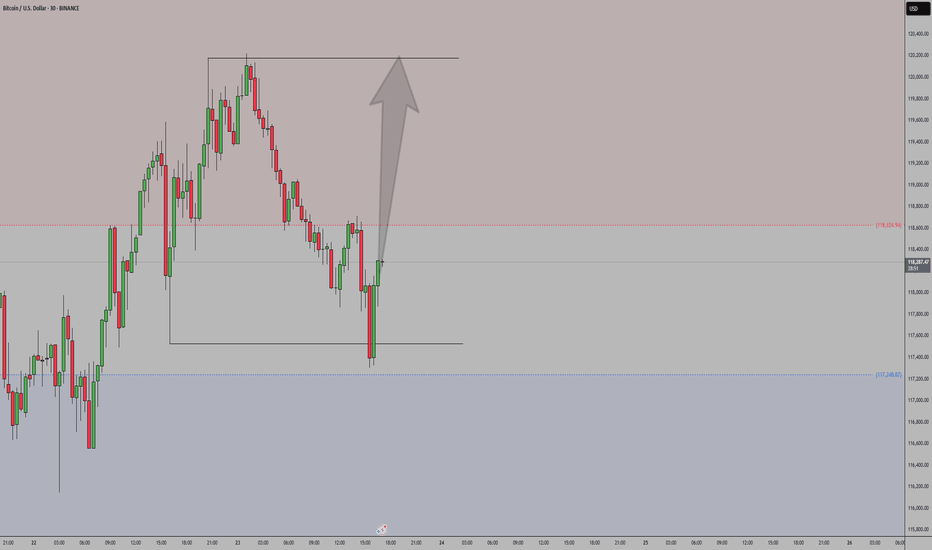

Institutions are adding BTC longs → bullish signal. Support Zone BTC looks bullish

Price Action: A key support zone has been broken and is now acting as resistance. Market Structure: Lower highs + lower lows forming → confirms downtrend. Bias: Bearish while price stays under the broken level.

Support Zone: Price has retested a strong support area Price Action: The retest held — buyers defended it, showing rejection wicks / bullish candles. Bias: Bullish while support holds → look for continuation to next resistance. Invalidation: Bias weakens if support breaks and closes below the zone. So as long as price stays above the retested support,...

