InternalTraderNYC

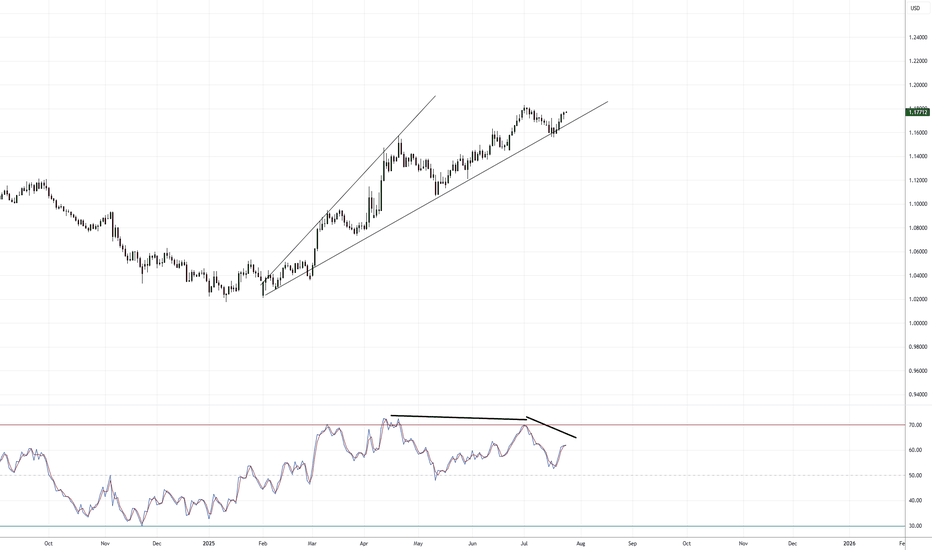

PremiumAs indicated on my previous EUR/USD idea ( that's still currently open ), I remain short EUR/USD given the technical aspect of things are still valid. Divergences are still in play along with a rising broadening pattern and the fact that we're trading at the yearly R3 level ( which is rare ). I suspect we will have some volatility with the ECB press conference...

The past 9 days have been quite interesting for the EUR/USD which has been relentless. Price has been rising like a helium balloon let loose at the park... Bulls have clearly been in control, not only the past 9 days but since the beginning of the year with the exception of the strong pullback in April & May only to bounce for another 700 pip run. I am totally...

Although the EUR/USD and GBP/USD popped higher late last week, I'm still keeping a close eye to stay short on the EUR/USD considering the bearish rising broadening pattern coupled with a yearly pivot point inter-median level and negative divergence on the MACD. This is all based on the daily chart. Many factors are in play right now with what's going on between...

In this video I go over the case for the U.S. Dollar bear taking a break and price action getting a pullback across the EUR/USD, GBP/USD and USD/JPY. I took a 42% profit on EUR/USD longs and currently keeping an eye on a short opportunity if weakness starts to creep in on the price action. Long term, I remain U.S. Dollar bearish across the board however...

Let’s take a look at the USD/CAD quarterly (3-Month) chart. Things are looking quite bearish for the coming months as price begins to get squeezed inside the ascending triangle. The bulls have tried multiple times breaking and clearing the 1.4500 price zone but has been met with a strong resistance each time. Considering that the MACD and RSI are diverging to...

In this video I go over the EUR/USD, GBP/USD and USD/JPY. Will the USD bears come pouring back in or give up the previous low on the EUR/USD... Some markers I'm watching is a "hidden" divergence on the MACD and it's potential signal for continued bullish strength for the EUR/USD, especially with the U.S. credit rating getting lowered by Moodys. I'm also watching...

In this video I go over EUR/USD, GBP/USD, USD/JPY, NVDA & SPX. With an overall bearish outlook on the U.S. Dollar, I'm watching for support to hold above 1.1200 on the EUR/USD in order to continue the rally. Although a pullback was expected after an aggressive up move over the span of 3 weeks, this will be interesting with a good amount of economic data set to...

Not much action due to the extended market break and Easter weekend but I expect more USD selling across the board in the coming weeks ahead. Long positions are sitting tight but two areas I am keeping an eye on are 1.1200 as a base support and 1.1500 as the resistance hurdle we need to clear in order to open up the gates to 1.2000+ GBP/USD is still a bullish...

After further analysis on the weekly and monthly chart, I have identified what looks like a much larger broadening bottom pattern which signals the possibility of much further U.S. Dollar weakness. Based on my previous video analysis, my original target for the EUR/USD was 1.2000 however 1.2500 – 1.3000 is not out of the question now. We haven’t traded in that...

In this video I go over last week's epic volatility and what I am looking for going forward. Long positions on EUR/USD at 1.0980 will remain in tact and still eyeing a target of 1.2000 out of the falling wedge displayed on both the monthly and quarterly charts. I do expect some pullback after a massive move to the upside to end the week however, the bull can...

In this video I got over some important outlooks on the EUR/USD, GBP/USD and USD/JPY along with outlook on the stock market. The U.S. Dollar has been getting absolutely crushed along with the stock market which usually has the opposite effect. Considering we may be into a stagflation scenario, this is not surprising. Tariffs have spiked volatility and puts the...

In this FX market preview I go into recapping the EUR/USD, GBP/USD and USD/JPY price action last week and what I'm looking at for this week. I also take a look at ETF's QQQE and Nvidia opportunities. I continue to hold my EUR/USD short positions while keeping a strong eye on 1.0860 and then 1.0900. I feel these areas are important for the bears to hold the line...

I couldn't resist the GBP/USD bear opportunity here displaying a broadening pattern. I'm already in established shorts on the EUR/USD at 1.0891 but decided to jump in on GBP/USD at 1.2916 considering the price movements can be more pronounced. Right now, my cap on whether this trade works or not is 1.3000. if we, for whatever reason, pop back up to 1.3000, I'd...

NVDA looks like it's resuming it's downtown after a temporary recover. I'm watching to see if we get close to $100 again. If so, the door could open for $90 or even $85. The rising wedge could still be in play here. Good Luck & Trade Safe.

In this video I go into what I'm currently looking at on the EUR/USD, GBP/USD and USD/JPY. Leaning towards the bearish side for EUR/USD, I want to see us take out 1.0800 before I have more conviction. I will continue to cautiously hold short positions for a possible run down towards 1.0600 area or the yearly pivot zone. Hope you enjoy this analysis. Good Luck...

After the previous 3 weeks of bullish havoc, the bears may have finally decided to pump the breaks on EUR/USD buyers. As price continued to push higher, I held on to short positions that I began building up at 1.0851 & 1.0909 as I wanted to wait and see if the Pivot level R1 area (1.0935) was going to provide the wall to begin declining back down. Once I saw the...

In this analysis I go over the EUR/USD and it's potential for further gains or a weakening bull and drop. I expect a volatile week considering it's FOMC on Wednesday and ECB speaking on Friday. Additionally, I share my outlook on ETF's I'm involved in. Currently in QQQE Put Option and closed my TQQQ Put for 30% gains last week. As always, Good Luck and Trade Safe.

After last week’s monstrous bull move on the EUR/USD, I had short positions at 1.0740 and 1.0795 which I ended up closing because I wanted to wait and see how much momentum this thing had. I got back in short at an average price of 1.0827 with a modest target at 1.0600. Although it looks like bullish momentum is stalling, I remain cautious. Resistance at the...