SPYder_QQQueen_Trading

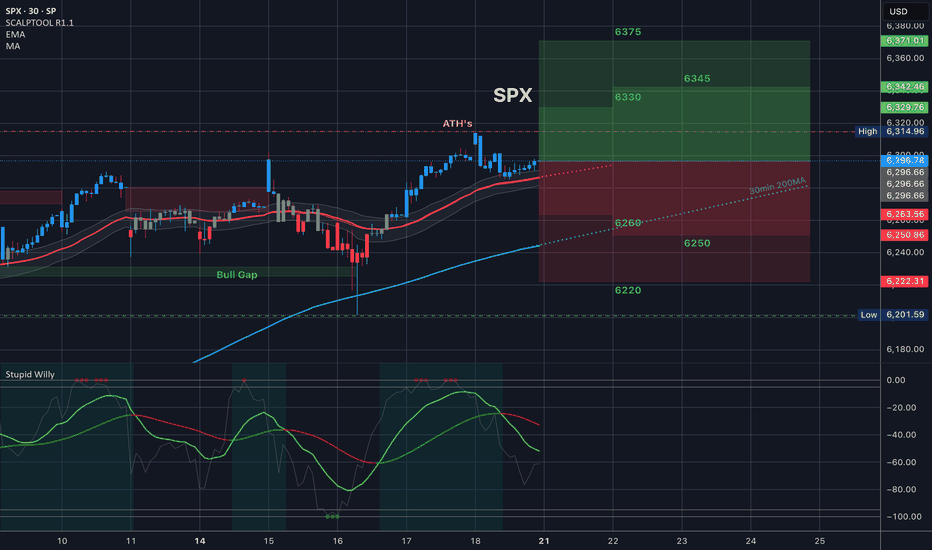

EssentialIt is time. For SPX today I sold SP:SPX 6420/6435 bear call spreads here. First order filled for 7.20, Back up orders at 6430/6445.

AMEX:SPY SP:SPX 5777 Target for end of August What do you guys think here?

574/576 Bear call spreads at open? Yes please. You know that those filled for 1.00 risk/1.00 reward - it was glorious. Closed up 100%

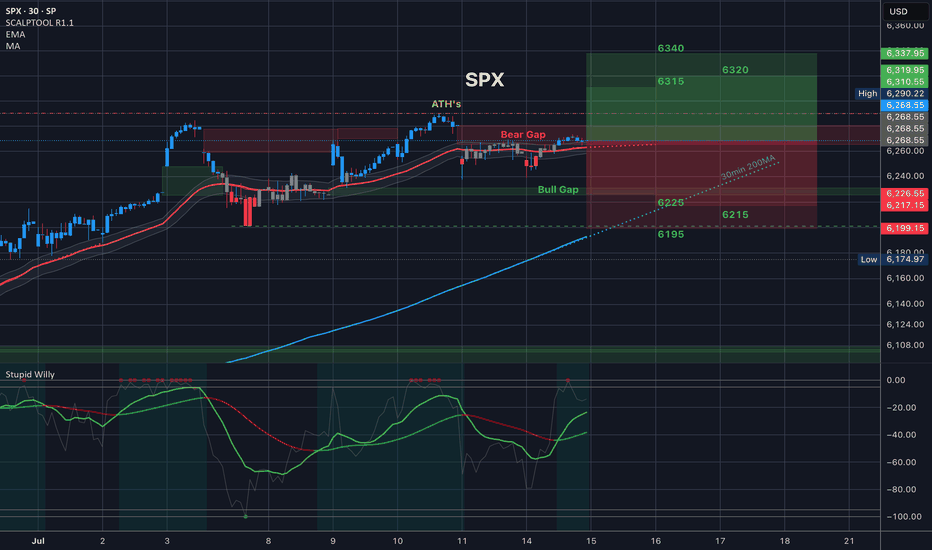

This is how last night’s members chart played out and it was amazing. We opened at the top of the implied move and all of the spreads at the top paid as we dropped back to the 30in 200MA The spreads I took at 6420/6435 but every spread shown here would have done well.

