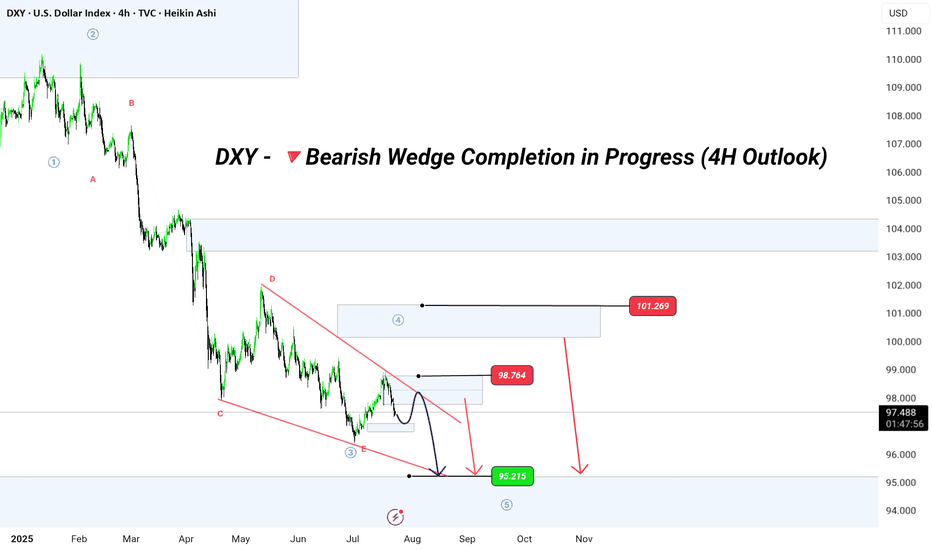

Wave structure complete. Retail thinks we’re going up. I know where it’s really going. This is GreenFire Execution, not prediction. 🧠 Final liquidity hunt possibly toward 98.76 or even 101.40, then lights out. Targeting the big liquidity pocket at 95.215 That’s where legends buy while the crowd panics. 📐 Elliott Wave | Wedge Mastery | Market Psychology If you...

