The technicals on this chart look great and with Baidu trading at 19 x forward earnings with a market cap of a mere $49 billion... for the "Google of China," at a 27% discount to it's 52 week high, this is a very low-risk, high-reward place to buy.

For those of you unfamiliar with the "Principle of Polarity," it states that what was once resistance becomes support and vice versa. Looking at a logarithmic monthly chart of TSLA, there are unquestionable and very significant levels of resistance that have finally been broken. Generally, when iconoclast stocks hit all-time highs, they don't stop. If you're...

The fundamentals are a little ugly, but if I were a contrarian investor, this one looks ripe. They say to buy when there's blood in the streets. The technicals indicate very low risk. You couldn't ask for a cleaner double bottom. It's also breaking out of well established downtrend resistance (dating back to mid 2016). This is a buy.

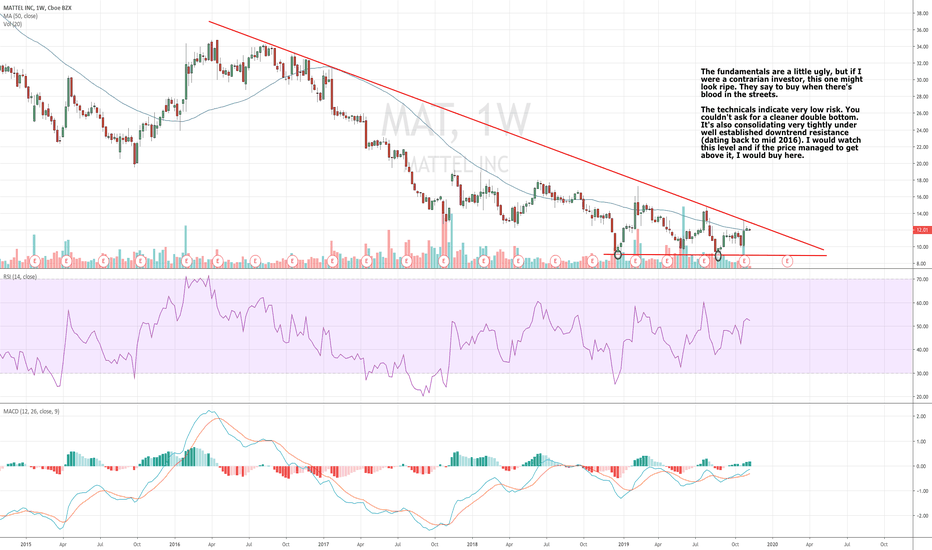

The fundamentals are a little ugly, but if I were a contrarian investor, this one might look ripe. They say to buy when there's blood in the streets. The technicals indicate very low risk. You couldn't ask for a cleaner double bottom. It's also consolidating very tightly under well established downtrend resistance (dating back to mid 2016). I would watch this...

Just a simple cup pattern within an uptrend. I believe the trend shifted in June and will continue upward for many months to come, in which case there will be many bases formed during this uptrend. I don't expect a handle to form unless ER is choppy. I'm long and margined. Hopefully ER drives it right through the pivot point.

SPX broke out of it's trading range a few weeks ago and has pulled back to find support along what was once resistance, which coincides with the 50DMA as well. Gap filled; Ready to resume bull market. I also ascribe to the notion that one should be buying stocks when everyone's telling you not to. There's nothing but negative headlines in the news regarding the...

SPX broke out of it's trading range a few weeks ago and has pulled back to find support along what was once resistance, which coincides with the 50DMA as well. Gap filled; Ready to resume bull market. I also ascribe to the notion that one should be buying stocks when everyone's telling you not to. There's nothing but negative headlines in the news regarding the...

SPX broke out of it's trading range a few weeks ago and has pulled back to find support along what was once resistance, which coincides with the 50DMA as well. Gap filled; Ready to resume bull market. I also ascribe to the notion that one should be buying stocks when everyone's telling you not to. There's nothing but negative headlines in the news regarding the...

TSLA's hitting it's trendline support. If it falls below it, I'm out. But if this holds, I would expect the price to go up indefinitely. If you're looking for the lowest risk price to get in, I don't think it's gonna get any better than this. Just be prepared to dump it if it goes any lower.

First and foremost, the fundamentals have me excited for TSLA. Consider the following: The truck will be released soon (trucks and crossovers are the best selling auto categories) They're selling more cars than ever China Gigafactory will be online soon (largest market for EVs on the planet) Exemption from Chinese tariffs Potential for full self driving They're...

I think the simplest technical analysis is the most reliable. Very basic indicators here are all signaling a top. RSI overbought, MACD crossing over, weekly support broken and a clean head and shoulders is forming. If it loses the neckline, it's an ideal short.

The technicals in the chart indicate this ain't over. I've been saying for months the fall in oil prices is a net negative for the US economy. Considering how much money was poured into the energy sector when oil was at $140 a barrel, a lot of jobs were created. The fracking industry has exploded. This year however, these companies' hedges are going to expire...

Market has been finding support along this trendline since 2011. It fell below it in August and is now finding resistance, closing on/below it. I believe we go down from here. I'm shorting a few stocks, have a couple leveraged inverse ETFs and have been trading puts. If we continue down next week, I've got a few more names I'll be watching.

NKE has formed a perfect head and shoulders and fell through the neckline on HEAVY volume. If support fails at this major trendline, I'm expecting a freefall. I won't pretend to know much about Nike's business, but I doubt a 28 P/E is warranted. Heavy insider selling is also disconcerting. This stock has PLENTY of room to fall. The market is crashing and this is...

Market breadth indicators have been turning over for months. I'm watching SPX for one last thing before I start shorting everything. Based on a small checklist of indicators I use, I'm expecting the market to crash before the year's end. With AAPL being the most owned stock making up large percentages of professional investors' portfolios, if the market starts...

Simple trendline suggests now is the time to get out of AAPL. My theory: The market is going to correct significantly from here and with AAPL being one of the most widely owned stocks, I would expect to see the liquidation start here first. Fundamentals are good, but it doesn't matter, if the market is falling apart.

I had originally hoped for a flag for a lower risk entry, but this would still be a good place to enter. Measuring implications would suggest ~$153 in early June. My only caveat: major index technicals look really bad, so I wouldn't expect this breakout to hold up in a down market. Apple's ER would be the catalyst. Considering the iPhone 6's success in China last...

AAPL has consolidated before the last 3 ERs and broken out thereafter. The chart appears to suggest the same thing is happening now. If so, I would expect a pullback to the major trendline around $116. Measuring the previous move and applying it to the breakout at ER, my price target would be around $143 in late May.