KeN-WeNzEl

Technical Analysis: 1. Daily Chart (Long-Term View): • The price has recently pulled back but remains in a long-term uptrend. • The MACD is negative, indicating past selling pressure, but it is starting to turn, which suggests momentum may shift bullish. • The RSI is at 47.54, close to neutral, meaning there is room for upside movement without being...

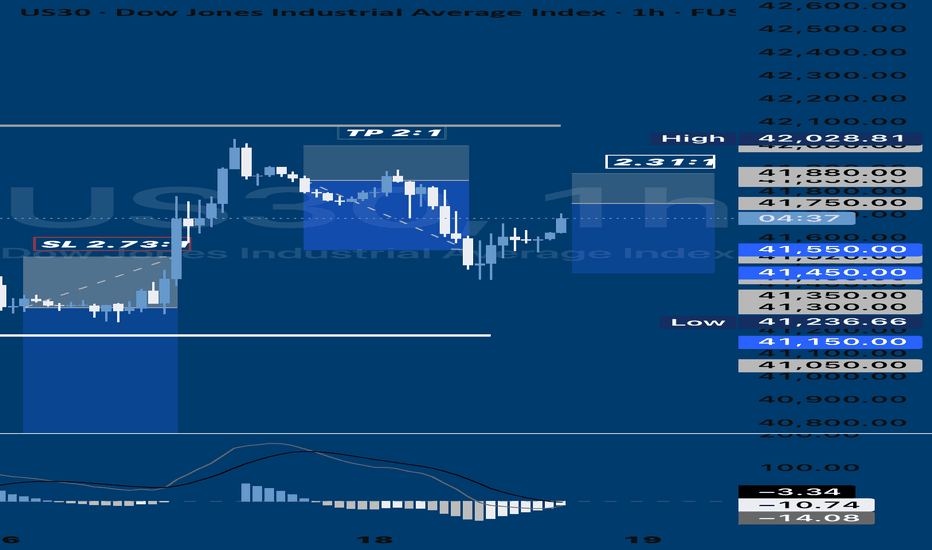

1. Technical Analysis Breakdown: Daily Chart: • Trend: Bullish overall, but showing signs of pullback. • MACD: Bearish, indicating weakening momentum. • RSI: At 45.23 — neutral but leaning toward oversold territory. • Support level: Around 41,500. • Resistance level: Recent high near 42,890. 15-Min Chart: • Trend: Strong intraday upward momentum. • MACD:...

The US30, also known as the Dow Jones Industrial Average (DJIA), is currently experiencing heightened volatility as investors grapple with mixed economic signals from the U.S. economy. On one hand, strong corporate earnings and resilient consumer spending have provided support, while on the other, concerns over persistent inflation, rising interest rates, and...

Technical Analysis: 1. Daily Chart: • Trend: Bearish correction after a strong uptrend. • MACD: Negative, showing increasing bearish momentum. • RSI: 38.25, indicating oversold conditions but with room for further downside. • Price Action: The price has broken below the short-term moving average, signaling further weakness. 2. 15-Min Chart: • Trend:...

1. Technical Analysis Daily Chart • Trend: The index is in a broader downtrend, with a recent pullback from highs around 42890 to 42060. • MACD: Deep in negative territory, suggesting bearish momentum. • RSI: 43.01 — indicating it’s closer to oversold but still has room to fall further before a reversal. 15-Minute Chart • Trend: Short-term uptrend, showing a...

Technical Analysis: 1. Trend: • All three timeframes (H1, M15, M3) show a clear downtrend. • Price has broken key support levels and continues to make lower highs and lower lows. 2. Indicators: • MACD: Bearish momentum is strong across all timeframes. • RSI: All readings are below 40, signaling bearish momentum with room for further downside. • OBV:...

Technical Analysis: 1. Trend Analysis: • H1 Chart: The price was in an uptrend but has started to weaken. The MACD is losing bullish momentum, and RSI is below 50, indicating bearish pressure. • M15 Chart: The price has recently made lower highs and lower lows, signaling a short-term downtrend. RSI is below 50, and MACD is negative. • M3 Chart: The price is...

