GunMoney

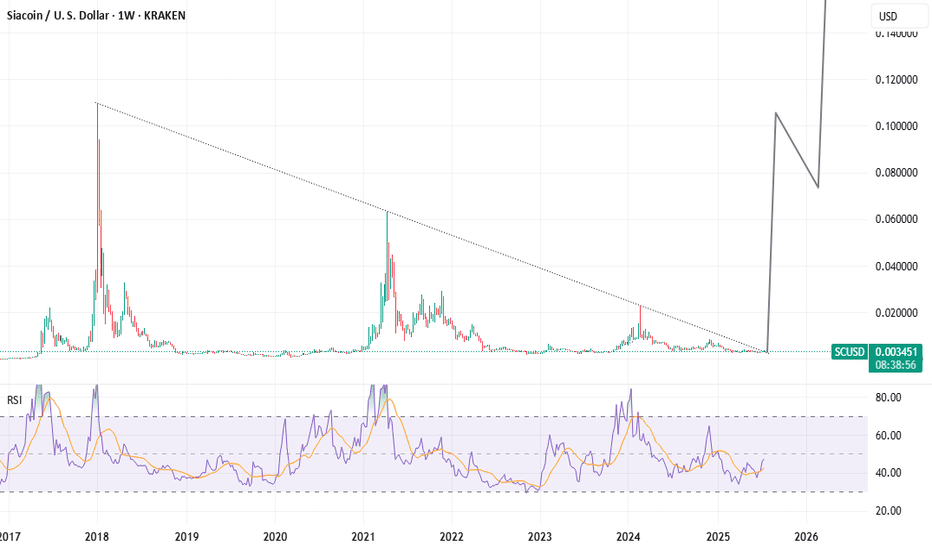

Breaking out from a near-identical structure to XRP’s Q3 2024 move, Siacoin (SC) is poised to moon. Once a top 20 crypto, SC has just closed outside an 8-year falling wedge on the weekly—marking the end of nearly a decade of compression. But this isn’t just a pattern breakout—it coincides with the biggest technical overhaul in Sia’s history, rolled out on the...

Cannabis stocks have been nothing short of annihilated lately. The last administration failed to deliver on their hot air promises and now the current one has done nothing to help the industry. Yet. We're headed either toward mass bankruptcy or the beginning of a new cycle. TLRY around 25 on the weekly RSI, as low as it's ever been. Getting hammered. I'm...

Gold and silver again are getting held down. Momentum is shifting bearishly as gold tops out again just above $2,000. Gold and silver miners are in a corrective pattern and will likely come down for a few weeks/months before we hit "the bottom" before the breakout.

When the fed starts cutting rates, I start building short

Gold and Silver have been holding strong, but weakness suggests another move down before support. As for metal miners, could there be a better set-up possible? Most all of them are sitting near historical lows looking to bottom out on the weekly RSI. I posted in July, 2022 that gold would move sideways until 2024, and then, blast-off. Think we're close....

Here's the simple premise. No technical analysis. No RSI, No MACD, No SMA's, No Volume Profiles, none of it. Two banks hold the majority of tether reserves (in USD). They are two banks in the Bahamas that have never allowed a 3rd party audit, they have never produced a balance sheet indicating any type of corporate solvency, they tried to keep their executives...

My November 1st post of a double-top is becoming more and more likely, but the overall environment does not favor a strong stock market. Strong Summer and Sept/Oct meltdown? Yeah, probably...

Gold is stalling out on the daily. MACD has oscillated bearishly, and daily and weekly RSI are near "overbought" levels. There is a massive weekly MA convergence structure around low HKEX:1 ,800 range. I want to see a test of this zone and gold RSI <30 before I consider loading up on miners.

The global banking environment is SCREAMING "run to gold as the only true safe-haven". Bitcoin is trash. Once USDT banks go belly-up crypto will crater. Don't let the hype and simps fool you, gold is the only true safe-haven there is.

Title and chart says it all. The macro-environment is suggesting gold and silver are on the verge of being the hottest trades of the year.

Regarding my post back in November 2022, we couldn't even muster the strength to get to 4,300. Let's face it, we're in rough shape. The Fed will try a few emergency tactics here in the coming weeks which will likely give us some relief in the near-term but the writing is on the wall. One last suckers rally so the sharks and whales can absorb some of the tax...

Many people are calling for "another leg down" before we're done correcting, but many people don't comprehend how massive this all is. Current weekly bullish divergence suggest rally soon. But the macro-fundamentals are dire and diminishing quickly 2023 might be one for the record books..... in a really really really bad way

Plenty of profits to take, so correction likely in the coming week. Big question, do we hold at 50D/200D MA and surge or do we get some "bad news" that absolutely tanks markets? Not a good time to be long either way.....

Big week for markets, stronger than anticipated economic data COULD send the VIX back to he teens and kick-off a nice equities rally. I'm mostly out and NEUTRAL right now but am ready for a breakout or breakdown. Leaning toward breakout....

Let's face it, the volume isn't there. Retail buyers are broke, many die-hard crypto fans have been destroyed and the LUNA and FTX melt-downs absolutely killed sentiment and damaged the industry beyond any short-term repair. Hash-rate is falling miners are going broke and bankrupt and retail credit card debt is at an all-time high. I was looking for a...

When we bottom in 2023 exchanges will start unraveling en masse due to FTX fall-out and miners going belly-up. But one more bull-trap to try to save the industry and prolong tether imploding. Probably only give us a few months however. I suggest prudence moving forward. I'm charting bottom around $7-$10K. Likely early in January, but we might get a second...

Tether dominance is sitting around 8.5%, it tops around 9.5%. That's it, that's the most tether dominance can be without the token unraveling. We get another sell-off tomorrow and bitcoin is around $14,000 and tether dominance around 9.5% that's almost a guaranteed bottom. Unless, the tether ecosystem melts-down, which is possible. Max-fear right now.

Another massive inverted head and shoulders coming up? I'm lowering my target to $14,000 range, within a few hundred dollars, then, fun.