#Bitcoin at a CRITICAL juncture! Testing the downward trendline (double yellow) at 95K as resistance, originating from 107K in Dec. This trendline has repeatedly rejected BTC, with multiple tests at 95K this week. Historically, rejections have led to drops to 82K support (tested 4x) or even the uptrend line at 77K (Mar/early Apr). If BTC fails to break & hold...

#Bitcoin at a CRITICAL juncture! Testing the downward trendline (double yellow) at 95K as resistance, originating from 107K in Dec. This trendline has repeatedly rejected BTC, with multiple tests at 95K this week. Historically, rejections have led to drops to 82K support (tested 4x) or even the uptrend line at 77K (Mar/early Apr). If BTC fails to break & hold...

#Bitcoin at a CRITICAL juncture! Testing the downward trendline (double yellow) at 95K as resistance, originating from 107K in Dec. This trendline has repeatedly rejected BTC, with multiple tests at 95K this week. Historically, rejections have led to drops to 82K support (tested 4x) or even the uptrend line at 77K (Mar/early Apr). If BTC fails to break & hold...

Bitcoin is at a pivotal moment, testing key levels that could determine its next major move. Here's a breakdown of the scenario I’ve outlined: Resistance at 88,802: Bitcoin hit a descending trendline and was rejected, suggesting strong overhead resistance at this level. Key Support at 85,000: This appears to be a critical threshold short term. Holding above it...

Bitcoin is at a pivotal moment, testing key levels that could determine its next major move. Here's a breakdown of the scenario I’ve outlined: Resistance at 88,802: Bitcoin hit a descending trendline and was rejected, suggesting strong overhead resistance at this level. Key Support at 85,000: This appears to be a critical threshold short term. Holding above it...

The USD/JPY pair is indeed at a critical juncture as of March 23, 2025, testing resistance around 149. Let’s analyze this based on the historical price levels and the current market context, without inventing unsupported details. The 149 level has shown significance in recent history. On December 24, 2024, USD/JPY faced resistance near this zone (close to 149.20...

The USD/JPY pair is indeed at a critical juncture as of March 23, 2025, testing resistance around 149. Let’s analyze this based on the historical price levels and the current market context, without inventing unsupported details. The 149 level has shown significance in recent history. On December 24, 2024, USD/JPY faced resistance near this zone (close to 149.20...

Let’s break this down based on the scenario you’ve described and explore what it might mean for Jasmy’s price movement, while keeping it grounded in general technical analysis principles. Historical Context and Double Bottom Analysis I’ve noted two key periods: November 2021 to March 2022: -Jasmy topped out at $0.35 in November 2021. -It corrected over four...

Let’s break this down based on the scenario you’ve described and explore what it might mean for Jasmy’s price movement, while keeping it grounded in general technical analysis principles. Historical Context and Double Bottom Analysis I’ve noted two key periods: November 2021 to March 2022: -Jasmy topped out at $0.35 in November 2021. -It corrected over four...

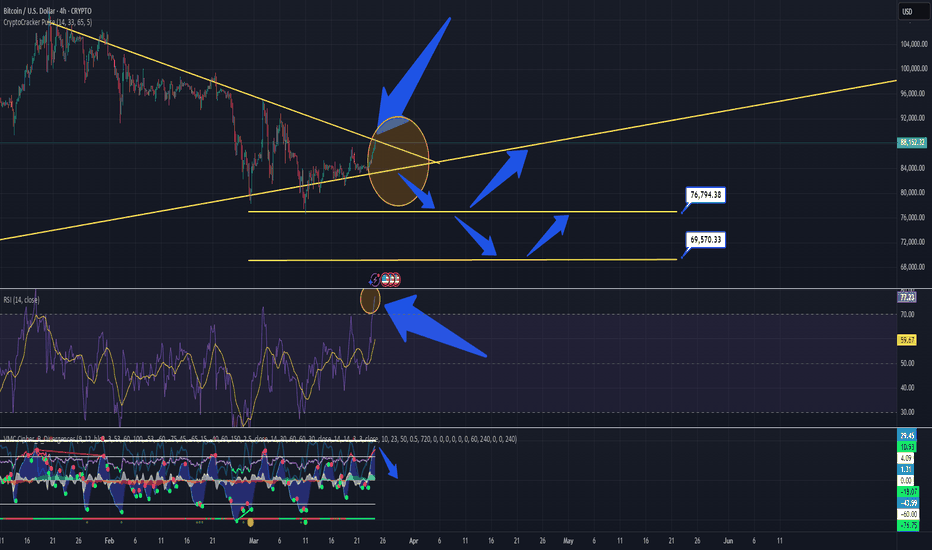

Bitcoin is testing a potential breakout from a descending wedge that began forming on January 20th. For the bulls to take control, BTC needs to close above $86,831 by the end of Monday, March 24th. A successful break and hold above this level could signal a strong upward move. On the flip side, failure to break out may lead to a drop toward $76,817, a key...

Bitcoin is testing a potential breakout from a descending wedge that began forming on January 20th. For the bulls to take control, BTC needs to close above $86,831 by the end of Monday, March 24th. A successful break and hold above this level could signal a strong upward move. On the flip side, failure to break out may lead to a drop toward $76,817, a key...

Bitcoin is testing a potential breakout from a descending wedge that began forming on January 20th. For the bulls to take control, BTC needs to close above $86,831 by the end of Monday, March 24th. A successful break and hold above this level could signal a strong upward move. On the flip side, failure to break out may lead to a drop toward $76,817, a key...

Jasmy appears to have found its bottom, with capitulation events occurring on February 25th and Sunday, March 9th. On the 4-hour chart, an oversold RSI condition has paired with a bullish divergence, signaling that selling pressure may be exhausted and a reversal is underway. The bulls have taken charge, as volume has flipped green for the first time in nearly...

Jasmy appears to have found its bottom, with capitulation events occurring on February 25th and Sunday, March 9th. On the 4-hour chart, an oversold RSI condition has paired with a bullish divergence, signaling that selling pressure may be exhausted and a reversal is underway. The bulls have taken charge, as volume has flipped green for the first time in nearly...

Jasmy appears to have found its bottom, with capitulation events occurring on February 25th and Sunday, March 9th. On the 4-hour chart, an oversold RSI condition has paired with a bullish divergence, signaling that selling pressure may be exhausted and a reversal is underway. The bulls have taken charge, as volume has flipped green for the first time in nearly...

As of March 14, 2025, the TOTAL 3 index, tracking the combined market capitalization of altcoins excluding Bitcoin and Ethereum, is following a well-defined ascending trend. Recently, the market cap dipped to $717 billion, where it found strong support at the lower boundary of an ascending channel—a trend line stretching back to October 2023. This support level...

As of March 14, 2025, the TOTAL 3 index, which measures the total market capitalization of altcoins excluding Bitcoin and Ethereum, is navigating a critical phase within an ascending channel. This pattern, defined by a rising trend line, has supported the market since October 2023, with a notable spike in early 2024 reinforcing its trajectory. Recently, TOTAL 3...

"CERE is trending upward with strong bullish momentum, confirmed by the 50-period moving average crossing above the 200-period moving average (golden cross). The monthly VWAP (green) is acting as reliable support, bolstering the uptrend. Volume profile analysis shows CERE trading above the Value Area High (VAH), which may soon serve as a new support level. Should...