H1-H4 TIMEFRAME SETUP Currently XAUUSD is following the rising channel along with flag pattern although I expecting market will fall from 3405-3410 zone. What possible scenarios we have ? • Market has to gives closing of H4 below 3390 for the implusive drop ,also I'm on holding sell trade above 3400 and my Targets are 3383 then 3370 • secondly If gold ...

As I mentioned throughout Today's commentary session: My strategy is sell from 3402-3405 Very happy with the profits so far multiple attempts after Back to back Tps HIT. TODAY'S PROFITABLE TRADES 💰🙌 GOLD SELL 3400 60 PIPS BE GOLD SELL 3402 200 PIPS TP GOLD SELL 3401 130 PIPS TP GOLD SELL 3400 190 PIPS TP •4 consecutive WIN •1 SETUP Always follow...

H1-H4 TIMEFRAME SETUP Currently XAUUSD is following the rising channel along with flag pattern although I expecting market will fall from 3406-3410 zone. What possible scenarios we have ? • Market has to gives closing of H4 below 3390 for the implusive drop ,also I'm on holding sell trade above 3400 and my Targets are 3380 then 3365. • secondly If gold ...

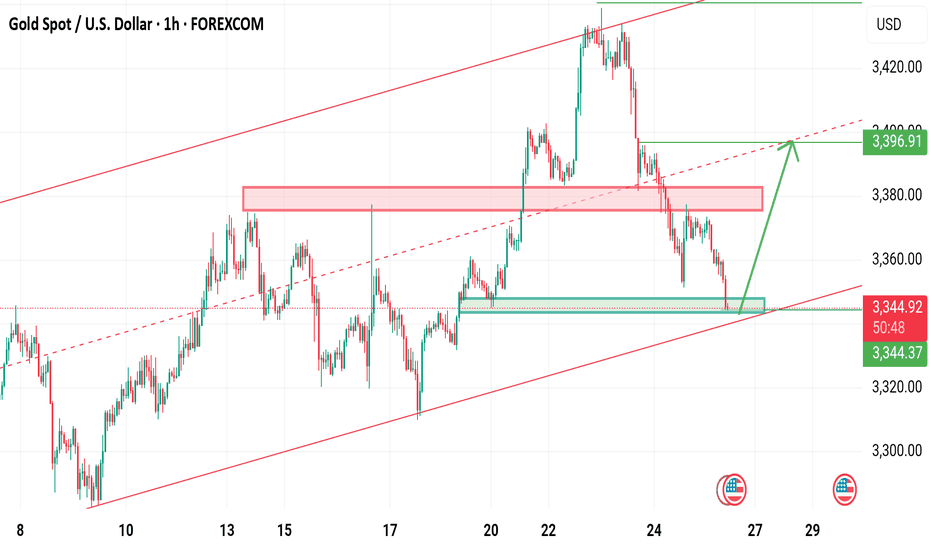

M30-H1 TIMEFRAME SETUP Currently we have range of 3370-3385 area although if H4 closed above 3385 gold will on bullish Bias till 3405-3410. What possible scenarios we have ? • Market has to gives closing of H4 above 3382-3385 ,also I'm on holding buy trade near 3382 and my Targets are 3402-3410. • secondly If gold drops to my Buying area where I will buy...

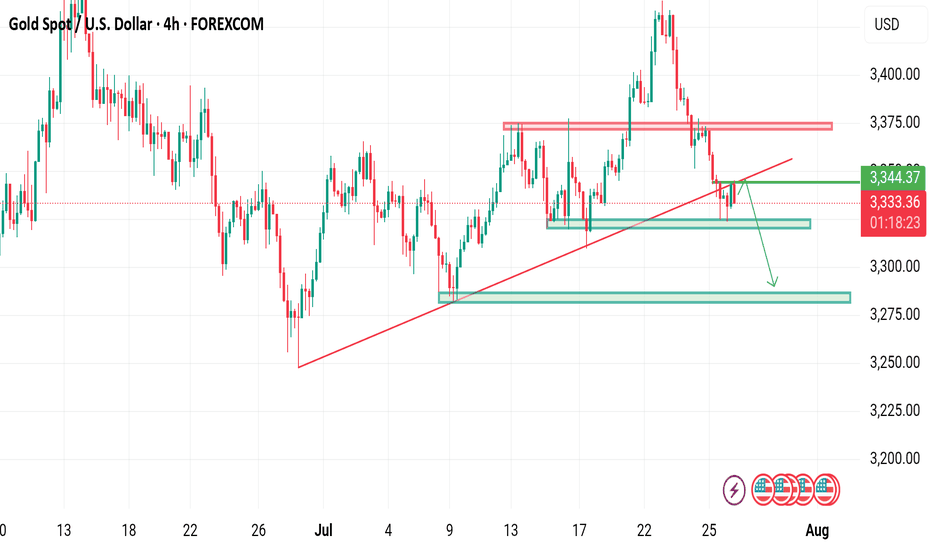

M30-H1 TIMEFRAME SETUP Currently we have range of 3345-3380 area also we have proper CHOCH on H4 at 3335 support area What possible scenarios we have ? • If market remains low 3372-3378 then you can scalp a sell trades towards 3360-3350 area which I take sell with minimal risk. • secondly I wait for drop to my Buying area where I will buy XAUUSD in dips...