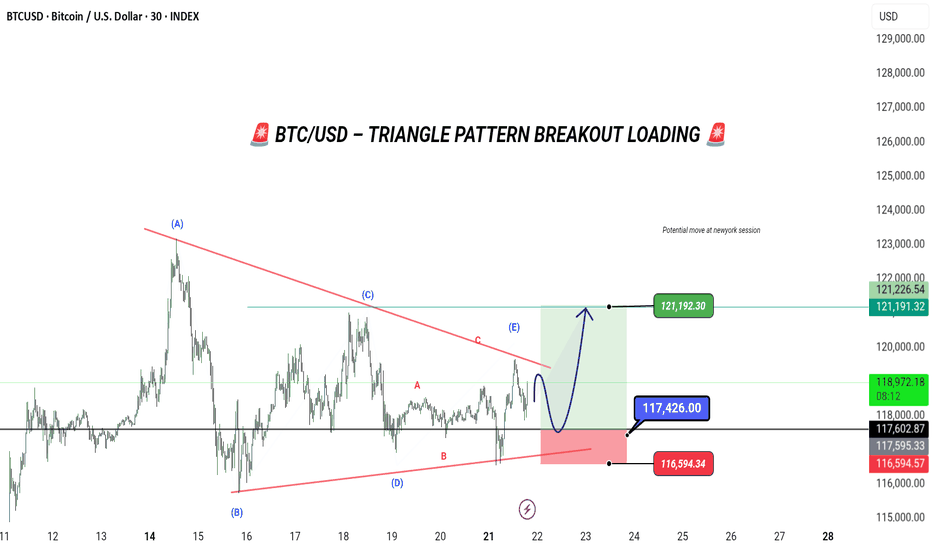

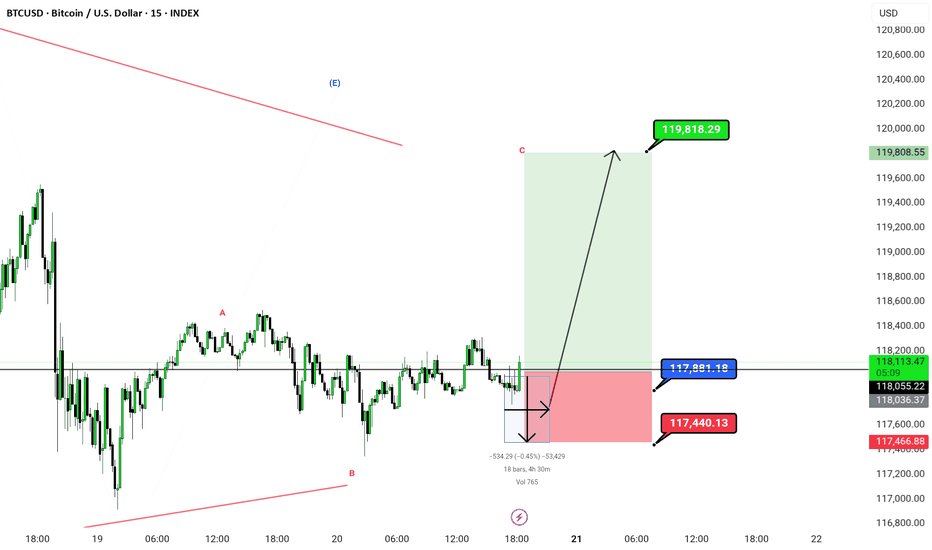

We’re coiling up like a spring 🌀 inside this textbook triangle structure — and the breakout is about to go BOOM. 👀 Watch the (E) Wave closely. This is where smart money traps the late sellers. Once price taps the 117.4K zone, expect a sharp reversal up. 🎯 Target: 121,192 📍 Entry: 117,426 ❌ Stop Loss: 116,594 💡 Logic: Classic Elliott Wave triangle → ABCDE...

