MyronWilson

EUR/USD rebounded from around the three-week low of 1.1655 during the European session. However, the overall trend of the exchange rate remains within the descending channel that has been in place since early July. Market concerns over the U.S. government's new 30% tariff measures have dampened risk appetite, limiting the room for the exchange rate to rebound. In...

On July 14, Bitcoin's price surged sharply, with the highest level reaching $123,100. This breakthrough ended its eight-month-long consolidation phase within the $90,000 - $110,000 range. The U.S. House of Representatives designated the week of July 14 as "Crypto Week" and plans to deliberate on a number of key bills. Among them, the Guiding and Establishing...

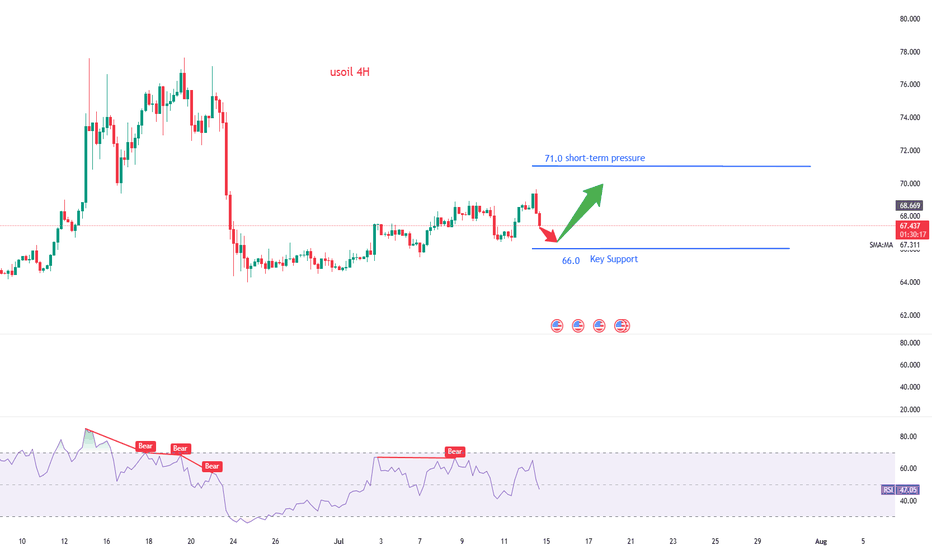

International oil prices continued to climb on Monday, though the gains were limited. Brent crude futures rose 8 cents to $70.44 per barrel, extending Friday's 2.51% rally. U.S. WTI crude edged up 5 cents to $68.50 per barrel, after surging 2.82% in the previous trading session. The primary driver behind the current upward move stems from market expectations of...

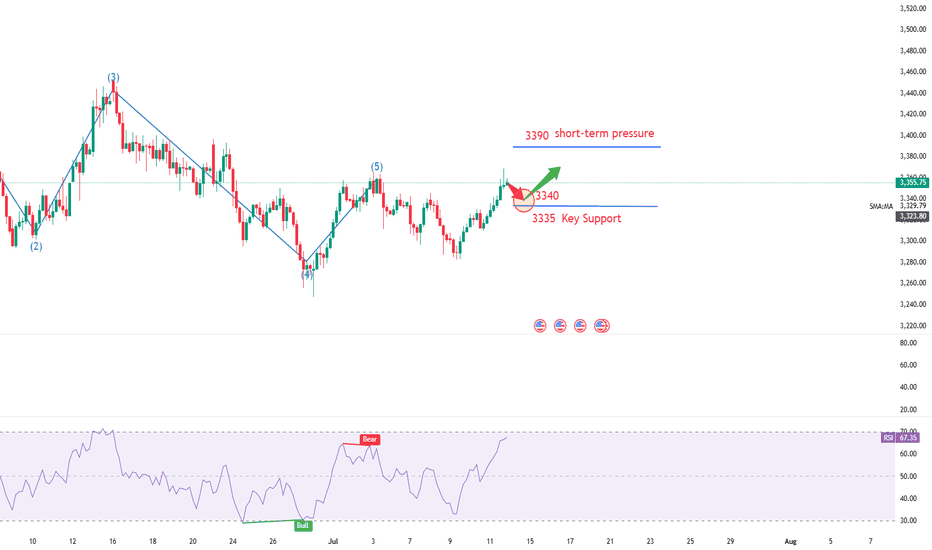

Spot gold edged higher, with the highest level reaching $3,374.71 per ounce, the highest since June 23. Over the weekend, Trump announced that a 30% tariff would be imposed on goods imported from the European Union starting from August 1, which further intensified market concerns about international trade and provided upward momentum for gold prices. Gold prices...