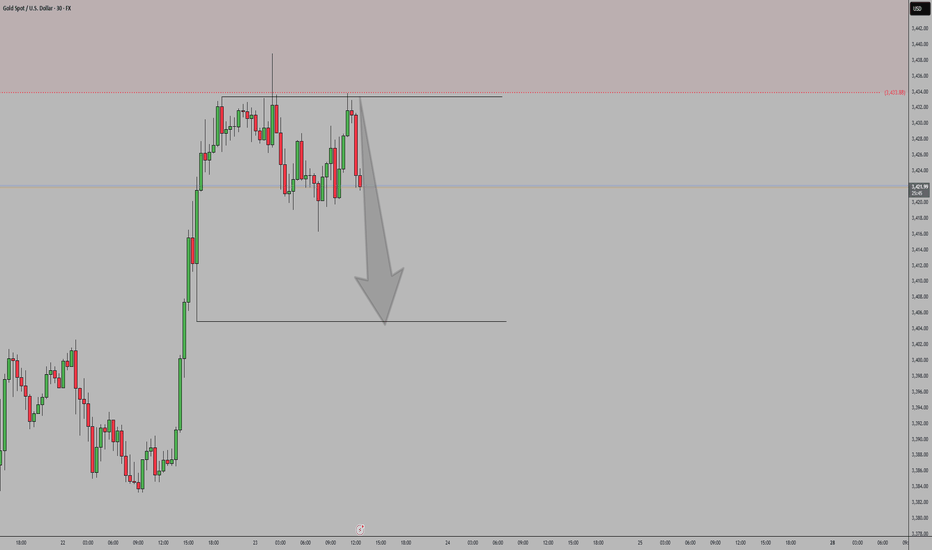

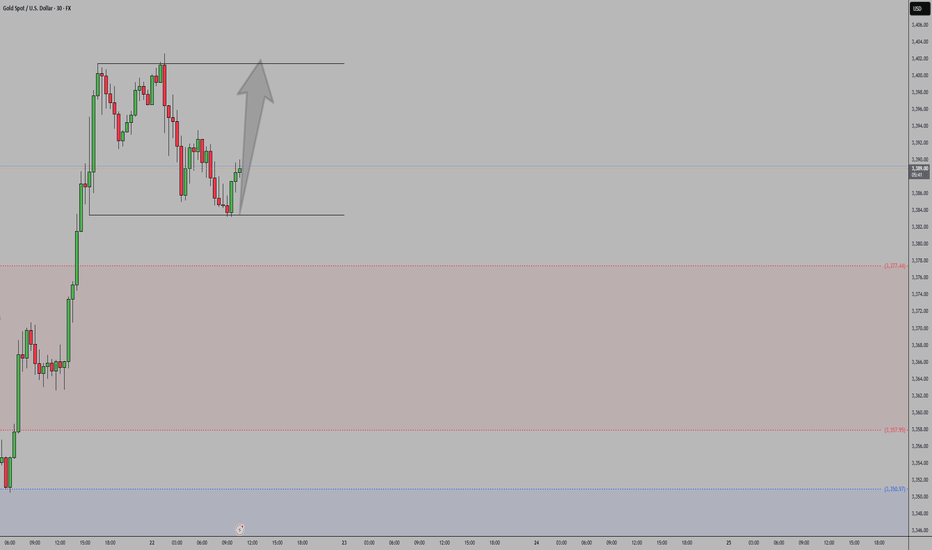

so Gold (XAU/USD) broke support, retested it as resistance, and is holding below. That’s a classic bearish continuation setup. Structure: Market forming lower highs and lower lows, confirming bearish trend. Bias: Strongly bearish while price trades under the broken support zone.

We have a strong bearish sentiment for EURUSD this week, so meaning big instituttions are selling the pair so we follow their lead. And we can see that we just broke below a support which is now acting as a resistance, more bearish momentum continuation can we expected

Weekly review for directional bias Align trades with institutional positioning Focus only on setups that confirm sentiment

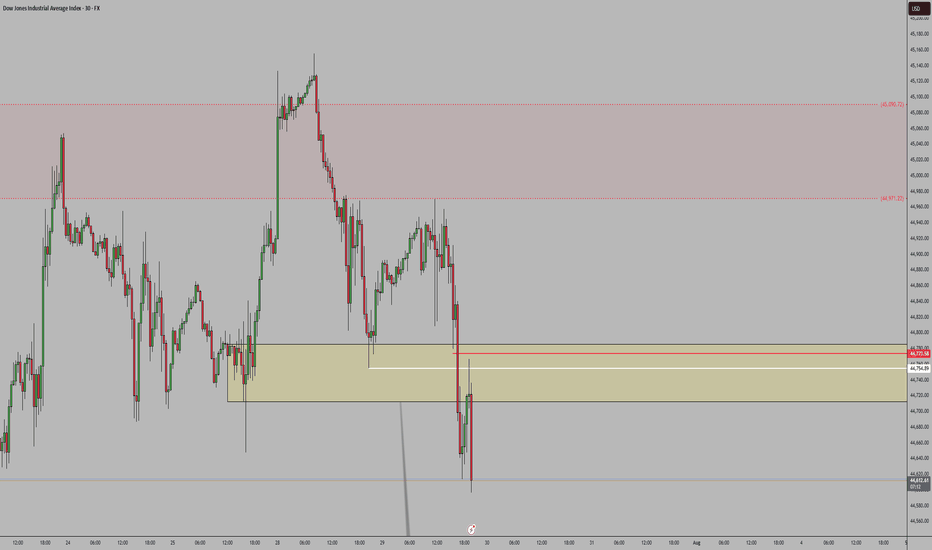

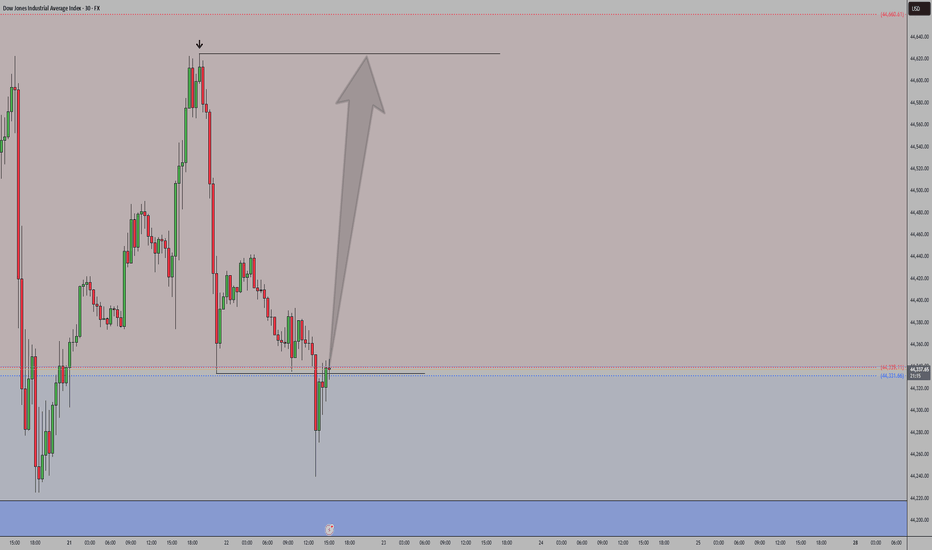

The latest COT report shows increased Non-Commercial short positions, indicating bearish sentiment among speculators. Commercial traders are also holding or adding to their short positions, reinforcing the negative outlook. Rising open interest further confirms market expectations of a decline in the US30.

