Interesting and Timely Divergences from this ratio. - RH

Short Call - Took an initial short position in several stocks at the end of day Friday. Looking to add more exposure throughout the next several weeks. I don't expect a crash or a recession or anything until late 2021, just a swift and moderate correction at some point in the near future. Larger move than we've had in many weeks - you can see this by the orange...

Do you believe in Dow Theory?

Melting up. Next week shaping up to be a fairly boring neutral holiday week. Goodluck Next Week - RH Recent Charts Worth Watching: Unemployment Rate: Bitcoin: EM relative strength: Value > Growth: SKEW: Bonds: REPO: VIX + VVIX: VIX vs. VIX3M: Industrial Production: www.tradingview.com Homebuilders: Regional Banks: China: ...

What a week. FED, BREXIT, TRADE DEAL, Impeachment blowup Next week we get GDP. Goodluck out there, - RH

Don't typically enjoy adding to the endless Bitcoin Chart posts, but this is really great chartology. Everything is clean: Trendlines, Fib Extensions, Patterns, Elliot Wave Counts, Divergences I don't trade Bitcoin, I never have. Just like looking and tracking how different parts of the market are moving. YITB, - RH

When plumbing works well, you don’t need to think about it. That’s usually the case with a vital but obscure part of the financial system known as the repo market. Bank of International Settlements has been reporting some very interesting documents connecting overleverage by MULTIPLE hedge funds (potentially even my hero Ray at Bridgewater) in the overnight...

Always amazes me how clean the charts look on some asset classes.

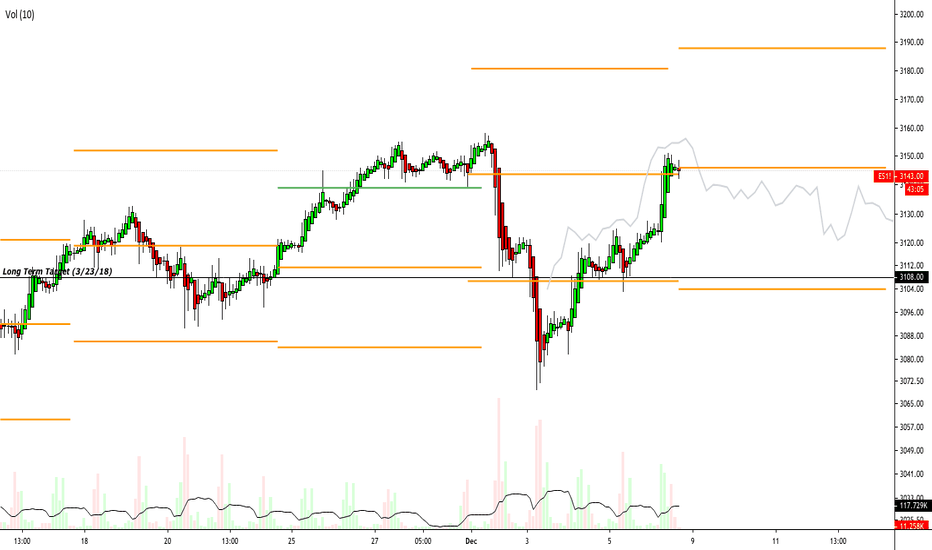

2hr view, Heiken Ashi candles. Next week should be fun. Goodluck next week, - RH

Got a Vanguard notification of a purchase this morning. I'd like to attempt to document, on the same day, all individual stock purchases for future reference and timing studies. Purchases are Long-to-Ultra Long term holdings. This will not be one of my forever-holdings. Companies purchased reflect positive outlooks on - Valuation, Growth potential, Technicals, and...

Trade Log Ideas - RH

Trend remains strong. Goodluck next week Happy Thanksgiving - RH

Very low volatility expected next week. Four day trading week, happy thanksgiving everybody. Last Week's Post: Unemployment: High Yield Continues to diverge: Homebuilders continue to look dicey: Real Estate looks dicey: Regional Banks look good: Growth could make a comeback relative to Value: Emerging Markets, looks like patience was...

My 2nd Long Term Target was hit and surpassed. Sentiment is complacent. Complacency is different from Greed. Still bearish, but more sneaky. I'm a strong believer in sentiment and I believe we're going to need to work off this extreme reading one way or the other. Historically, we move sideways to lower after reaching such optimistic levels. It's not...