KrisadaYoonaisil

PremiumLong-term yen weakness persists due to Fed–BoJ policy divergence and declining exports. Technical analysis USDJPY has formed a series of higher highs and higher lows, signaling the early stage of an uptrend. However, the strength of this trend remains uncertain, as each new high is followed by a pullback, indicating a fragile uptrend. If the price holds...

The Bitcoin bull has been resting for a while, and it may be ready to run again soon. Technical Analysis Bitcoin consolidated within a narrowing range, shaping a potential Bullish Falling Wedge, a continuation pattern that typically precedes an upside breakout. Closing above 121,000 would confirm the bullish structure and signal trend continuation. RSI below...

USDJPY may have already found its bottom and is now on a rising path Technical Analysis USDJPY found long-term horizontal support (1.5 yrs) at 140.00 in April and began a slow rebound, forming consistent higher lows—signaling strengthening bullish momentum despite no clear breakout yet. The EMAs across multiple timeframes are starting to converge after an...

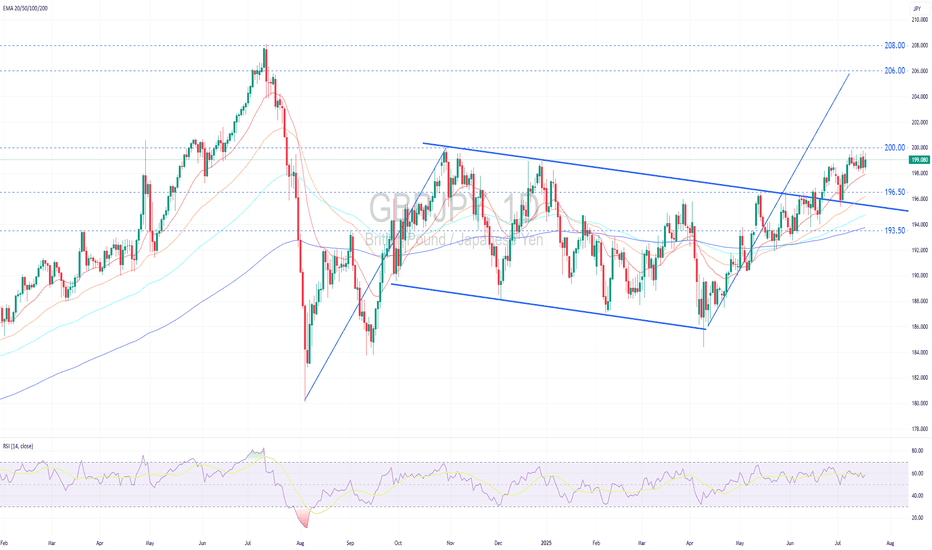

GBPJPY remains in a solid uptrend. Technical Outlook: GBPJPY remains in a firm uptrend, forming a series of higher highs and higher lows while holding above widening bullish EMAs, signaling strong bullish momentum. Price is currently consolidating sideways near the recent peak, following a successful retest of the broken descending trendline, a classic...

Gold price has completed a Gartley pattern and is now in leg C of a corrective wave. Gold appears to start a downtrend following the completion of a Gartley pattern . This move suggests a potential bearish reversal, with the current decline likely marking the start of a sustained move to make a significant lower low, rather than a short-term pullback. The...

DXY Likely to Rebound Significantly Soon Technical Perspective: DXY recently broke below its previous low, forming a lower low, with both EMAs signaling a downtrend. However, the price has now reached a 14-year-old long-term ascending trendline support , which reflects the strength and effectiveness of this tool. So, we can expect a reaction at this line....

BTCUSD Breaks and Holds Above Key Resistance, Poised for New All-Time High BTC price has held above the descending resistance line after breaking out yesterday, indicating a confirmed breakout. This suggests that bitcoin's price may continue its upward trend sustainably. The BTC price is currently testing the prior high at 110500. A decisive close above this...

Gold might rebound significantly today, with a potential reversal zone around 3250–3285. Technically , gold has been in a bear market for the second consecutive week, pushing the RSI into the oversold zone up to 1H timeframe. This suggests a potential rebound soon, allowing the bears to take a breather before resuming the downtrend. Additionally, the price...

USOIL may reach a saturation point and is likely to swing down, at least in the Short Term. Technically, the price has tested the upper boundary of the descending channel near the key psychological resistance at $75 per barrel but failed to close above it, despite a brief breakout. This reflects the strength of the 75 resistance zone. Moreover, the RSI...

XAUUSD can still surge for another leg before a possible reversal XAUUSD is on a steady and gradual uptrend with no signs of a bearish reversal at this moment. Instead, the current price action shows signs of a sideways accumulation phase, indicative of bullish continuation. The next technical target is 3440, corresponding to the 161.8% Fibonacci...

After silver prices surged significantly on Monday, the market followed by a consolidation phase, forming a symmetrical triangle pattern. Typically, this pattern signals a continuation of the prevailing trend, but confirmation is required on a breakout—ideally sustaining above the previous high at 34.80. If the price hold above 35.00, it would confirm a...

Silver got a healthy breakout and appears reasonably attractive as a buy following the signal. 1. After an extended consolidation, silver has broken out of its upper range to retest the previous swing high. This breakout from its sideways range is technically significant, reinforced by a strong bullish candlestick that indicates robust upward momentum. Another...

Gold prices are likely to surge today for several reasons, but do not expect a long-term rally just yet. Technically, the price has tested the former resistance-turned-support level at 3250, which aligns with the 50% Fibonacci Retracement, and has completed a 3-wave minor structure. After testing the 3250 level, the price rebounded significantly and broke...

The key reasons include: 1. Profit-taking at high price levels: Technically, the price has failed to make a new high, prompting continued selling pressure. It hit 78.6% Fibonacci Retracement before a correction, making it possible for a bearish reversal. 2. Hopes for U.S.–China trade negotiations: Easing tensions between the U.S. and China have boosted investor...