Michael_Harding

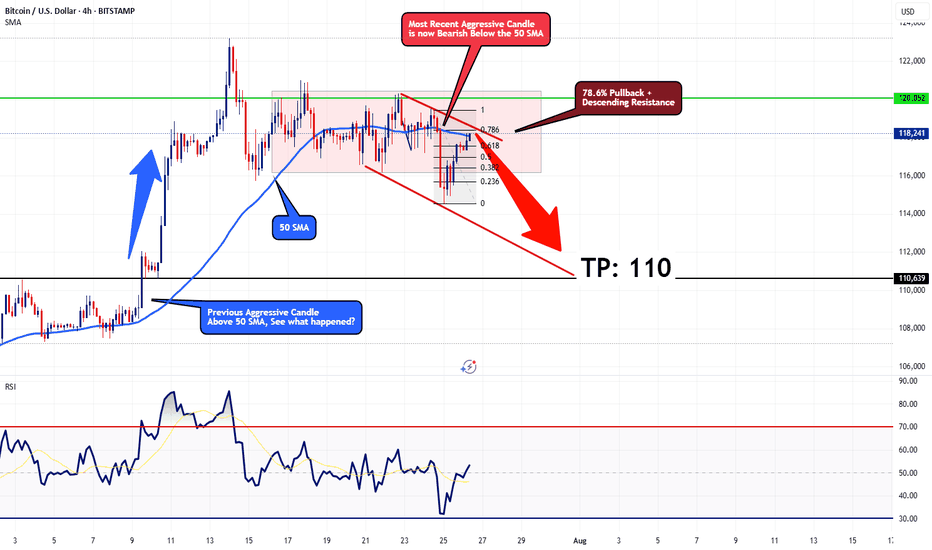

EssentialOn the 4-hour timeframe, Bitcoin seems to be starting a corrective phase, likely moving toward the $110 mark. Current price action is facing resistance at a descending trendline, aligned with the 78.6% Fibonacci retracement level, which should limit any short-term upward moves. The price is also trading below the 50-period SMA, with a strong bearish candle from a...

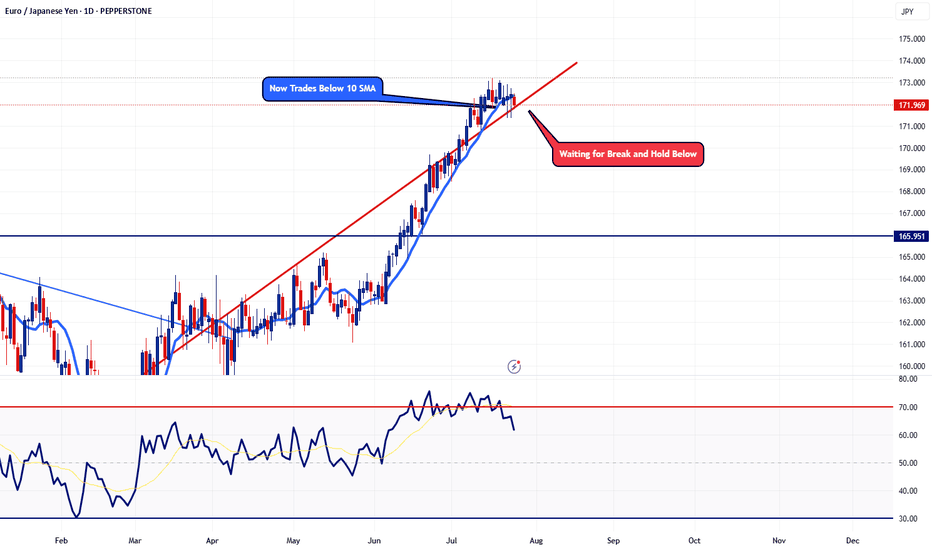

Taking a look at the daily timeframe, price action is now trading below the 10 SMA. This pair has not traded below the 10 SMA since May 26. Now I'm just waiting for a few more confirmation before I'm fully confident. For now, adding a few small sells won't hurt. Trade Safe - Trade Well

