-EURAUD is on downtrend -The price break a support -We can see the backtest, and that's the best place to short

-USDJPY is in uptrend -RSI is very high, so need to wait a correction

I think AUDJPY price break the resistance zone and going up to the next at 77.5-78

USD/CAD price forming double bottom on the H4 chart, and the price is at 6 month low.

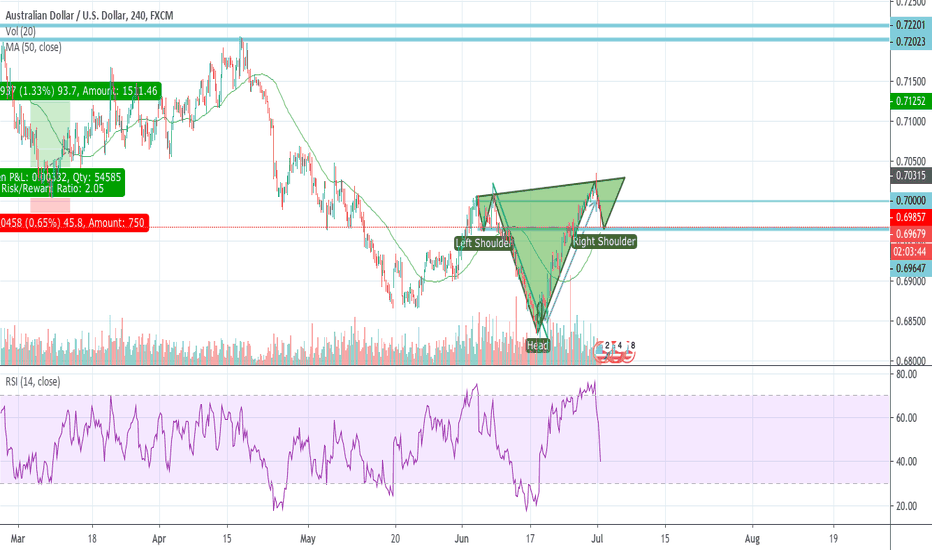

AUD/USD H4 chart possible head and shoulder chart pattern.

AUDNZD price come close to a support level. I think if it reach the support zone, it will turn around.

USD/CHF price rebound from a support zone, and we can see a double bottom chart pattern on the H4 chart

AUD/CAD price is at low level, and the Relative Strength index too. I think this is a good place to open long position on short term

-The FOMC interest rate decision is at BST today at 19:00 -Canadian inflation accelerated in May -Oil stocks are expected to have fallen by 1.1 million barrels 9:30 BST - UK, CPI inflation for May. Tory's race for leadership continues to dominate the UK news and hence the GBP trading. However, merchants can now view the upcoming May CPI data and pay attention...

AUDUSD price break downtrend, with an impulsive wave. Wait correction and open long

GBPJPY is now on downtrend, but on the chart we can see a double bottom chart pattern, and the price arrived to the support zone. -If the price going up and break the trend line open long

The daily chart show us a double bottom, and we can see the price was on downtrend, but the price break the trend line, and we can see the backtest. I think the price will going up to 1.16

GBPUSD price is at support zone , i think its a good entry for long position. If the price can't break this support and bounce from here, we can see double bottom on the daily chart . I open long for this pair at current market price, and I set my first take profit to 1.275.

Summary: -3% increase in oil after two tankers attacked -The outlook for further disruptions in the region is increasing -Potential double bottom is noticeable on oil at 59.50 There has been a sharp rise in oil prices after reporting that two tankers have been attacked in the Gulf of Oman, which may have additional geopolitical consequences. Increasing tensions...

The price of gold since April 2018 is at its highest level around $ 1355 / ounce, mainly due to tensions in the Middle East, weaker data from China and a stronger dollar. The green bean strengthened the retailer. 13.30 BST before the data is reported. Compared to the April decline, it is expected to improve in May.

-The strong increase in coffee prices is due to the strengthening of BRL and the fear of frost -The Brazilian hurricane delayed harvest, which could lead to a deterioration in crop quality -Coffee consumption has risen to historic highs, but it is not yet visible at coffee bars -Farmers receive only 10% of the final consumer price, so they don't get too much...

AUDCAD price is on low level, and the Relative Strength index is in oversold zone, this is a good entry for long position's.

Oil prices fell at the end of last week due to the global economic slowdown The last two consolidation phases resulted in further downturns However, correction is also possible - at 50% retracement levels The main support is shown by the 61.8% Fibo retracement last exchange rate drop Traders are expecting an oil correction, but oil prices continue to fall due to...