SMGBTrades

PremiumNASDAQ:MSTR multi-month base, higher lows, 50-sma reclaim, relative tightness up the right side on reduced volume, RS 98, 40% institutional ownership

NASDAQ:PLTR higher lows, 50-sma reclaim, had obeyed the 50-sma for multi-month move with few undercuts and reclaims, relative tightness up the right side, RS 99, extra rocket fuel with recent news catalysts, 49% institutional ownership Potential resistance on the earnings gap up to be aware of

CRYPTOCAP:BTC forming a range and getting tight with lower than average volume, under a rising 150/200 MA (could be resistance). Shorter term MAs looking to cross 10/20. Will keep my eyes on NASDAQ:IBIT and CBOE:BITX if this range breaks in either direction

Watchlist for this week. Most have two tight days and higher lows Above $20, ADR of 3%+: NASDAQ:PLTR NYSE:IONQ NYSE:BROS NASDAQ:FTNT NYSE:OKLO NYSE:RBRK NYSE:TOST NYSE:SNOW Below $20, ADR of 3%+: NASDAQ:RKLB NYSE:QBTS Thematic: NASDAQ:AAPL NASDAQ:AAPU NASDAQ:NVDA NASDAQ:NVDL AMEX:SOXL

Great example of continuation set-up on MSTR in 2024. Capturing the second leg following a shorter consolidation after digesting the first leg.

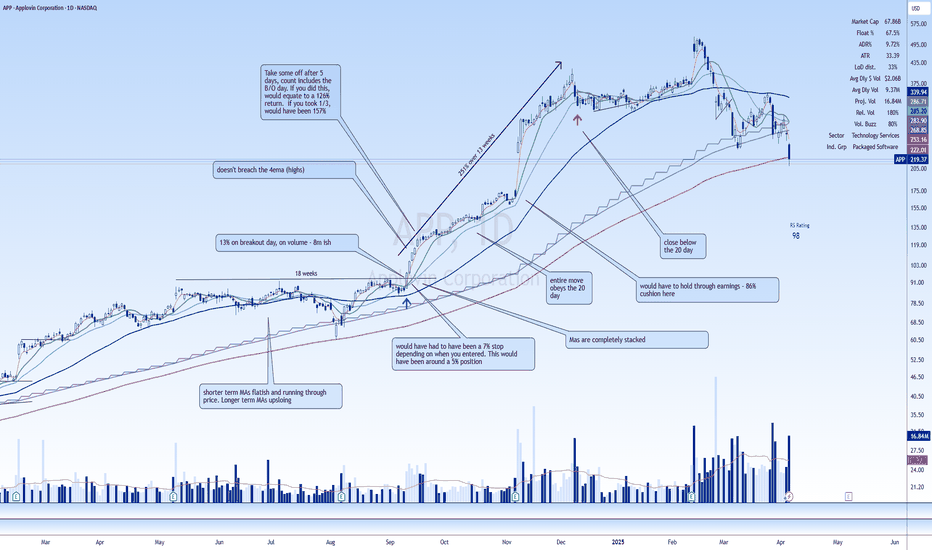

Consolidation breakout on APP in 2024. Ticks all the boxes - proper range break breakout on volume, MAs stacked, volume dry up in base, obeys the 20day on run-up.

NYSE:ESMT Almost a 2 yr trading range and flagging out as a continuation play. Will keep an eye on.

Evalu. Date: 13-May-23 Trade Type: Consolidation (needs volume) MA Surf: 20 & MA convergence Move 15%+: Yes Angle 45ish: Yes ADR >4%: Yes Higher Lows: Yes Consol. >=5 bars: Yes 2+ Tight Closes: Yes Stop less than ATR: Yes Linearity: Yes Dly ASX:VOL Criteria: Yes Vol Dry-Up: Yes

- MA confluence on pullback - High RS - High ADR - Higher lows in base - Biotech

- Very tight right side - MA confluence - High RS - High ADR - Oil and Gas

- Big initial move right of out the gate - ~1 month consolidation - Confluence of MAs - New Momentum - High ADR - Pharma

- Massive move 2,000%+ - Obeyed 20 MA for entire move - Sitting back on 20 MA - High ADR - Tight right side - Biotech

- Run up and settle - Sitting on 5MA - High RS - High ADR - Biotech

NASDAQ:BBIO tight action. Pharma has been popping as of late - hopefully that continues. Anticipation set-up.

NASDAQ:DUOL setting up. Continuation set up looks good for this week.

NASDAQ:XPON tight coming into the 50 day. Nice run and holding tight.

Tight Action on $UNCY. Massive run up on big volume and holding level.

$FSLR later stage base but right side tight again. May take a stab at it.