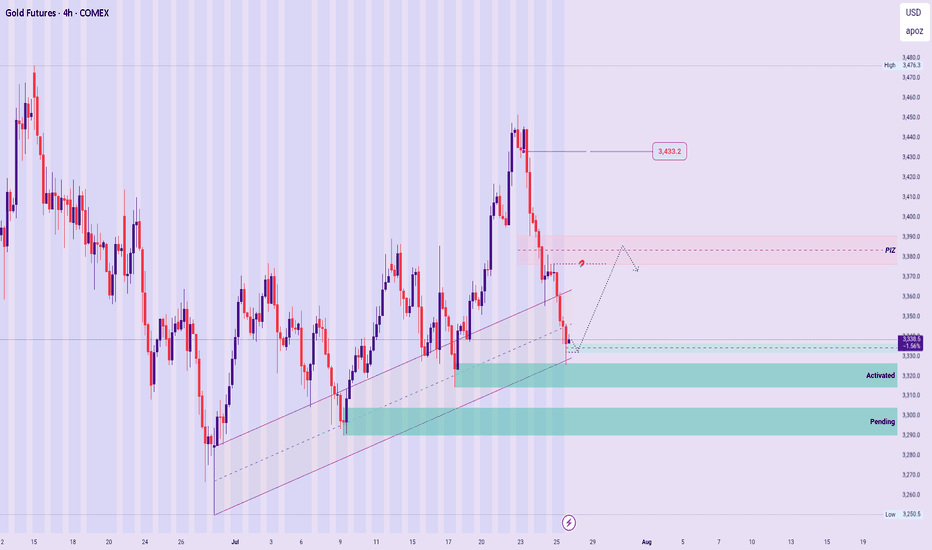

REVIEW SUMMARY ▪︎ HTFs maintain a bullish stance — no confirmed violation yet. ▪︎ On the 4H, Price is unfolding within a Descend Sequence targeting a key Price Base (purple support zone). This opens up multiple tactical scenarios: 1️⃣ Rejection Zone has activated — if sustained, I expect a bullish drive above the OCZ, potentially reaching the IPT. 2️⃣ Failure...

REVIEW SUMMARY ▪︎ On the Higher Timeframes (HTFs), the Buy-Side Bias Environment (BBE) remains intact, with no confirmed breach of the ongoing Ascend Sequence. ▪︎ However, the 4H chart reveals a developing Descend Sequence within a steep, channel-like structure, recently triggering a Rejection Block (Activated). ▪︎ If this Rejection Zone holds, I expect a...

Structural Outlook: The broader bullish sequence remains valid, with no structural breach confirmed yet. However, price is currently reacting at a sensitive level, warranting measured caution. Zone Dynamics : ▪︎ A recently activated Rejection Zone is expected to support a gradual impulse toward the PIZ. ▪︎ From the PIZ, two scenarios unfold: a. If it...

