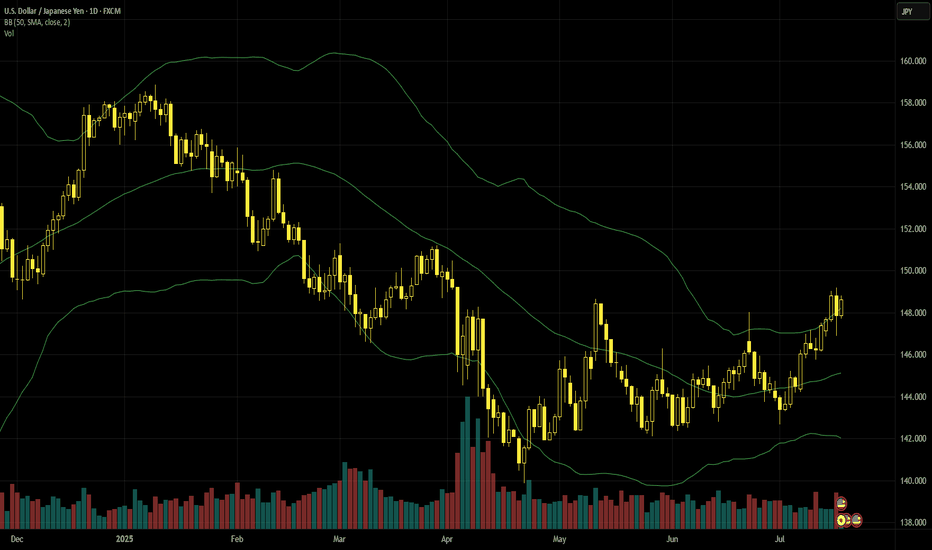

Both the Fed and the BoJ reaffirmed their cautious approaches to changing rates in recent days, but the dollar had the larger boost. The next cut by the Fed isn’t expected until the end of October. While the BoJ upgraded its expectations for inflation this fiscal year, the impact of trade wars on both sides is still developing. Havens haven’t had significant...

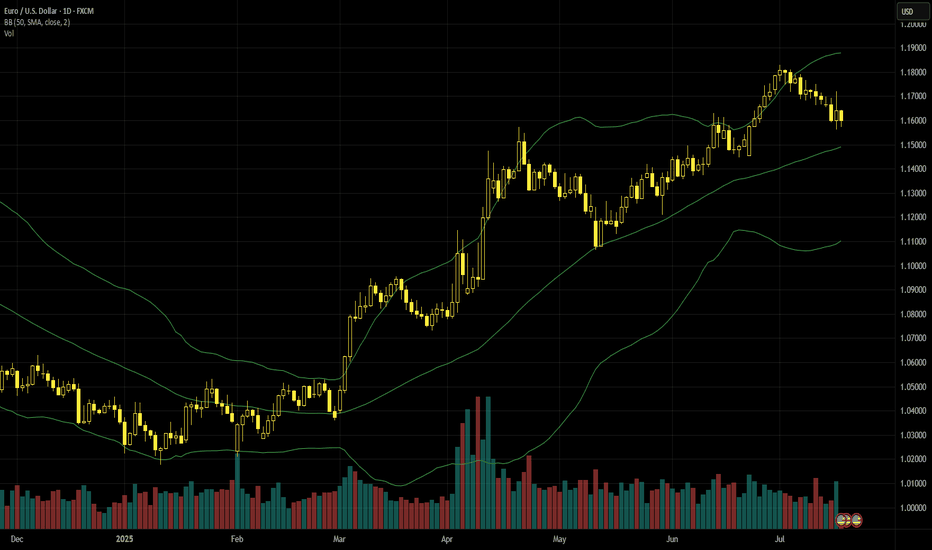

Euro-dollar reached six-week lows on 1 August as traders continued to digest the trade deal between the EU and the USA which is widely viewed as being negative for the former. 30 July GDP releases from the eurozone and the USA also showed that American growth is much stronger, but eurozone-wide flash GDP for the second quarter was still slightly better than...

