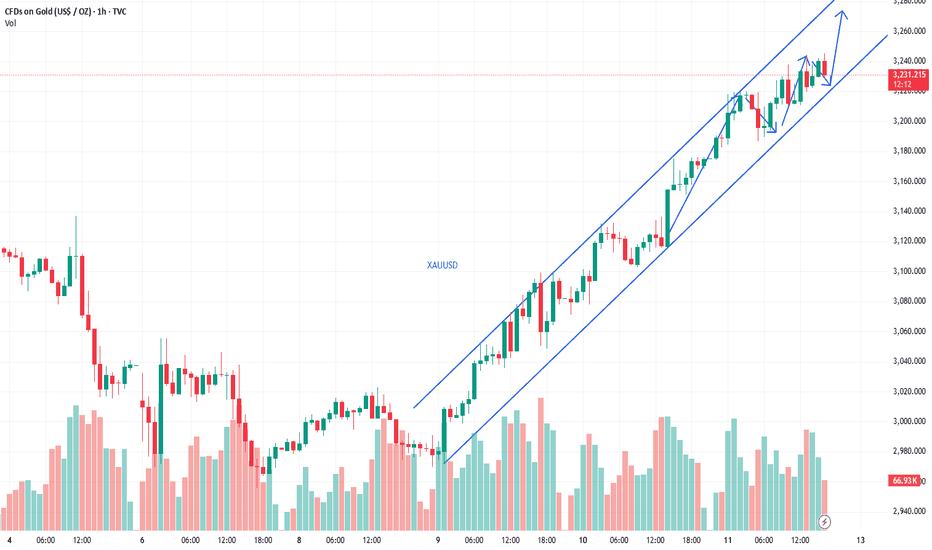

As of now, gold is consolidating around $3,231/oz, maintaining a tight range near recent highs. Despite short-term fluctuations, the medium-term bullish trend remains intact, supported by both macro fundamentals and technical structure. 🔮 Trend Outlook: Medium-Term Bias: Bullish. Maintain a "buy-on-dip" strategy supported by geopolitical risk, monetary easing...

🔍 Market Overview: Gold remains in a consolidation phase near multi-year highs, hovering around the $3,200 level. The prior high of $3,245 acts as short-term resistance, while the $3,175–3,180 area offers critical support. Although price momentum has paused, the broader bullish structure remains intact. Macro catalysts including geopolitical uncertainty, ongoing...

Gold has entered a phase of subdued volatility, currently trading around $3,221/oz. This stands in sharp contrast to the previous week’s triple-digit swings, with recent intraday ranges tightening to under $20 — a sign of market indecision and volatility compression. From a technical perspective: $3,245/oz remains a critical resistance level, representing the...

Earlier, gold prices surged to an all-time high of $3,245/oz, but soon encountered selling pressure, triggering a pullback that briefly broke below the $3,200 psychological level, touching intraday lows near $3,193. As of now, the price is consolidating around $3,210, with short-term momentum appearing to fade. From a technical perspective: $3,220 represents the...

Heading into next week, we maintain a bullish medium-term outlook on gold, with a continued preference for trend-following long positions. Although short-term bearish attempts persist, the broader upward structure remains intact, with pullbacks presenting tactical buying opportunities. Key support is observed around $3,200/oz, which serves as a strategic level for...

In the previous trading signal, it was advised to take profits around $3235. Based on the latest market analysis, gold prices are expected to experience a downward correction. Therefore, it is recommended to open short positions around $3230. Investors should closely monitor market trends and adjust stop-profit levels in response to price fluctuations to secure...

Currently, gold prices are exhibiting an upward trend, fluctuating between $3230 and $3233. Based on market analysis, it is anticipated that gold prices will continue to rise. It is recommended to enter long positions near $3230, with a target profit around $3235 to secure short-term gains. Continue to monitor market developments, maintain profits, and adjust...

Currently, gold prices are showing a clear bearish trend, previously fluctuating around $3240. Based on market predictions, there is a potential for further downward movement in gold. A short position was suggested around the $3240 level, and as the market corrected, gold prices have indeed dropped, allowing short-positioned investors to lock in profits....

This week, concerns over a global economic slowdown have swept across Wall Street, becoming the dominant market sentiment. In this context, U.S. President Trump's erratic messaging on tariff policies has triggered a panic sell-off in U.S. stocks, bonds, and the dollar, highlighting gold's position as a safe-haven asset. Gold prices have surged sharply, breaking...

Gold prices have now surged to around $3240, continuing the recent strong upward momentum. Based on the previous trading signal, a long position at $3220 was suggested; however, due to the high volatility, many investors may have missed the opportunity to go long at that level. At this point, with prices approaching $3240, it may be an opportune time to establish...