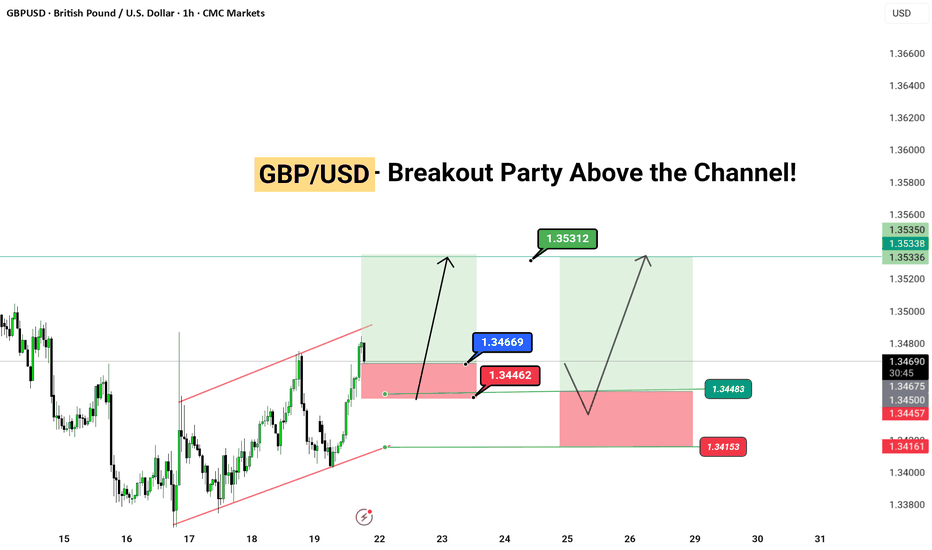

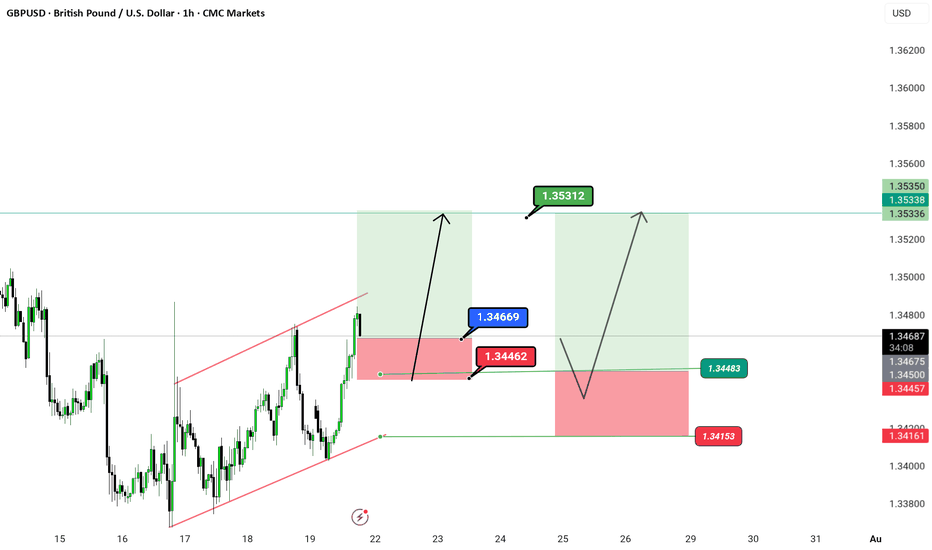

We just broke structure on the 1H. Simple setup, clean price action. Nothing complicated. 📍 Breakout Zone: 1.34669 ✅ Target 1: 1.35312 ✅ Target 2: 1.35350 ❌ Stop Loss: 1.34462 ⛔ Invalidation Level: 1.34153 🧠 Price broke out of the red channel and retested — now it's game on. If we stay above structure, next move is liquidity grab at the highs. This is how you...

🎉 GBP/USD – Breakout Party Above the Channel! 🎉 Pound-Dollar just said “bye-bye” to the red channel and is getting ready to dance its way up 💃💵 We have a clean breakout with two possible flight paths 🚀: 📍 Entry Zone: Around 1.34669 🎯 Targets: 1️⃣ 1.35312 2️⃣ 1.35350 (Double top zone – watch this closely 👀) 🛑 Stop Loss: 1.34462 ❗ Invalidation below: 1.34153 📐...

