Liz_Trading_gold

Gold technical analysis and trading strategy From the daily level, the gold price has confirmed that it has broken through the lower track support of the large convergence triangle, forming a typical three-day continuous pull-up pattern. Yesterday's big positive line was full of entities, not only breaking through the 3365-3377 area of the previous few weeks of...

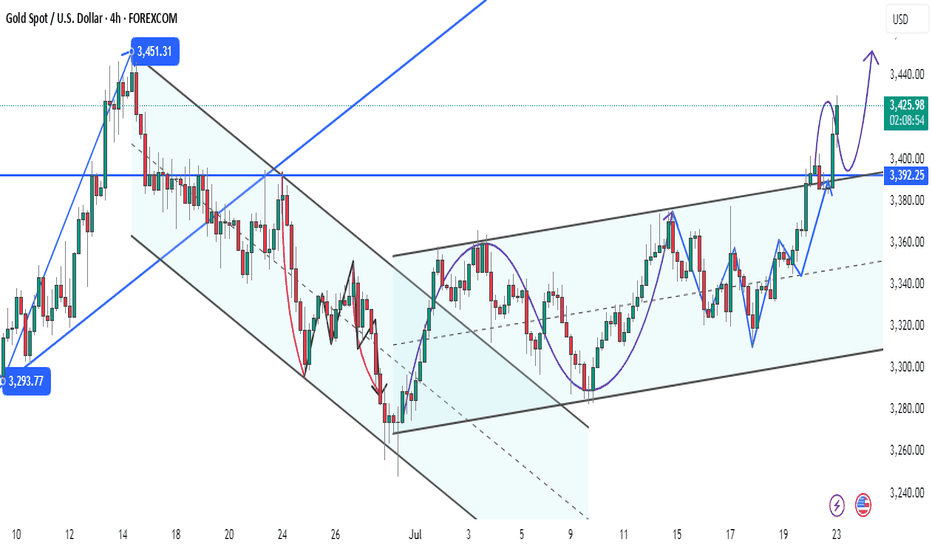

The long-short game of gold has entered a critical stage! On Monday (July 21), spot gold (XAU/USD) continued its mild rise last Friday and continued to put pressure on the upper edge of the oscillation range of 3375-3385. The weak dollar is still the main driving force, and the market's wavering expectations for the Fed's rate cuts have made gold caught in a...

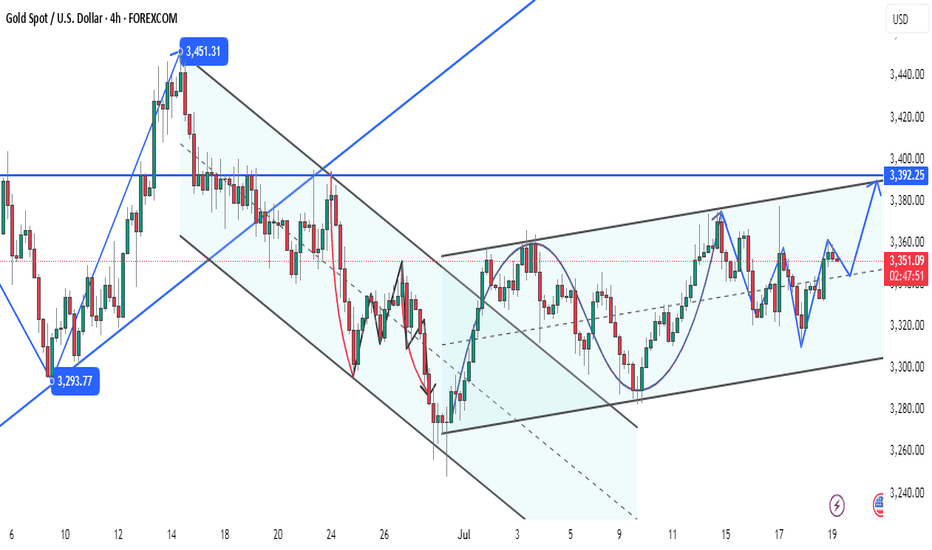

Gold fluctuates upward, focusing on key support and resistance Gold maintained a fluctuating upward pattern as expected on Friday, with a low of $3,333 and then stabilized and rebounded, reaching a high of $3,361, and finally closed at around $3,350. The weak dollar provides support for gold prices, and the decline in U.S. Treasury yields enhances the...

