FxWirePro

EssentialGold pared most of its gains on a strong US dollar. It hits an intraday low of $3307 and is currently trading around $3311. Any breach below $3305 (365- 4H EMA) confirms trend weakness and a dip to $3245/$3200 is possible. The strong US dollar and surge in US 10-year yield after strong US jobless claims and GDP data. It is good ot sell below $3305 with an SL...

USDCHF breaks significant resistance 0.8090 on board-based US dollar buying. It hits an intraday high of 0.81058 and is currently trading around 0.081003. Technical Analysis Points to Further Upside The pair is trading above the 55-EMA, 200 EMA and below 365 EMA on the 4-hour chart, indicating a mixed trend. The immediate resistance is at 0.8135, any break...

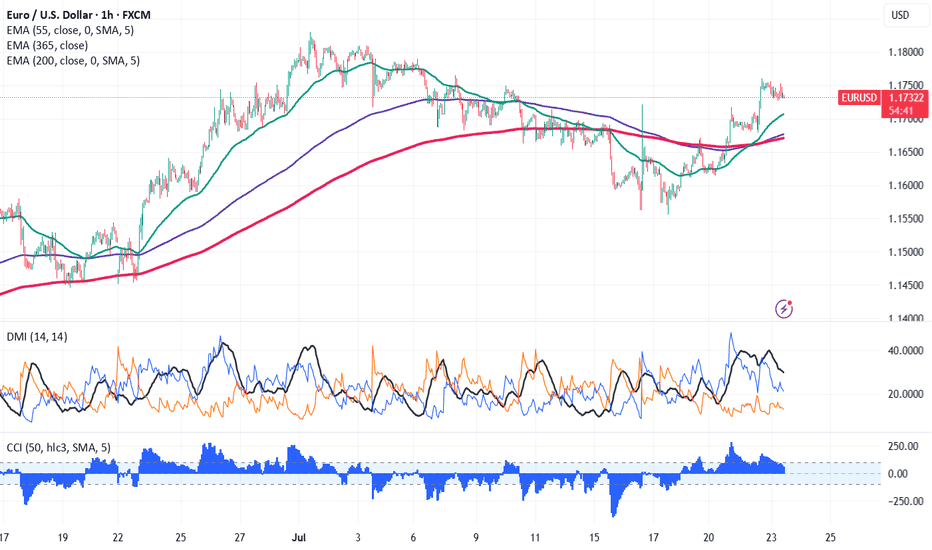

EUR/USD surged above 1.1750 on easing trade tension. It hit an intraday low of 1.17604 and is currently trading around 1.117428. Overall trend remains bullish as long as support 1.1670 holds. The pair is holding above the 55 EMA,above 200 EMA, and 365 EMA in the 1 -hour chart. Near-term resistance is seen at 1.1765, a break above this may push the pair to...

The GBP/JPY lost its shine on board-based yen buying. It hit an intraday low of 197.01 and is currently trading around 197. Intraday trend is bearish as long as the resistance at 197.75 holds. The GBP/JPY pair is trading below 34 and above 55 and 200 EMA (Short-term) and 365 EMA (long-term) on the 15-min chart, confirming a bearish trend. Any violation...

Chart pattern-Head and Shoulder Gold pared most of its gains as US and China trade tensions eased. It hits an intraday low of $3291 and is currently trading around $3294.81. Gold prices are holding below the short-term moving averages 34 EMA and 55 EMA and above the long-term moving averages (200 EMA) on the 4-hour chart. Immediate support is at $3340, and a...

Chart pattern-Head and Shoulder Gold pared most of its gains as Israel and Iran ceasefire agreement. It hits an low of $3295 and is currently trading around $3327. Gold prices are holding below short term moving average 34 EMA and 55 EMA and above long-term moving averages (200 EMA) on the 4-hour chart. Immediate support is at $3340 and a break below this...

