MyMIWallet

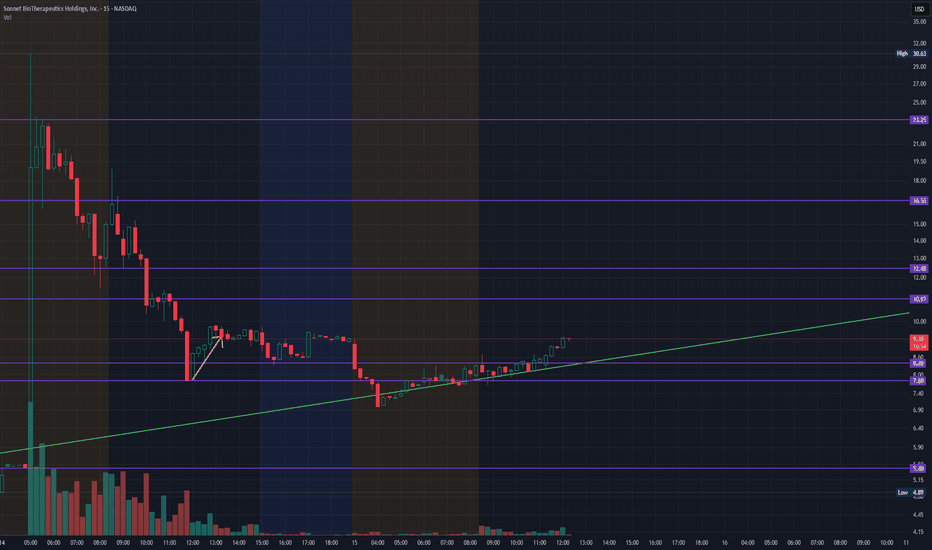

EssentialAfter SONN broke out to $30.63 from $4.20 in yesterday's pre-market, after announcing entering an agreement to become a Public Cryptocurrency Treasury Company. We entered NASDAQ:SONN at $8.28 this morning in's pre-market during the completion of consolidation and convergence on the EMAs from the Consolidation Downtrend. Looking for a $16 PT / 50% Fib Retrace...

$WIF.X $1.18 PT over the course of the next month if we can break that higher level of resistance. Entry at $0.93 with a $0.85 Stop Loss on the 3:1 RRR. IF we hold that long at least... Will position a shorter stop to be conservative so If we lose momentum, we would look for re-entry at the smaller compression zone which also rest at the $0.85 Price Levels. #WIF...

We enter BBAI at $5.11 look for confirmation above the $5.20 which we expect to confirm support after consolidation of this morning's breakout (if it even recedes from this point), with a price target of $8.35 which would provide the potential for a ~65% Gain on the potential trade and continuation. We have a stop set for $4.06 on the trade. This comes after the...

ASTS set an ATH yesterday (6/25/25) and has consolidated in the pre-market, allowing for anyone who may have missed the stock's run off of those $48.92 Resistance Levels, which have also reversed and turned in support in today's pre-market sessions. The dip in the stock in this morning's pre-market comes from the company announcing that they will be repurchasing...

Grab Holdings just rebounded strongly off this $4.05 Support Level that was established back in Oct. 2025 while also releasing news of Grab partnering with Tech Firms to assess ithe mpact of autonomous vehicles in South Asia. With this trade, we will be looking for a $4.50 retest and bounce back to $4.80. Entering around $4.10-$4.12, anything below that and...

NOG recently bounced off the $27.42 Support level held since March '23. We're looking for a 50% Retracement Retest at the $35.84 Levels, so we're looking for an entry around the current Price Levels that it's been consolidating in since March 5th. Even purchasing at the bottom of this current consolidation would require a Stop Loss around the $23.82 Price Level,...

Purchased shares of SCNX at $2.89 after the company had a breakout, releasing news of partnering with Kindeva to launch the 10mg Rezenopy nasal spray for opioid overdose treatment. We're looking for a $4.92 retest, entering with a $2.22 stop loss on the Trade. FINANCIAL NEWS: 7:41 AM EST, March 06, 2025 (Benzinga Newswire) SCIENTURE HOLDINGS, INC. NASDAQ:...

OLIN bounced off of the $22.98 after breaking/retesting Downward Trend Support Levels that have been support since Sept 2024. We are looking for a Top-Level Resistance breakout back to the $28 - $ 30s for a decent 20-30% in the Trade. If not, back to the 50% Retracement around the $36.26 over a longer timeframe if the company can reverse the recent stock...

XRP may pull back a little lower, providing an entry below the $2.30s.

Nokia brought out of it's current channel, tapping $5.14 before pulling back which we expect it to come back to the $4.53 for another potential entry before it's stronger continuation to the upside within this channel, ultimately heading back to the $6.50 Price Levels. FINANCIAL NEWS: Nokia Oyj (NYSE:NOK) shares are trading higher by 6.25% to $5.104 during...

In Friday's Trading Session (02/28/2025), we saw NWBI close below its 50% Fib Retracement Level of $12.62, a mixed signal that can only be distinguished in Monday's Trading Session (03/03/2025). If we close below that $12.62, then we expect a pullback to the $11.51 Price for potential entry, unless some lower prices could be captured below. Tracking the Stronger...

This morning, the VIX popped to $19.26, not seeing levels like this since the Jan. 27th, 2025 jump to $19.93, where the SPY saw an almost 3% drop, NASDAQ dropped 5%. We saw concerns of heightened market uncertainty, with investors weighing robust consumer spending against mixed economic signals. There were murmurs that the subdued durable goods orders and...

Trade Alert: UNIT – Bullish Breakout & Fib Retracement Play 🚀📈 Symbol: UNIT Exchange: NASDAQ Company: Uniti Group, Inc. Trade Type: Stock (Long) Market Sentiment: Bullish Alert Priority: High Current Price: $5.08 Target Price: $8.50 Recommended Entry: $5.64 Stop Loss: $4.65 Market Update & Trade Rationale Uniti Group (UNIT) is on the verge of a major breakout,...

VITL - Vital Farms is positioned in a very strong support level, looking for an entry between $31.40 and its current price ($35.40 as of this MyMI Trade Analysis). Looking for resistance around the $41.54 Price Level, so a potential exit there before seeing a continuation to that $44.54 Price Target over the next 2-3 months placing our Stop Loss around $32.04 if...

Overview Looking for an incoming buy-in opportunity on APO - Apollo around the $158-$160 range by mid-February. This setup aligns with a potential longer-term hold and a continuation back to its previous all-time highs (ATHs). If it follows an incremental climb higher, this could yield a 19-20%+ gain, with even more potential if it surpasses those ATHs. The...

As the White House proposes 25% Tariffs on Steel and Aluminum imported to the US, and with the current resistance we're seeing around the $6069 Price Level, we're now looking for a potential pullback as more import duties are to be included along with Steel and Aluminum come Tuesday / Wednesday of this week. If we do see a pullback, we're looking to see if it...

Overview Looking for an incoming buy-in opportunity on APO - Apollo around the $158-$160 range by mid-February. This setup aligns with a potential longer-term hold and a continuation back to its previous all-time highs (ATHs). If it follows an incremental climb higher, this could yield a 19-20%+ gain, with even more potential if it surpasses those ATHs. The...

COST has been trading below it's most recent 200 Candles right around the $951.64 Price Level, currently consolidating and presenting an additional opportunity to get around that lower trend level (Bottom Purple) to ride this into the year. With the planned Tariffs, we plan for that to be handed down to the consumer ultimately, causing a potential continued rise...