EGX30 stock started to fall, reaching the 32,383.579 support line, the 32,343.473 support line, and the 32,283.315 support line, showing the sellers' dominance over the buyers. This is because investors are cautious about the U.S. meeting with many countries, including China, on trade deals, aiming to secure a fair trade deal. In addition, it was expected that the...

EGX30 stock has shifted gradually to a higher zone, reaching the 32,291.751 resistance line, the 32,344.197 resistance line, and the 32,422.866 resistance line, showing the buyers' dominance over the sellers. Additionally, the upward trend is because Egypt's blue-chip index EGX30 closed 0.7% higher, which led to a 1.6% increase in TMGH, which strengthened the...

TMG Holding trend has recently taken an upward trend between the support line 46.873 and the resistance line 54.511, up by 0.78%. It is expected to keep rising till breaking the 1st resistance line at 54.115 and then the 2nd one at 54.423 points because of positive fundamental analysis. On one hand, the CBE's decision about cutting the interest rate by 2.25% would...

ORAS trend was neutral between the support line 266.851 and the resistance line 291.935, the trend was down by 0.14%. The stock rose, and broke the first support line to reach the second support line 267.905, then the third support line 268.432. It's expected to keep rising till reaching the resistance line 290.144, then 290.671, because of the CBE's decision...

El Sewedy Electric stock trend rose last period from the support line 78.287 to the resistance line 88.149, then rebounded to reach the support line 78.65, so the general trend was down by 0.24%. The stock rose, and broke the first support line 78.65 to reach the second support line 78.7574, then the third support line 78.858. On the other hand, when the stock...

EGX30 stock shifted to a higher zone, between 32,191 resistance line and 32,006 support line, reflecting the buyers' dominance over the sellers'. It is expected to not breach the resistance line at 32,191 points since that there is no historical trend, but in case of falling it's expected to reach the support line 32,147 then 32,094 then 32,006 points.

EGX30 stock shifted to a new zone, between the 31,865 resistance line and 29,991 support line, reflecting the buyers' dominance over the sellers'. It is expected to reach the resistance line 31,949 then 32,025, and in case of falling, it's expected to reach the support line 31,831 then 31,798. In addition, this zone is a result of the decision of The Central Bank...

EGX30 stock stabilized in a consolidation zone, failing to breach the 29991 support line. Despite breaking the 30041 support line to the downside, it corrected its upward trajectory between the 30529 support line and the 31302 resistance line, reflecting the bulls' dominance over the bears. This is because Egypt agreed to work towards a package of $7.5 billion in...

Despite the positive data about the indicator ADP nonfarm employment change that has been more than the expected data by 405K points, the US dollar index has fallen by 0.44% between the resistance line 96.336 and the support line 95.911. This is due to the high frequency of Corona injuries in the United States and the outbreak of the Omicron mutated, which...

The US dollar index has faced a rise of 0.2% between the support line 95.074 and the resistance line 95.266, and this is due to the positive data released by The Bureau of Labor Statistics about job openings and labor turnover, which has been more than the expected data by 0.42k points. Therefore, the index is expected to rise to breach the first resistance line...

The Aussi has faced a downward trend between the resistance line 0.7337 and the support line 0.7289, which reflects the decline of the Australian dollar against the rise of the US dollar. In addition, the reason behind this fall is the negative data released by The Australian Bureau of Statistics about the unemployment rate that has decreased than the expected...

The US dollar index has faced a rise of 0.35% between the support line 94.283 and the resistance line 94.609, and this is due to the positive data released by the Bureau of Labor Statistics about three economic indicators. Firstly, the unemployment rate which has been less than the expected percentage by 0.1%. Secondly, the average hourly earnings which has been...

The Dow Jones Industrial Average stock has faced a rise by 1.25 points; as a result of the appearance of the continuation pattern of the ascending triangle and the positive data about the ISM Manufacturing PMI released by the Institute of Supply Management which shows an increase than the expected data by 60.4 points. Therefore, the stock is expected to continue...

The Loonie has faced an upward trend, which reflects the decline of the Canadian dollar against the rise of the US dollar. In addition, the reason behind this rise is the negative data released by Statistics Canada about the GDP (MoM) that has decreased than the expected data by 0.3%, which shows contraction in the Canadian economic activity. Therefore, the pair...

The USOil has faced a fall of 2.72% between the resistance line 84.47 and the support line 82.03, and this is due to the negative data released by the U.S. Energy Information Administration about the crude oil stocks, which has been less than the expected data by 2.3M points. Therefore, the stock is expected to decrease to break the first support line 82.03 to...

The US dollar index has faced a rise of 0.23% between the support line 93.5 and the resistance line 93.787, and this is due to the positive data released by the United States Department of Labor about the unemployment benefits, which has been less than the expected data by 8k points. Therefore, the index is expected to rise to breach the first resistance line...

The cable pair has faced a slight decrease until it touched the support line 1.3776; due to the Office for National Statistics’ report about the consumer prices (YoY), which has appeared to be less than the expected percentage by 0.1%, in addition to the appearance of the reversal pattern of double top which may affect the pair and make it decline by 0.23%,...

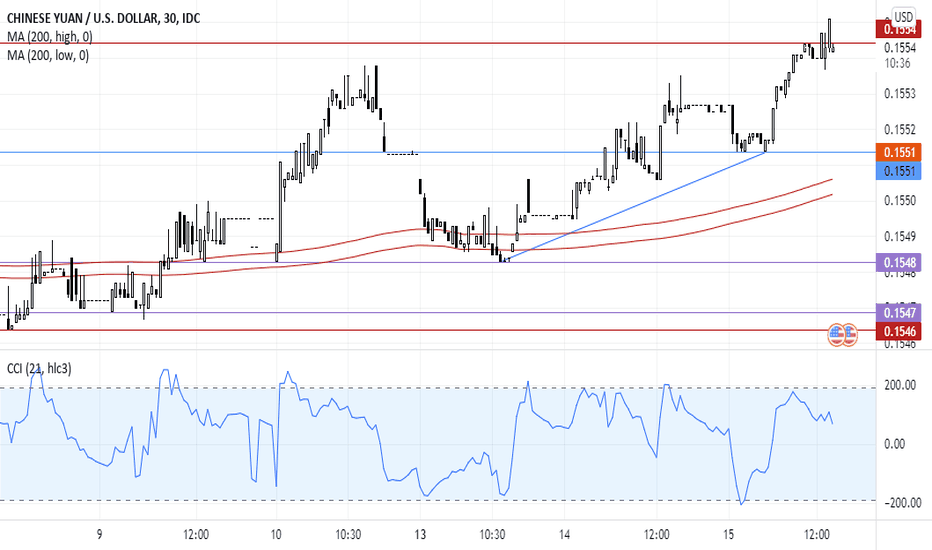

The currency pair of the Chinese Yuan against the US Dollar has started to rise by 3 points between the support line 0.1551 and the resistance line 0.1554, and this is an identical reaction to the continuation pattern of the ascending triangle. On the other hand, the Chinese Yuan may reverse its trend and start decline against the rise of the US Dollar; due to the...