LTCBagHODLR

Bull Divs still in play. Projection line is from prior run up on the regression channel.

ETC coat riding ETH. After 26, little resistance between it and 30. Several strong fibs exist there. Attainable (and beyond) if BTC continues push to 135 by EOM

If BTC loses this levels the Divs will invalidate. But if at a minimum it crabs for a week, they are in play, which is a strong signal on the W TF.

Hidden bill divs established, MA, and fib support currently holding. Nice reversal setup.

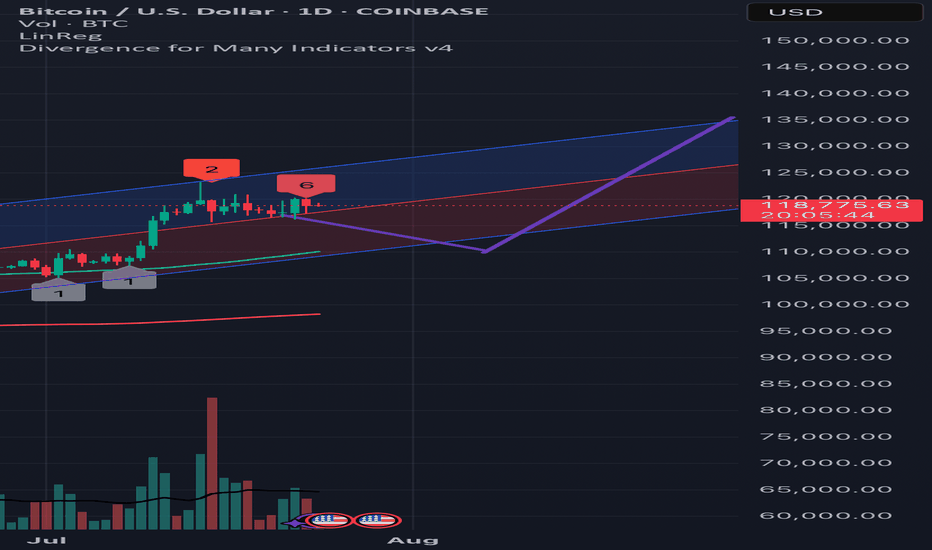

5 hidden bear Divs on yesterdays daily. 2 wicks on the 50MA. If the engulfing holds, nice setup for a reversal with a target of 130 +/- by EO August.

MA and fib convergence at 19. Nice potential entry assuming BTC holds daily channel at or around 112. Long way to 112 so ETC may break support.

Bearish divergences have aligned on the daily. Careful trading at altitude.

Minor pullback to regression channel bottom then attempt at HH. Bottom of daily regression channel is centerline of weekly regression. If channel support fails, 100 maybe.

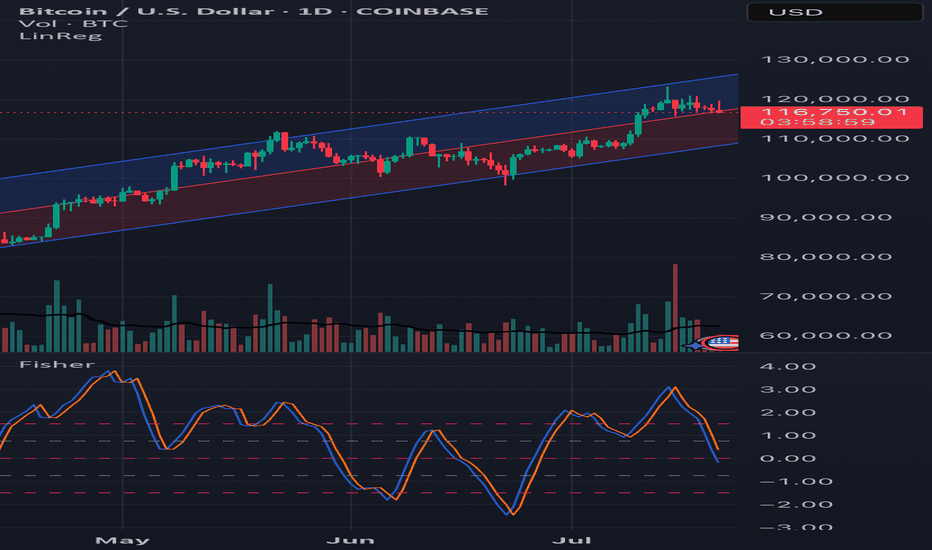

Fisher is head south and a breakdown to the bottom of the regression channel is likely.