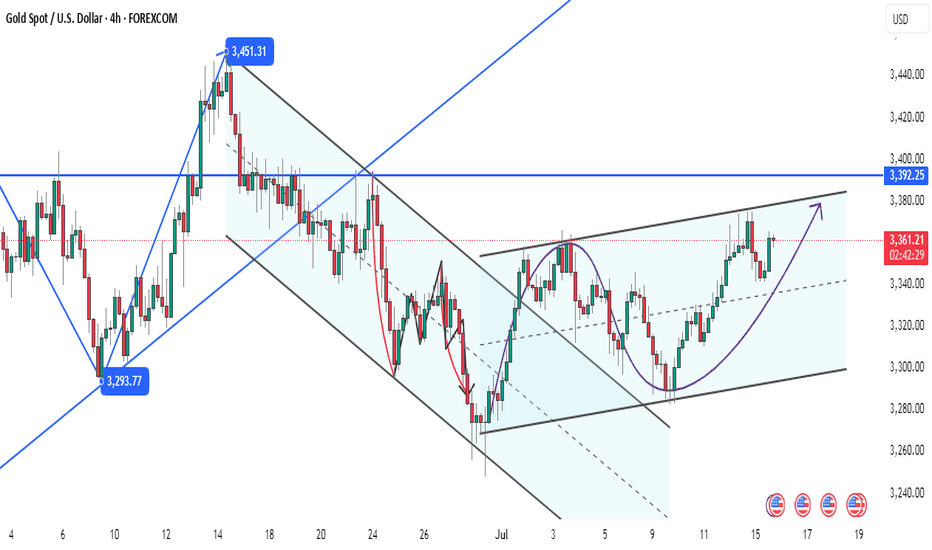

At the end of gold shock convergence, 3310 defensive long orders are still the main theme! Gold, what are you waiting for? After three consecutive months of triangle convergence shock, the market is getting narrower and narrower, and the bulls and bears are tug-of-war. The market patience is being exhausted! But the more this time, the more calm you should be-the...

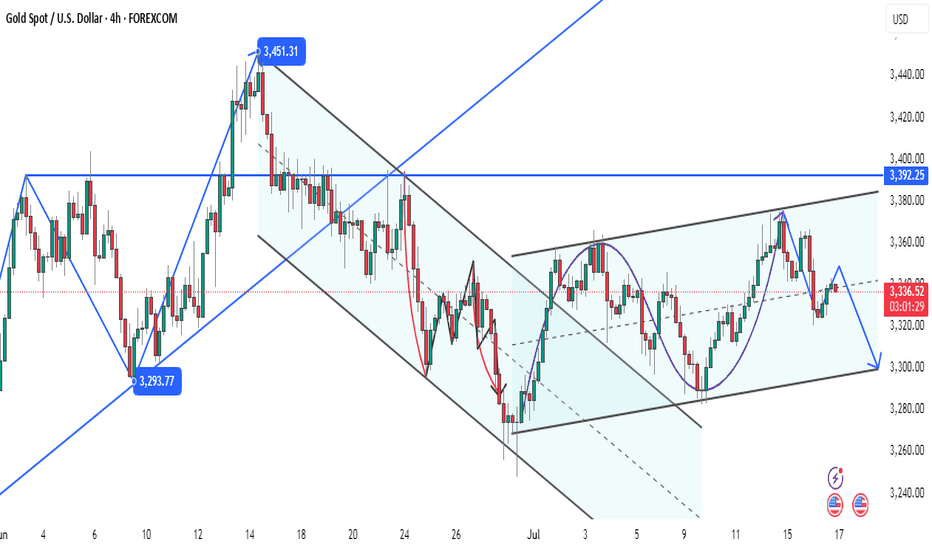

Market review: Risk aversion changes instantly, gold price rises and falls Yesterday, the gold market experienced dramatic fluctuations again. First, it fell to around 3320 due to the pressure of the strengthening of the US dollar, and then it soared by 50 US dollars to 3377 in the short term due to the rumor that "Trump may fire Powell", but the gains were given...