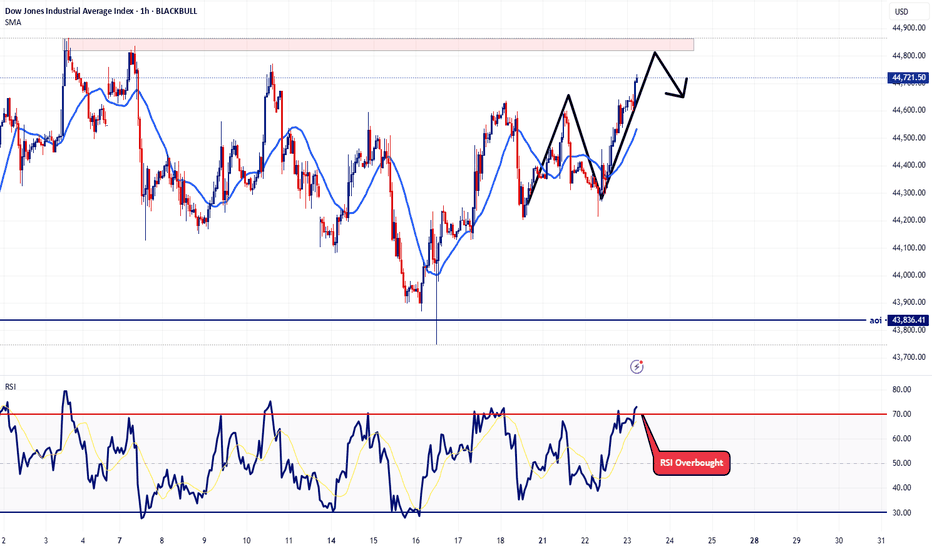

Considering today is now Wednesday and Wednesday's have a consistency of being one of those off days. Primarily because usually there are Fed speeches on this day that manipulate the market. With that said, I'm expecting price action to play out how I plotted the arrows on the chart. I believe there is still some further upside for today but then I believe we...

This morning, after the US CPI report was released at 8:30 AM EDT, EUR/USD surged briefly due to a slightly weaker-than-expected inflation reading. Despite this, signs of rising inflation persisted, leading EUR/USD to rise sharply before quickly retreating. EUR/USD has seen an intermediate top at 1.1830 since early July. The euro is under pressure due to looming...

This pair doesn't really get much attention but the fact is that the US is the strongest country of the majors while New Zealand is actually the weakest. When I pooled together all the economic data, these are the facts. With that said, this pair is approaching a significant confluence resistance territory and it's highly unlikely to break above. Needless to say,...

This is an update to my last post, I'm still waiting for that 4hr candle to close below the last. However, now I'm starting to spot more bearish indications on the 1hr timeframe. First thing I'm noticing is the RSI divergence show that the bullish strength is weakening. RSI on the 4hr + the 1hr are heading lower. Now I'm still waiting for that 4 hour to close...

Taking a look at the 4hr chart, RSI is showing signs that the bullish momentum is starting to fade with the bearish divergence. In the event we get a 4hr candle that closes below the last, I'll be looking to start scaling some short positions with this pair. Trade Safe - Trade Well.

This is a pretty good setup when taking everything into consideration. BOC on Wednesday likely to add additional strength to the Loonie from the tariffs. Earnings also adds more fire power towards this pair gaining in value along with Gold, looks like it wants to top off.

Waiting for a bullish pullback to sell around the 1.29 handle. Trade Safe - Trade Well. God Bless...

Potential head and shoulders build up for EURUSD with the latest sentiment from Trump and is continuation pattern with the tariffs. This Friday earning season kicks off which may soften EURUSD from dropping off a cliff. Also talks of 1.25% cuts from the Fed by year end may add some additional cushion for this pair. For this reason, my downside target remains on...

BTC trading in a descending channel on the daily timeframe. Trade wars are weighing down equities as well as Bitcoin. Until the tariff narrative changes, expect further downside with BTC. Trade Safe - Trade Well. DM for account management ~Michael Harding

Inflation Hot in the US, while the UK CPI cooling off. Dump it

Inflation is hot in the United States, dollar will strengthen. UK likely to weaken in the days ahead... Now's the time to sell. Trust me...

Stocks likely to drop lower, inflation is still hot. Trade Safe - Trade Well.

Stirling very likely to weaken when you analyze all fundamentals, sentiment and technicals. Trade Safe - Trade Well

Waiting for AUDCAD to reach the level I plotted on the chart to sell it. Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any regulated FX broker. Trade Safe - Trade Well ~Michael Harding

Let's see what happens with the upcoming CPI data from the UK. In the event figures come in less than analyst forecast, guess what?? Well this pair will go south! Why well Fed's comments last week were not dovish, tariffs are still causing inflation providing strength and stability for the greenback. Waiting for UK CPI data to confirm my analysis. Leave a...

Taking a look at the daily chart, EURUSD is resting at a minor pivot point. However, I suspect further weakness based off comments from the Fed last week and with all eyes on this Friday's PCE report. Leave a comment below, let me know what you think. Share with friends. Check out my profile for more awesome trade plans and setups. DM for copy trading, use any...