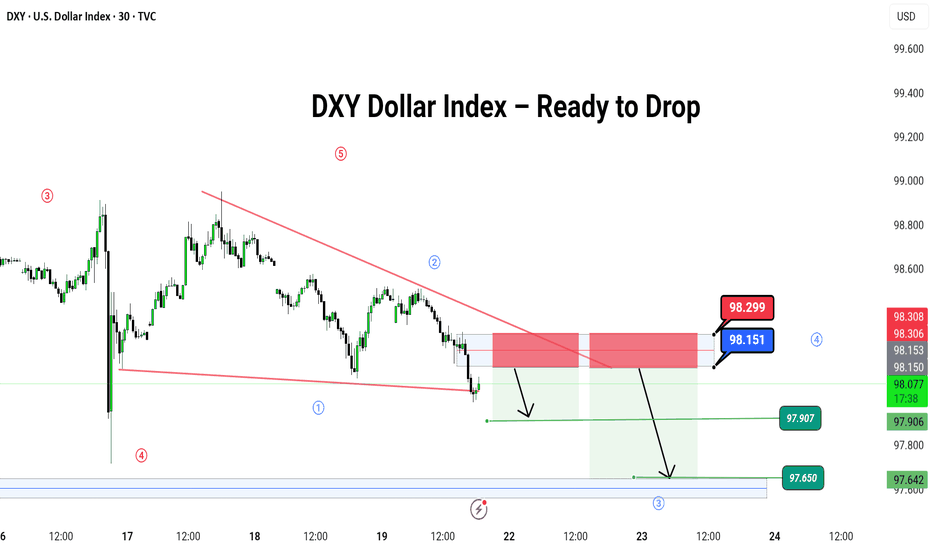

🌪️ DXY Dollar Index – Ready to Drop Like a Hot Potato? 💸 Hey traders! 🎯 The DXY (U.S. Dollar Index) is dancing inside a falling wedge 🔻, and it just hit the top of the party zone (red box 🎁). 📍 We're watching for a bounce up to this red zone near 98.151–98.299, then expecting a big slide down like a rollercoaster 🎢 toward: 🎯 Target 1: 97.907 🎯 Target 2:...

This chart shows a 15-minute timeframe analysis for BTC/USD (Bitcoin/US Dollar) using Elliott Wave . --- 📊 Chart Summary: Wave Structure: Labeled with corrective wave A–B–C, indicating the end of a corrective pattern. Price is currently in the potential reversal zone near Wave B, suggesting a bullish move toward Wave C completion. --- ✅ Trade...

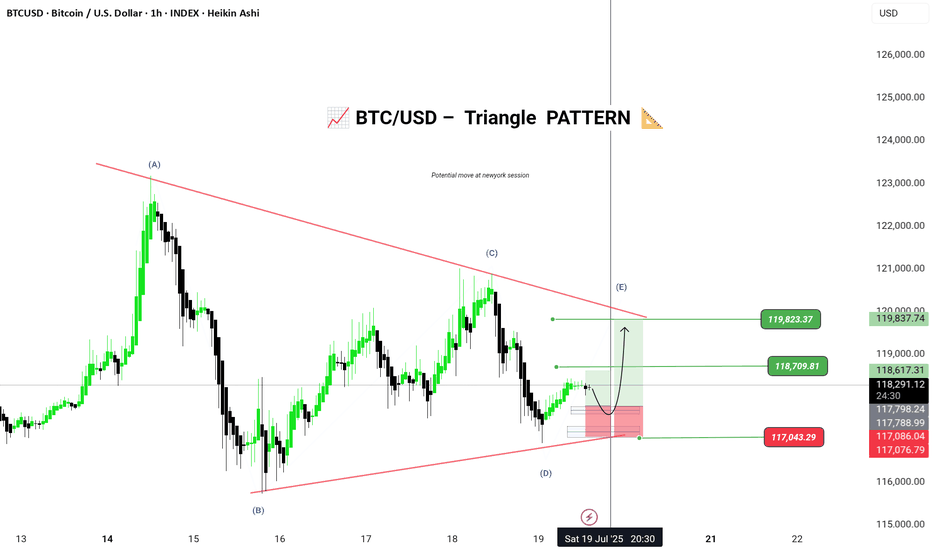

Bitcoin is currently forming a contracting triangle (ABCDE) structure on the 1H chart. The market appears to be respecting the lower trendline support and could be completing Wave D, now preparing to push into Wave E. 🟢 Entry Zone: 117086 – 117076 🎯 Targets: • 118709 • 119823 ⛔ Stop Loss / Invalidation: Below 117043 🧩 Pattern: Elliott Wave Contracting Triangle 📅...

