BTC is in the Buy Zone (current price down to $6800). I do not think we see the Nov.25 low of $6500 again. RSI is currently below 40. RSI was recently as low as 22. If we see RSI this low again, this would be like a double bottom on RSI which I consider bullish. Based on the RSI trend, I don't see these "BTC going to 5K" predictions accurate. This would...

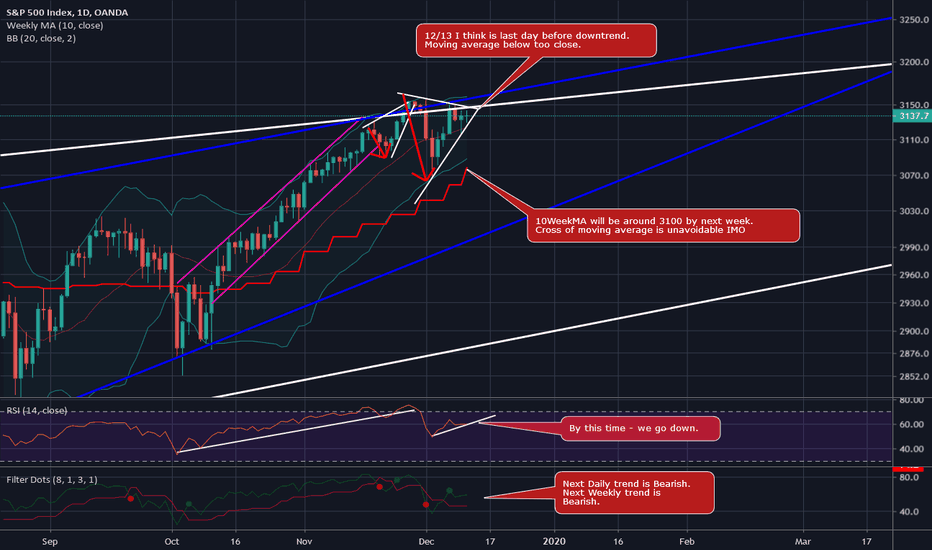

30Min view of SPX shows we stayed within the current wedge pattern for the most part. There was a small increase above the resistance line which moved the tip of the pattern back by 7 hours. (I don't think this is big deal) 10WeekMA is coming from below like a shark. IMO we have less than a week before SPY/SPX turns down. News - Steve Bannon was on CNBC this...

Using the 10WeekMA for SPY we can see selloff's occur the last 3 times when price was within $8.60 or less of the moving average (red zigzag). We are currently less than $8.60 from the moving average - but no selloff. If we use the normal moving average on 64bars, and ignore the double jump up, by 12/13 price is closer than last selloff. Last selloff price was...

On Weekly chart shown, GDX formed a bull flag and is ready for breakout. Price went outside wedge and retested 10WeekMA/outer wedge of triangle - looking good. Buy signal on today's Daily candle. Weekly candle still on buy signal at end of long bearish trend. Weekly rend shows next flip is Bullish. Next Daily trend flip is also Bullish. RSI trend is also forming...

We are sort of in the middle of downtrend. I like to wait for clear trend reversal. Should be around January/February IMO unless Death Cross flips and price goes above moving averages. There is also a bear flag formation under the death cross. What I see as most important - the biggest selloff happened when price crossed under 50DayMA , not the death cross....

Based on the Daily trend with AAPL, and the high correlation with SPY, I see us taking our trip down before year end. The moving average is too close to price with AAPL. The blue resistance line is multi-year (forming in 1998 see Outter Space Chart) and I don't see price going beyond blue resistance by more than $10. By next week the 10WeekMA will be around $263....

SPX / SPY - the final wedge within a wedge pattern has little room left to expand further IMO. Top white resistance line is multi-month resistance from Weekly view chart from 12/9 (see link below). RSI trend is already high in position and short. Bollinger Bands are tight. Going back in pattern, last time price angle like this with tight bands we have...

Someone asked me to chart UBER. So with these two lines we can see what a dumpster-fire this thing really is. There may be an entry point sometime January 2020. This chart makes me laugh. I will try to update around January. Thank you for liking, commenting, throwing up a chart, following, or viewing. I am not a financial advisor. My comments and reviews are...

THIS IS NOT READY YET IMO IHI - Medical Devices ETF Forming an ascending wedge similar to much of the market. Bearish pattern. Pattern runs out of room February 2020. Watch closely Jan. 15 2020 going forward for entry. When Weekly trend turns bearish and gets close to white resistance line for breakdown, this would be entry point. I will update getting...

THIS IS NOT READY FOR ENTRY IMO NFLX looks to be headed down while it fills this consolidation wedge. This Weekly view shows the next trend is bearish. I would need to see 1-2 more weeks of time, or cross of the MA to enter bearish. I would prefer to wait for bullish entry here around March 2020 (more room to run). I will keep an eye on this and update as...

BTC may be entering the Buy Zone into the end of the year. 10WeekMA looks to intersect with price (unless we get a selloff) around Dec.31. When price goes above moving average we should go up for weeks. Next Weekly trend is bullish on Filter Dots. Anything around $7K I would be buying for long term holding. Thank you for liking, commenting, throwing up a chart,...

The fake breakdown in AAPL and SPY is getting old, but the moving average cross is becoming unavoidable. The blue resistance line in the AAPL chart is multi-year resistance (hard to breakout). 10WeekMA is pressing upwards toward this blue resistance line, leaving price no room. 10WeekMA is moving roughly $1 per day closer ($4.90 every 5 days). With current white...

SPX / SPY is overextended and on a weekly basis has been bullish over 12 weeks. This is abnormal with RSI on Weekly in the 80's. But we keep getting these breakdowns, which lack momentum, and form back into same pattern. Wedge which has resumed now ends on 12/12. My SPY Puts are for 12/27. I am going to consider getting some out into January if price falls by...

VIXY/TVIX showing a Buy Signal on the Daily yesterday. Yellow bull flag formation (kind of sloppy but its there). Price currently broke out bullishly. 10WeekMA is reaching out farther by the day to reach price. Rate is currently $1 per day closer to price (which is fast). If we cross 10WeekMA, price should continue higher. Based on current rate, 10WeekMA should...

MSFT showing that the breakdown last week which occurred did not confirm by breaking the lower channel. Price needs to break pink and white lines to continue down and fill the red gap boxes. Resistance line and trend line cross this Friday. This means we may see sideways movement until Friday/next Monday. RSI trendline was broken last week. RSI current trend...

MTUM is the ETF ticker which tracks momentum. The pink lines show a megaphone pattern, which is bearish when tilted up. education.howthemarketworks.com The inner white trendlines of the megaphone show price hitting the angled resistance. The angled resistance crosses the current white price trendline on 12/13. Going back in history with MTUM, inside the megaphone...

AAPL Weekly view shows how overextended this bullish trend really is. RSI is currently over 80 and has been over 76 since October. Yellow ascending wedge protrudes out the top of the main blue multi-year resistance line. (from Outter Space AAPL chart) In the history of AAPL, there are no instances where price spikes out the top in such a manner. The blue...

Fake breakdown on AAPL still resulted in returning to overbought status quickly. 12/10 end of day appears to be when pattern runs out of room. We may get up to $274 before a selloff. The trade deal is what we are playing here. This doesn't mean I don't like AAPL. It is the pattern and the situation. The risk is to the downside for AAPL. If you cannot handle...