Technical Analysis: 1. Trend Analysis: • 1H Chart: Clear uptrend with a pullback and price stabilizing near 2918. • 15M Chart: Price has been consolidating after a recovery from a dip. • 3M Chart: Market is forming higher lows, showing strength. 2. Indicators: • MACD: • 1H Chart: Bullish momentum, MACD line above signal line. • 15M Chart: MACD recovering...

Technical Analysis: 1. Trend Analysis: • H1: Uptrend resuming after a pullback. MACD histogram turning positive, indicating bullish momentum. RSI at 59.21, showing strength but not overbought. • M15: Price recently broke above resistance and is holding above it. MACD near zero but turning positive, supporting bullish continuation. RSI is neutral at 50.36,...

Technical Analysis 1. Trend & Price Action • On the H1 timeframe, gold is rebounding from a recent downtrend and has formed a higher low, indicating a potential reversal. • The M15 timeframe confirms this rebound, with price breaking above the short-term resistance. • The M3 timeframe shows price consolidating near the highs, which suggests accumulation before...

Technical Analysis 1. 1H Chart (Higher Timeframe Trend) • Downtrend Reversal: Price was in a strong downtrend but is now bouncing off a key support near 2827-2830. • MACD: Histogram is reducing bearish momentum, suggesting a possible trend reversal. • RSI (14): Rising from oversold conditions (~54.89), indicating bullish momentum building up. 2. 15-Min Chart...

In recent weeks, gold (XAU/USD) has experienced a notable pullback from its record highs, influenced by a combination of technical indicators and fundamental factors. The emergence of a Shooting Star candlestick pattern at the peak suggests potential short-term bearish momentum, while overbought conditions indicated by the Relative Strength Index (RSI) further...

Technical Analysis: 1. Daily Chart: • Trend: Uptrend but showing signs of exhaustion. • MACD: Still bullish but momentum is weakening. • RSI: 53.11, indicating neutral momentum, with a possible shift to downside pressure. 2. 15-Min Chart: • Trend: Clear downtrend forming. • MACD: Bearish momentum is strengthening. • RSI: 42.74, nearing oversold but with...

Analysis: 1. Daily Chart: • Strong uptrend with price making higher highs and higher lows. • MACD is bullish, and RSI is at 62.67 (still below overbought territory). • No major resistance above the current level, suggesting continuation. 2. 15-Min Chart: • Price is recovering from a recent pullback. • MACD is turning positive, signaling a potential bullish...

Technical Analysis: • Daily Chart: • Strong bullish trend with price at all-time highs (2924.45). • MACD is showing high bullish momentum. • RSI is at 63.76, near overbought but still room for upside. • 15-Minute Chart: • Recent pullback to 2903.40 and strong bounce. • MACD is crossing bullish from oversold levels. • RSI at 64.92, confirming bullish...

Technical Analysis: • Daily Chart: • Strong uptrend with price near all-time highs. • MACD is bullish with strong momentum. • RSI at 71.76, slightly overbought, but trend continuation is likely. • 15-Minute Chart: • Bullish structure, price making higher highs and higher lows. • MACD is positive, confirming upward momentum. • RSI at 51.04, showing room for...

Technical Analysis 1. Daily Chart (Macro View): • Trend: Strong bullish trend, price at 2933.30, nearing overbought RSI (69.87) but not extreme. • MACD: Strong bullish momentum (MACD 54.58 > Signal 56.73), indicating sustained buying pressure. • Resistance Level: Around 2945, with room to test or break. • Support Level: Around 2813.30. 2. 15-Min Chart...

Gold is in a strong uptrend on the Daily chart, making higher highs and showing strong momentum. The RSI is above 70, indicating overbought conditions, but this is typical in strong trends. The MACD is bullish and confirms momentum. On the 15-minute chart, Gold is consolidating after a strong rally, suggesting a continuation higher. The RSI is neutral (49.33),...