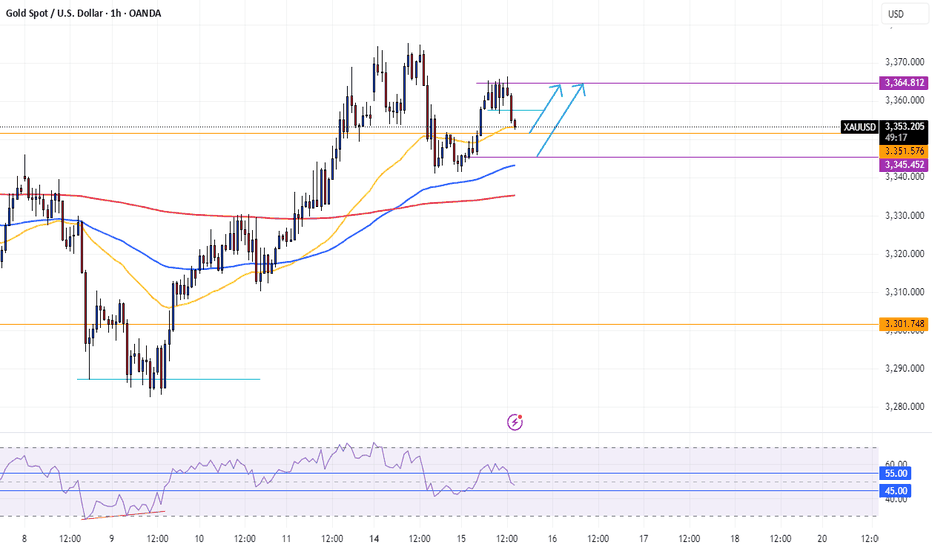

XAUUSD is currently on a retracement from the Asian high of the day at $3365. Looking for a Long opportunity from either the pivot level at $3351 (Break and Retest zone) or the Asian lows of the day at $3342. Momentum is in favour of further bullish movements with these key level provide the best platform for the market to continue the bullish move. Price is...

EURUSD is currently in a retracement within a bullish trend with clear Bullish market structures in place. Price is currently approaching the break and retest level at 1,16285... a potential pivot point which acted as a resistance level in the past. On the 4-hour timeframe, price is trading below the 21 and 50 SMA due to the slow nature of the retracement and we...

XAUUSD is bullish per the 4 hour and 1 hour timeframe with continued bullish momentum coming out of the fundamentals around tariff uncertainty. There is clear bullish market structure. XAUUSD is currently sitting on the pivot level of $3350 (Resistance turned support) after a retracement prior for the NY opening bell which gives rise for a long opportunity from...

EURJPY currently has bullish market directionality and is on a retracement. price is trading above the 50 SMA and we can observe bullish momentum from the RSI trading above the 55 level. Potentially break and retest zone at 167,550. Awaiting a reaction to this level which could see the bullish trend resuming.

Gold is currently moving with steady bearish momentum to the downside. at the opening of the week we saw downside momentum which is supported by price trading below the 50 SMA and trading with bearish momentum on the RSI below 45. Potential retracement towards the $3344 price levels before continuation to the downside support at $3300. Looking to capitalize on...

US30 shows strong bullish confluences at the opening of the week, currently testing the resistance level at 42,900. Price is above above the 50 SMA and favors bullish momentum per the RSI above 55. Potentially retracement towards the break and retest level at 42,400 where we could see a potential continuation of the bullish trend after the market collects enough...

USTECH is currently on a bullish impulse move, sitting at the resistance level of 22,000. price is trading above the 50 SMA and we can see momentum favors the bulls with the RSI above the 55 level Expecting a drop in price, based on the technical analysis, where we could potentially see a retest of of the 21,800 price level before the bullish trend resumes...

EURJPY has Bullish market directionality and is currently on a retracement per the 4 hour charts. Potential entry location at 166,425 Bullish confluences include price trading above the 50 SMA, Bullish momentum from the RSI with the current indication of price sitting within the sweet spot region between 45-55 which signals the need of the retracement. Bullish...

USTECH is currently on a break out to the upside, resuming the bullish trend. Price broke out above $21820 and is currently on a retracement where it could potentially provide a break and retest level at $21820. Price is trading above the 50 SMA and is currently showing bullish momentum coming out of the RSI. There is bullish structure amidst the consolidation...

US30 had a break out to the upside from $42560 and we are not seeing a potentially retracement to the break and retest level where we can expect a further jump to the upside. Seeing bullish structure on the 15 min and higher timeframes with confluence at the breakout. Price is currently above the 50 SMA on all timeframes above the 15min and momentum is bullish...

EURJPY is currently in a bullish trend from a higher timeframe perspective with the potential for a further long opportunity at the end of the current retracement. On the 1 hour timeframe, EURJPY is trading above the 50 SMA and is approaching the 55 zone of the RSI indicating the end of the retracement and continuation of the bullish trend. addition confluences...

Gold is currently in a retracement with the potential for a further to the upside from the $3400 break-and-retest level. Last week we saw a massive rally to the upside for Gold after 2 days of indecision, during this rally, Gold broke above the $3400 resistance zone and now has the potential to use this level and platform to bounce further to the upside. On the 4...

EURJPY currently has bullish market directionality and is on a retracement from the 165.000 level toward the break and retest zone at 164.250. on the 4 hour timeframe price is trading above the 50 SMA and is in the Bullish RSI zone above 55 below 70. The 164.250 price points lays in the sweet spot between 45-55 in the RSI which signals the potential end of the...

Gold is currently showing signs of Bearish market directionality on the 4 hour timeframe with price trading below the 50 SMA and RSI showing bearish sign trading below 45. This is a retracement in the context of the higher timeframe but price has the potential to continue all the way down to $3250. We could potentially see a retest of $3340 (potential...

USTECH is currently in a bullish consolidation from a 4 hour perspective. The 1 hour timeframe shows price is currently making a move to the upside which provides an intraday opportunity to trade to the upside. Confluences for the long position include the break and retest position at $21350 which has been tapped, price trading above the 50 SMA and volume...

Gold is currently showing bullish market directionality on the 4 hour chart. Per observation of the chart we can see the bullish structure, coupled with price trading above the 50 SMA and settling in the bullish territory of the RSI. Gold is currently in a retracement and could potentially find support at the break and retest level at $3326 before continuing its...

US30 is currently in bullish consolidation zone. We can see the price is continuing to make highs in the medium but has found resistance at 42830 with support at 41800... This is a narrow range from which to trade and entries can be blurry at times due to the fast paced nature of the market once these levels are hit... I am looking to take further long...

Gold is currently sitting upon a major support level at $3290... Price still trading above the 50 SMA confirming the bullish market directionality and is currently in the sweet spot on the RSI between 45-55 indicating the retracement is nearing its completion upon the 4 hour chart... Awaiting a Long entry on the 1hour/15min timeframe per price action signal