Short-term Outlook (1–4 Weeks): • Analysis: Oversold stochastic oscillator showing bullish crossover potential. Price approaching strong historical support near $90–$95. Candlesticks indicate seller exhaustion. • Trade Direction: Long • Confidence Score : 75% (Bullish reversal likely) Medium-term Outlook (1–3 Months): • Analysis: Significant correction...

t's awkward when 'all models are wrong, some are merely useful' when i called 'the fear is in the streets' with a buy action forward. boy was i wrong (and so paid the price for that call) but with -30% additional downside i've been stalking this patiently.. and +/- 5% diff i think This is it a good bottom as any now (you cant ever time them right) but merely...

ZIM’s current daily chart indicates that the stock is testing critical support around the $14.80 level after a recent bearish price action, down approximately 4.33% at the last close. The JP Momentum Stochastic DeMark indicator (bottom pane) clearly illustrates deeply oversold conditions, with multiple blue triangles signalling potential short-term trend...

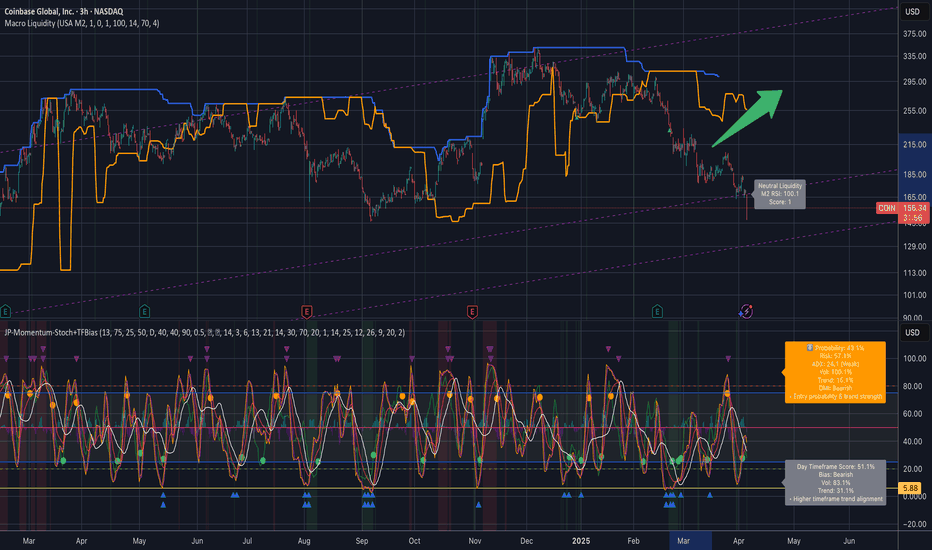

# **Coinbase (COIN) – Technical Analysis** ## **Current Market Overview** - **Price:** $214.17 - **Trend:** Bullish within an **ascending channel** - **Support Zone:** $200 - $205 (Trendline Support) - **Resistance Levels:** - **Short-Term:** $230 - $240 - **Mid-Term:** $270 - **Long-Term:** $300+ --- ## **Chart Patterns & Indicators** ### **1. Ascending...

Historical severely oversold area. Welcome to the MAX PAIN (looking at the greed&Fear at 11 today) At this max fear stage it’s hard for the herd to see wood for the trees and things also the perfect phase to pickup a contrarian play. 👇 🔹 **Trade Direction:** Long (Potential Reversal) 🔹 **Entry:** $170 - $173 (Current Zone) 🔹 **Stop Loss:** $165 (below recent...

multi timeframe confirmation just dropped in my lap. I see strong BUY confirmation based on our momentum framework. 🔹 **Trade Direction:** Long (Bullish Reversal) 🔹 **Entry:** $156 - $157 (Current zone) 🔹 **Stop Loss:** $152 (below recent swing low) 🔹 **Target 1:** $164 (short-term resistance) 🔹 **Target 2:** $171.50 (previous support-turned-resistance) 📊...

