This is an interesting situation, when the day traders are shorting the stock, while the insiders are buying the stock. Truth is, the insiders didn't purchase since June 2018.

This is an interesting situation, when the day traders are shorting the stock, while the insiders are buying the stock. Truth is, the insiders didn't purchase since June 2018.

There was news released on Aug 23 that KKR wants to purchase the auto parts unit from Fiat Chrysler for 5.8 billion euro. The stock gapped up next day, but didn't vary during the day. Second day from the news it increased $1 from $16.86 to $17.87. Now KKR is offering more money than before (6.2 billion euro), so I expect the price should go up in premarket. The...

Today I've been watching PTI since before 5:30 am. I've seen it going up to the high level of $3.58, then going down to $3, contemplated if I should buy some position in the premarket around $3.10 (and I didn't). Later I watched it breaking the previous high of $3.60, almost bought them at 8:11 (my order was lower by a few cents than the down spike), then kept...

CLRB has a buy rating on Zacks Rank, but it has poor financial. Based on my experience (or lack of) studying the graph, I expect the stock will drop in the future. At the moment the stock is $4.08.

I purchased some LEVB at $4.29 because of it was one of the premarket gainers. My program gives SE score is slightly negative, but not as bad as for other high gainers. The volume has increased lately. I hope to sell around $5.25 in the next days.

I purchased some SYN for $3.92, based on the very high volume from Sep 28. There are things which I like and things which I dislike. I like that two analysts have a buy rating and Zacks Rank is a 2 - buy. I don't like that the stock fell so much since last year. I don't like the gravestone doji from yesterday. I don't like that the company is losing money. The...

On Sep 24, I was watching the market and I noticed this insane move of AMRN from $3 to $9 in the premarket. I usually get greedy when I see large increases in price, I buy at the top and I usually end up losing money in the following days. This time won't be the same! I will go against my instincts, which failed me so many times before! This time I will go short!...

I decided to buy (impulsively) some TLRY stock. I got in today at $122.98. The fundamental data is not good (the company is losing money at the moment) so I based my purchase on FOMA and on the hype surrounding the company. Usually it doesn't end well for me when I take such hasty decisions... The recent spike to $300 and fall to $100 shows there is a lot of...

IGC has a market cap around $100 million. It has potential to grow but it is very speculative. The insiders sold shares.

There is a number of insider traders who made purchases The company is profitable and doesn't have much debt. Zacks has a rank of 4 - sell. I am concerned about the falling trend, I don't know if the bottom will be reached soon.

SLCT is a small company, with a market cap of around $240 million. The company is profitable and has pretty low debt. Starting with Aug 31, many insiders purchased stock. Zack's rank is a 3 - hold on the company and there seem to be at least one analyst with a rating of strong buy.

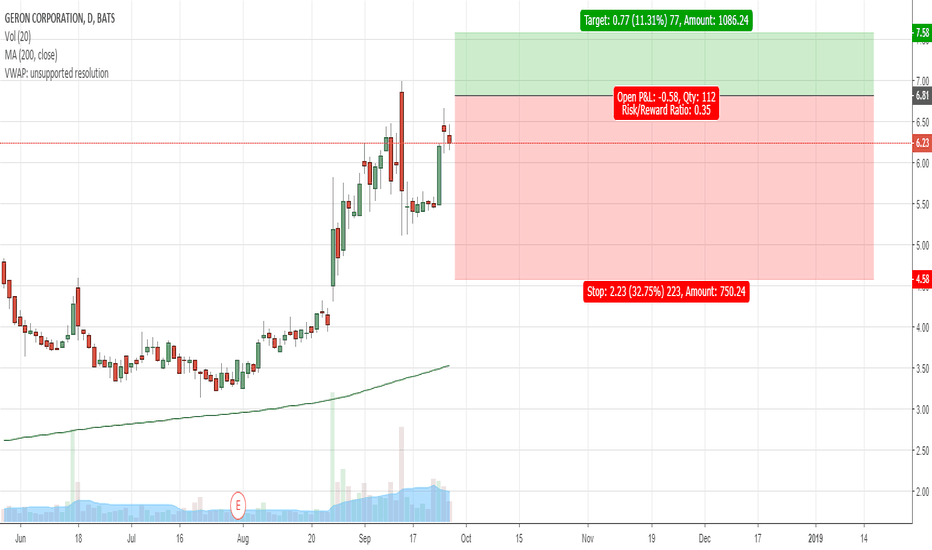

GERN dropped very badly in premarket today because of some bad news involving Johnson & Johnson's (NYSE:JNJ) Janssen unit. I was curious to see if there was any insider trading in the days before the news was released. I found out there were two transactions, both of the director and the secretary sold a total of $7 million dollars in late August - middle...

The recent IPO of QTT showed high interest in this stock. Although they are losing money at the moment, they have a large user database. Many IPO stocks can be purchased at a lower rate within six months from the issue date, so it may be wise to wait for a few months before purchasing. There is also some risk for the price to increase significantly until then.

The director of EYES has made large purchases in this stock from August - September. The stock has poor financial status, losing money. I would personally not invest in this stock, but the director seems pretty certain there will be some positive outcome in the future as he accumulated over 30 million shares.

ABMD showed up a few days ago on one of my scans, together with ALGN, HQY, IDXX, SIEB and VLRS. I noticed that yesterday it increased 10%

NVO scored high on my picking software, mostly due to its good fundamentals. I look forward to see how the stock will perform in the future. Tradingview indicator shows 10 indicators to sell and 4 to buy.

I am working on a software to identify potential good trades by scanning thousands of stocks and this stock has a good overall score. The focus is on finding good value companies with little debt that generate a profit. This stock was found with SE v1.00.05. At the moment I am doing a lot of changes, add new selection criteria, change weightings of various...