Mike-BTD

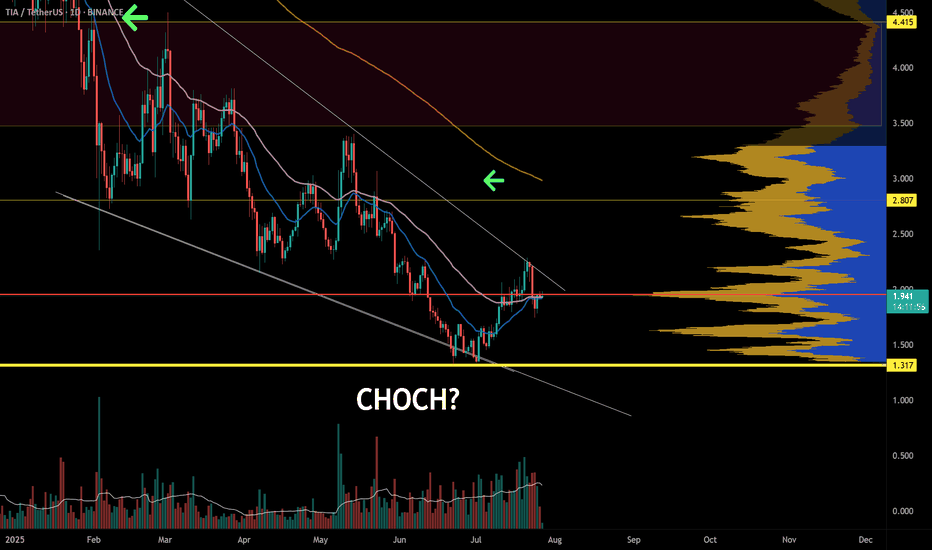

PremiumTIA is still in a downtrend, LL and LH. A proper CHOCH of market structure would confirm a reversal. In the meantime, we keep an eye on momentum shifts. Patience is key. Full TA: Link in the BIO

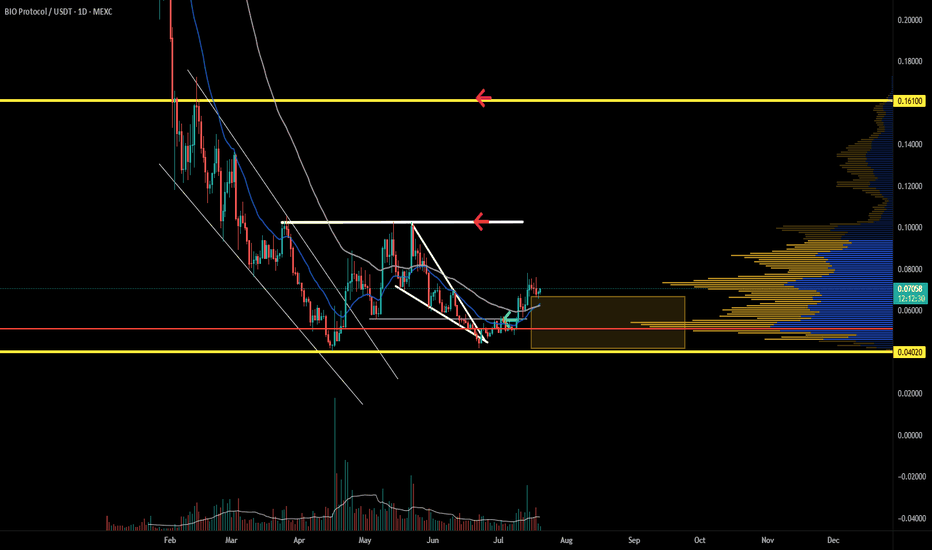

BIO is forming a healthy structure backed by market participation. As long as price action does not fall below the bottoms, it is likely that new highs will be made. Momentum and trend oscillators are looking bullish and are trending towards overbought states. Full TA: Link in the BIO

SHIDO is printing a nice reversal structure. A confirmed break of the tops would complete a CHOCH. Volume suggests healthy market participation at this level with a strong chance of getting overbought. Full TA: Link in the BIO

LOGX is still showing weakness in the chart as the price keeps making lower lows and lower highs. The current level is important because it could be the spot where the price can react at the previous low. A floor price would also be bullish, suggesting that no more selling is happening. Full TA: Link in the BIO

AXL is now within a clearly defined range. At the bottom of the range, the RR is at its best. The best part of this range is the amount of volume. This suggests the market is participating here. Full TA: Link in the BIO

ESX is a new project in speculation mode. Price action is a true reflection of low liquidity and low market cap volatility. If the sell pressure continues, downside targets should be prepared for. Full TA: Link in the BIO

QUBIC price is being held down by some FUD. While the rest of the space decided to move up, Qubic is on a coffee break. Now for the important questions. What will happen to the price when the next bearish response comes in for BTC? Will the FUD continue to hold down the price? Is Qubic now undervalued? Full TA: Link in the BIO

ETH is holding up by a thread. There are signs of weakness in the market, and if the Ethereum price breaks below support, it is likely we will see follow-through. Full TA: Link in the BIO

BTC is at a very important level. A role over is expected, but without market structure confirmation, it's important to consider the possibility of a move up. The bearish thesis on lower timeframes is the easy one. Ensure your bullish thesis is also considered. A confirmed lower low or a lower high would confirm a CHOCH reversal. Full TA: Link in the BIO

MORPHO is still in a retracement. However, the structure is mature and well developed. These low-volume moments are where sentiment cues can be picked up. If a proper CHOCH can be achieved, DCAing and the next bearish response may be the opportunity. Keep in mind that invalidation is clear. Full TA: Link in the BIO

ETH is struggling below resistance; however, an exchange of hands on lower timeframes can give the bulls a bit more wind. A break back into structure would be bullish. Don't mind me, I've been smoking that hopium. Full TA: Link in the BIO

TAO retracing for a confirmation low is bullish. The real concern is that this turns into a dead cat bounce and the price makes a LL. As long as the price stays above the previous low, as momentum and trend oscillators get oversold, the structure is intact. Full TA: Link in the BIO

CETUS is at the bottom of the range, looking for support. RR is healthy; however, a break below would introduce the possibility of hunting liquidity at lower levels. A proper CHOCH on lower timeframes would help identify a bottom. Full TA: Link in the BIO

RAY is looking to find its bottom. RR is in favour of a long. Horizontal support is a clear invalidation of the bullish thesis. A break below confirms a lower low. Full TA: Link in the BIO

BTC has some work to do. Either it will correct for a nice confrimatio low or strucure out for a bull fag. Either way, the price remains within a downward-sloping channel. That keeps me neutral bullish. But until I see a pivot point structure with signs of divergence in oversold conditions, it's difficult to get a proper RR. Full TA: Link in the BIO

RENDER technically is still in a downtrend. Given the current events, it is likely that a lower low will confirm the trend continuation. Keep in mind that the price is now oversold. Time to watch for support signals. Full TA: Link in the BIO

BTC setup is very clear. Why? Because the structure is clear. The current price is an inflection point; both bears and bulls are watching to make their next move. May the strongest of the two prevail. 95k or 110k? Full TA: Link in the BIO

SEI is working on its pivot. In the meantime, we accumulate at positions of strength. A proper higher low and a higher at this level would be a good sign. Full TA: link in the BIO