LGNDRY-Capital

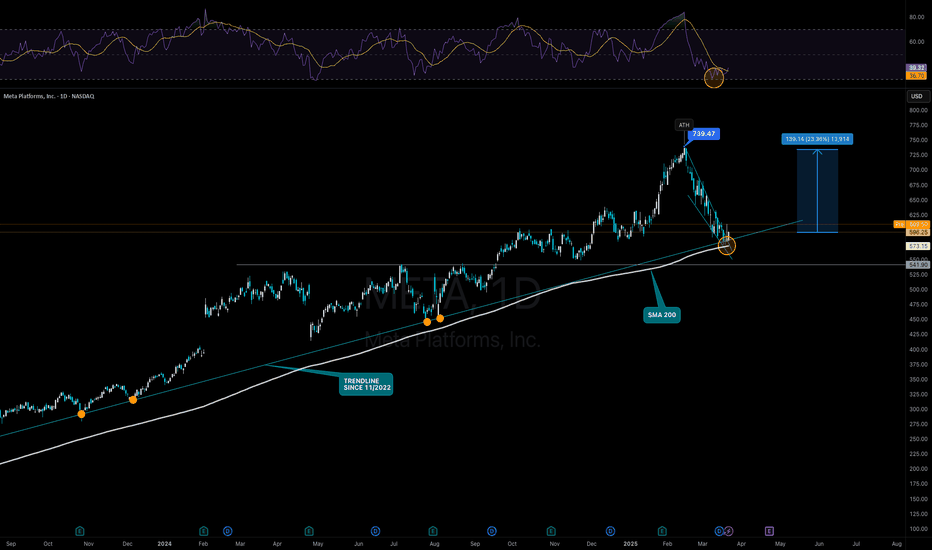

PlusNASDAQ:META Meta has hit the trend line from November 2022 after a price loss of 20% and has shown with a first small bounce that it is still relevant. At the same time, the SMA200 is also at the same point. Last but not least, the 0.238 Fib is also located in this area (from the entire upward movement from November 2022). Technically, we can therefore definitely...

NASDAQ:ADBE ADBE, as well as other tech stocks, was beaten hard over the last couple of months. The earnings recently did not provide any relief for the chart either, although the figures were not particularly bad. In particular, the possible prospect of finally being able to expand and monetize Adobe's own AI “Firefly” continues to offer good...

NASDAQ:GOOGL GOOGL has consolidated significantly over the last few weeks and, like the NASDAQ, has also taken a beating. Due to the now attractive valuation, the continued stable growth and earnings growth, GOOGL is still a good investment. Technically, we have reached a trend line and a weaker horizontal support with a further support area at around USD 150....

NASDAQ:NVDA got hit hard by the huge sell-off today and because of the DeepSeek release. The Chinese GPT alternative claims to be better or at least as good as GPT using way less and way older NVDA GPUs. If true, this could create a lot of stress on the CapEx of big US tech companies because the managers will ask their employees why they needed to buy all of...

Technical View NASDAQ:ON ON bounce off from a bigger support area from 2022 at around $53 building an ascending triangle. We have a gap above our current price (which can function as a magnet for the stock price). A smaller resistance at $60 might be our first target and the bigger resistance at $77 could be our final target resulting in 36% ROI. The trade...

Upward trend with a bullish wedge break. Support is at around $75 and target is at around $80. If we see prices well below $75 this trade is invalidated. But do not put your SL to close below the support.

On December 10, 2024, we had a look at the weekly chart of NYSE:BA Boeing and it was a very good opportunity to get into this stock. Since then, we made over 20% in under one month. After consolidating for nearly three weeks, we may have another chance to get in for the next leg up to $200. The only thing to worry about are the earnings on January 28....

NASDAQ:ADBE is currently nearing a confluence support (an area where multiple support elements are combined) at around $410-$420. Nevertheless, opening a first position right now is already an option given the attractive valuation and the horizontal support (blue zone). In addition there are two big daily gaps (red zones) above the current price giving us some...

I’ve already written a weekly analysis on NASDAQ:AMD , which you should read before this one, as it explains the broader technical and fundamental support in the bigger picture. Looking at the 4-hour chart, we can see the more granular movement of the stock over the last few months. The fact that we held the trendline, which has been in place since 2023, is...

NASDAQ:AMD weekly charts looks very good. The trendline from March 2023 is intact and we also touched the 61.8 fibonacci from the complete move (starting in October 2023). The descending wedge could be broken to the upside today, which would be a bullish sign for a stronger move towards $200. All in all, many semiconductor stocks are currently on supports or are...

Our last NASDAQ:NVDA trade went very well. Within a few weeks we made more than 15% re-testing the ATH and generating a new one. Directly after hitting the ATH we saw a sell on good news event during the CES and the presentation of the “Home AI PC”. The perfect time to buy was yesterday minutes before markets closed. The price formed a falling wedge with a RSI...

MIL:RACE has a technically interesting setup that also fits well with the weekly setup that I presented a few weeks ago. The current consolidation has once again reached the lower zone and should find support from here one more time. Recently, a significant bounce was achieved from here several times. In addition, Ferrari is moving at the daily SMA 200...

🐂 Trade Idea: Long - NOVO 🔥 Account Risk: 20.00% 📈 Recommended Product: Stock 🔍 Entry: +/- 750.00 🐿 DCA: No 😫 Stop-Loss: 675.00 🎯 Take-Profit #1: 1,000.00 (50%) 🎯 Trail Rest: Yes 🚨🚨🚨 Important: Don’t forget to always wait for strong confirmation once possible entry zone is reached. Trade ideas don’t work all the time no matter how good they look. Do not...

With NASDAQ:NVDA , we are currently in a promising position to see a final exaggeration into the end of the year. The stock has risen over 180% percent in 2024 and I think we have a good chance to make 200% out of that. Looking at the chart we can see a clear uptrend trendline starting in August this year with multiple touchpoints along the line. Since October...

Since my first NYSE:UNH idea a couple of days ago the price of this stock dropped significantly. If you've been part of the first idea you should've been able to lock in around 1.x% of return when using a tight stop-loss. Otherwise you've been stopped out with break-even. Nevertheless, the sell-off was not helpful and is completely exaggerating the situation at...

NYSE:XOM is inside it's sideways channel since March 2024 and trades within a price range of $108 - $123 with one failed breakout to the upper side in October. The recent pulldown came from commodity prices (oil) and political drama about how much oil will be offered in Trump's term. Of course, it would be best if supply will not outpace demand too much since...

NASDAQ:PEP stock is currently trading at a discount to its fair value. That's why traders and investors should have a look at this bluechip, especially given its low beta statistic. Of course, macroeconomic uncertainties, such as the University of Michigan's latest consumer sentiment survey (which projects inflation to rise to 2.90% from 2.60% next year), could...

BINANCE:SOLUSDT is consolidating since the end of November after hitting the zone at $260. The consolidation looks overall very bullish (bull flag) and healthy. As you've seen in my analyse from 4 days ago the situation looks very good. Also, Bitcoin is still holding very strong at $100K (currently at $103K). To determine, if the consolidation might be over...