Junmadayag

PlusShorting ETH on daily bearish crt and possible weekly crt as well

Im already on this trade and I am looking at another possible trade entry for a possible ABC pattern. Let me know what you think.

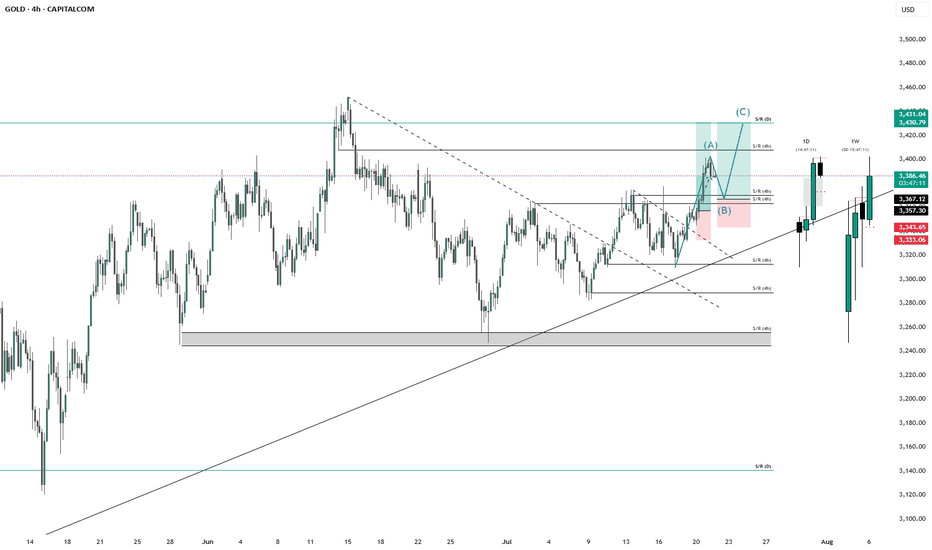

Looking at 4h chart, our short term bearish channel has been broken indicating a possible reversal. Waiting for this sell setup to trigger. Let me know your thoughts.

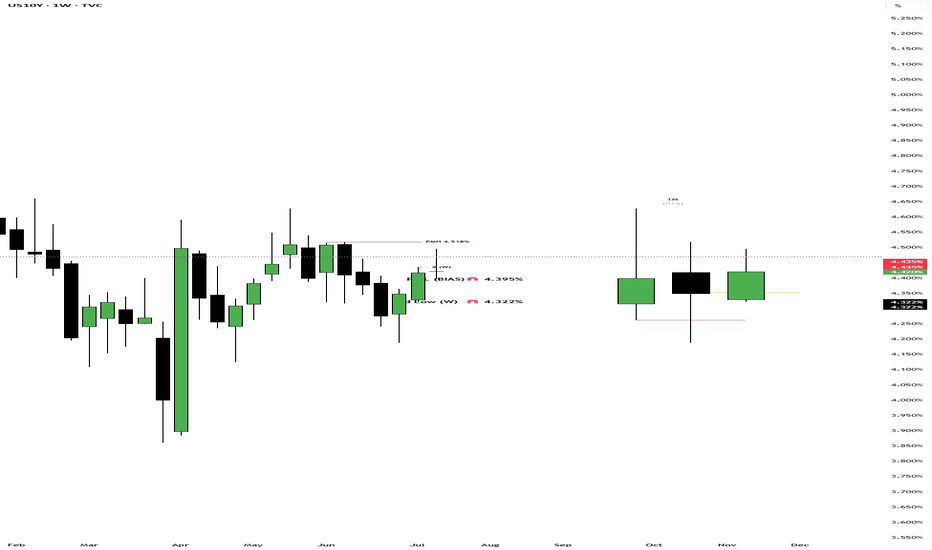

US Treasury 10Y Technical Outlook for the week July 21-25 (updated daily) Overnight On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Christopher Waller. The consumer sentiment index rose in July,...

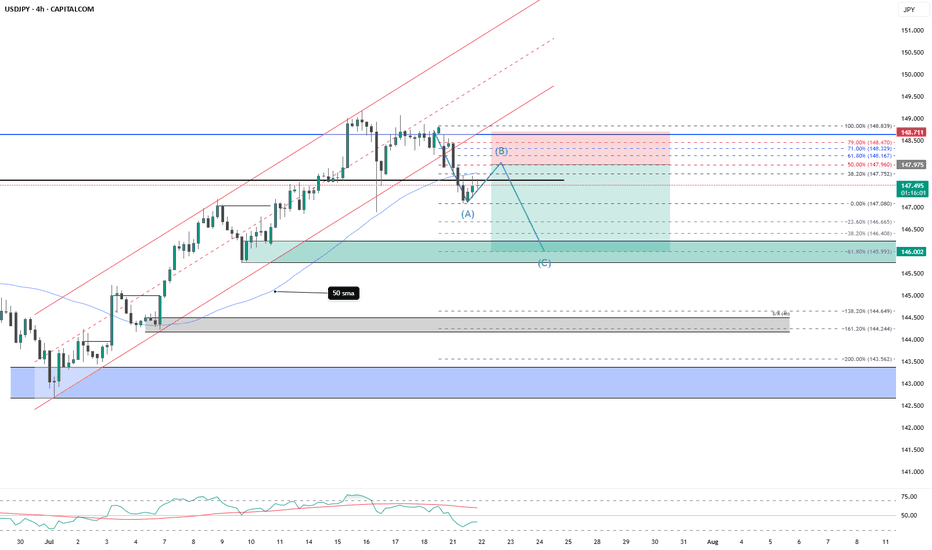

Mid-Week FX Profile Update with Daily and Weekly Overlays USDJPY EURUSD GBPUSD GOLD