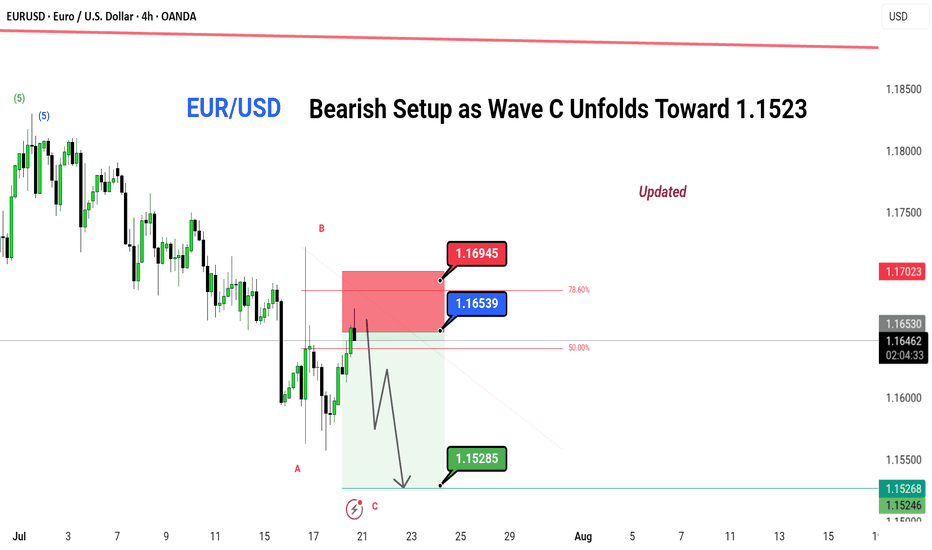

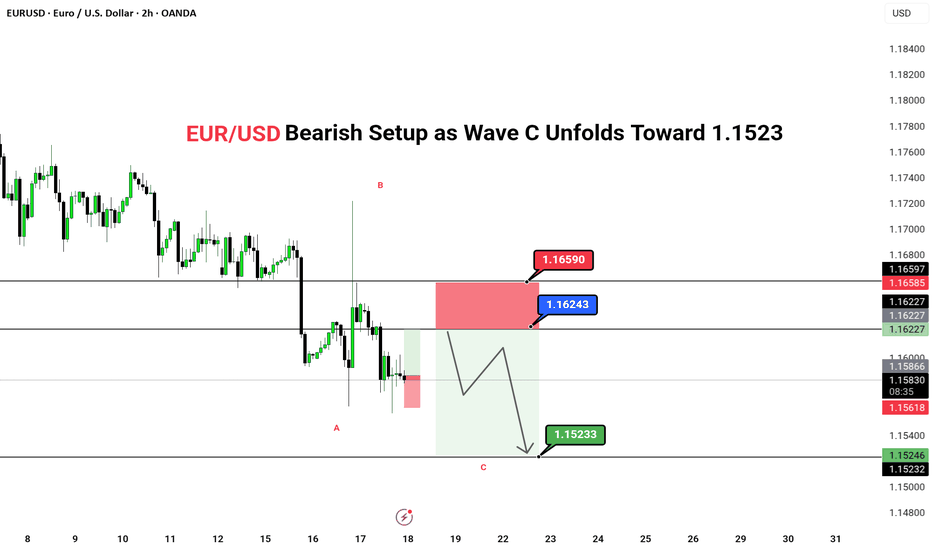

📉 EUR/USD – Bearish Setup as Wave C Unfolds Toward 1.1523 Price has retraced into the key 78.6% fib zone after completing Wave B. With clear rejection from the supply area and lower highs forming, Wave C is now in play. Expecting bearish continuation with potential downside targets around 1.1523. 🔻 SHORT BIAS (Wave C in Play) 📍 Entry Zone: 1.16530–1.16945 🎯...