Multiple Bear Divs on latest close. Careful trading at altitude.

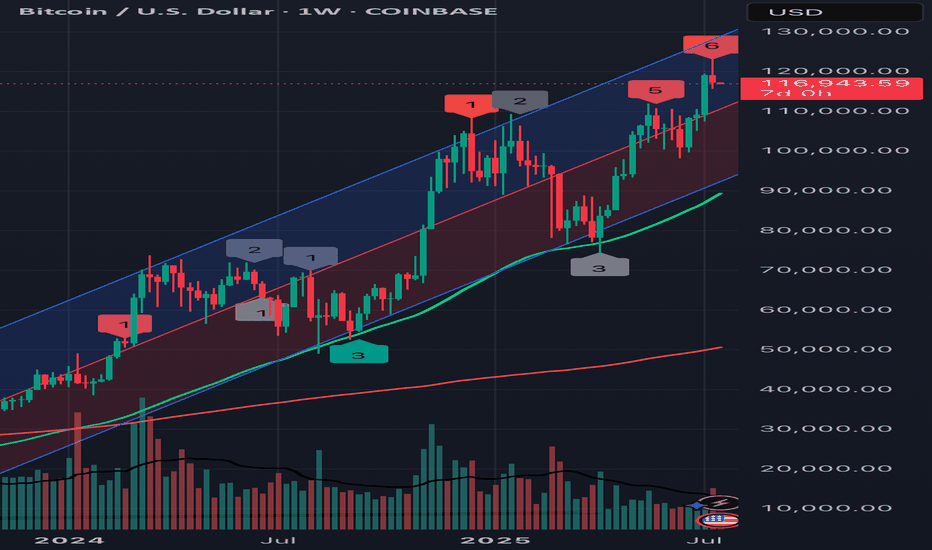

Bear Divs are a rare occurrence on the Weekly TF, but we just printed one. Even a single hidden bear div has been a reliable indicator in the past, as shown. Careful trading at altitude.

Lines and VWAPs and Fibs over a long time frame. Sometimes it's good to just zoom out.

Look for a bounce on support in the 40-41 range off vwaps, MAs, 2.236, and/or trend line. A rejection at the sellers vwap around 43.5 seems likely. If so, could we eventually see 36.5 - the top of the 3 month channel. From there, it’s anybody’s guess.

Just had a nice breakout. Up against the POC and the original impulse line on this fib channel. H4 fisher, stoch and RSI need a breather. Hidden bear divs peaking out. Let’s retest 38/39 before overextending ourselves.

Fisher and Stoch turned down. Top of wedge. 4 Hidden Bear Divs. MACD losing momentum. Turn down here and the H2 MA 50 should cross down on the 200.

BTC is sitting on the 1D EMA20 and is hovering just above the 2018 2.618 fib. Stoch RSI has turned down and Reg RSI is holding with a downward trend. With SPX broken out of its wedge, we may see this week test the EMA100 or 200. Stay watchful.

After yesterday’s totally unamazon-related bear hunt (the giga liq), our bear divs went into hibernation. That’s ok; we still have some hidden ones. After breaking up too quick for its own good, we broke a super vwap but gassed out on a golden fib. Now, we turn back down into the daily channel — just like the last time we tried 40 and failed. But this time,...

Bear Divs haven’t printed since 5/8. Strong VWAP overhead, too. BTC needs a strong upward move to breakout. But we haven’t had this many Green Days in quite some time…