Gutta_CEO_

PlusI believe NYSE:BABA is priming up for a breakout, returning to All-Time Highs and possibly Higher! - Technicals: Break and Retest (Symmetric Triangle) - Upcoming Earnings: August 14th - Potential Catalyst: US / China Trade Deal or Extension

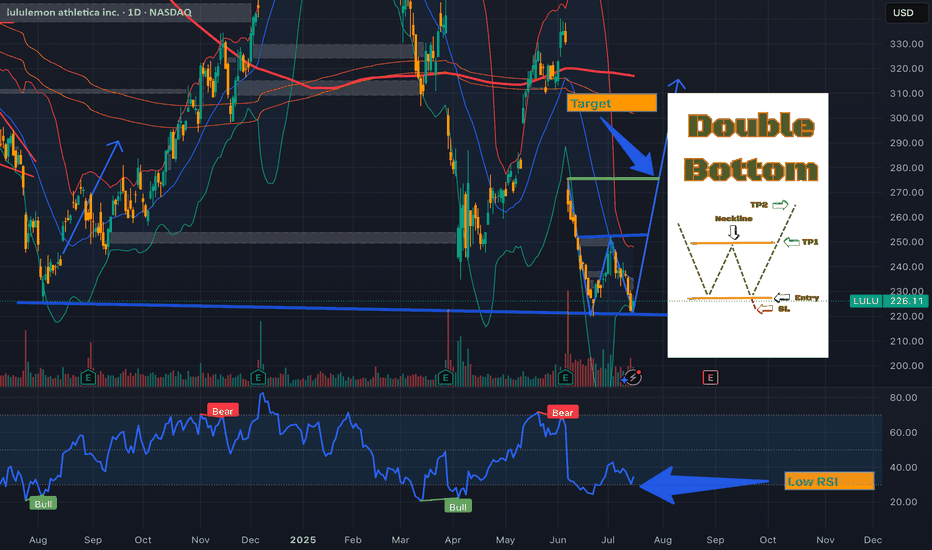

“LULU is forming a potential Double Bottom on the daily chart, with two lows around $222 (support) and a neckline at $252. The pattern suggests a bullish reversal if the price breaks above $252 with strong volume. RSI is showing bullish divergence, and the 50-day MA is converging near the neckline, adding confluence. Target: $275.50 (pattern height added to...

Could we see the bulls step in and leads us into earnings?

AAPL is forming a symmetrical triangle on the 4H chart, setting up for a potential breakout. This neutral pattern, with converging trendlines, signals consolidation before a big move. The upper trendline (resistance) is near $207, and the lower trendline (support) is around $200, with the current price at $205. RSI is neutral at 50, and volume is...

UNH testing third support touch at ~$394, with RSI near 30 on the weekly, signaling potential oversold conditions. Despite a tough Q1 with 4% EPS growth and rising medical costs, UNH boasts 10% revenue growth, a 2.08% dividend yield, and a massive 51M member base. Is this a dip to buy?

- Low RSI - Double Bottom - Gap Fill (Upside) - Low impact from potential Upcoming Tariffs

NASDAQ:COIN has formed a nice cup and handle formation on the weekly chart, signaling bullish momentum going into and through 2025…. with a president that 100% supports cryptocurrency, andthe previous week’s Bullish Engulfing candle with a significant increase in volume this confirms that we should see further bullish momentum!!!!

NYSE:PG is showing signs of a potential reversal….after testing the 200 MA technicals are shifting bullish!

As McDonald’s is attempting to recover from the gap down due to the outbreak, we see an inverse head and shoulders pattern forming……Bouncing from relatively low RSI……Following rate cuts by the Fed…….I believe we are primed and well position for a nice rally until 2025!

Bull Flag forming on NASDAQ:META I believe we will breakout soon!

NASDAQ:FSLR has great Fundamentals, and we are now signaling Bullish Divergence (2h Chart). The post-election selloff is a little overdone. This was due to the market anticipating the trade disruption caused by Trump tariffs. With NASDAQ:FSLR being domestically positioned I believe this is a great buying opportunity on this stock......I am not a financial...

With Google approaching earnings bouncing from the 200MA and forming an inverted headed shoulders pattern I believe we could see significantly bullish move to the upside to retest highs before seeing major resistance and possibly settling at new highs

After a few weeks of falling to the bottom of this ascending channel I believe AMD will see a pivot back to the upside soon!

NASDAQ:FSLR received an upgrade to Buy from Neutral by Citi Bank…..while approaching the 200MA and previous area of support…..undervalued on all time frames……with plenty of headway to retest All Time highs. Given the election supports further funding for Solar Projects to assist with our energy demand we could see a significant move to the upside into year...

AMEX:OIH may see some bullish momentum soon as geopolitical tensions get worse daily.

NYSE:MCD is overbought….and approaching resistance. I believe we’ll see a bearish rotation soon!

I believe we’ll see a NASDAQ:TSLA rally on the Robotaxi news! This is not only ann additional source of revenue for the so-called car company “Tesla”, but this revolutionizes the car industry as a whole! Allowing car owners to now turn their idle assets (cars) that just sit in their driveway into a profit generating asset allowing their vehicle to go out and...

NASDAQ:COIN is currently bouncing from it 200 MA with plenty of room to push higher on the RSI. Commentary has been picking up significantly and crypto and major corporations and Governments Showing great interest in establishing themselves in the crypto world…..With stocks due for another pullback, and September historically being one of the worst months of the...