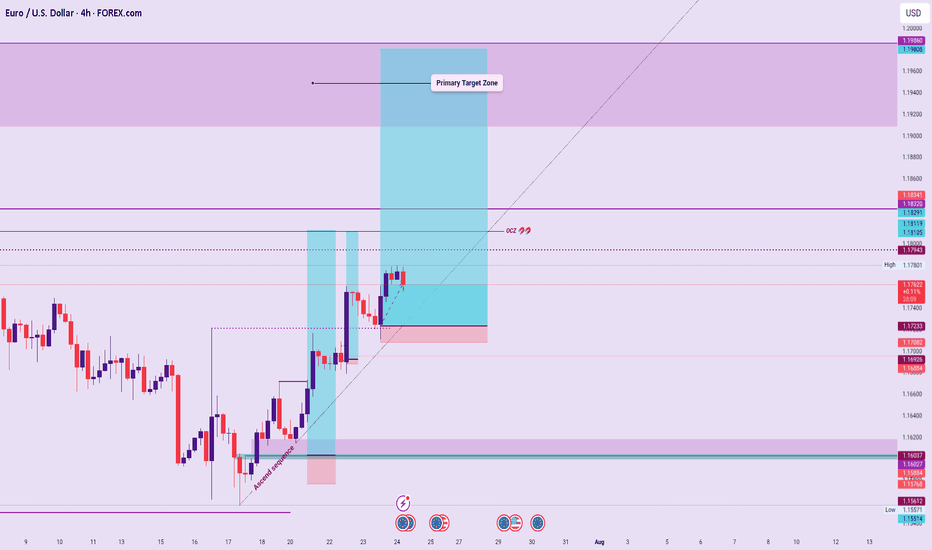

Sequence Expectation: If the current Ascend Sequence structure holds, I anticipate price extending toward or above the target zone, aligned with the directional flow. Liquidity Magnet: The OCZ remains a strong attraction point for buy-side flows, given its repeated gravitational pull on price. Invalidation Criteria: A structural breach of the Sequence Line...

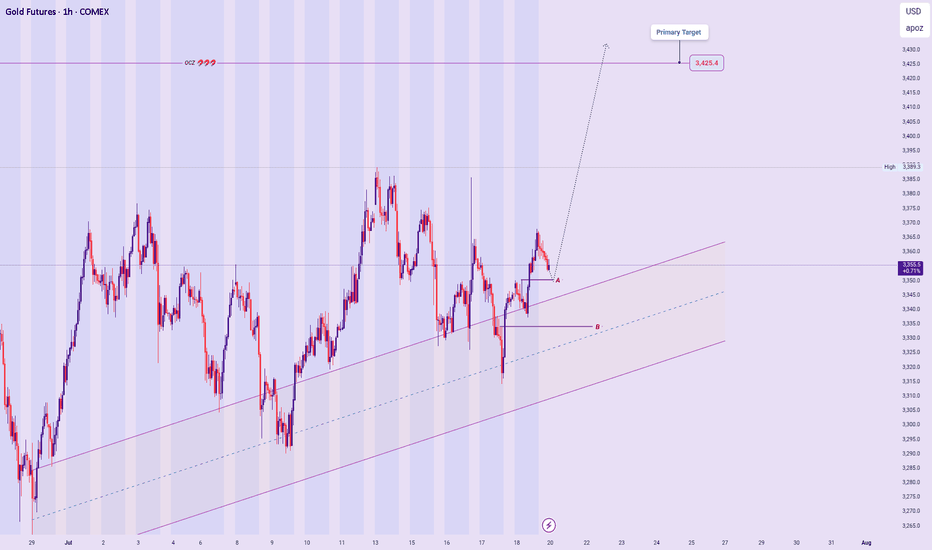

Bias Overview: Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes. Price Expectations: Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation. While less likely, a deeper pullback into Price Zone B may occur before the rally unfolds —...

Higher Timeframe Bias: Ascend Sequence remains valid on the Monthly, Weekly, and Daily structures, with the current Descend Sequence viewed as a pullback phase within broader bullish flow. Structural Insight: Despite recent sell-side pressure, price failed to break the Range Low during last week’s trading — suggesting possible defense of bullish territory. ...

Bias Status: Core outlook remains unchanged from last week — still favoring the Buy-Side Bias Environment (BBE) in alignment with HTF Ascend Sequence. 👉 Trade Plan: Actively seeking long setups as long as price holds above the mid-range of the current structure. A potential Retrace Precision Entry (RPE) zone aligns around the 4H Price Inefficiency Zone...