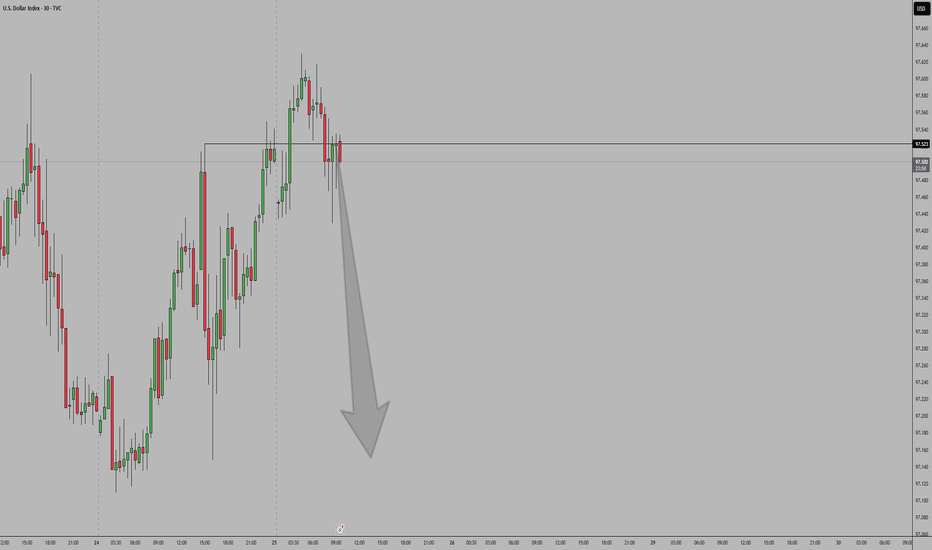

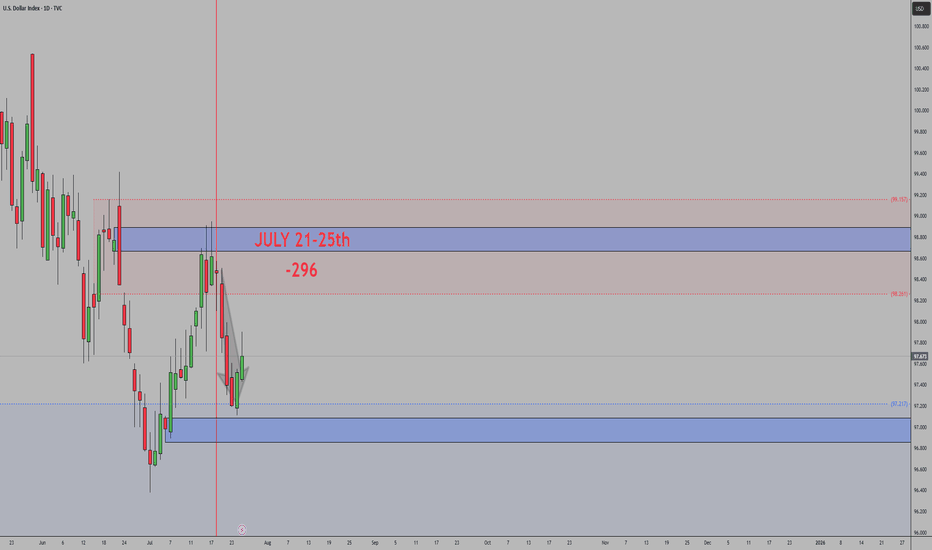

DXY Bullish COT Setup Commercials: Net-long ~3,988 → smart money positioning for strength Large Specs: Net-short ~3,451 → bearish bias, potential squeeze risk COT Index: 94.5% → near historical extreme, signaling possible trend shift

