MMFlowTrading

Premium🔔 GOLD PLAN 21/07 – QUIET START TO THE WEEK, WATCH OUT FOR KEY RESISTANCE! 🌍 Market Overview Gold has bounced back strongly following a brief pullback late last week. The move comes as geopolitical tensions and global conflicts continue to escalate. While this week may not feature high-impact economic data, macroeconomic risks and global uncertainty remain the...

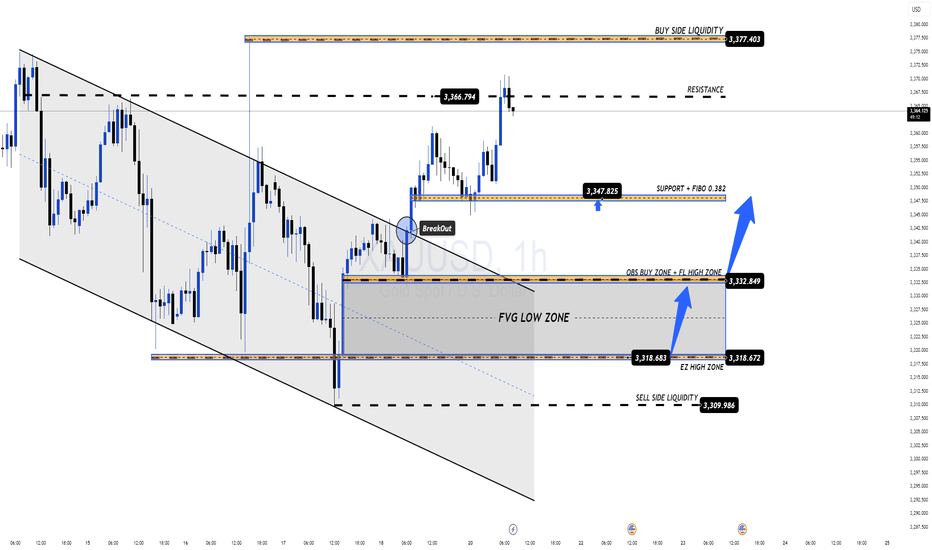

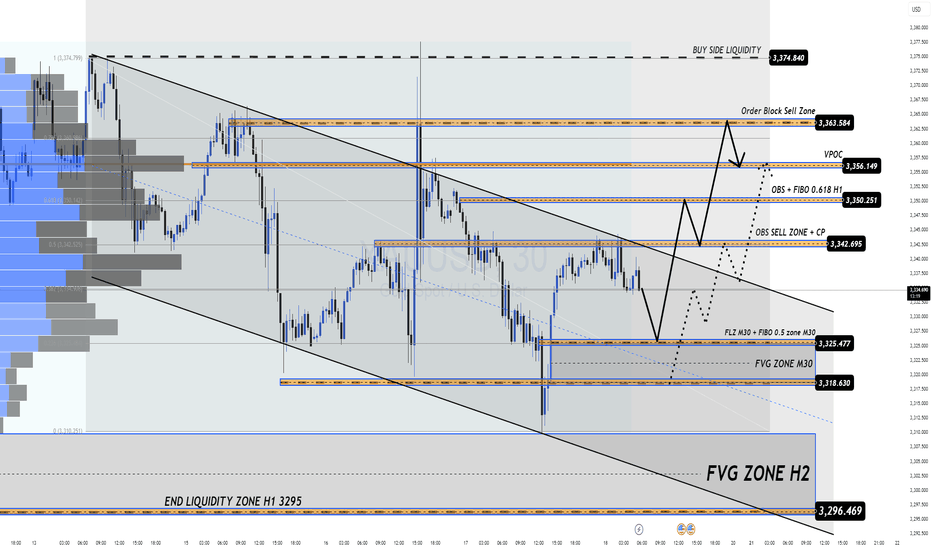

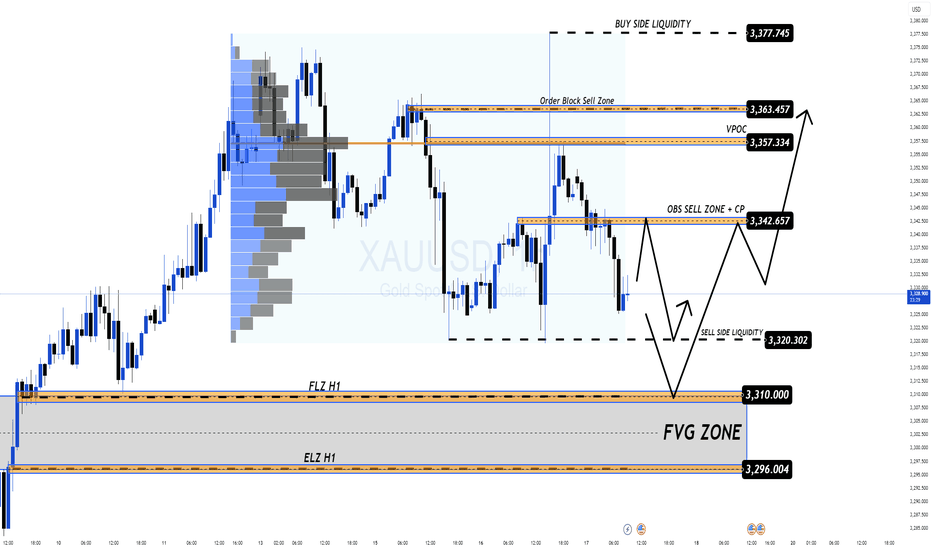

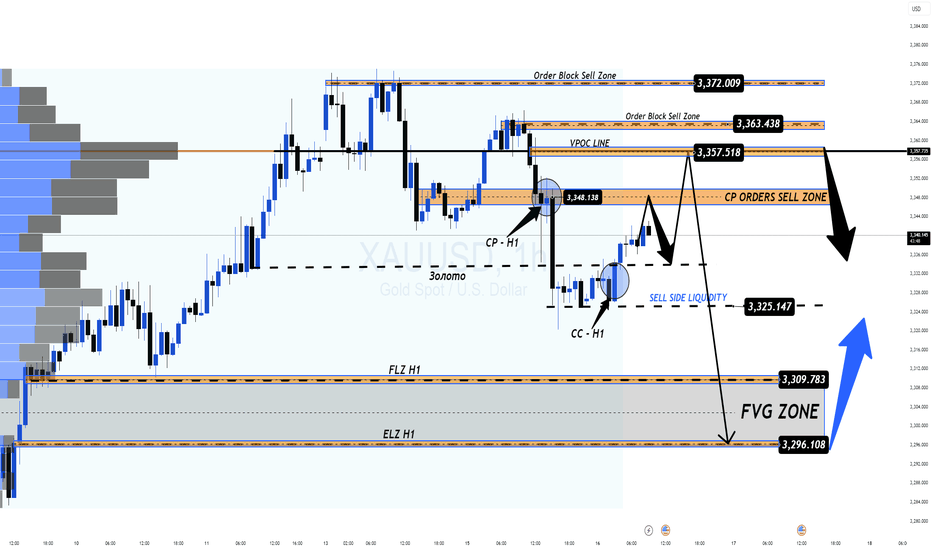

GOLD OUTLOOK – READY FOR THE NEW TRADING WEEK (JULY 21–25) 🟡 Market Recap: Gold made a strong bullish reversal at the end of last week, following a liquidity sweep at the FVG ZONE 3310. Price surged quickly toward the OBS SELL ZONE around 335x–336x. However, by Friday’s close, price reacted to multiple confluences (OBS + FIBO zones) and closed below the VPOC...

Psychology Is 80% of Trading Success – But Most Traders Still Ignore It Have you ever followed a perfect setup… and still lost money? You entered at the right level. The trend was clear. Confirmation was solid. But you closed the trade too early. Or held onto a losing trade far too long. Or took a revenge trade just to “get it back.” This isn’t a strategy...

Gold Outlook – Market Tensions Mount, Liquidity Zones in Play Price action heats up as we enter the final trading day of the week. Are you ready to ride the wave or get caught in the liquidity sweep? 🔍 Market Sentiment & Global Highlights Gold rebounded strongly after dropping on better-than-expected US data. However, several macro risks are keeping gold buyers...

