QuantumEdgeAnalytics

Essential🚀 G.O.D. Flow (Gamma, Orderflow, Dealer Positioning) 1. 🧩 Summary Overview Ticker: BBY Current Price: $67.50 Flow Setup Date: Current Session Trade Type: Intraday / 0–2 Day Swing 2. 🔬 Flow Breakdown 🔵 GEX (Gamma Exposure): Highest -GEX at 70 → potential volatility pocket and resistance zone. Despite matching +GEX at 70, net gamma is negative — bearish...

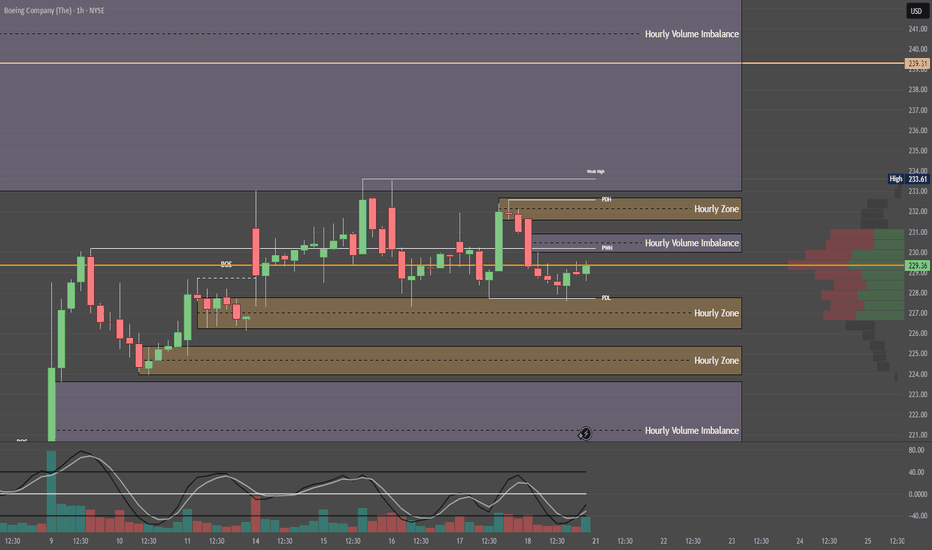

🚀 G.O.D. Flow Certified Trade Blueprint – Boeing (BA) 1. 🧩 Summary Overview Ticker: BA Current Price: $229.34 Trade Type: Day Trade / 0–2 Day Swing System: G.O.D. Flow (Gamma, Orderflow, Dealer Positioning) 2. 🔬 Flow Breakdown 🔵 GEX (Gamma Exposure): Highest negative GEX at $230 = possible resistance or sticky zone. However, +GEX2 at $235 and +GEX3 at $240...

Really don't understand this stock but retail really loves it. Seems like they want to push this to 36 for a possible run up into earnings before possibly dumping.

WMT’s weekly outlook balances its defensive resilience against macroeconomic headwinds, with a comprehensive synthesis of technical, market, and strategic factors guiding its trajectory for weekly options contracts. The FAME framework underscores WMT’s long-term bullish potential, driven by robust fundamentals (+5% revenue, $0.58 EPS, 21% e-commerce growth) and...

AT&T (T) Trading Analysis for Monday, April 21, 2025 Sentiment Analysis -Overview: Sentiment on X and StockTwits is neutral, with investors appreciating T’s 4.11% dividend yield but expressing concerns over tariff-driven cost increases. Analyst consensus remains stable, with a “Hold” rating and a $21.50 target (April 20 ), though some Reddit (r/options) users...

Kohl's Corporation (KSS) Trading Analysis for Monday, April 21, 2025 Sentiment Analysis ----Overview: Sentiment on platforms like X and StockTwits leans bearish, driven by tariff concerns and Kohl’s weakening fundamentals, with projected sales declines of 5-7% in 2025. JP Morgan’s Underweight rating and $7 price target as of April 14 underscore margin...

Sentiment: Bullish. AI and government contract hype drives enthusiasm, though valuation risks noted. Chatter lean bullish, citing growth momentum. Outlook: Neutral, slightly bearish. Options pin $88, with $85 puts active. ICT/SMT eyes $86-$88 buys to $92 if $86 holds. Bearish below $86 risks $80. Influential News: Federal Reserve: Two 2025 cuts aid growth...

Sentiment: Neutral. AI chip dominance drives optimism, but tariff risks and valuation concerns temper enthusiasm. Chatter posts split—bulls see growth, bears eye correction. Outlook: Neutral, slightly bearish. Options pin $110, with $105 puts active. ICT/SMT eyes $108-$110 buys to $115 if $108 holds. Bearish below $108 risks $105. Influential News: Federal...

Sentiment: Neutral. EV and AI optimism persists, but tariff risks and high valuation concern traders. Chatter split—bulls eye robotaxi, bears see pullback. Outlook: Neutral, slightly bearish. Options pin $250, with $240 puts active. ICT/SMT eyes $245-$250 buys to $260 if $245 holds. Bearish below $245 risks $240. Influential News: Federal Reserve: Two 2025 cuts...

