Gold (XAUUSD) Long If the price comes to 3339.40 Long Entry: 3339.4 Stop Loss: 3324.20 Take Profit: 3375.54 Trade Idea (Long): Gold has shown bullish continuation following a corrective pullback. The entry at 3336.82 targets a key resistance zone at 3375.54, with a stop loss below recent structural support. This setup anticipates a final push into...

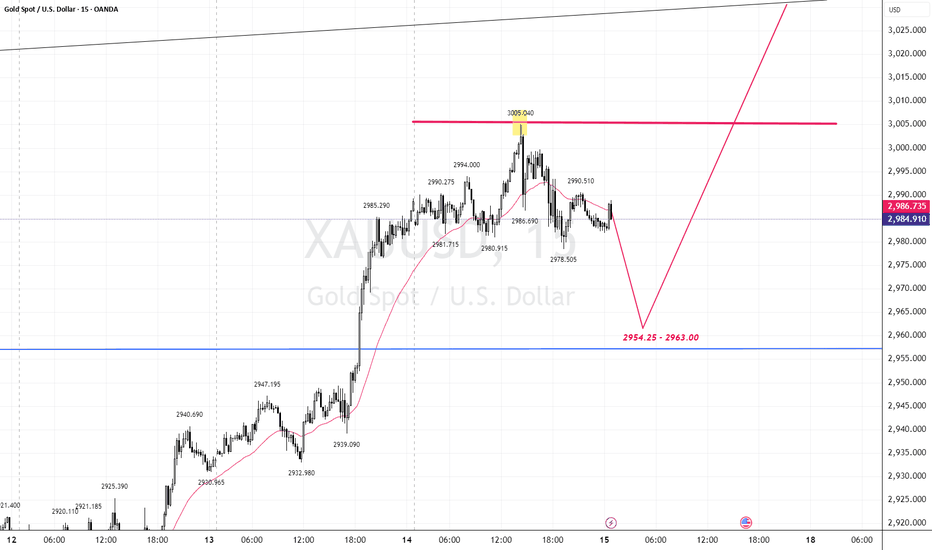

GOLD Gold rose sharply after breaking above 3000 USD , I do personally expect a bit more higher to 3030-3050 levels before it forms some sort of correction . Major investors seem to be with safe-haven assets as Trump’s tariffs moving on , specially to the fear of US economy growth. Entry - 2954.25 - 2963.00 Target - 3030 Manage your risk , there is no...

GOLD ----------- Buy stop - 2360.55 S/L - 2355.40 T/P - 2369 / 2372 Cheers

GOLD ----------- Buy stop - 2360.55 S/L - 2355.40 T/P - 2369 / 2372 Cheers

Fundamental------ Gold price seems to be looking up again after a week of profit lock mode, It seems like after reaching all the time high the price headed down with the conflict between Iran-Israel war as well as the uncertainty of reducing Fed rate due to higher economical data. On Thursday the Gross Domestic Product ( GDP ) came out 1.6% which less than...

Nasdaq-100 dropped almost 2% that's a 6th straight loosing days as the NVIDA drooped 10% due to Shares of the AI chip leader got swept up in a broader AI sell-off after one analyst noted that Super Micro Computer failed to report preliminary revenue that indicates a doubt of its future result. Also Netflix (NFLX) dropped over -6% in pre-market trading despite...

Fed march rate-cut hopes fading with the NFP data popped up way more higher than expected , on the top of that PMI data reached higher than expected putting icing on the cake US 10 year bond yield bounded back from 3.77 to 4.11% currently , I do expect DXY to move higher with another breakout .

EUR/USD Outlook for the next week EUR/USD seems to have changed its direction to bearish. We can clearly see that the pair failed to cross above the 1.10 level. Fundamentally, the ECB seems to have kept a step up ahead of the FED, saying it is mostly likely to reduce borrowing costs in the summer, while the US economic data shows some strong momentum, dimming...