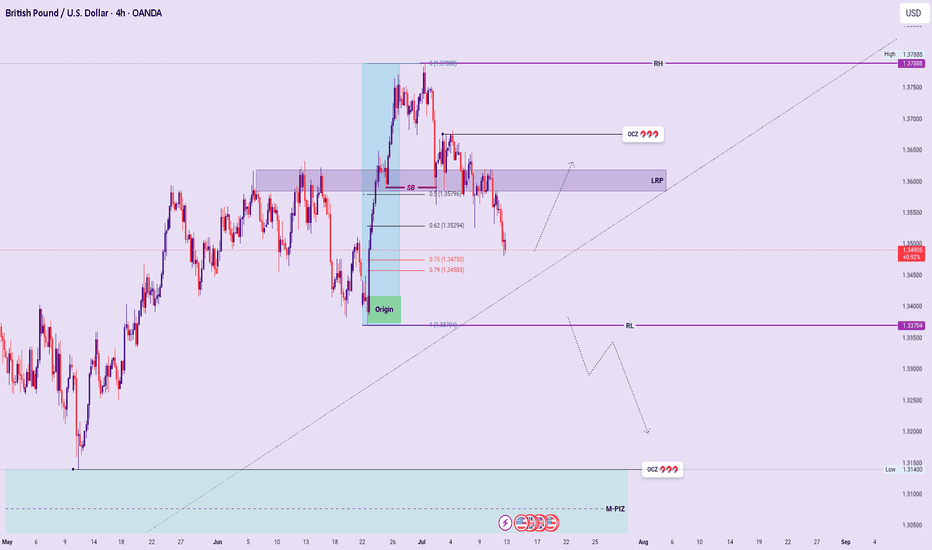

Higher Timeframe Bias: The Ascend Sequence on Monthly, Weekly, and Daily remains intact; current Descend Sequence is viewed as a pullback within bullish orderflow. HTF bullish stance is maintained unless invalidated. Current Structure (Short-Term): Descend Sequence is still active across Daily, 4H, 1H, and micro-timeframes—momentum favors sell-side flow for...

Current Market Context: Price is currently oscillating between two Higher Timeframe Price Inefficiency Zones (PIZ), resulting in a neutral bias for initiating new positions. Anticipated Scenarios & Bias Filters: If both upper and lower PIZ zones reject price, confirming compression and exhaustion, bias will shift toward a Sell-Side Bias Environment...

A quick entry at LND open. Monitoring for any invalidation that might present

Current Price Action Development: Liquidity beneath the VCP Range Low successfully taken via Sweep Event. Price has reversed back inside the compression zone, signaling potential bullish reclaim. Anticipated Scenario: Watching for a confirmed Trend Signature Shift (TSS) to validate bullish continuation. Entry model of choice: Retrace Precision Entry (RPE)...

Took a snipe entry at the Price Base aligning with a 5min PIZ. Trade protected already.

Multi-Timeframe Structural Outlook: Higher Timeframes (M,W,D): In Ascend Sequence sweeping major liquidity levels 4H Structural & Liquidity Picture: Trend Signature Shift (TSS): A clean TSS followed the Sweep Event, shifting internal structure bearish and signaling short-term vulnerability. Trap Vectors & Liquidity Mechanics: Price engineered multiple...

Clean Sweep Event (SE) tapped liquidity, followed by a Trend Signature Shift (TSS) hinting bullish reversal. Eyes on price retesting the LRP zone before targeting Primary Liquidity at 198.800, with extended focus on the OCZ/W-PIZ zone above 199.500.

Multi-Timeframe Structural Outlook: Higher Timeframes (Monthly, Weekly, Daily): Broad structure remains bullish within an Ascend Sequence, though notable Monthly Price Cap Rejections indicate overhead resistance slowing momentum. Daily & 4H Technical Picture: Value Compression Phase (VCP): Price compresses within 3500 – 2956, with consolidation occurring above...

Multi-Timeframe Structural Outlook: Higher Timeframes (Monthly, Weekly, Daily): Market structure remains in a clear Ascend Sequence, reflecting an intact Buy-Side Bias Environment (BBE). Price action continues to build bullish structure, supporting an overall upward lean. Lower Timeframe Technical Snapshot: 4H & 1H: Current price consolidates within a...

1. Liquidity (Buy side and Sell side) 2.imbalanaces During market open for the week, at Asian session, I would expect buy side liquidity to be taken. Then price trade lower to create a sell side liquidity which is inturn taken out before a rally to the upside. My bias for the week is bearish but after a short bullish move to fill imbalance at 1.03619 zone

As seen on the daily timeframe, the trend is downward. Price formed a descending triangle, a downtrend continuation bias pattern.