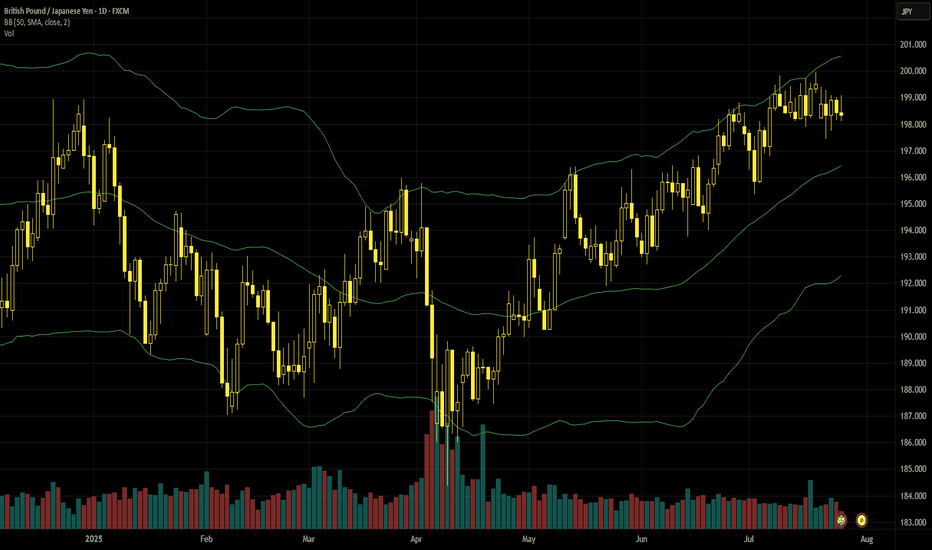

Weaker retail data and concerns about fiscal policy which affected the pound negatively and caused it to decline against various other major currencies don’t seem to have had a big impact on GBPJPY. Several recent trade deals between the USA and other countries including Japan have reduced demand for havens like the yen and gold. The big shift recently was a...

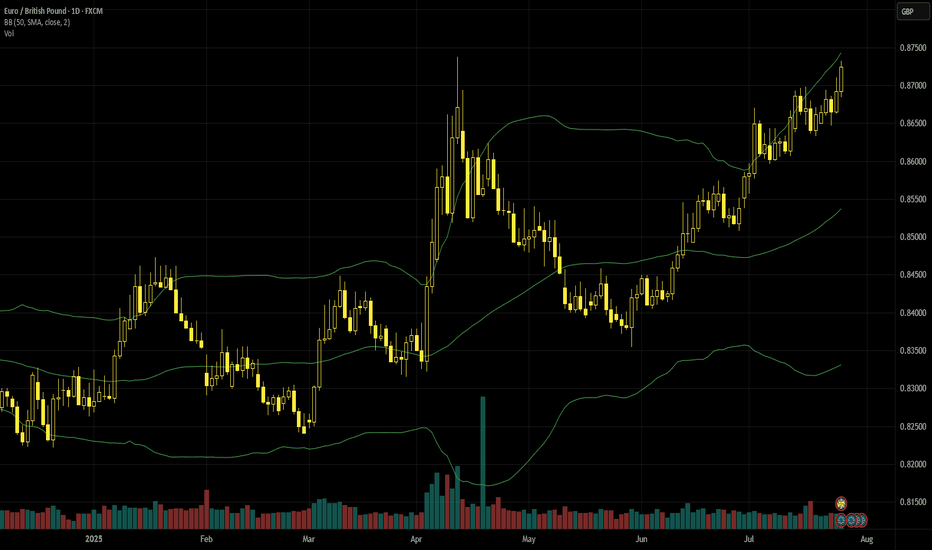

The ECB’s relative hawkishness or at least lower dovishness on 24 July seems to have boosted the euro significantly, with euro-pound in particular continuing its uptrend. Here though the generally weaker recent sentiment on British growth and disappointing retail data added fuel to EURGBP’s gains. There’s also some likelihood that the EU will secure a trade deal...

