PAAL is flashing early trend reversal signals with a reclaim of the 20-day SMA and confirmation of a double bottom around the $0.09 zone. Now that price has flipped $0.14 back into support, bulls could be ready to push higher. 📌 Trade Details: Entry Zone: Around $0.14 Take Profit Targets: 🥇 $0.20 🥈 $0.27 Stop Loss: Daily close below $0.11

RNDR has formed a textbook double bottom at the $3.00 high-timeframe support, hinting at a potential trend reversal. The strong bounce off that level shows bullish intent, and we’re now eyeing the $3.50–$4.00 zone for a potential throwback entry, turning old resistance into new support. 📌 Trade Setup: Entry Zone: $3.50 – $4.00 Take Profit Targets: 🥇 $5.25 🥈...

Company Snapshot: XPeng NYSE:XPEV is solidifying its status as a smart electric vehicle pioneer, blending cutting-edge AI, proprietary battery tech, and global expansion to challenge the status quo in EV innovation. Key Catalysts: Product Innovation 🚀 New 2025 G6 & G9 feature 5C fast-charging AI batteries Turing-powered autonomous driving is among the most...

JUP is showing strong signs of oversold conditions and is now approaching a major support zone ($0.22 – $0.30). This area offers a favorable risk-to-reward opportunity for a bounce if buyers step in. 📌 Trade Setup: Entry Zone: $0.22 – $0.30 Take Profit Targets: 🥇 $0.4050 🥈 $0.4467 Stop Loss: Just below $0.20

SUI has dropped into a key support zone ($1.60 – $1.96) after an extended selloff. The price is showing oversold conditions, making this a potentially high-reward setup if a bounce confirms from this zone. 📌 Trade Setup: Entry Zone: $1.60 – $1.96 Take Profit Targets: 🥇 $2.50 – $2.90 🥈 $3.25 – $3.60 Stop Loss: Just below $1.50

Company Snapshot: Monster NASDAQ:MNST continues to dominate the $60B+ global energy drink market, expanding across 159 countries with a diverse portfolio and strong executive leadership. Key Catalysts: Global Market Expansion 🌐 Strategic brands like Predator and Fury targeting emerging markets New geographies = incremental revenue & brand exposure Category...

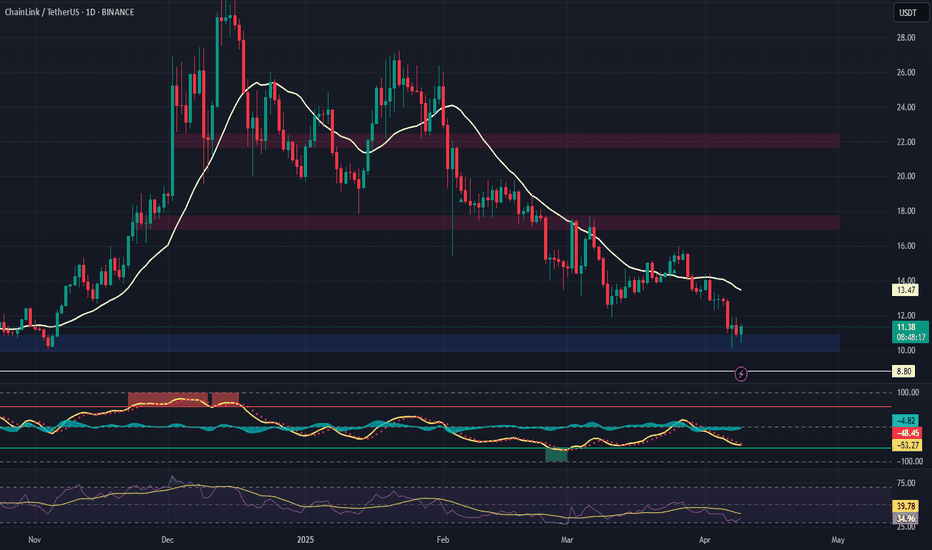

LINK has retraced sharply and is now sitting at a critical support zone ($10.00–$11.00), historically a strong base for reversals. This offers a solid risk/reward opportunity for a potential bounce and test of upper resistance zones. 📌 Trade Setup: Entry Zone: $10.00 – $11.00 Take Profit Targets: 🥇 $17.00 – $17.70 🥈 $21.70 – $22.40 Stop Loss: Around $8.80

ONDO is showing relative strength amid the broader altcoin pullback, holding key levels and now pulling into the $0.50 support zone. This area lines up for a possible RSI bullish divergence, which could spark the next leg up. 📌 Trade Setup: Entry Zone: ~$0.50 Take Profit Targets: 🥇 $0.85 🥈 $1.13 🥉 $1.34 Stop Loss: Daily close below $0.42

SUI is retracing into a key support level around $2.00, providing a potential high-reward swing setup if buyers defend this zone. 📌 Trade Details: Entry: ~$2.00 Take Profit Targets: 🥇 $2.50 – $2.90 🥈 $3.25 – $3.60 Stop Loss: Just below $1.60

Cardano (ADA) is currently sitting at a key support zone, presenting a solid risk-to-reward long opportunity if bulls can hold the level. 🛠 Trade Plan: Entry: $0.63 – $0.70 Take Profit Targets: $0.78 – $0.84 (First Target) $0.96 – $1.02 (Extended Target) Stop Loss: Just below $0.58

Company Snapshot: Nintendo OTC:NTDOY continues to dominate global entertainment with iconic franchises, cross-platform expansion, and the highly anticipated Switch 2 in 2025. Key Catalysts: Switch 2 Launch in 2025 🚀 150M+ Switch units sold → massive installed base Backward compatibility + hardware upgrades could drive a super-cycle in hardware/software...