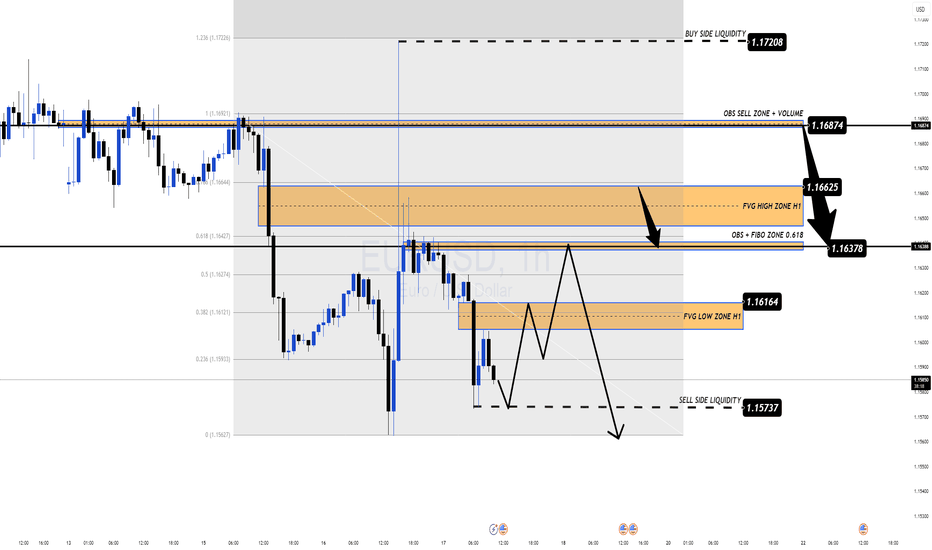

EUR/USD Forecast – Bears in Control Ahead of US Jobless Data 🌐 Macro View: Dollar Regains Strength Amid Uncertainty EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand,...

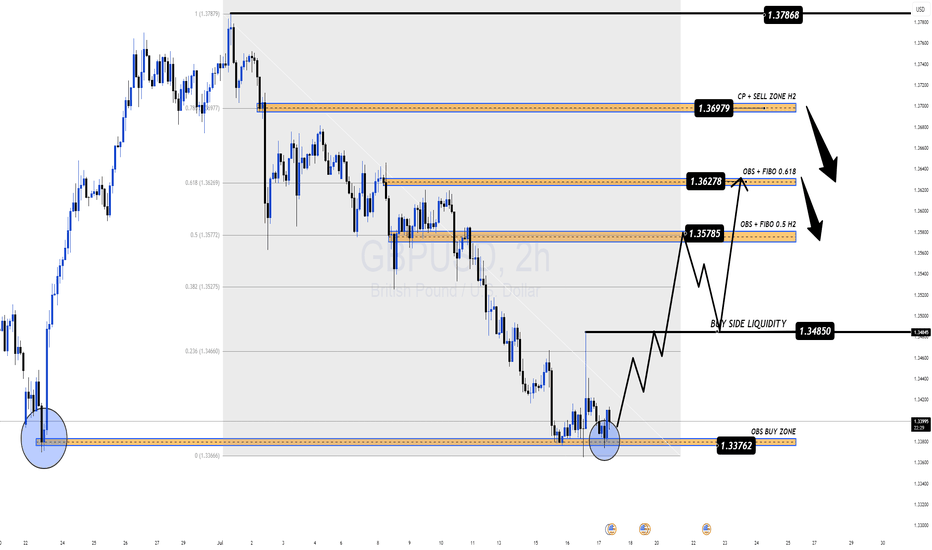

GBP/USD Outlook – Sterling Rebounds But Faces Heavy Resistance Ahead 🌐 Macro Insight – UK Labour Data Mixed, Trump Headlines Stir Market The British Pound (GBP) regained some lost ground against the U.S. Dollar after the UK labour market data revealed mixed signals: Wage growth cooled as expected, suggesting a potential easing in inflationary pressures. UK ILO...

