GoldTrendSentimentxToday

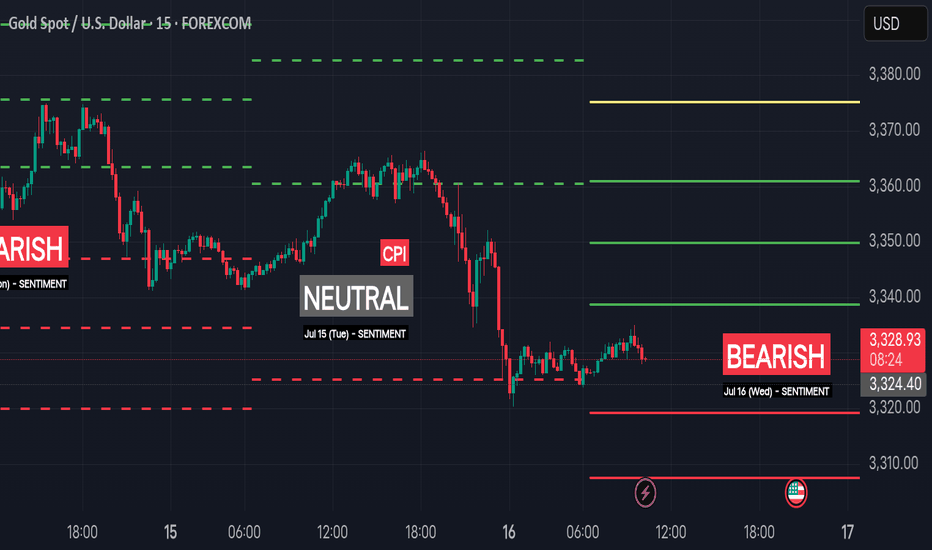

Sentiment: Bearish 🟢 Support Levels 1. 3319.20 – Minor support near Friday’s bounce zone 2. 3307.60 – Key support from early U.S. session rejection zone 3. 3296.10 – Institutional support / demand buildup 4. Extreme Support: 3283.40 – Break below this opens extended sell-off zone 🔴 Resistance Levels 1. 3338.70 – Minor resistance from overnight price...

Although sentiment going into Monday is broadly bullish , driven by escalating geopolitical tension and anticipation of a breakout, XAU/USD may still open with a brief pullback , not because traders are ignoring the situation, but because markets often test the conviction of retail and early-positioned bulls before making a decisive move. When gold opens...

In my trading strategy, I incorporate Andrew's Pitchfork, utilizing its median line as a signal for analyzing price action. This line often provides a basis for analysis, potentially aiding in decision-making. Additionally, I integrate Fibonacci Retracement, with a focus on the 38.2% levels, which are commonly observed as potential pivot points for identifying...

In my trading approach, I employ Andrew's Pitchfork, leveraging its median line as a significant indicator. This line typically contains price movement around 80% of the time, offering a reliable framework for analysis. Alongside, I integrate Fibonacci Retracement, with particular attention to the 38.2% ratios. This level often serves as a critical point for...

Good entry point for sell is 2013 and for buy 1966. It highly likely that gold will retrace first to 2013 before continuing it bearish trend.

Gold move in such wide drop, but it has to go up a bit more if it wanted to go down further Signal: Buy@1990.30

Reversal might happen in the next few hours, there's still room to go up but 2033 would be a good entry for sell or the next resistance after it.

Gold still have room to go up, might test resistance@2027

The trend sentiment for XAUUSD on November 29, 2023 is bullish , based on the following factors: - The economic calendar shows that there are no major events or data releases that could affect the demand and supply of gold or the US dollar today. This means that the market is likely to follow the existing trend, which is upward for XAUUSD. - The technical...

![[XAUSD] Potential Bearish Move During Asian Session XAUUSD: [XAUSD] Potential Bearish Move During Asian Session](https://s3.tradingview.com/u/uDkRPUnl_mid.png)

![[Gold] Nov. 29: Bullish, Sentiment Trend Analysis GOLD: [Gold] Nov. 29: Bullish, Sentiment Trend Analysis](https://s3.tradingview.com/7/7n7kUxw4_mid.png)