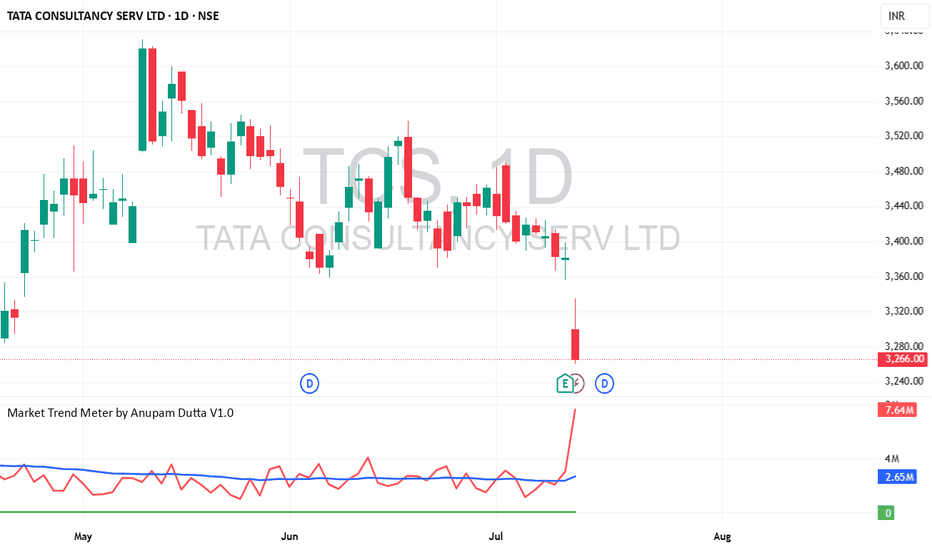

📈 TCS Long Opportunity – Medium-Term Swing Trade 🔹 Entry : ₹3266 (Last Close) 🔹 Target : ₹3525 🔹 Qty : Up to 25 shares 🔹 Timeframe : ~6 months 🔹 Estimated ROI : ~16.49% annualized A moderate-risk swing setup on Tata Consultancy Services . Technically and fundamentally aligned for gradual upside, assuming market conditions stay favorable. Entry...

My proprietary option pricing model, OptionSigma , identifies 25,200 as a key resistance level in the Nifty50 Index. Until this barrier is decisively broken, I won’t adopt a bullish stance. 🚨 Disclaimer: This is not a trade recommendation. Always conduct thorough research before making any trading decisions. #nifty

Today, I entered a long position in the Nifty50 25100 June (Monthly) Call option , securing an average price of ₹469.10 . I plan to accumulate additional lots at lower prices, with a strategy to hold until expiry. 📌 Disclaimer: This is not a trade recommendation. Please conduct independent research and assess risk factors before making any trading...

Analyzing the 7th Feb settlement prices using my proprietary OptionSigma model, a key level emerges: 23,698.80. 📌 Bullish Scenario: A clean breakout above 23,698.80 signals strength—potential long opportunities in Nifty February Futures or Monthly Call options. 📌 Bearish Scenario: Failure to breach this level? Shorting is the only play—either via futures or...

I plan to buy the ICICIBANK 1290 Put Option (January Contract) CMP: 25.90 | Best buy below 15.00 STOPLOSS: 7.50 TARGET: 1260 January future level. Validity: Till 27th January 2025 Trading session. Disclaimer: This is not a trade recommendation, for educational purposes only.

Building upon my prior analysis, where I held a bearish outlook on Crude Oil January Futures , I now present a contrasting bullish perspective. While I had previously emphasized the confidentiality of the stop-loss level for short trades, this setup focuses on a call option strategy aligned with my expectations of upward momentum in the market. For this trade,...

Based on my proprietary indicators, I maintain a bearish view on WTI Crude Oil. I am anticipating a downside target of ₹5800 (target open until 15th January 2025). Current Position: Holding short positions in MCX Crude Oil January 2025 expiry futures from ₹6025 levels. Intend to add more shorts if prices move to higher levels. Risk Management: ...

Summary: I'm bullish on the Natural Gas January 280 call option. Here's my trade idea: Current Price: Closed at ₹24.76 on December 27, 2024. Entry: Best Buying Price: Aim to enter below ₹18.80 for optimal risk-reward. Target: Price Target: Looking towards ₹37-₹40. Rationale: The current market conditions suggest potential for an upward movement in...

I bought a 940 January put option @ 30.90, and my Target 920 January Future Level (CMP @ 933.15). For Educational Purpose Only.

Market Outlook: I hold a highly bearish view on the Nifty50 23900 Call Option with an expiry date of 26th December 2024. This outlook is based on a detailed analysis of market trends and proprietary indicators. Entry and Stop-Loss Levels: Entry Level: Ready to sell the 23900 Call option at or above ₹142.40. Stop-Loss: Maintain a strict stop-loss at...

Stock Outlook: I maintain a bullish outlook on HDFC Bank (HDFCBANK) with a swing trade target of ₹1913.15 by February 27, 2025. This target aligns with the current technical and market trends indicating upward momentum. Stop Loss Strategy: To manage downside risk, ₹1600 has been identified as a crucial support level. Any daily settlement below this level will...

Sell Nifty50 24500 Weekly Put Option (19/12/2024 Expiry) Entry: At CMP 215/230 SL: 400 Target: 0.50/0.05 Validity: Till expiry. Disclaimer: For Educational/Information Purposes Only.

Sell Crude Oil January Expiry (Mini Contract) Entry: CMP 5941/Above 5955 Stoploss: 6055 Target: 5808 Validity: Till 15th January 2025 Disclaimer: For Educational Purposes Only

Buy Nifty50 December 2024 (Monthly) 25000 Call Option. Entry: CMP 70.10 Stoploss: 67.15 Target: 150/200 Validity: Till 26/12/2024 3:25 PM(IST) Analysis Logic: Volatility Contraction(VC) Disclaimer: For Educational/Information purposes only.

HDFCBANK Stock Analysis – June 2024 Overview: On May 30, 2024, the HDFCBANK spot closed at 1514.85 with an ATM IV of 25.69. According to my algorithm, the VVIX (VolatilityVision Index) was at 25.5614, indicating that bullish investors in this stock were not panicking over the impending Lok Sabha election results on June 4, 2024. Key Levels: - Probable...

🚨 Stock Update: TATAMOTORS 🚨 Date : 16-05-2024 TATAMOTORS breached major support today due to heavy selling pressure and closed at 936.40. I expect the stock to consolidate for a while, which presents a good opportunity to accumulate. I'm bullish on this stock and plan to buy small quantities below 930 with a stop loss at the next support level (872.10) . My...

I always use a 200-period EMA and RSI with a 200-period. An RSI above 50 indicates bullish strength in the EMA. Let's analyze Bombay Burma (NSE: BBTC) shares. Based on the chart and the April 25, 2024, closing price of 1578.90 , the best buy is below 1553 . The stop loss is set at 1321.60 , with a probable target of 2107.00 . This setup offers a risk-reward...

Greetings traders, I'm excited to share my trading plan for the Nifty50 options from 3rd May to 9th May. Let's dive into the analysis and potential scenarios. Bullish Outlook: Firstly, I hold a bullish sentiment for the Nifty50 9th May expiration option contract. Based on my analysis, I foresee two possible scenarios unfolding during this period. Scenario...