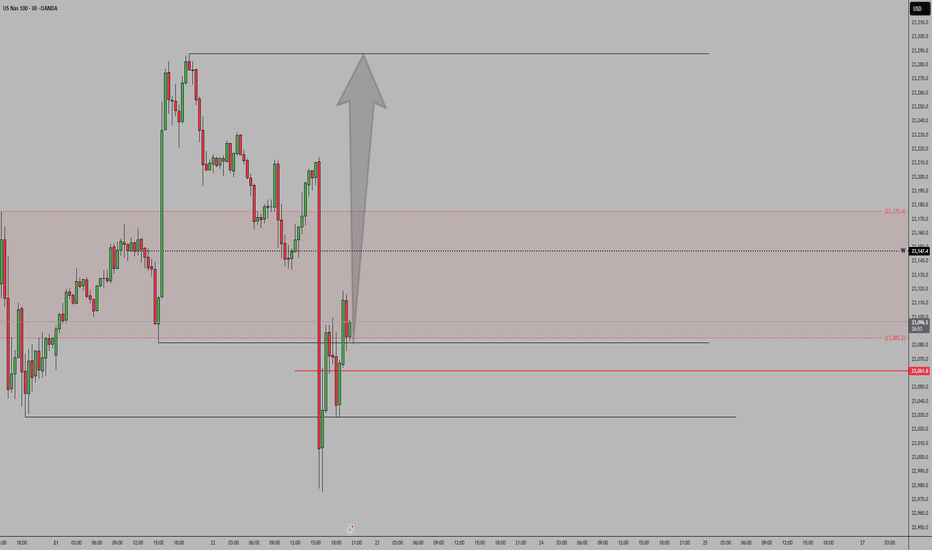

bearish nasdaq after taking out liquidity short term based and more bearish momentum can be expectected .

The U.S. Dollar Index (DXY) continues to exhibit a bearish outlook driven by a combination of technical weakness and shifting macroeconomic fundamentals. Market expectations for Federal Reserve rate cuts, coupled with softer U.S. economic data and declining demand for the dollar as a safe-haven asset, have weighed heavily on the index. Technically, the DXY remains...

JULY 21-25 recap Net was -296 last week Price dropped until Wednesday Hit the weekly demand zone (strong support) Sellers paused or covered shorts there Buyers stepped in → possible bounce or reversal

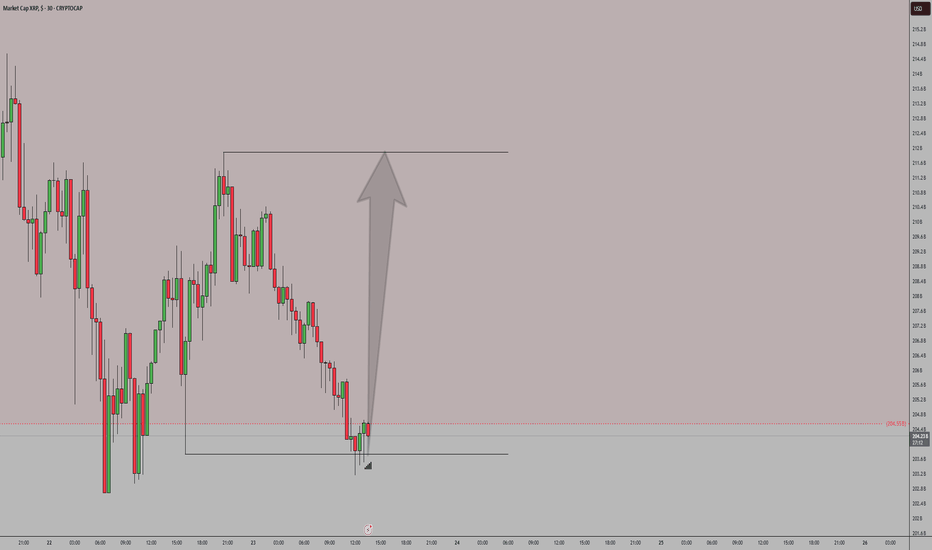

XRP has been gaining strong upward momentum recently, overcoming key resistance levels with confidence. The buying pressure looks steady, and the market sentiment around XRP is increasingly positive. If this trend continues, XRP is well-positioned for further gains in the short to medium term.

XAUUSD shows short-term bearish pressure, with price failing to hold above recent resistance and momentum weakening.

Bitcoin is showing strong bullish structure, with buyers stepping in at key support and price pushing higher with momentum. Market sentiment remains positive, and the uptrend looks ready to continue if current levels hold.

USDJPY continues to show solid bullish momentum, with price respecting higher lows and breaking through resistance zones cleanly. The market structure remains strong, supported by steady buying pressure and positive sentiment around the U.S. dollar. As long as support levels hold, the path of least resistance remains to the upside, with potential for continued...

US30 maintains a bullish outlook, supported by improving economic data, rotation into industrials and value stocks, and resilient corporate earnings. As long as price holds above key support levels, the broader uptrend remains intact.

COT data shows large speculators increasing net long positions on the Nasdaq-100, reflecting rising institutional confidence in tech and growth sectors. This positioning supports a bullish bias, especially as price holds above key moving averages and market breadth improves.

Gold maintains a bullish outlook supported by ongoing global macro uncertainty, central bank demand, and expectations of lower real interest rates. As long as price holds above key support levels, the uptrend remains intact.