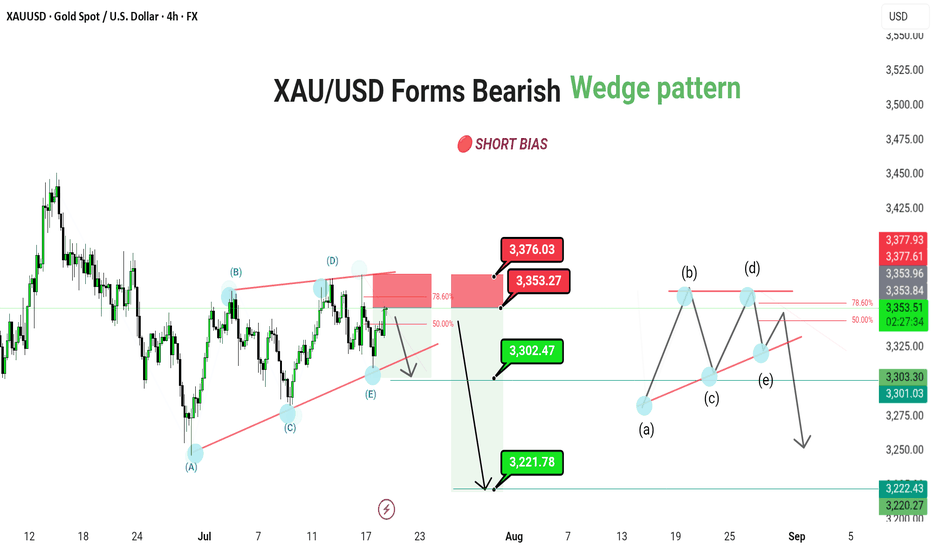

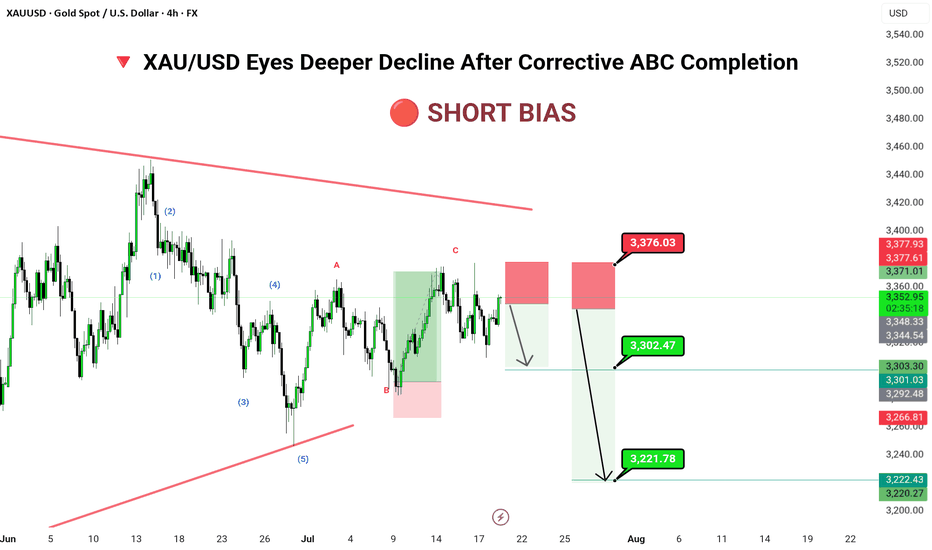

XAU/USD (4H) | FX | Gold Spot vs US Dollar 🔴 SHORT BIAS 📅 Updated: July 18 --- 🔍 Description Gold is trading within a bearish contracting triangle, suggesting a continuation move to the downside after the recent corrective bounce. Price is currently approaching the key 3,371–3,376 resistance zone, which aligns with the 78.6% Fibonacci retracement and upper...

🔻 📊 Technical Structure (4H) ✅ 5-wave bearish impulse completed ✅ ABC correction likely completed ✅ Supply zone: 3,371–3,376 📌 Downside Targets First: 3,302.47 Final: 3,221.78 🔻 Invalidation Zone Above: 3,376.03 (Break above invalidates short scenario) --- 📈 Market Outlook Macro Context: Gold faces pressure amid rising real yields and stronger dollar...

