PatternTrader0807

It makes sense why it popped back down now as I added the 200MA. If I were to guess the stock will move down and retest the .20 cent area. Otherwise, back to .15ish cents it is. With any luck (not looking so hot) there is a pump at .20 and it breaks out past .27 and past the 200MA. Just a heads up if you're holding! Good Luck!

I have a wild theory about Fannie Mae and Freddie Mac. There is a lot of speculation for both companies since the housing bubble crash. I think fear will drive the price down to as low as $1.00 - $1.75 range. Once the Blue Print is revealed I think it will shoot back up. It could also gradually climb back up depending on how the news sells the overhaul. Let's see...

I think tomorrow will really decide where UPL goes. The volume on the previous high was massive, with an equally massive sell-off. The 2hr Stoch-RSI looks poor, but the Daily and Weekly Stoch look like something might change. Here are the two outcomes I have come up with: A) The buyers/sellers from the last pump saw how quickly the stock moved when they bought...

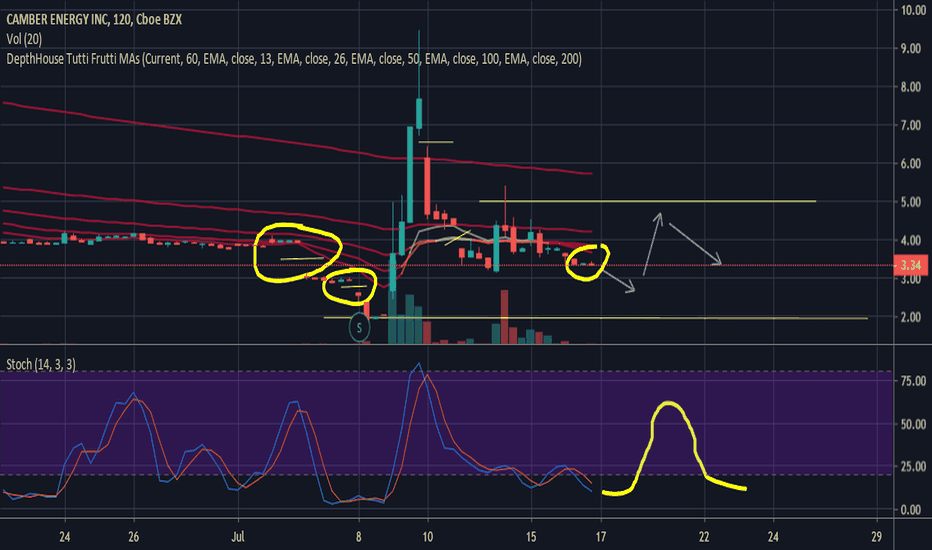

So I got into this stock in a stupid place. I'm taking the opportunity to learn and hopefully this helps other people. I knew beforehand NOT to enter during a sudden jump and did anyway. As quickly as it comes up, it can come down. Mistakes aside. It's a learning experience. I have a light idea of what CEI will do next by noticing what it did before the jump. My...