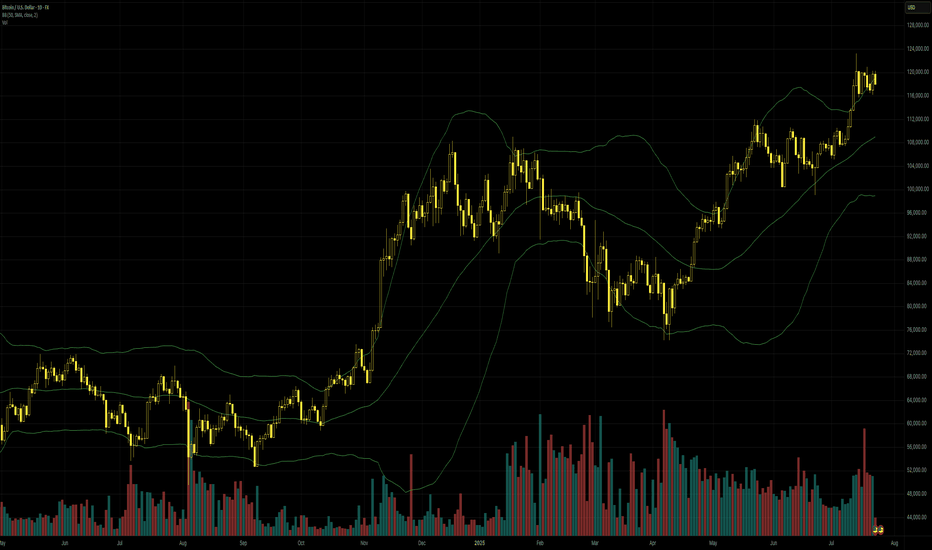

Generally lower trade tension, ongoing expectations of two more cuts by the Fed this year and speculation about Jerome Powell’s possible replacement have been some of the main macro fundamental factors driving bitcoin recently. Sentiment in crypto markets generally is greedy but liquidity and volatility have been more limited. So far this movement starting in...

Risk appetite overall improved near the end of June as a series of countries including Japan signed new trade deals with the USA. Recent British data, primarily on inflation, suggest that the Bank of England will continue to be cautious about cutting rates, possibly more so than the Fed. However, the British government’s budget deficit and increased borrowing are...

Gold gained around 21 July as participants continued to focus on trade negotiations but the sequence of deals on 23 July challenged the narrative of rising trade tension somewhat. The base case of two more cuts this year by the Fed is broadly positive for the yellow metal but now there’s some intrigue about whether the Fed might even hold in September. The record...

USDJPY gained more strongly than most other major pairs with the dollar in the aftermath of June’s higher American inflation. One of the key factors here seems to be generally disappointing trade data from Japan and rising concern in some quarters of a technical recession; weaker economic figures challenge the prevailing expectations that the BoJ will continue to...

The announcement of 30% American tariffs on the EU from 1 August caused some negativity on the prospects for the bloc’s economy, but as with any similar announcement so far this year it’s likely that the figure can be negotiated down or just backtracked by the American government. A more immediate important factor driving euro-dollar down has been the significant...