Gold 17/07 – Market Volatile Amid Geopolitical Tensions & Fed Rumors 🌍 Macro Sentiment: Uncertainty Continues The global gold market opened Thursday with high volatility following headlines that former U.S. President Donald Trump was considering firing Fed Chair Jerome Powell. Though Trump later denied the claim, the initial rumor spiked fear in financial...

XAUUSD 16/07 – Temporary Rebound or Trap Before the Next Drop? 🌍 Macro View – Calm Before the Volatility? Gold is currently hovering around $3,334/oz after an aggressive sell-off earlier this week. While June's Core CPI data from the US came in lower than expected — easing immediate inflation concerns — the broader macro landscape remains far from stable: New US...

USD/CAD Remains Below 1.3700 Ahead of CPI Data from the US and Canada USD/CAD continues to decline ahead of inflation data from both the US and Canada. The US inflation rate is expected to rise to 2.7% year-over-year in June, up from 2.4% recorded in May. Meanwhile, Canada’s CPI is forecasted to increase by 1.9% year-over-year in June, up from 1.7% in...

XAUUSD: Gold Moves Sideways, Awaiting Key Economic Data – Correction or Continued Uptrend? 🌍 Macro Overview – Waiting for CPI Data from the US At the moment, Gold is trading in a wide sideways range between the 3x and 4x price levels, while traders are awaiting key economic data this week from USD, GBP, AUD, and EUR. 📊 Important Economic Data Today: US CPI Report...

Gold Outlook – 14 July | Early Week Pullback Ahead of Key Economic Releases 🌍 Market Sentiment & Macro Overview Gold has started the week with a sharp retracement after filling prior liquidity gaps (FVG) from the past two weeks. This early weakness signals a risk-off tone as traders adopt a cautious stance ahead of a heavy macroeconomic calendar and geopolitical...

Trader Psychology | Part 1: Overtrading – The Silent Threat to Consistent Performance In trading, more does not mean better. One of the most common and damaging psychological pitfalls traders fall into is overtrading — executing too many trades, often without clear setups, simply to stay active in the market. It’s subtle, it feels productive… but it quietly...

XAUUSD: Gold Bounces Strongly from the Bottom – Is This the Start of a Breakout? 🌍 Macro Overview – Gold’s Movement and Market Sentiment Gold recently experienced a strong bounce from the 3.282 USD/oz low, reaching 3.317 USD/oz. This movement has sparked some optimism, but let’s take a look at the key macroeconomic factors that might be influencing gold: 📉 US...

Analyzing the Market with Fundamental and Technical Analysis In addition to technical analysis, it's important to consider fundamental factors that could influence the market. News releases, economic reports, and central bank decisions can significantly impact price movements. Fundamental Analysis: Keep an eye on major economic indicators like NFP, CPI, and...

🔘Gold Faces Strong Resistance at 3300 – Is a Reversal on the Horizon or a Deeper Correction? ⭐️ Gold has recently faced a significant price correction after bouncing off key resistance levels. As geopolitical events settle and economic data comes in, the market is now testing crucial support levels. Today’s session could provide important insights into whether...

Gold Breaks Below 3300 – A Buying Opportunity or Sign of a Bigger Correction? 🧭 Market Update: Is the Sell-off Truly Dangerous? Gold saw a surprising reversal at the close of the US session yesterday after a sharp decline targeting the 329x liquidity zone, followed by a strong buying momentum that pushed the price back above this level. After testing the...

Gold Breaks Below 3300 – A Buying Opportunity or Sign of Deeper Correction? 🧭 Weekly Kickoff: Is the Sell-off Really That Dangerous? At the start of the week, gold experienced a sharp drop to 3306 USD, breaking through the psychological 3300 support level and testing the 329x region. However, this isn't necessarily a sign of a sustainable downtrend — it's more...

Gold Consolidating Ahead of Next Move – Is 3390 the Bull Target or a False Breakout Trap? 🧭 Fundamental Outlook Gold has entered a tight consolidation phase following a wave of high-impact macroeconomic events: The US House of Representatives has passed Trump's “Super Bill”, raising expectations of increased fiscal spending and long-term inflationary pressures....