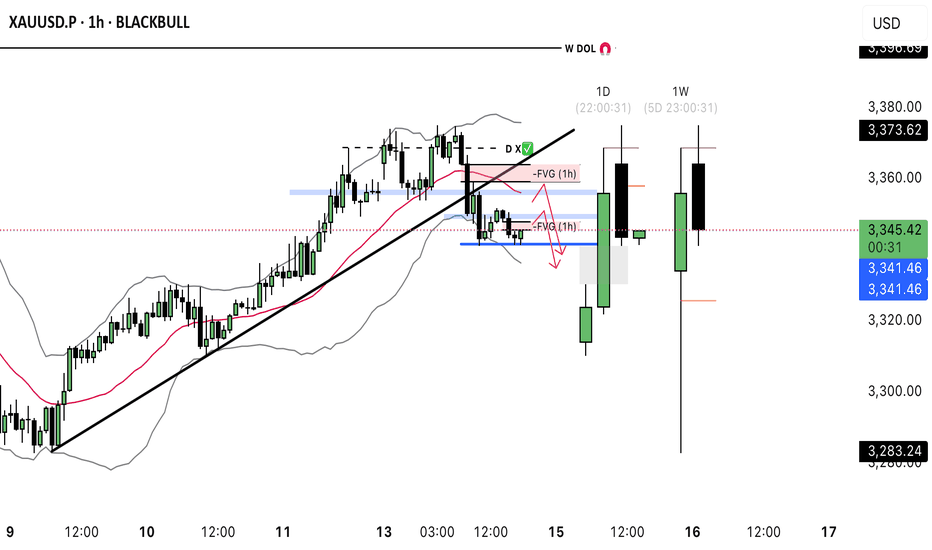

Gold-Are we going to expand lower or higher this week Chart 1hour with daily and weekly overlay (Indicator bollinger band 20,2) Tonight is CPI and Inflation numbers www.myfxbook.com

US Treasury 10Y Technical Outlook for the week July 14-18 (updated daily) Overnight On Friday, the US 10-year Treasury note yield increased by nearly 4 basis points to approximately 4.39%, driven by market concerns over new tariff threats from President Trump. These include a proposed 35% tariff on Canadian imports starting August 1, 2025, and planned 15-20%...

US Treasury 10Y Technical Outlook for the week July 7-July 11 (updated daily) Overnight The US 10-year Treasury yield increased by 6 basis points to 4.34%. A stronger-than-expected jobs report triggered the rise. Nonfarm payrolls reached 147,000 in June. April and May payroll figures were revised higher. The unemployment rate dropped to 4.1%. Wage growth slowed to...

US Treasury 10Y Technical Outlook June 30-July 4 Overnight On June 27, 2025, the US 10-year Treasury yield rose to 4.26% after five sessions of decline, as markets anticipate earlier Fed rate cuts. Recent data, including subdued PCE inflation, a sharp drop in May consumer spending, a 0.5% Q1 GDP contraction, and rising jobless claims since 2021, support these...

Fx Outlook for the Week June 23-27 #DXY #USDJPY #EURUSD #GBPUSD #GOLD **Disclaimer:** The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on...

US 10Y TECHNICAL OUTLOOK FOR THE WEEK JUN 23-27 (UPDATED DAILY) Geopolitical event Early Monday in Asia, US equity futures fell and oil prices surged following US strikes on Iran's nuclear facilities over the weekend, prompting a risk-off sentiment that saw Asian equities decline and the dollar strengthen against major currencies. The US Treasury market faced...

US 10Y TECHNICAL OUTLOOK FOR THE WEEK JUN 16-20 (UPDATED DAILY) Overnight U.S. Treasuries ended the week lower as rising energy prices sparked inflation concerns, potentially delaying Federal Reserve rate cuts. Crude oil surged $5.12 (7.5%) to $73.16/bbl, up 13.3% weekly, following Israel’s strike on Iranian nuclear facilities and Iran’s retaliatory missile...

US 10 YEAR TECHNICAL OUTLOOK FOR JUNE 9-13 (JUNE 9 UPDATE) Overnight U.S. Treasuries declined following a stronger-than-expected May employment report, signaling a robust labor market and sustained economic growth, reducing expectations for near-term Fed rate cuts. Investors sold across the yield curve, with the belly experiencing the most pressure. Meanwhile, the...

US 10 YEAR TECHNICAL OUTLOOK FOR JUNE 2-6, 2025 Overnight, U.S. Treasuries remained stable, with shorter-dated maturities slightly outperforming longer ones. Mixed economic data included stronger-than-expected April personal income, weaker-than-expected May Chicago PMI, and concerns over U.S.-China trade tensions. Treasury Secretary Bessent noted stalled talks,...

US 10Y Technical Outlook for the Week May 26-30, 2025 Market Recap: Week Ending Friday, May 23, 2025 U.S. Treasuries surged early after President Trump’s X post proposing a 50% tariff on the EU, citing stalled trade talks, sparking a flight-to-safety amid growth concerns and tariff uncertainty. The 10-year note yield fell from 4.54% to 4.45%, and the 30-year bond...

US 10y Treasury Outlook for the Week May 19-23,2025 May 19, 2025 Friday Fundamental Recap U.S. Treasuries rose, with the 30-yr yield nearing its mid-January peak (5.005%). Gains followed Japan’s Q1 GDP contraction (-0.2%; expected -0.1%) and a strong eurozone trade surplus (EUR36.8 bln; expected EUR17.5 bln). Weak U.S. data—April Housing Starts and May Consumer...