Fractal777

Gold's consolidation period in a wave 4 sideways pattern is about to conclude. Anybody short this asset is about to get burned, a more than 90% probability of an upward surge is imminent. There are multiple support touch points on this upward trend line...does it get any clearer? Appreciate a thumbs up...God Bless you all!

Gold has consolidated the past few weeks and has now bounced from solid support. The current wave 4 looks complete and should now be followed by a strong upward move in wave 5, wave 5's in the metals are the strongest...expect a move towards $4000 coming. Your chance to get on board early and ride this bull run again! Appreciate a thumbs up, good trading and God...

Gold topped out around $3500 a few weeks ago and has corrected in a healthy pullback to our $3160 target for buying support. The uptrend line was again touched yesterday to be followed by strong buying support, this is a golden buying opportunity...the current wave 4 will be followed by a potentially strong upward thrust. Wave 5's in metals are usually the...

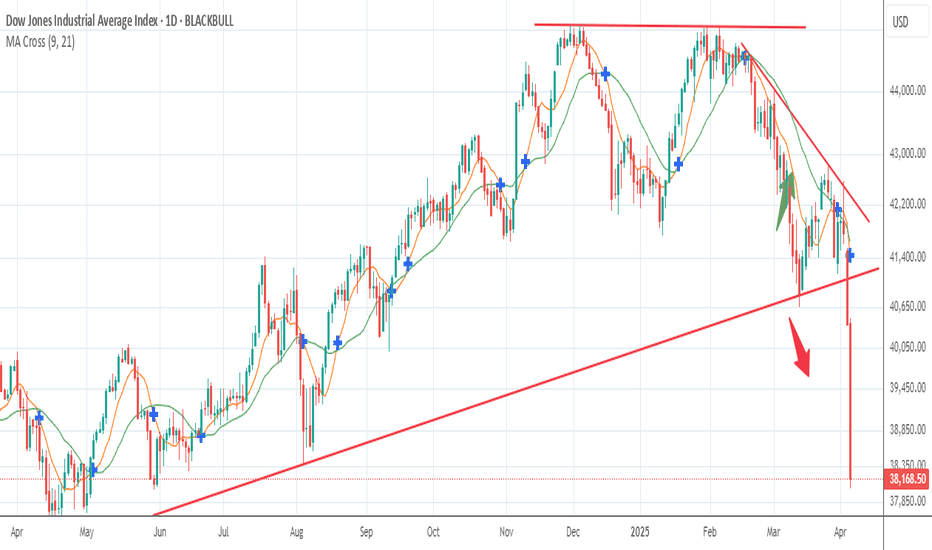

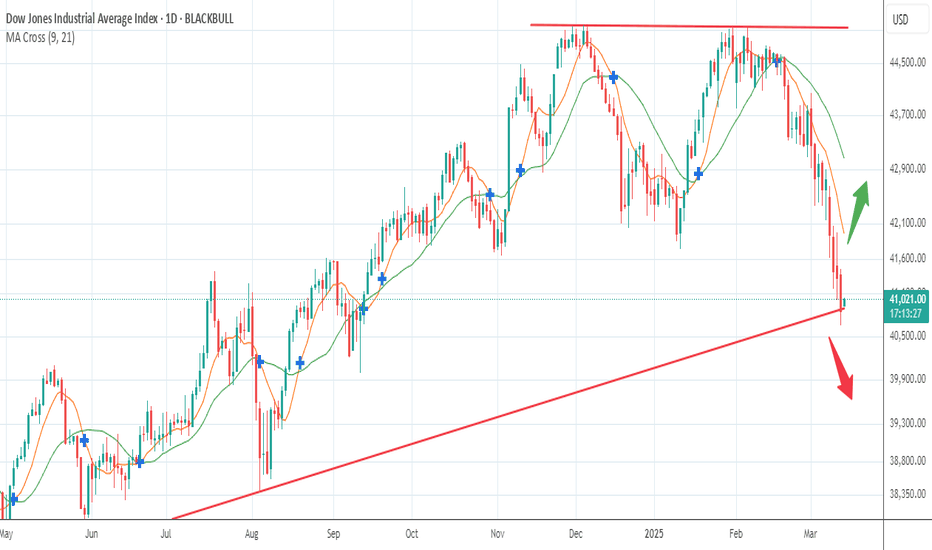

The Dow got slammed on Wednesday, down 2%, no follow through yesterday. Despite all the look of this rally being a bounce to sell, notice the uptrend line of support developed, this is the dynamics of markets, morph and twist to shake out weaker hands. Would not be surprised to see a resumption of this rally to all time highs into June/July, the tariff wobbles...

