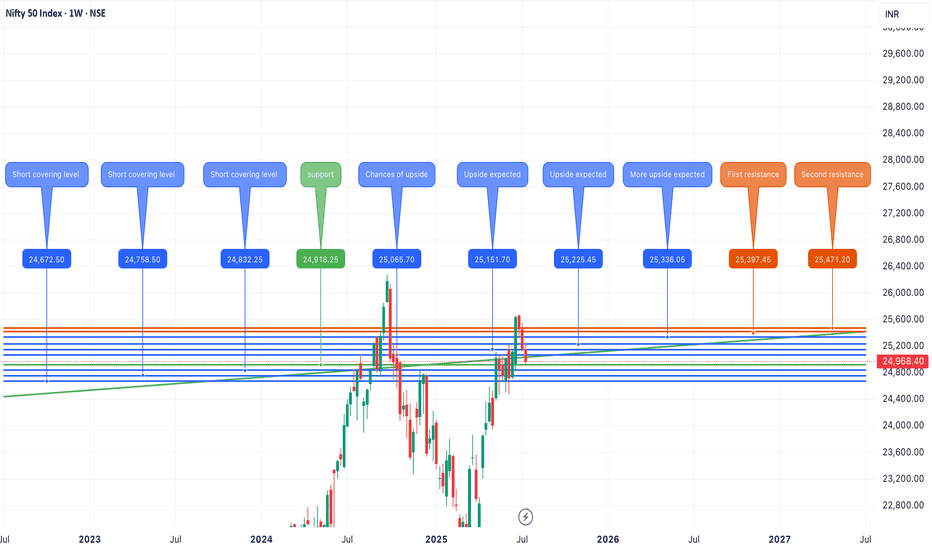

Nifty closing is bearish and we can expect further retracement in the first half of the week , imp level to watch on downside are 24750-650 . For upside momentum nifty must cross and sustain above 24950-25050 . ALL LEVELS ARE MARKED IN THE CHART POSTED

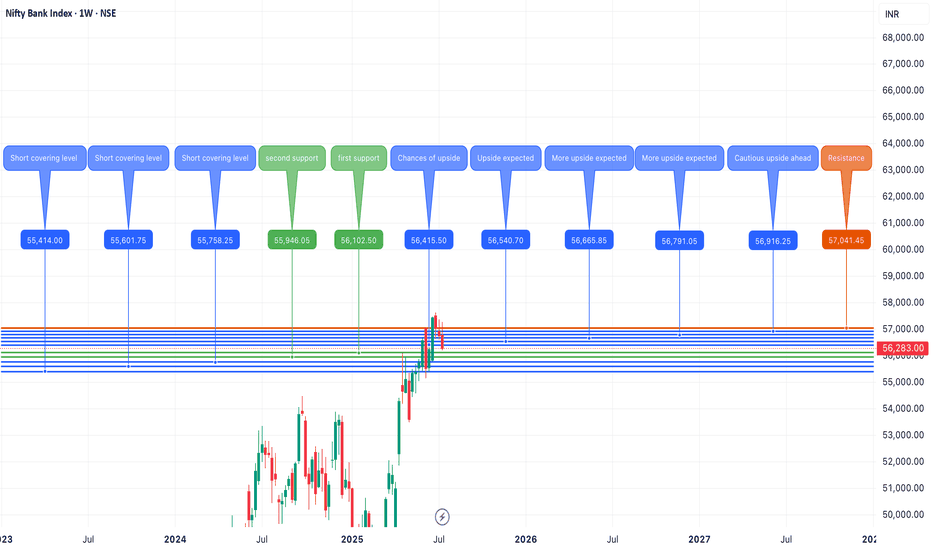

The Bank Nifty is showing indecision, with the weekly close at 56,500 favoring bears over bulls. The key support zone lies between 56,250 and 55,900. If Bank Nifty breaches this range, further downside is expected toward the significant short-covering zone of 55,500–54,850. On the upside, Bank Nifty must cross and sustain above 56,650 to gain momentum, potentially...

Banknifty is looking uncertain but we can expect short covering in later half of th week if it retraces upto 55400-600 , Imp support levels on downside are placed between 55900-56100 and below that we can expect levels upto 55700-400.On the upside imp level to watch 56550 and if banknifty crosses and sustains above 56550 then we can expect further upside upto...