Gold has limited safe-haven support, and the opportunity to short at high levels is emerging Short-term safe-haven support Trump said that he would impose a 10% tariff on small countries, which caused market concerns, and the gold price rebounded slightly to $3,342. However, the tariff intensity is mild (only slightly above 10%), and the risk aversion...

Upward opportunity in the bull-bear tug-of-war of gold Current price: $3,360/ounce, yesterday's roller coaster market of $3,375-3,343 ▶ Key driving factors Bullish factors: 🔥 Trump tariff bomb: 30% tariff on EU/Mexico from August 1 (EU 21 billion euro counter-list to be issued) 🌪️ Geopolitical risks escalate: The United States issued a 50-day ultimatum to...

Gold trend analysis: Tariff war adds fuel to the fire, 3400 becomes the life and death line for bulls and bears! 🔥 New fundamental variables: Trump's tariff stick triggers risk aversion Trump suddenly announced a 30% tariff on the EU and Mexico (effective on August 1), and the risk of a global trade war soared The EU fought back strongly, Mexico vowed to defend...

The gold bull-bear game intensifies: a breakthrough opportunity is hidden in the short-term shock The gold market experienced violent fluctuations this week, and the core contradiction came from contradictory employment signals: ADP cooling: The number of private sector jobs in the United States unexpectedly decreased in June, which once strengthened the...

Gold market analysis: The oscillation pattern continues, beware of the risk of a correction Fundamental Overview Federal Reserve policy divergence: The minutes of the June meeting showed that only a few officials supported the July rate cut, and most decision makers were still worried about the inflationary pressure brought by Trump's tariff policy, which...

The oscillating pattern under the tug-of-war between gold risk aversion and the dollar News: The interweaving of long and short factors has caused gold to fall into a tug-of-war Positive factors: Trump's new tariff policy: The United States will impose a 25% tariff on Japanese and Korean goods from August 1, and US stocks fell in response. The market's risk...

Fundamentals Although the market risk aversion has cooled down recently, the cumulative increase in gold this year is still more than 25%, mainly benefiting from the continued increase in gold holdings by global central banks and ETF fund inflows. The market is currently paying attention to the trend of US trade policy on July 9. If the negotiations break down...

Gold Weekly Review: Thrilling Week, How Long Can Gold Price "Fly"? This week's gold market is even more exciting than a roller coaster! It looked sluggish when it opened on Monday, but suddenly rushed to $3,365 like crazy on Wednesday. Before we could cheer enough, it gave you a "big dive" on Thursday, and on Friday it was like a drunkard in the range of...

Dear traders, the sell-off last night directly brought the bulls back to their original form. The closing price of 3325 made most of the gains accumulated hard this week spit back. To me, this wave of market is a typical "data killing". The June non-agricultural data came out halfway, and the employment data was so strong that even the old foxes on Wall Street...

This week, market sentiment was stirred up and down by Trump's tariff stick. This unconventional president, while firing at Canada and Japan, let the July 9 tariff deadline hang like a knife over the heads of risky assets. If the suspension order is not extended, the market may have to relive the chaos of "Liberation Day" in April - gold will become the...

Gold trend analysis: Geopolitical risks still exist, technical side is strong and volatile The recent situation in the Middle East presents a cycle of "conflict-easing-re-escalation". After a brief exchange of fire between Iran and Israel, Israel turned to attacking surrounding armed forces, and geopolitical risks have not completely dissipated. Such "deterrent...

Gold Weekly Review: The Long-Short Strangling War after the Geopolitical Smoke Dissipated When Trump announced the ceasefire agreement between Israel and Iran on social media, the market's risk aversion was like a deflated ball - the trend of gold prices plummeting 2% in a single day exposed the most vulnerable weakness of contemporary gold: in the dual game...

Gold bears revel: 3300 has been broken, is 3250 far behind? On Friday (June 27) in the European session, gold continued to fall, 3287 was shaky, and it was only one step away from the key support of 3277. Last night, the gold price was still "fake high" near 3350, but today it was directly pressed to the floor by the bears - the break of 3320 declared the end of...