Short term risks for long term gainzzz 3h,4h and daily charts indicate heavy oversold conditions which make this a good opppr for the contrarian play, to target $3 levels for a 30% upside. However we need to reclaim key levels of support first…. 🔹 **Trade Direction:** Short (Bearish) 🔹 **Entry:** ~$2.05 🔹 **Stop Loss:** $2.25 (above recent resistance) 🔹...

This one came in as a 60% probability of trade success and i see why. Nothing is certain but here is the TA Overview (HD 3H Chart) Trend & Momentum: Price is consolidating near 385, with recent lower highs suggesting a cautious bias. The 50/200 MAs hover above current levels (around 400–405), creating overhead resistance. Stoch RSI is in a lower region,...

ByBit exogenous news is wildcard so we’ve broken down support as all hell broke loose. Here is the revised outlook of the trading plan: Trading Plan Based on Risk Appetite Aggressive Trader (Short-Term) • Long Entry: $234-$236 (oversold conditions). • Stop-Loss: Below $230. • Target: $248-$252. Swing Trader (1-2 Weeks) • Long Entry: On confirmation...

This is beaten down. So much so, that it’s beaten down on many time frames. In my book it’s a contrarian opportunity here. My indicator tells me the same. The COIN stock is showing oversold conditions based on momentum indicators. • The 3H chart suggests a potential reversal or at least a short-term relief bounce. Timeframe Analysis Short-Term (3H - Intraday...

Why? Because my crystal TA balls say so. Seriously though, here is my reasoning, given the indicator momentum Price Action & Trend Analysis • The stock is currently at $222.42, down -1.86%. • The price recently broke down from a local high near $244 and is in a downtrend. • Break of Structure (BoS) and Change of Character (CHoCH) labels indicate trend...

MRK, along with many othe rpharma stocks has taken some serious beating. But we like fear - as an opportunity- and it’s here( I dare say it) based on the bottom most will rejection, aka a shooting star. So here are my forecasts in my crystal ball:: 1. Overall Trend and Structure • Longer-Term Trend: MRK peaked near the $115–$120 region in late 2022/early...

Ok this looks oversold. In fact, Oversold on multiple timeframe So here’s a technical analysis with potential price targets and trade direction: Current Market Conditions & Observations 1. Trend Direction: Bearish • The stock is in a clear downtrend, breaking multiple levels of support. • Break of Structure (BOS) labels indicate lower lows forming...

Technical Analysis for QuantumScape (QS) - Daily Chart Trend Analysis & Market Structure: • Current Price: $5.12 (+0.99%) • Short-Term Trend: Bearish • Price is trading below short-term moving averages, indicating continued weakness. • Failed breakout attempts in recent weeks suggest strong resistance above $6.50. Medium-Term Trend: Consolidation/Potential...

Short & Medium-Term Outlook Trend Analysis: • Short-Term (Current Price Action): • The stock has recently found support around the $600-$610 range and is attempting a bounce. • The green arrow and projection indicate a potential upward move of circa 5% to $638, which aligns with the next resistance level based on recent price action. • The moving averages...

Crystal ball has spoken, AMZN is due for a small DIP. Trend Analysis: • The price is trading in an overall uptrend, respecting the 50 EMA (yellow) and 20 EMA (gold), indicating strong bullish momentum. • Recent price action has formed higher highs and higher lows, maintaining bullish structure. JP StochDemark Indicator Insights: • The indicator is approaching...

This one is nice and quiet, and well corrected Short-Term Analysis (Days to Few Weeks) Chart Patterns & Indicators: • Price Action & Support/Resistance: AMD appears to be trading in a consolidation phase. Recent price action has shown AMD testing a key support level which may be associated with a recently established trend line or the 20/50-day moving...

Key Technical Levels and Indicators Current Price Range: Mid– SWB:16S Immediate Support: $14.80–$15.20 Deeper Support: $12–$13 Near‐Term Resistance: $18–$19 (coinciding with short‐term moving averages) Higher Resistance: $20–$22 (major zone from recent swings) On the daily timeframe, ZIM has: 1. Broken below its short‐term moving...