Sentiment: Neutral. Dividend yield (4-5%) and debt reduction ($123B) attract income seekers, but telecom competition and tariff fears limit enthusiasm. X posts praise stability, though growth concerns persist. Outlook: Neutral, slightly bullish. Options pin $27, with call buying eyeing $28. ICT/SMT supports $26-$26.50 buys to $27.50-$28 if support holds. Bearish...

Analysis: Post-Close Options Activity (April 11): Data: System reports 469.32K contracts traded on April 11, with puts at 10.99% (calls ~89%). High call volume at $31/$32 strikes suggests bullish bets. Interpretation: Call-heavy flow indicates retail/institutional optimism, likely targeting a sweep above $31.35 (weekly high). Potential for a liquidity sweep...

T (AT&T Inc.) Sentiment • Sentiment is neutral with a bearish tilt. April 10 options activity shows put-heavy volume at $26 strikes, reflecting caution. RSI (14) at ~50 (estimated, flat trend at $26.40 close) suggests indecision. X posts highlight concerns over telecom debt loads and tariff risks on equipment imports, but some speculate on institutional...

KR (Kroger Company) Sentiment • Analysis: Market sentiment for KR is neutral leaning bullish. Post-close options activity on April 10 shows balanced put/call volume, with slight call dominance at strikes near $69, suggesting cautious optimism. RSI (14) at the April 10 close (estimated ~60 based on recent uptrend to $67.96) indicates momentum without overbought...

HIMS (Hims & Hers Health, Inc.) - Sector: Healthcare (Telehealth) Sentiment: Bullish. Post-close call volume steady, RSI ~58 (up from ~55), Amplified GLP-1 demand—speculation persists despite tariff noise. Tariff Impact: Minimal. Domestic focus shields HIMS; 104% China tariffs irrelevant unless generics supply tightens. News/Catalysts: Current: tariff pause...

NYSE:ZIM (ZIM Integrated Shipping Services Ltd.) - Sector: Industrials (Shipping) Sentiment: --Bearish (slight softening). Pre-market put volume softened, RSI likely ~35 (down from ~38 with a -2.8% drop from $12.9608 to $12.591), X posts overnight mixed—tariff fears dominate, but LNG fleet news (10 new 11,500 TEU vessels announced April 8) offers faint...

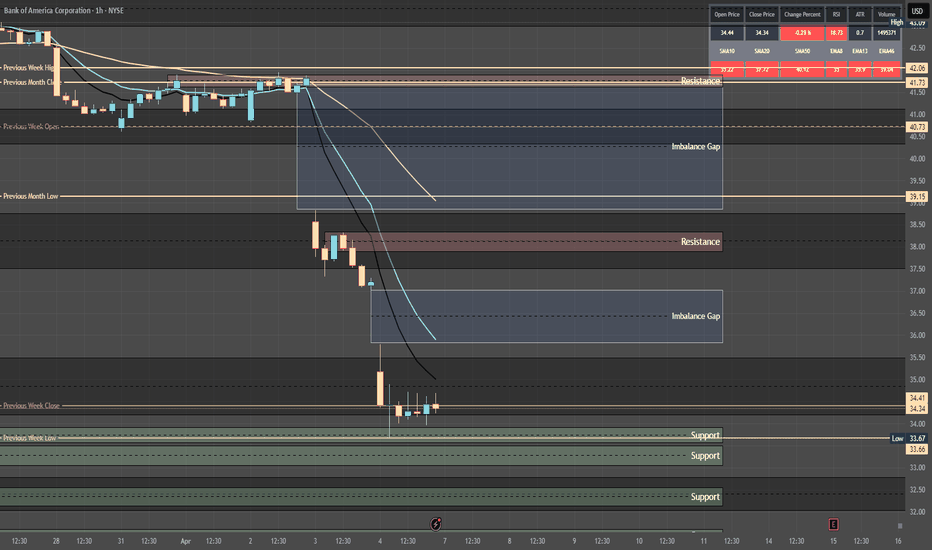

BAC (Bank of America Corporation) - Sector: Financials (Banking) Sentiment: --Neutral (slight bullish tilt). Pre-market options lean call-heavy, RSI likely ~48 (up from ~45 with +1.8% from $35.58 to $36.23), X posts overnight mixed—rate fears vs. recovery hopes—suggesting a bounce from $34.19 (April 4). Tariff Impact: --Moderate. 10% tariffs could hit loan...

IWM (iShares Russell 2000 ETF) - Sector: Broad Small-Cap ETF (Russell 2000) Sentiment: --Bearish (softening). Pre-market put volume eased, RSI 44 up from 42, X posts overnight hint at an oversold bounce despite tariff fears, suggesting a less dire tone. Tariff Impact: --Moderate. Industrials/financials exposure persists. News/Catalysts: --Consumer Credit...

BAC (Bank of America Corporation) - Sector: Financials (Banking) Sentiment: Bearish. Put volume rises, RSI 45 weakens, X posts note banking fears from tariffs/economic uncertainty. Tariff Impact: Moderate. Tariffs may slow growth, impacting loans, but domestic focus softens the blow. Sentiment drives more than fundamentals. News/Catalysts: Banking sentiment...