Today's red Doji candle at the underside of the downtrend line is a high potential short entry point if not already. Despite the rally the past week or so, it is far from convincing...no real conviction to buy this market and who can blame them. The current wave 2 bounce will be followed by wave 3 down as the most likely scenario, or we are in a wave 4 to be...

The Dow rallied on higher volume and has gapped up on futures to the trend line, notice each rally is lower highs, is this one different? We went short on a reversal last week and then closed our short mid session with an update...now we short again. The falls this week were on lower volume, a sign of minor wave two up which should be an ABC, the C rally part...

What a week, our last idea had a neutral stance and correctly so, volatility was extreme. We did know a bottom of sort was in the making or at least temporarily...now the bounce and where to? If you have not already realised, any ideas other than Trump caused the recent world mayhem, then you are in denial. Any little respect for this Trump quickly evaporated...

What a week, two days of plunge and the Dow sits below where Tariff Trump won. World markets were ripe for this situation, waiting for the trigger... the trigger no doubt was Trump. The charts do not lie, the news does not matter as much as price action, the question now is where we bottom for a while and bounce...any rally is to be sold. Don't try and catch a...

The past few weeks have caught out many bulls as Trump tariffs wreck the markets. 41K support today may just be the bottom, this area must hold, otherwise we are heading not just for a correction but a bear market. The falls have been consistent and steady, no real plunges which points to a correction, although we do have a double top from the Dec highs and early...

Another week of record gold prices, the media attention phase has properly begun. Monday's pop higher above the trend line shows acceleration, today's pullback was perfect in kissing back that trend line and another long entry. We are in a larger wave 3 up, within that wave we are in minor wave 3 up, still waves 4 and 5 to finish this strong move...at some point...

Friday's action saw a solid rally and pivot, fuelled by shorts covering. Expect a rally from Friday's low to continue for a few weeks at least, a possible ascending triangle in the making, any breach of Friday's low would suggest the top is in and a bear market in the making. Gold was hammered last week, that is good news for those eager to buy either leveraged...

The Dow will conclude years of a bull run in the next few weeks, a very last push to new highs...by March, the top should be in. Gold's rally the past few weeks should take it to $3000 U.S or more...coinciding with the markets last push. Trump's tariff campaign will only ramp inflation, long term pain will come and he will be remembered for all the wrong...

Another great week for gold bulls, a shooting star candle to finish Friday, likely pullback next week and a small correction before resuming the upside thrust. To attempt to put into context of what is occurring, we have to look at the bigger picture. The current wave up has some way to go, this minor wave 2 correction coming will be followed by a powerful rally...

Long gone are economic data which should be bullish for stock markets and instead have become bearish, yesterday's jobs number was too strong, lesser chance of rate cuts this year...it's all about the debt and managing this enormous pile of borrowing binge...the reality check is approaching fast. The Fed has of course trapped itself, buying of all securities for...

Another year, another pumped and manipulated charade. Some observers called a melt up move for 2024, instead, we got a rally of around 10%...too much weed being smoked. The 18th of Dec witnessed a 1500 point decline, that was your big guns spitting the dummy. The first wave one down and subsequent wave two ABC up either finished or another small move up to...

Some believe gold has finished it's bull run, old hat from the late 70's folks say they have seen this before and calling a crash. The Oct/Nov highs were ripe for a correction only, a wave four sideways triangle. This building structure has perhaps only a matter of days before breaking out, buy at today's support or wait for the upper breakout for...

The Dow finished up on Friday, but off it's high as selling came in late...notice the sincere break of the trend line last week and Friday's action came back to kiss the under line..odds are that this week coming is down. Just a few days until the big show, the outcome has already been decided, they are selected, not elected. Whatever the outcome of the theatre,...

Our top trend line has been touched a few times and rejected now, three days of falls could be the catalyst of the top being in and the early beginnings of a major turn down. Down days repeatedly see increased volume compared to light volume on up days...usually the market hold up until the Punch & Judy show in November. They don't ring the bell at the tops, lets...