Rotuma

PremiumAlphabet's stock is down 26% since December 2024. With a fragile technical setup and mounting macroeconomic headwinds, Q1 results may confirm investors' worst fears. Market Position: From Leadership to Uncertainty Alphabet Inc. (GOOG) is set to report its Q1 earnings and revenue on Thursday, April 24, 2025, in what could be a decisive moment for the stock. After...

Mounting Delivery Pressure, Global Boycotts, and Revenue Misses Leave Tesla at a Critical Turning Point Overview Tesla shareholders are on edge ahead of the automaker's Q1 2025 earnings report, set to be released on Tuesday, April 22. The results will cover financial performance from January 2024 to March 2025, a period already clouded by deteriorating delivery...

The 2-year Yield currently trades at 3.805%, unfolding within a well-defined three-year falling wedge pattern. This formation follows an extraordinary surge from 0.105% in January 2021 to 5.283% in October 2023—reflecting rapid Fed rate hikes and inflation expectations. The 4.00% level, which aligns with the Fibonacci 23.6% retracement, has been tested multiple...

USD/CNH is at the centre of the tariff war. A three-year resistance zone near 7.35/7.32 has failed once again. This repeated failure shows strategic resistance by Chinese policymakers or macro selling pressure. Support Levels: 7.27 and 7.25 must hold. A drop through these levels could spark a move to 7.20 and 7.17. Geopolitical Lens: China may begin allowing Yuan...

GLD has gained 60% since breaking out at 191.65 in March 2024. It now aims for 318.85, with a longer-term target of 350.65 if the macro backdrop continues to deteriorate. Demand Drivers: Safe haven flows, central bank accumulation, and the loss of confidence in USD-backed bonds. Volume confirms conviction buying. Strategic Implication: GLD is confirming the...

USD/JPY is down nearly 10% from its January 2025 highs at 157, now trading just above the 140 threshold. The currency pair is testing the base of a 10-year rising wedge, and its recent failure to reclaim support at 148.83 is concerning. Structural Breakdown: If 140 is lost, the potential downside opens to 135, 132, and 127. The last time this pair broke similar...

VIX pulled back from 41.50 to hold at 24.50 and now trades near 27. A breakout above 27 targets 34 and 36.60. Market Message: The fear gauge is no longer receding after spikes—it's forming higher lows. Expecting more volatility is not paranoia; it's preparation. Strategic Warning: A rising VIX during falling yields and equities reflects systemic fragility. Watch...

The US Dollar Index (DXY) is sitting at a generational pivot zone around the 100 level, a midpoint in its 10-year price cycle. It has failed to reclaim this level decisively, and macro headwinds continue to build: The re-escalation of tariff wars by the US administration, alienating global partners Increasing capital outflows to the Yen, Gold, and emerging crypto...

The 10-year US Treasury Yield, once the benchmark of global confidence, is now exhibiting signs of a macro top. Since its 2020 low of 0.333%, it surged to 5.00% in October 2023, marking the end of the 40-year bond bull market. It now trades around 4.20%—a key Fibonacci confluence zone and the March 2025 breakout retest area. A breakdown below 3.95%–3.82% could...

As the US dollar teeters on long-term support, yields flash warnings, and USD/JPY unravels, Bitcoin's structure points to a reversal—and a potential role alongside gold as a global safe-haven asset. Bitcoin and Gold: The New Twin Pillars of Safety? A profound shift may be underway in how investors, institutions, and even governments perceive Bitcoin....

Farmers, Boeing, and tech sectors brace for severe damage as USD threatens to break critical 10-year support amid escalating trade tensions. Technical Breakdown: Crucial USD Zone Under Threat The US Dollar Index (DXY) currently sits precariously within a critical 10-year support and resistance zone between 100 and 98. Historically, this key price area has...

