The 1.0 Fibonacci level could be a potential reversal zone for CHFJPY.

I think it will take liquidity from activating multiple stops here and turn into an uptrend

The recent drop in Novo Nordisk's stock price is attributed to several factors. A key issue is the company’s struggle to meet the surging demand for its weight-loss drugs, such as Wegovy. Although demand remains strong, investors are concerned about Novo Nordisk's ability to scale up production and deliveries, which is creating downward pressure on the...

CHF REER = 118 → overvalued towards historical average levels (~100)

Canadian Dollar Currency Index 3rd bottom and super depreciated currency, we expect an increase.

This is my personal view on CAD/CHF in both the short and long term. I believe the pair presents interesting opportunities based on recent market behavior and potential fundamental shifts. Short-term movements might differ from the long-term trend, so I’m keeping both perspectives in mind when analyzing and making decisions.

This is my personal view on CAD/CHF in both the short and long term. I believe the pair presents interesting opportunities based on recent market behavior and potential fundamental shifts. Short-term movements might differ from the long-term trend, so I’m keeping both perspectives in mind when analyzing and making decisions.

This is my point of view regarding the S&P 500. Will it play out exactly like this? Probably not, but as a general picture, I think there will be similarities.

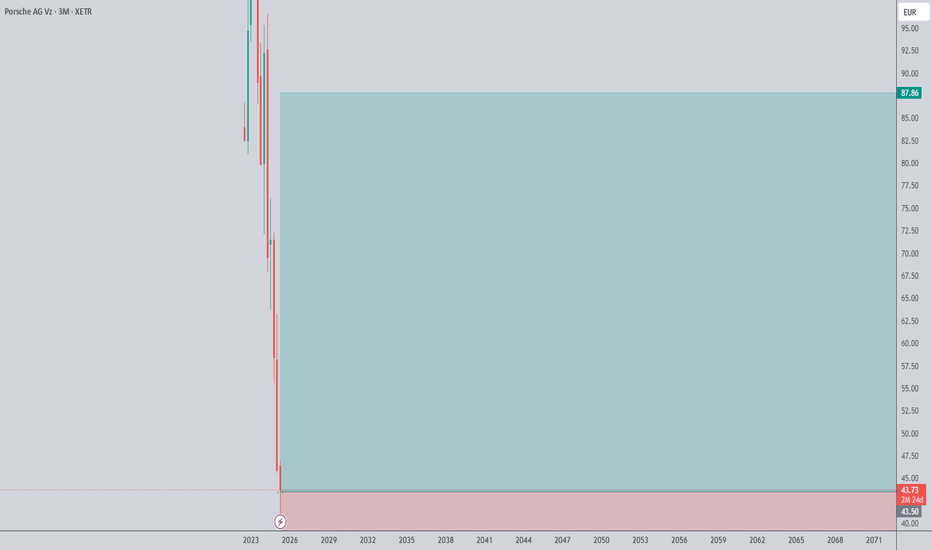

Strong Brand with Loyal Customers Porsche is a premium brand with global recognition. Even during downturns, demand for luxury products like Porsche remains relatively resilient. Fundamentally Solid Company Porsche has strong revenue, high profit margins (some models generate over 15–20% margin), and a reputation for financial discipline. Undervalued During...

NZD has a high interest rate (around 5.5% as of 2025), as New Zealand is battling inflation and maintaining tight monetary policy. CHF has a very low or even negative interest rate (Switzerland traditionally keeps rates low due to deflationary tendencies and currency stability). 📉 Current Imbalance: The NZD/CHF currency pair is at historically low levels,...

Looks like a trend reversal at last. 1. Strong pinbars from the levels below 0.92 that rob the stops. 2. A broken trend line, higher lows, higher highs 3. it is currently at a very important level,we are watching how it will react and whether it will be overcome. 4. We are now long on a larger time frame.

Why Invest in CONMED Corp (CNMD)? Strong Earnings Growth – CONMED has experienced a remarkable increase in earnings, with EPS surging by 104% year-over-year and net income rising by 105% YoY. This indicates strong financial performance and profitability momentum. Attractive Valuation – The stock is currently trading at a P/E ratio of 13.79, which is significantly...

Reasons to Invest in CVS Health (CVS) Strong Market Position CVS Health is a leading healthcare company with a diversified business model, including retail pharmacies, insurance, and healthcare services. Its extensive network provides a competitive advantage. Attractive Valuation CVS is currently trading at a P/E ratio of approximately 12.23, which is lower than...

Why Buying Occidental Petroleum (OXY) is a Good Investment Warren Buffett's Strong Endorsement Berkshire Hathaway, led by Warren Buffett, has been consistently increasing its stake in OXY, holding over 25% of the company. Buffett's long-term approach and confidence in OXY suggest strong fundamentals and future growth potential. Solid Financial Performance OXY...

Looking Ahead: USD/CAD Forecast for the Coming Years When analyzing the future outlook of USD/CAD over the next few years, several key factors come into play, including economic policies, commodity prices, and overall market sentiment.

Double Top Formation 📉 | CHF Poised to Weaken Across All Pairs 💱 The Swiss Franc (CHF) is showing a classic double top pattern, signaling a potential bearish trend. The structure is solid, aligning with technical analysis principles, and suggests a decline in CHF value against major currencies. 🌍 💡 Key Highlights: Double top formation: Indicates strong...

We think this is a great low-risk deal opportunity - short-term Buy

Are you ready to explore one of the most intriguing currency pairs in the forex market? 🌍 In this video, I dive deep into CAD/CHF to uncover the trends, key levels, and potential opportunities that 2025 holds for traders like you! 🕵️♂️💡 🚀 What to Expect: ✅ A detailed analysis of the Canadian Dollar 🇨🇦 vs. Swiss Franc 🇨🇭. ✅ Key drivers shaping the forex market...