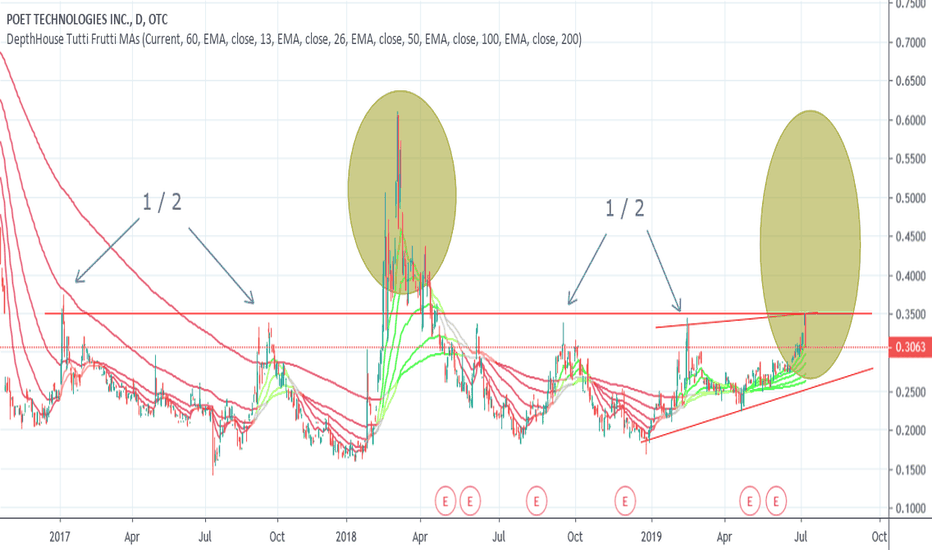

This is interesting. The stock hasn't hit .30 cents in some time. The last push above the 200ema was rejected in a couple of days. The volume selloff back in April for one move was about 438k. The volume now in buys far exceeds that. This could be either a real decent pump. Considering the news has been quiet, perhaps a pre-public market reaction to something that...

With all the recent activity it's hard to tell. The volume columns look like a sea of red, but the buy columns at the end are still significant. I think it could make a pop back up to the .40 cent area. I actually think this company has a good future with a unique product. Possibly a stock that trades in $3-$4 range if they keep their expenses tight.

This stock is interesting to look at. "Mentor Capital, Inc. focuses on investments in the medical marijuana and social use cannabis sector. The Company is operating an acquisition and investment business." - Trading View Something interesting with this stock happens in this range. It's hard to see but if you zoom in all time when the stock dips below .10 it...

It looks like the price and MA are on a crash course. Unfortunately for me, my broker site switched from "Limit Order" above MA to "Buy" on the trade tab. So I purchased before confirmed Break Out. Worst case it goes down to .20 and we see a nice bounce. Volume looks good as well as the MACD. Fingers crossed for my bank account.

It's nearly identical. Interestingly, the first on the left has a large sell spike. The one of the far right a large buy spike. 3 pops then a dip repeat throughout. The trend lines may not be exact, but you can see the 200 bumping the trend line on the right like the previous identical pattern. After each 3 top pop, there is a cascading effect that sends the...

The MACD is about to see either a crossover and back to .23 area or another gap up past .27. If you look at July 10-11, and 11-12 the MACD had similar patterns to crossover. Scenario A) If it drops to .23 and holds, it would coincide with July 5th. If it breaks .23 then the next drop would be to .18 formed on July 9th. Scenario B) The gaps are worrisome. There...

The upper trend line comes down off the 6-month chart. A new lower high has occurred. It's attempting to find support at the 100ema. The potential is there, they just need some good news. Seems like the media has been vehemently against them lately. "Stay away," etc. I feel a BO is due, but likely temporary.

Something isn't quite right here. The market tends to move before the news then whatever it is, once the public finds out a major change happens. Low volume for 3 months then suddenly it spikes. Seems a bit weird. Thoughts?

Only down side is it probably will close the gap, but it's above all the EMAs. Worst case it finds support at the 200EMA. I see resistance at .37, but all the EMAs are trending up, which is good. I think this has a chance at a breakout. Their news is good, and their product is unique enough to support long term growth. Depending on what it does July 9th (Gap down...

I can't be the only one who sees this right? 90%+ increase? Dare to take a chance? Swing or a Miss?

I can see two scenarios playing out with FCEL: 1) The stock is sitting on the 200EMA and tested it July 3,5, and 8th (Today). Seems to want to stay above it. So, either it will lay flat in this area (.72-.68) or it will drop (possibly gap) back down to the .54 area. The 3 day trend would imply that could happen, unless from the 3rd forward is a Pennant. In which...

I'm not extremely familiar with this company, but their news isn't bad. I'm likely seeing a break of the resistance Monday-Tuesday. Could be slight retraction down to support with continued consolidation. If it breaks resistance my Stop loss will likely be .33 maybe .32 6% seems right looking at the swings during intraday. Still close to support though. I'm...

This stock is really hard to gauge. Volume looks pretty week the last month or so. Up side is since crossing the 200MA it has tested it 4 times (depending on how you look at it). At a minimum it appears to want to stay above the 200MA. The 20/50MA look pretty week though. Possibly a cross soon. If so it may Re-test the .08 mark at low. If the current trend...

So, looking at UPL I have very mixed feelings about the stock. It could go one of two ways: 1) Looking at the hanging man candlestick it would appear bearish for 3 reasons: a) That .26 area is the last downtrend hold line (which it fell through). b) Opening the 5th July it hit the same prior support and fell back down. it eventually jumped above it as trading...