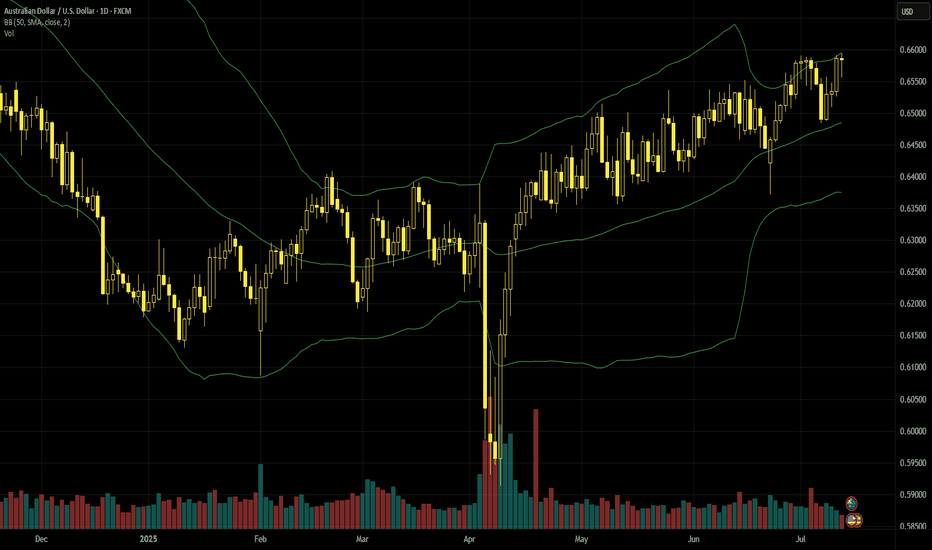

The yen has declined in most of its widely traded pairs in recent days as trade tension between the USA and Japan escalated again. JPY’s appeal as a haven appears to be lower compared to the situation early last quarter. Meanwhile the RBA unexpectedly held its cash rate on 8 July. Although the BoJ is fairly likely to hike to 0.75% at the end of July, it seems...

8 July’s surprising hold by the RBA helped the Aussie dollar to recover lost ground against its American counterpart and push up to a new high. Sentiment seems to be mostly discounting the American governments announcements about upcoming tariffs while underlying data from Australia are somewhat positive or at least certainly not as negative as had been expected...

Euro-dollar’s uptrend which has lasted fairly consistently since the start of 2025 continued in June with the price reaching a fresh four-year high above $1.18 on 1 July. Less confidence in the USA as the government continues to flip-flop and contradict on tariffs has driven capital out of the dollar. Monetary policy in the eurozone might stabilise with majority...

Gold bounced quite strongly on 30 June from around $3,250 the week before that as traders monitored the debate around the American tax and spending bill and its likely effects on the deficit. However, 3 July’s stronger than expected NFP seems to have capped gains for the time being. Further implementations of tariffs has continued to be chaotic. While there’s no...

So far, the yen hasn’t seen much demand as a haven amid the war between Israel and Iran. Some expectations indicate that the Bank of Japan might call for a single hike to 0.75% on 31 July while the Bank of England seems likely to cut to 4% in August. Regardless how rates move over the summer, it seems very likely that the differential in rates will shrink further...

Cable’s established uptrend seems to have paused for now after a slight decline in British inflation and caution from the Bank of England. The BoE highlighted risks in both directions for inflation in its statement and press conference on 19 June while the Fed seemed more concerned about the possibility of rising inflation after its meeting the day before. There...

Platinum reached its highest price since June 2021 on 9 June above $1,200 amid a major shortfall in supply. The World Platinum Council expects insufficient supply of nearly a million ounces this year amid disruption in South African mining and a surge in demand from China. Trading a chart like this is obviously challenging for many strategies because it’s...

Gold posted a fairly large intraday drop on 6 June after May’s NFP came in as expected and slightly positive. On the trade front, Donald Trump and Xi Jinping’s call on 5 June, the first since January, seems to have gone well and in-person negotiations between the USA and China were ongoing on 9 June in London. The Russo-Ukrainian war rumbles on with no clear...

Cable’s long uptrend, lasting since the start of the year, has continued in June so far with the price reaching a new high on 5 June. Relative political stability in Britain can be contrasted with the USA’s chaotic implementation of new tariffs and friction in the governing Republican party over the tax and spending bill. The uptrend is quite mature and the price...