The current uptrend for gold is clear. If there is a pullback at the opening next week, still recommends prioritizing long positions. From a technical perspective, the 1-hour moving average has formed a golden cross, indicating strong bullish momentum. After breaking through in the afternoon, gold prices pulled back to test the 3330 support level, and the...

The data released by the U.S. Bureau of Labor Statistics showed that the U.S. seasonally adjusted non-farm payroll employment in June was 147,000, with the consensus forecast at 110,000. The previous value was revised up from 139,000 to 144,000. The annual rate of average hourly earnings in June stood at 3.7%, below the expected 3.90%, while the prior figure was...

The ADP employment data in the U.S. unexpectedly cooled down, with private sector employment dropping by 33,000 in June, far below the market expectation of an increase of 95,000. The previous value was revised down from 37,000 to 29,000, marking the largest single-month decline since March 2023. Meanwhile, the Challenger Enterprise Layoff Report showed that the...

During the U.S. trading session, spot gold trended higher in a volatile manner, reaching a three-day high of 3,357.88 as of 22:30. The rally was primarily driven by a weaker U.S. dollar, heightened uncertainty over U.S. trade agreements, and intensified market expectations for Federal Reserve rate cuts. The global economic uncertainties have highlighted gold's...

During Monday's Asian trading session, international oil prices fell, primarily due to the combined impact of eased geopolitical tensions in the Middle East and expectations of OPEC+ production increases, which raised market supply outlooks. Although the two major benchmark oil prices recorded their largest weekly decline since March 2023 last week, they are still...

During Monday's U.S. trading session, spot gold demonstrated certain resilience, reflecting the complex game between market risk aversion and risk appetite. This week, it will welcome the impact of the U.S. non-farm payroll report. At the beginning of Monday (June 30) trading, spot gold once fell 0.8% to $3,247.87 per ounce, a new low since May 29. However,...

Technical Analysis of Bitcoin (BTC) Contracts: In terms of today's market, the daily chart of the large cycle closed with a small bullish candle yesterday. The K-line pattern shows consecutive upward movements, with the price above the moving averages. The attached indicators are in a golden cross, indicating an obvious upward trend in the long term. However, the...

The EUR/USD exchange rate is consolidating at high levels, posting gains for the seventh consecutive trading day. The pair briefly approached the three-year high of 1.1744 in intraday trading, accumulating a roughly 2% weekly gain so far. This rally is primarily driven by intensified expectations of U.S. rate cuts and temporary easing of geopolitical tensions. In...

WTI crude oil futures stabilized for the second consecutive day, maintaining fluctuations within the broad range of Tuesday and oscillating around the key level of $65.12. A sustained break below this level would confirm the resurgence of selling pressure, and a breach of $64.00 could trigger a decline toward $61.90. On the upside, if the price holds above $65.12,...

On last Friday, both the data and news fronts were bearish, leading to a step-by-step decline in gold prices. The bears completely dominated the market, and the feeble rebound made it difficult for long-position holders to exit. Gold trended lower in a volatile and slow decline, rebounding only to a high of 3,321 before plummeting all the way, consecutively...

In the early morning, gold directly continued its bullish correction pattern. In the European session, it reached around 3336 at the highest, then continued to pull back in the US session, hitting around 3312 at the lowest and temporarily stopping there. It showed the intention to start a second rebound correction and closed at 3332. Opening at 3333, it rebounded...

Bitcoin has surged to around $106,700 at its peak and hovered around $104,800 at its low. Overall, the trend remains relatively stable, continuing to stay at a relatively high level. What is driving the market? First, institutional funds have flowed in again. Recently, many investors have bought Bitcoin through ETFs, with substantial capital inflows, which has...

On Wednesday, international oil prices stabilized and rebounded after two consecutive days of correction, as the market reassessed the short-term easing of the Middle East situation and changes in crude oil supply. Brent crude oil futures rose by $0.75, or 1.1%, to $67.89 per barrel; WTI crude oil rose by $0.71 to $65.08. Previously, U.S. air strikes damaged key...

On Wednesday, gold prices edged higher, mainly driven by the U.S. Dollar Index hovering near a one-week low and depressed U.S. Treasury yields, which enhanced purchasing power for non-U.S. dollar investors. The market remained focused on the Middle East situation, as the fragile ceasefire between Israel and Iran still held uncertainties. However, with the...