Nifty trend is looking unclear and closing is certainly not in favor of bulls, downside would be open upto 24700 if nifty breaches important support of 24900-830. To resume its upside momentum nifty must cross and sustain above 25150-200. All levels are marked in the chart posted.

Banknifty closing isn't looking bearish until now , but if it breaches 56500-400 on the downside, then we can expect a retracement upto 55800-500+ . On the upside, if Banknifty successfully crosses and sustains above 57250-300, then we can expect it to continue the upside upto new highs of 57800-58000+ .

Nifty is looking uncertain at the moment , and we can expect a highly volatile week ahead for Nifty. Upside momentum can be trusted only if Nifty crosses and sustains above 25320, and it can continue upside momentum upto 25600-650. On the downside, if Nifty breaches 25050-24950, then we can expect a downtrend upto levels of 24750-650.

Nifty is looking positive for the upcoming week , and we can expect levels upto 26000 on nifty in the upcoming week . Imp range to watch for upside is 25650-750 .Until then call writers can hamper intraday upside moves. Bulls need to remain cautious of sell on rise until nifty crosses and sustains above 25650-700 range. On the downside imp support zone are...

Banknifty is looking neutral for the upcoming week , not looking very action-packed week for Banknifty and it can remain subdued with positive bias. While on the upside, if Banknifty crosses and sustains above 57600, then it can form new all-time highs upto 59000 levels . And on the downside, if Banknifty breaches 56800, then we can expect a small retracement upto...

Nifty is looking positive for the week ahead, and we can expect momentum to continue up to 26000-26148 levels.The Important level to watch for upside would be 25750-800, and if Nifty breaches downside support of 25550, then we can expect a small retracement up to 25200-300 on the downside. All levels are marked in the chart posted.

Nifty bank is looking positive for the week ahead and we can expect momentum to extend upto 58500-950 in the upcoming week. The important level to watch for upside momentum is 57800. Upon crossing and sustaining above 57800, we can expect upside momentum. On the downside, if Banknifty breaches 57200 and 57000, then we can expect a small retracement upto...

Banknifty closing is looking positive, and we can expect upside momentum to continue up to 56600. Upon crossing 56600, we can expect a bigger upside momentum up to a new all-time high of 57267-57500. But if due to any global factors we encounter a bearish move, then imp levels on the downside would be 55770-55300.

Nifty is looking positive for the upcoming week. Closing above 25000 is giving confidence for upside momentum upto 25500. Only caution for upside is global tensions which can hamper the momentum . On the downside, if Nifty breaches 25000-24900 range only then we can expect downside move upto 24750-650. ALL LEVELS ARE MARKED IN THE CHART POSTED.

Nifty is looking uncertain due to global uncertainties, and we need to track and expect moves through levels as there is no trend present on the chart right now . Upside is expected only if Nifty crosses and sustains above the 24850-950 range, and then it will face resistance at 25084. Upon crossing that, we can expect good short cover in Nifty. While if Nifty...

Banknifty can remain highly volatile, and we can expect a green bar on weekly charts . Expecting short covering from lows if we do not get any fresh global uncertainties. Imp levels to watch on the downside are 55200 and 54800 .And if banknifty breaches 54800 on the downside then we can expect further retracement upto 54500-54000. On the upside, Banknifty must...

Banknifty is looking positive for the upcoming. Now, 56000 is an essential support for bulls, and we can expect this momentum to continue up to the level of 58200-58500 until Banknifty trades above 56000. And if Banknifty breaches 56000, then we can expect levels up to 55000.

Nifty is looking positive for the upcoming week, and we can expect upside momentum to continue up to 25500 in the upcoming week. Right now, downside risk is looking limited up to 24650, which we can expect only if Nifty daily closes below 24900.

Banknifty is looking positive for the upcoming week , but upside confirmation only if Banknifty crosses and sustains above 56000-56100. Until then, Banknifty trend is not confirmed, especially for upside. As of now, downside looks limited, but if Banknifty breaches 55000, then we can expect a small retracement . ALL LEVELS ARE MARKED IN THE CHART POSTED.

Nifty is trading at a very important zone; this week will be very important for both bulls and bears. Upside only above 24970 as it will act as a resistance until Nifty crosses and sustains over it. If Nifty manages to hold above 24970, then we can expect strong short covering upto 25300-400. But if Nifty breaches 24600 on the downside, then we can expect...