H4 TIMEFRAME SETUP We shared daily our XAUUSD for deep insights and knowledge. Currently we have range of 3345-3380 area also we have proper CHOCH on H4 at 3335 support area As I mentioned in our previous commantary we have bullish momentum which is almost near our milestone. What possible scenarios we have ? • Atm i took sell from 3385 with minimal risk...

Currently we have range of 3345-3380 area also we have proper CHOCH on H4 at 3335 support area. What possible scenarios we have ? • i'm expecting the buying of gold at 1st 3340-3335 area if we got confirmation of rejection, market has to gives closing above On H4. buy at this zones for target of 3380-3400. • below 3330-3325 we'll have sell towards 3290 milestone.

▪️I'm expecting selling at 3345-3348 from my zones although I took a small risk of sell at 3342 And my Targets will be 3333-3324 ▪️Secondly if H4 candle closing below 3250 I will not sell till next stability This trade is based on liquidity sweeps #XAUUSD

I mentioned throughout Today's commentary session: My strategy is still the same – i took buy from 3290-3294 Very happy with the profits so far. My medium-term targets remain 3335-3345 which is achieved 300 pips achieved alhumdullilah. All I say thanks to those who followed us and made profits.

Gold is currently holding the Range of 3275-3310. What's possible scanarios we have? we have NFP data on deck today, expect potential volatility. Until the release, gold may continue to range between 3275 and 3315. This trade is totally unexpected how can gold react on numbers. •If the H4 & D1 chart breaks below 3270, we could see a further drop toward the...

Gold is currently below rising channel and holding the Range of 3320-3335,although yesterday implusive drop is incompleted without testing 3290-3280 What's possible scanarios we have? ▪️I'm still on bearish side till 3345 is invalidated and candle flips above. I open sell trades at 3332 again and holds it . if H4 & H1 candle close above 3345 I will not hold...

Gold is currently below rising channel and holding the Range of 3320-3335,although yesterday implusive drop is incompleted without testing 3290-3280 Eyes on DXY What's possible scanarios we have? ▪️I will wait next for my sell trades at 3338-3345 area but what we have to watch during that time H4 candle closing.if H4 & H1 candle close above I will not hold...

Gold is currently below rising channel also completion of structural support chart . Eyes on DXY What's possible scanarios we have? ▪️I will wait next for my buy trades at 3290-3285 area but what we have to watch during that time H4 candle closing. ▪️Secondly if H4 candle closing below 3278-3275 this upside move will be invalid Additional TIP: let the...

I mentioned throughout Today's commentary session: My strategy is still the same – sell from 3338-3340 Gold around my key level at 3345-3340, which the market respects well and as our first target was 3318 then 3305 Very happy with the profits so far. My medium-term targets remain 3290 which is pending but 300 pips achieved alhumdullilah. I sold gold from...

Gold is currently below rising channel also completion on Head& Shoulder on H4 time frame. DXY is recovering on weekly charts. What's possible scanarios we have? ▪️today's not mych volume had been seen, still my stance are same H4 candle closed above 3345 ,I will be on bullish side till 3370-3380. ▪️Secondly H4 candle closing below 3330 this Parallel moves...

Gold is currently below rising channel What's possible scanarios we have? ▪️if H4 closed above 3345 ,I will be on bullish side till 3370-3380. ▪️if H4 candle closing below 3330 this Parallel moves upside will be invalid and we have targets at 3290 on mark I'm expecting selling move #XAUUSD

Gold is currently still holding rising channel last hope for buyers the bottom trendine . Below 3335 buyers will be liquidate What's possible scanarios we have? ▪️I'm gonna take buy trade from 3340-3338 area by following our rising Trend along with structural liquidity sweeps strategy, my target will be 3357 then 3368 in extension. ▪️if H4 candle...

Gold is currently still holding rising channel we were on sell throughout today and achieved with 180 PIPs TP Hit now I'm going to take Buy trade at 3350-3340 zone What's possible scanarios we have? ▪️I'm gonna take buy trade from 3340-3350 area by following our rising Trend along with structural liquidity sweeps strategy, my target will be 3365 then...

![Excellent selling trades Delivered [550 pips] XAUUSD: Excellent selling trades Delivered [550 pips]](https://s3.tradingview.com/e/ERh8CX2b_mid.png)