Riscora

A new trading week begins after an exceptionally strong bullish close last week. Given the strength of that rally — and seeing how long/short ratios are now heavily skewed to the long side — I expect this week to open with a pullback. To me, the bullish impulse feels exhausted, so I’m watching for a short-term retracement. My initial target is a move toward...

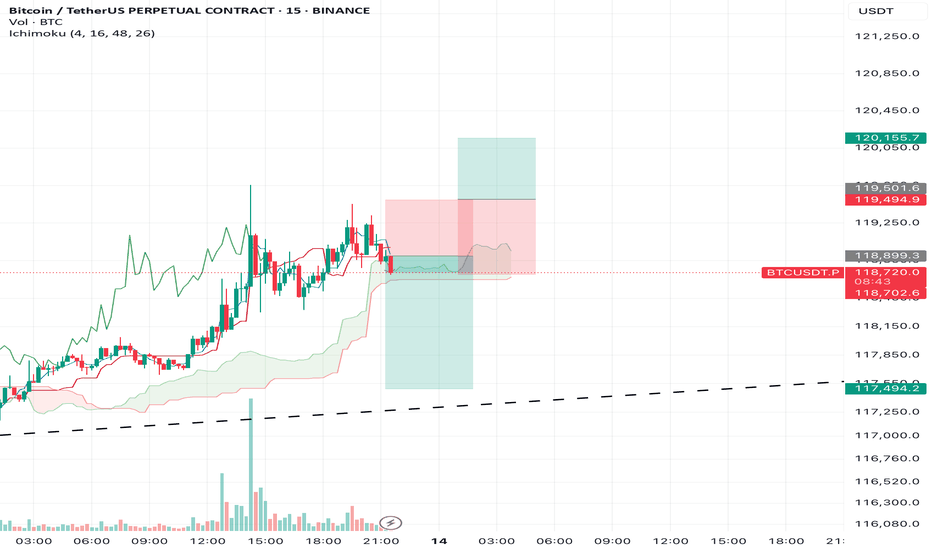

Yesterday was a fantastic bullish day, but price never reached my planned long entry block — buyers were too strong for a proper retest. At this stage, I believe the bullish impulse has run its course and we’re likely to see a sideways phase, as marked on my chart. I don’t expect new highs from here: the market is overcrowded with longs, and this rally needs to...

I see the green zone as an attractive area to look for long entries. After the strong move, I expect BTC to stay in a range for now. My main plan is to long from the green block and look to take profits at the upper boundary (yellow block), where liquidity is clustered. No interest in shorts at the moment — will monitor price action for changes. Range trading is...

Reflections on the previous trade: Yesterday’s short setup played out: we reached the targeted downward block, as expected. However, price didn’t bounce to the 108000 level (untapped area), leaving a liquidity gap that isn’t great for bears. This means we might revisit and fill that zone in the future. Today’s context: A strong sell-off and the untapped 108,000...

Yesterday’s short setup didn’t work out as planned — stop-loss was hit as bulls showed strong momentum. However, I still believe that a move to the yellow block (downside liquidity zone) is possible, and the idea remains valid. The main mistake was with the stop placement, not the scenario itself. After taking a loss, I’m more cautious: reducing risk, lowering...

Today’s idea: I’m expecting a retracement to the 107,867 level as a pullback to the recent impulse. The move we observed earlier aligns with my prediction from last Friday — liquidity was taken out above the highs, and now I anticipate a deeper correction against the overall bullish move. My main scenario for the day is a move down into the 106,400 area at...

Previous idea played out. The last candle showed strong volume and a wick to the upside, signaling some liquidity has been taken. From here, I expect either a minor high above that wick or a correction down to the 0.618 area, then continuation of the bullish move towards the yellow liquidity block. If price breaks below recent lows, the 106,300 level has proven...

Today’s idea: We’ve seen strong volume at the current support zone. My expectation is for a move upward towards the yellow block at 107,900, targeting liquidity that has accumulated above the dotted trendline. This is my main scenario for today: a range-bound session with a liquidity sweep to the upside. Watching for reaction as price approaches the yellow...

Yesterday’s idea worked out perfectly: price reached the target block and continued its upward move. Today, bulls remain firmly in control, and I expect the bullish trend to continue towards the 108,620 area. The recent pullback is viewed as a correction within the ongoing impulse. Buyers are clearly dominating the market, so my main scenario is further growth to...

Yesterday’s plan worked out partially. For now, I believe the bullish move has run its course and today we should see a corrective phase. My main target for the correction is the yellow block at 106,300. Ideally, I’d like to see a pullback towards the entry area before the move continues. The scenario is invalidated if we break above the previous high — in that...

Previous idea recap: Bulls proved stronger than expected — we didn’t get the move down to 104,000 as anticipated. Instead, price rallied directly to the 106,300 block, as outlined earlier, and saw only a brief pullback. Current outlook: Buyers remain in control here. My new base case is a move towards 106,900 (yellow liquidity block). Ideally, I’d like to see a...

My main scenario for today: Expecting BTC to sweep the lows near 104,350, then see strong buying interest and a move up towards the yellow liquidity block around 106,300 by the end of the trading day. Ideally, I want to see this reversal on clear volume. If there’s no strong buy reaction at 104,370 and buyers fail to step in, then I expect BTC to break lower —...

We’re approaching a major liquidity zone in the yellow highlighted area. I expect this zone to be swept soon — likely triggering a wave of stop-losses and liquidations. Once this liquidity is taken, I anticipate a sharp move down on increased volume. After this liquidity event, my base case is a buyback from lower levels, with price rebounding towards the upper...