📊 Technical Structure (2H) ✅ Channel structure remains intact ✅ Wave (4) nearing completion within resistance ✅ Strong sell zone between 0.9345–0.9363 📌 Downside Targets First: 0.93129 Final: 0.92721 🔻 Invalidation Zone Above: 0.93634 (Break above would invalidate current wave count) --- 📈 Market Outlook EUR Weakness: Dragged by soft PMIs and ECB's...

EUR/USD Bearish Setup as Wave C Unfolds Toward 1.1523 🔴 SHORT BIAS 📅 Updated: July 18 --- 🔍 Description EUR/USD appears to be unfolding a classic ABC corrective structure, with Wave B now likely completed below the key 1.1624–1.1659 resistance zone. The price action has shown clear rejection in this supply area, opening room for Wave C to extend lower toward...

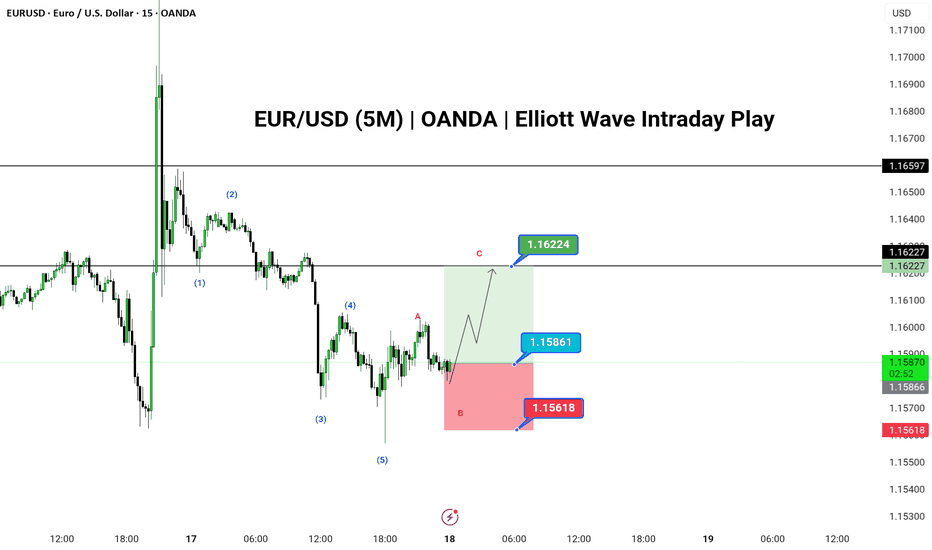

🟢 LONG BIAS 📅 Updated: July 16 EUR/USD has completed a clean 5-wave impulse structure to the downside, followed by an unfolding ABC corrective pattern on the 5-minute chart. With Wave A and the ongoing B leg nearing completion, bulls may look to capitalize on a Wave C rally toward the 1.1622 resistance zone. The structure suggests a temporary bullish move...

