Golden_Spur

PremiumMEBL is in sideways for almost seven months now. It is very much likely to continue in that fashion as interest rates cut is expected further. Therefore, buy on parallel channel's bottom and sell on its top is recommended. GANN support & Resistance fanes and Fib retracement tools have been used. Price has honoured both GANN and Fibonacci for this SCRIPT....

On monthly TF, MSCL has completed the Bullish SHARK harmonic pattern (93% compliant). Now it has started its reversal journey and is at ideal price to buy for substantial gains in couple of months. RSI is at 35 level moving upwards. KVO is although below zero level but has started to look upwards as well. As soon as KVO Blue line crosses the trigger Green line...

On Monthly TF, two harmonic patterns have been drawn. Gartley (94% complying) and Butterfly (88% complying). In this bull run prices are moving way to fast. And due to market sentiments Bulls are in control. In normal bull run Gartley pattern will be complied before price drops but chances are that price will make new All Time High and follow Butterfly. RSI is...

On daily TF, since 20 Jan 2025 BTC was in downtrend following regression channel. MACD also was mostly indicating short trade. However, now MACD is showing likely upward movement. Moreover, Williams Alligator also suggesting a likely change of trend to bullish. Coupling that with USA falling stocks, BTC is a gaining attraction of US investors. Therefore, one may...

PSO on Daily TF has been retracing quite a bit. Right now price has just bounced back from Price Action Support Zone. However, a detailed GANN based analysis supported by Fib retracement, RSI and KVO has been performed. Trade Values Buy-1: 408 Buy-2: 342 Buy-3: 322 SL: 272

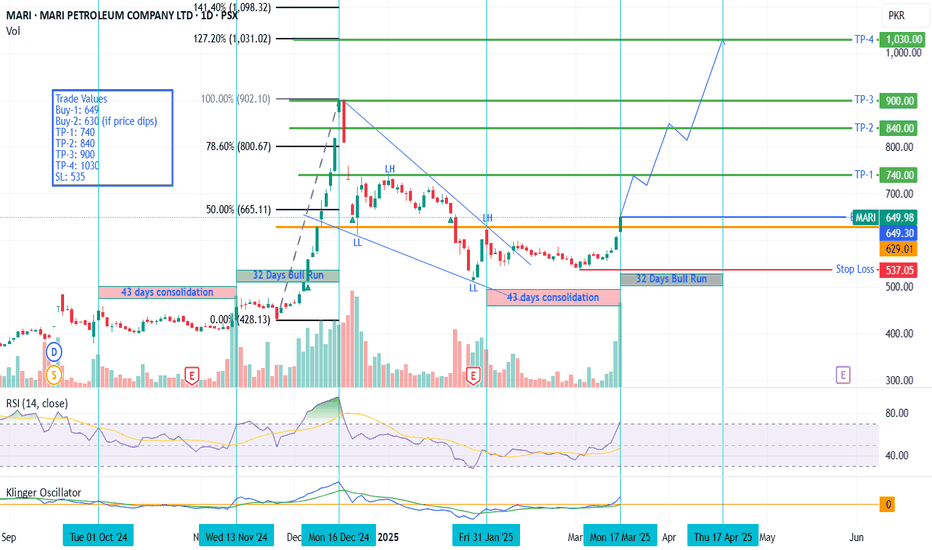

MARI is the market leader of PSX. Historically, on time cycles it has shown consolidation period of 43 days before going into a bull run spanning around 32 days. Price after making the falling wedge has broken the structure upwards and now has even crossed the recent Lower High 627.40 as well - which signals a trend reversal towards bull run. Very good volumes are...

On daily TF, PSO has broken the falling wedge and now is moving upwards. Only likely resistance zone is close to previous all-time high. AB=CD Harmonic pattern has been drawn. KVO is moving upwards indicating bull run with RSI also testing 60. It is a good opportunity for getting into the SWING trade now spanning over around three months. Trade Values Buy-1:...

RSI 14 indicator is above 70 line and there is no bearish divergence yet. Klinger Oscillator is above '0' indicating a bullish state; however, Klinger Oscillator (Blue) is yet to cross over the trigger line (green). EMA 89 line is also below the price chart indicating a bull run. AB=CD Pattern has been drawn for TP1. Pole and Flag pattern has been drawn for...

Fauji Cement Co Ltd (FCCL) share price is almost at Daily Channel Support Level. Technically, price may bounce from this support. However, a SHARK Harmonic pattern has been drawn (93% compliant) which if followed will drop the prices significantly. KVO is dipping below zero level indicating a Bear run; additionally RSI is also dipping which supports the dropping...

Power after the pressure of selling has started to recover. Price is just under the 8/1 resistance line of upper Gann fan. Once price crosses it then this line will start acting as support. Just see the repetition of the triangle pattern (Orange). RSI is also moving upwards and at present it is around 57, therefore, there is sufficient room to consider...

Fundamentally, FCCL is progressing steadily. Its recent quarterly report ending Dec 2024 is a little bit better than previous quarter ending Sep 2024. Similarly, as compared to previous year same quarter, its revenue has almost jumped 25% (from 20B Dec 2023 to 25B 2024). Historically, Quarter ending March shows some lesser revenue due to bit lesser sales during...

THCCL price has made a wedge which is an indication of price going up any time. RSI has already bounced from 30 and moving upwards. Klinger is just hinting at likely beginning of the bull run for this SCRIPT. Fundamentally, from cement sector, this will show progress as sales will be substantial during post Ramadan and pre-monsoon (April ~July). Coupled with...

PAEL is in sideways zone. It has established a support zone at Fib 38.20% by bouncing twice from there. Another dip is quite possible. Resistance zone is quite large and it is expected that it may take a month to break across it. Therefore, Buy on dip will be the way to go. Trade Values Buy-1: 38.11 SL: 36.80 TP-1: 43.49 Buy-2: 46.61 SL-2: 43.20 TP-2: 57.10 TP-3: 59.24

CNERGY has been in the consolidation for quite some times and it may continue to play in that zone. Technically very correct Buying (Buy-2) is recommended once price breaks the resistance zone. However, price has been following ascending parallel channel as well, and at the moment it is close to the support line. Therefore, it may continue to go up. However, if...

OGDC has been sideways after making a HH and even broke its regression channel. It has now made a bullish hidden divergence on RSI. Although KVO is still down but it is anticipated to gain momentum due to good news coming up from OGDC management. Trade Values: Buy-1: 214 (Current Market Price) Buy-2: 209.00 ~ 209.50 (on dip) Buy-3: 237 (Technically a correct...

MARI is moving between 660 to 740 over the past one month or so. KVO is dipping which suggests a further dip in price. RSI is also dipping much below Zero level. Therefore, I'm eager to see it test 610 level once more. However, this is No 1 Stock of PSX and may attract Buyers at any time. Therefore, I'll buy in steps to make sure I have the stocks at lower...

SYM on 4h trading sideways range. Price is currently at a buyable range. A parallel channel has been drawn, where price will remain in the range. Trade Value Buying Zone: 17.80 ~ 17.30 TP Range: 18.80 ~ 19.30 SL: 16.90

On 4h time frame, FLYNG was slipping down in a regression channel, continuously making LHs and LLs. Now it has broken out of the regression channel and moving upwards. Seeing overall KSE-100 moving sideways, this SCRIPT is also expected to move in sideways. So the trading strategy should be to buy on dip and sell on previous price resistance. Trading...