Ryany88

EssentialLooking at this current H4 leg trending down, we have levels of H4 supply to come test with some gaps that need filled. We have high impact news incoming, my trading ideas are to follow what I see, we have a H4 demand level from the left which has deeper levels of daily demand with draws of liquidity in the form of lows and equal lows. My idea is that we clear...

We are now within our daily demand zone after purging liquidity, after our sell off from silt supply we still haven’t seen price respect a H4 level of supply, I would like to see price pullback for us to consider shorts from this area of interest. We can see that M15 OF is still chained bearish in order to look for longs we need to see supply fail and demand...

Good morning ladies and gents, today on GU I’m a bit unclear, we seen our sell off from daily supply taking out levels of H4 demand, however we still haven’t tested H4 supply to confirm our H4 trend reversal, technically we could turn bullish again. We are now are a level of H4 demand, we could continue to break this level and take out the daily low which...

1. we have taken out a level of H4 demand, however to confirm our new bearish intent we need to see a H4 level of supply hold this being our first level of respect. 2. at the current moment M15 structures are chained bearish showing us the desire for price to continue lower, we do have further H4 gaps below with H4 demand as our potential targets so we could...

We are in a key level of daily supply, we should becareful as this is where we could see a shift in the H4 from pro trend bullish to bearish, this is given that it is the first level of daily supply we have come into since breaking/sweeping the daily low. The H4 structure is still intact as bullish, we could react from these levels of H4 demand with gaps resting...

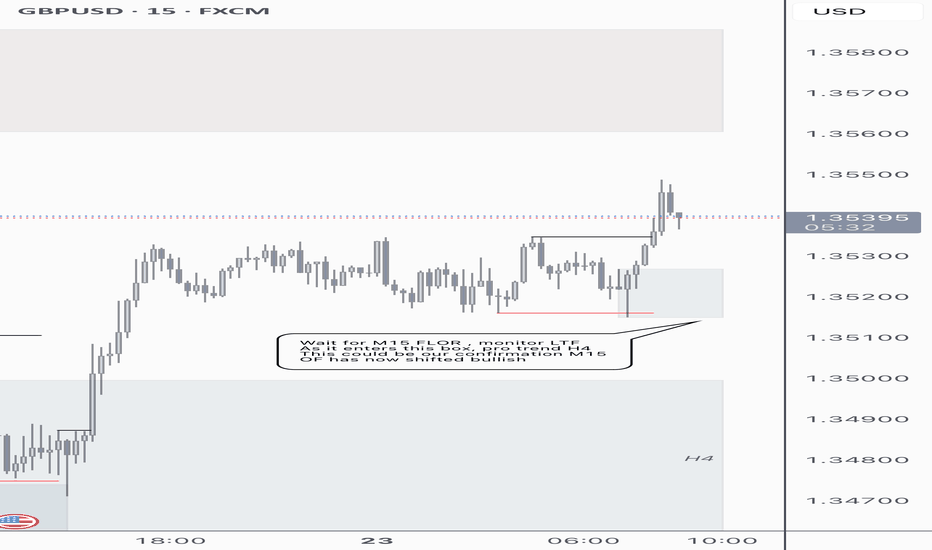

Yesterday our OF changed on the M15 aligning with the H4 trend, I have established H4 as bullish, at the moment in the M15 we have swept a low and broken supply so I want to monitor price as it comes back into my M15 demand in order to look for longs where we start to see LTF OF align with the M15 and H4 trend

Today I’m looking at potential shorts into the H4 demand zone, we have seen H4 supply break after taking a HTF level of liquidity as marked out by my red line, now I’d like to see H4 demand being respected as our FLOR (first level of respect) to continue higher. Intraday il be wanting to see if the M15 demand fails then supply is retested to look for short...

We have sold off clearing nearly all the liquidity from the previous bullish leg, we still have a very tiny FVG as marked, we could take the LQ into this FVG, clear and start to see bullish intention; im kind of confused as i see a bullish scenario from the previous bullish leg but also a bearish scenario from the current front leg. Zones I will be looking...

We are coming up for bitcoin halving supposed to happen sometime around this month, we have broken some immediate structure to the left with a sweep of liquidity (as identified in the red circle) however we could use this liquidity to come lower, i have marked a couple zones where i think buys could be valid i will check intermitently and see when the lower...