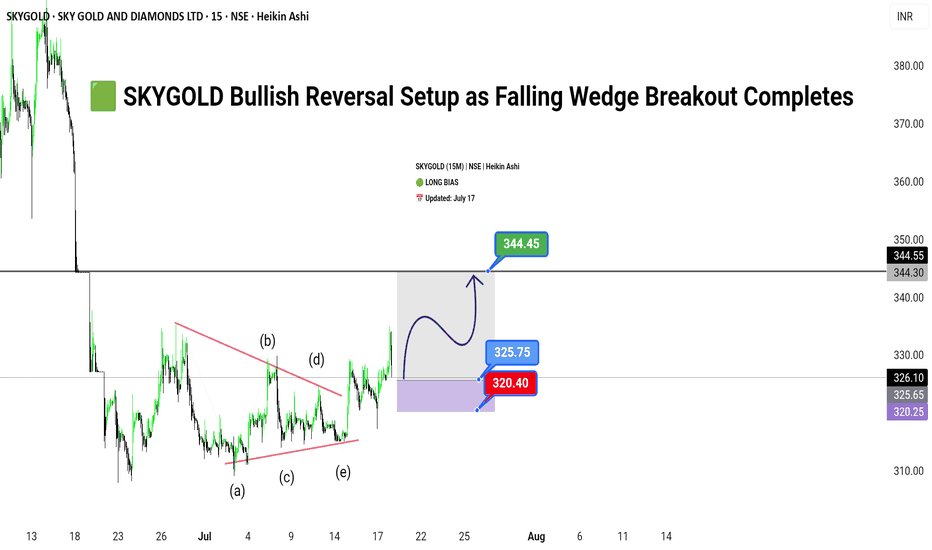

🟩 SKYGOLD (15M) | NSE | Heikin Ashi 🟢 LONG BIAS 📅 Updated: July 17 --- 🔍 Description SKYGOLD has emerged from a prolonged corrective phase, breaking out of a well-defined falling wedge pattern on the 15-minute chart. The price action has respected a clean Elliott Wave ABCDE structure within the wedge, suggesting a completed consolidation cycle. With bullish...

Buying pressure 😉 Nzdusd bullish , fibb50% fvg Need urgent buying

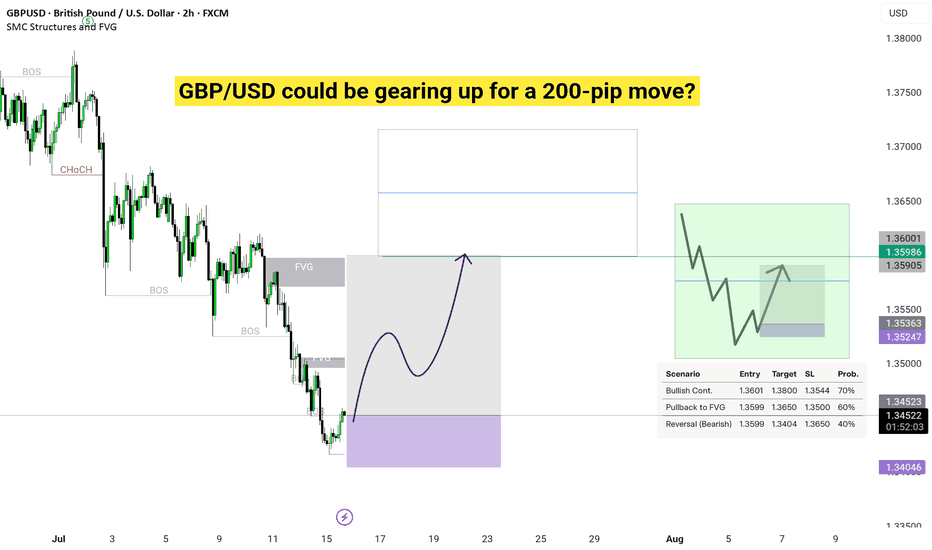

Start: We jump in at 1.3601 if it’s going up or filling the gap, or 1.3599 if it might drop. Goal: We aim for 1.3800 if it goes up, or 1.3404 if it goes down. Safety Stop: Like a safety net, we stop if it drops to 1.3544 (up plan) or rises to 1.3650 (down plan). Chance: These are best guesses based on the chart’s clues!

Strong CHoCH + Demand zone = High-probability bullish continuation setup!" ✅ Key Highlights: 🔴 Multiple BOS confirm bearish trend continuation up to late June. 🔵 CHoCH on early July marks a potential bullish reversal zone. 📉 Price currently retracing into a demand zone (highlighted blue box) for potential long entries. 🔮 Expected bullish leg targeting the...

Pair: EURUSD 🔹 Timeframe: 30 Min 🔹 Bias: Bearish (Short Setup Expected) 🔹 Current Price: 1.17358 --- 💡 Market Breakdown: The pair is approaching a premium zone (1.17381 – 1.17567) where smart money may induce liquidity grabs before a sharp sell-off. The structure shows a clear Break of Structure (BoS) followed by a Change of Character (Choch) confirming...