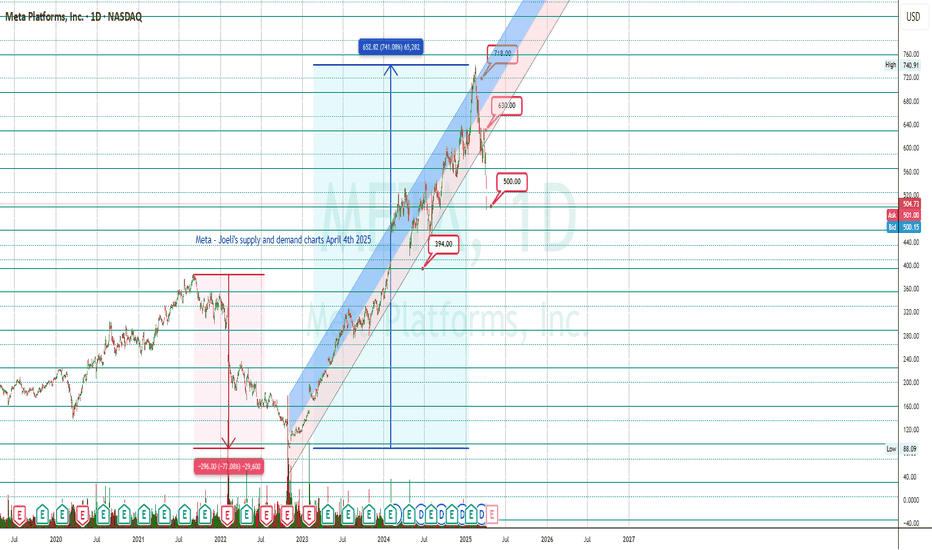

Meta posted an unprecedented 741% rally from $88 to $740 within two years, culminating in early 2025. The exhaustion pattern at 740—coupled with the breakdown of the 694 and 630 support levels—signalled the end of the bull run. The last stand at 564 failed in March, unleashing a steep 15% drop over three trading sessions. Currently sitting near $504, Meta is...

Despite MicroStrategy's latest Bitcoin accumulation and bullish US crypto policy shifts, price action tells a different story that could spell trouble for BTC if key technical levels give way. 📉 MicroStrategy's Struggle: Bullish Accumulation vs Bearish Structure MicroStrategy (MSTR) ended Q1 2025 with a deeply concerning price structure that signals the bulls are...

BTC and the crypto market's second stage to the downside is about to take stage. As of March 29, 2025, the cryptocurrency market is experiencing notable volatility. Bitcoin (BTC) has declined by approximately 2.5% over the past 24 hours, trading around $85,291. This represents a decrease of nearly 9% since January when it peaked above $100,000. The broader...

The 10-year Treasury yield recently failed at the critical resistance level of 4.38%, previously highlighted as a significant pivot. On the daily chart, the yield formation now resembles a potential head-and-shoulders reversal pattern, which would have profound implications if completed. Immediate Supports: Crucial Support lies at 4.30, followed closely by 4.22...

Dow futures reflect weak momentum, retreating after a 50% retracement of the prior 9% decline from 45075 to 40707, facing rejection at 43083. Critical Supports: The immediate focus lies on 42416; failing this Support will accelerate losses to subsequent supports at 42214 and the critical 41882 level. Resistance Levels: Strong overhead resistance at 42546, 42750,...

The S&P 500 futures index has retraced approximately half its previous losses from a steep sell-off that began at 6148. After rejection at 5818, prices now hover precariously above critical Support at 5732. Immediate Support Test: Failure at 5732 would trigger additional bearish pressure toward the next support levels at 5649 and 5566. Bullish Reversal Potential:...

The Nasdaq Futures' brief rebound from the critical 19345 support was decisively rejected at 20458, marking a continuation of bearish sentiment. Current Scenario: Now, testing immediate support at 19857 failure here opens the pathway downward to subsequent supports at 19716 and 19646, ultimately retesting the critical low at 19345. Resistance Levels: Clear...