Chart pattern- Bullish Gartley pattern Potential Reversal Zone (PRZ)- 0.8070 USDCHF pare most of its gains improving risk mood. It hits an intraday low of 0.80877 and is currently trading around 0.80866. Intraday bias appears to be bearish as long as the resistance 0.8140 holds. Technical Analysis Points to Further Upside The pair is trading below the ...

USDCHF formed triple bottom near 0.8180 and showed a minor pullback. It hits an intraday high of 0.82685 and is currently trading around 0.82666. Intraday bias appears to be bullish as long as the support 0.8180 holds. Markets eye US Durable goods order data nd SNB chairman speech today for further direction. Technical Analysis Points to Further Upside The pair...

The GBP/JPY pair is trading below 55 and above 200 EMA (Short-term) and 365 EMA (long term on the 4-hour chart, confirming a bearish trend. Immediate resistance is at 194,a breach above this level targets of 194.70/195/196.50. Any breach below 192.85 confirms the intraday bearish trend. A dip to 192.35/191.70. Market Indicators (1- hour) CCI (50)-...

ETHUSD breaks significant resistance after a long consolidation. It hits an intraday high of $1906 and is currently trading around $1901.42. Overall trend remains bullish as long as support $1500 remains intact. The key near-term resistance is at $1956 any breach above targets $2000/$2300/ $2500/$2770/$3000/$3400/$3600/$3800/$4000. A robust bullish trend will...

ETHUSD formed a double top around $1875 and showed a minor sell-off. It hits an intraday low of $1834 and is currently trading around $1837. Overall trend remains bullish as long as support $1500 remains intact. The key near-term resistance is at $1875 (trend line joining $4109 and $3746) any breach above targets $2000/$2300/...

Gold lost its shine on strong US dollar. It hits an low of $3275 at the time of writing and is currently trading around $3273. Rate Cut Expectations on the Rise According to the CME Fed Watch tool, the chances of 25 bpbs rate cut in June 18th 2025 meeting have decreased to 60.70% from 61.10% a week ago. Technical Analysis: Key Levels and Trading Strategy Gold...

Minor trend line resistance $2.12. XRPUSD breaks minor trend line resistance after a long consolidation. It hit an intraday high of $2.2509 and is currently trading around $2.224. A daily close below $1.60 could signal a further minor bearish trend. XRP remains above both short-term (34 EMA and 55 EMA) and long-term moving averages (200-day EMA) on the 4-hour...

BTC/USD currently trades above both short-term (34-EMA and 55-EMA) and below long-term (200-EMA) moving averages on the daily chart. Minor support is around $75800; breaking below this would drag the pair down to $72000/$65000. Immediate resistance is around $88000 any breach above confirms intraday bullishness, a jump to $90000/ $95000/$100000. A secondary...

The EUR/JPY trades higher ahead of ECB monetary policy today. It hits an intraday high of 162.57 and is currently trading around 162.45. The intraday outlook is bullish as long as the support 161.50 holds. Technical Analysis: The EUR/JPY pair is trading above 34, below 55 EMA and 200-4H EMA in the 15 min chart. Near-Term Resistance: Around 162.60 a breakout...

GBP/JPY gained slightly after forming a minor bottom around 187.46. It hits an intraday high of 189.03 and is currently trading around 188.94. Intraday trend is bullish as long as support 186.50 holds. The GBP/JPY pair is trading above 34 and 55 EMA (Short-term) and below 200 EMA (long term on the 15-min chart, confirms a bullish trend. Immediate resistance is...

The EUR/JPY gained sharply on a strong Euro. It hit an intraday high of 162.69 and is currently trading around 162.39. The intraday outlook is bullish as long as the support 161.50 (200- 15 min EMA) holds. In reply to the temporary halt by the U.S. government of a scheduled 20% tariff on European products in favor of a flat 10% tariff for three months (not...

Pattern formed- Three drives pattern (Bullish) The GBP/JPY was one of the worst performers this week on board -based yen buying. It hit a low of 185.57 at the time of writing and is currently trading around 186.27. Intraday trend is bullish as long as support 185 holds. The GBP/JPY pair is trading below 34 and 55 EMA (Short-term) and 200 EMA (long-term on the...