Potential for a bearish pullback on the XAUEUR H9 which could lead to a price movement towards the support level at 2800. SELL levels from 2918

Gold, Silver, Platinum Outlook – Gold Eyes Breakout as Dollar Weakens - Gold is gaining momentum and approaching a major breakout level near $3,350, supported by a weakening U.S. dollar, rising Treasury yields, and renewed safe-haven demand. A recent U.S. credit downgrade, driven by fiscal concerns, has added pressure on the dollar and boosted interest in hard...

Gold Surges Amid Escalating Trade Tensions and Geopolitical Uncertainty - Gold prices rose sharply as investors reacted to rising global uncertainties. This is the highest level gold has reached in the past three weeks. - The rally was mainly driven by two major developments. First, trade tensions between the United States and China worsened. President Trump...

Potential for a bullish pullback on the GBPCHF H4 which could lead to a price movement towards the resistance level at 1.13400. BUY levels from 1.10300

Potential for a bearish pullback on the EURUSD H12 which could lead to a price movement towards the support level at 1.08900. SELL levels from 1.13200

Potential for a bullish pullback on the AUDNZD H8 which could lead to a price movement towards the resistance level at 1.09000. BUY levels from 1.08300

Potential for a bearish pullback on the XAGUSD H4 which could lead to a price movement towards the support level at 30.600. SELL levels from 33.600

XAUUSD& SILVER—Risk-On Mood Pressures Prices, Fed Easing Eyed - Gold and silver prices experienced downward pressure during Friday’s Asian trading session, as a resurgence in risk appetite prompted investors to move away from safe-haven assets. Gold (XAU/USD) fell from an early high of $3,370 to $3,316, while silver (XAG/USD) dipped near $33.44, though it...

Potential for a bullish pullback on the SP500 H4 which could lead to a price movement towards the resistance level at 5620. BUY levels from 5500

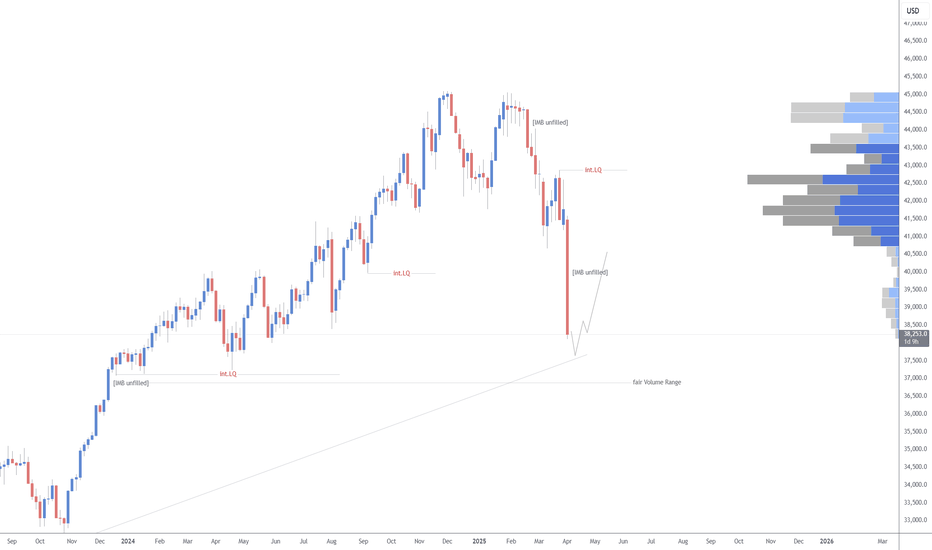

Potential for a bullish pullback on the US30 1D which could lead to a price movement towards the resistance level at 42200. BUY levels from 39600

Gold prices have soared to a new record high of $3,500 per ounce, fueled by a weakening U.S. dollar and escalating concerns over Federal Reserve policies and trade tensions. The dollar index has fallen to 98.164, prompting investors to seek refuge in gold as a safe-haven asset. This surge reflects a strong bullish sentiment, with traders buying into the rally...

Gold Prices Surge Amid Inflation Concerns and Increased Tariffs - Gold prices have formed new ATH. The driving forces behind this ascent include escalating inflation concerns and intensified trade tensions, notably the U.S. administration’s recent increase of tariffs on Chinese imports from 104% to 125%. - These heightened tariffs have amplified fears of...

Potential for a bullish pullback on the NASDAQ H9 which could lead to a price movement towards the resistance level at 20100. BUY levels from 18550

Potential for a bullish pullback on the US30 1D which could lead to a price movement towards the resistance level at 40600. BUY levels from 37800

Potential for a bullish pullback on the CADCHF H4 which could lead to a price movement towards the resistance level at 0.61600. BUY levels from 0.60200

Gold Prices— a Warning About Global Uncertainty - Gold prices just hit a record high, soaring past $3,085 per ounce in March 2025. That’s not just a number—it’s a warning sign. Investors aren’t piling into gold for no reason. They’re reacting to a world that feels more uncertain by the day. - The U.S. has imposed heavy tariffs on Canada, Mexico, and China,...

Gold Rally Pauses, But Bullish Trend Holds Gold hit an all-time high of $3,167.84 earlier this week amid safe-haven buying sparked by President Trump’s new tariffs and China's retaliatory duties, which intensified global recession fears. The resulting forced selling in equities caused a brief pullback in gold prices. However, this dip is seen as mechanical, not...

Potential for a bearish pullback on the US30 3D which could lead to a price movement towards the support level at 38400. SELL levels from 41900