Company Overview: Expand Energy NASDAQ:EXE is strategically positioned near the Gulf Coast, enabling it to capitalize on rising global LNG demand with a disciplined growth strategy. Key Catalysts: $2.7 Billion Capital Plan (2025) 💰 $500M for debt reduction & share buybacks, improving financial flexibility. Balances growth investments with shareholder...

Company Overview: Nano Nuclear Energy NASDAQ:NNE is revolutionizing clean, compact nuclear power with small modular reactors (SMRs), addressing data centers, remote sites, and disaster relief energy needs. Key Catalysts: ZEUS Microreactor Development 🚀 Successfully assembled first hardware, marking a key milestone toward commercialization & revenue...

Company Overview: Comstock Resources NYSE:CRK is accelerating natural gas production, reinforcing its position in the Western Haynesville play, a key U.S. gas region. Key Catalysts: Production Expansion & Strategic Acquisitions ⛽ Increasing drilling rigs from 5 to 7 for higher output. Acquired 64,000 net acres in Haynesville, boosting reserves & market...

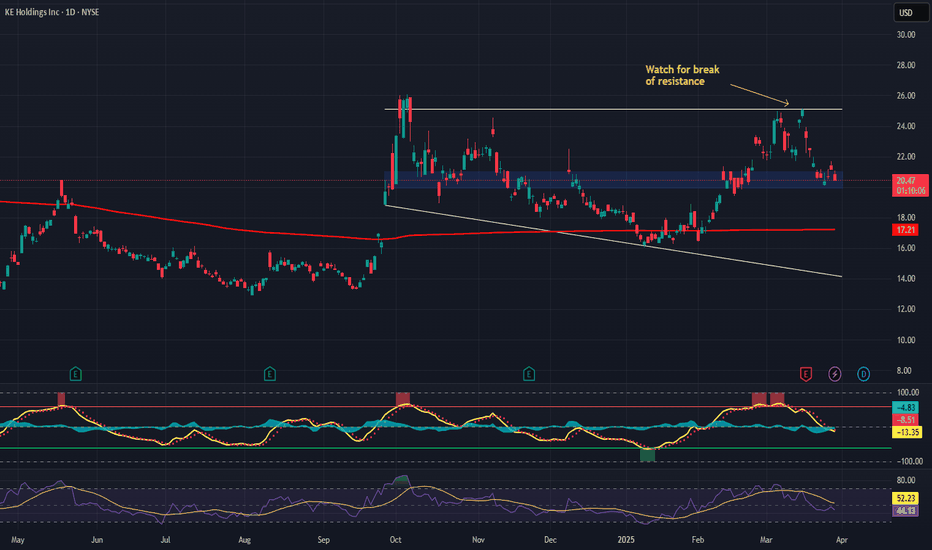

Company Overview: KE Holdings NYSE:BEKE is revolutionizing real estate with its hybrid digital-physical platform, leveraging strategic backing from Tencent (8% voting power). Key Catalysts: Strong Financial & Earnings Growth 💰 Analysts project 20.9% annual earnings growth and 26.7% EPS increase. Reinforces BEKE’s leading position in China’s real estate...

Company Overview: Harmony Gold Mining NYSE:HMY continues to outperform expectations, delivering higher grades, cost efficiency, and production expansion. Key Catalysts: High-Quality Gold Extraction ⛏️ Underground recovered grades surged to 6.4 g/t, exceeding full-year guidance. Reinforces HMY’s ability to extract high-quality ore. Cost Efficiency & Rising...

Company Overview: Chevron NYSE:CVX continues to demonstrate strong operational efficiency, strategic expansion, and record-breaking U.S. production. Key Catalysts: Production Growth & Profitability 🚀 Global production up 7% in 2024. U.S. output surged 19% to record levels. Permian Basin nearing 1M bpd, reinforcing cash flow strength. Strategic Expansion &...

SUPER has had a strong rally over the last two weeks, and it's now facing resistance. We're eyeing a pullback to the next support level for an optimal long spot trade. 🛠 Trade Details: Entry: Around $0.54 Take Profit Targets: $0.60 - $0.66 (First Target) $0.73 – $0.80 (Extended Target) Stop Loss: Just below $0.45 📊 We'll monitor for support confirmation...