This is how last night’s members chart played out and it was amazing. We opened at the top of the trading range and all of the spreads at the top paid as we dropped back to the 30in 200MA

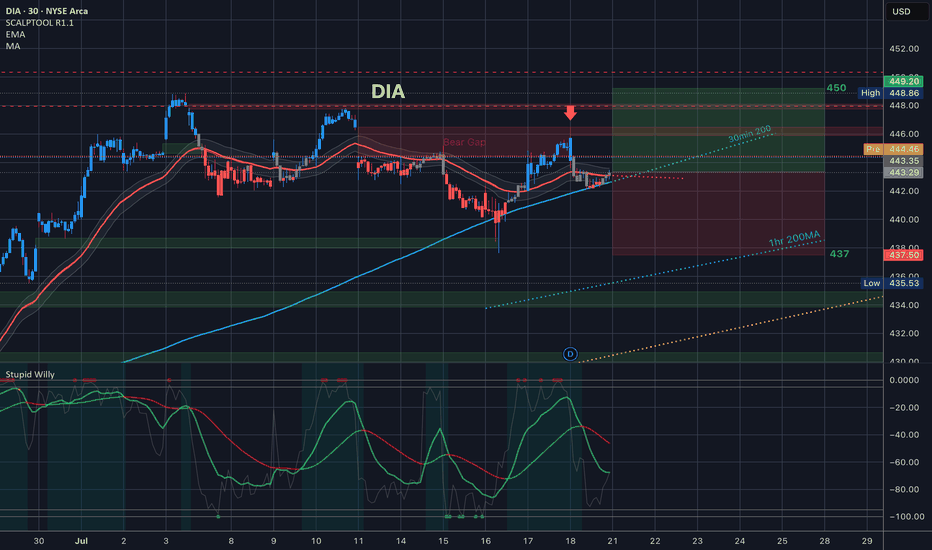

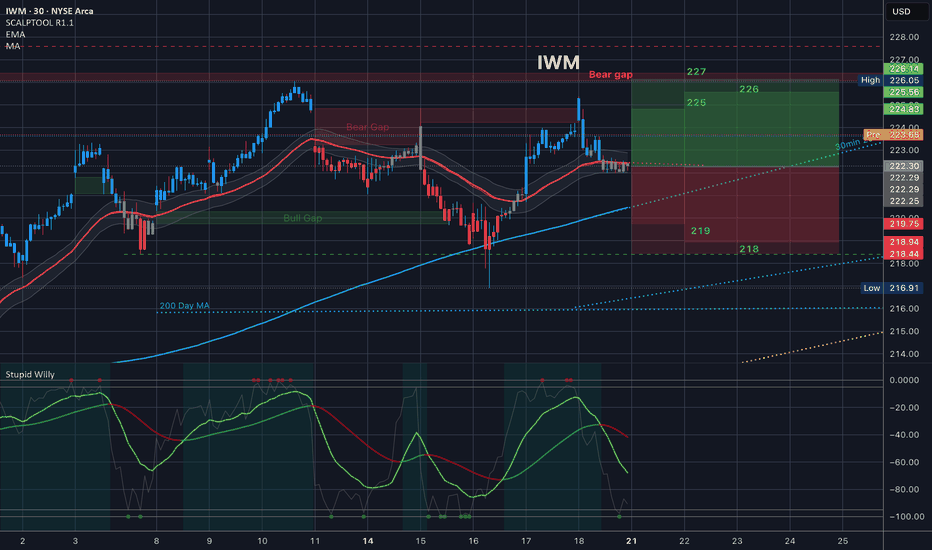

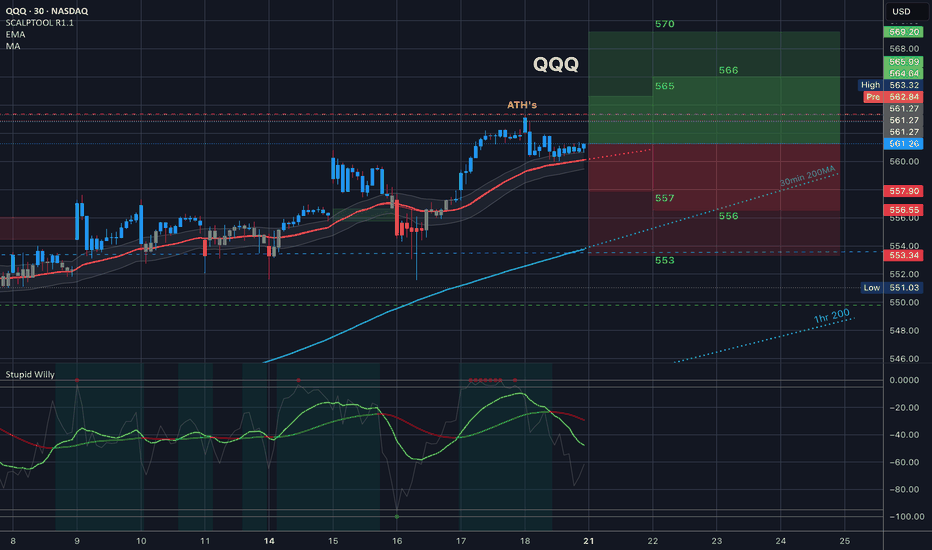

This is the trading range for the week and everything in it. How are you playing it?

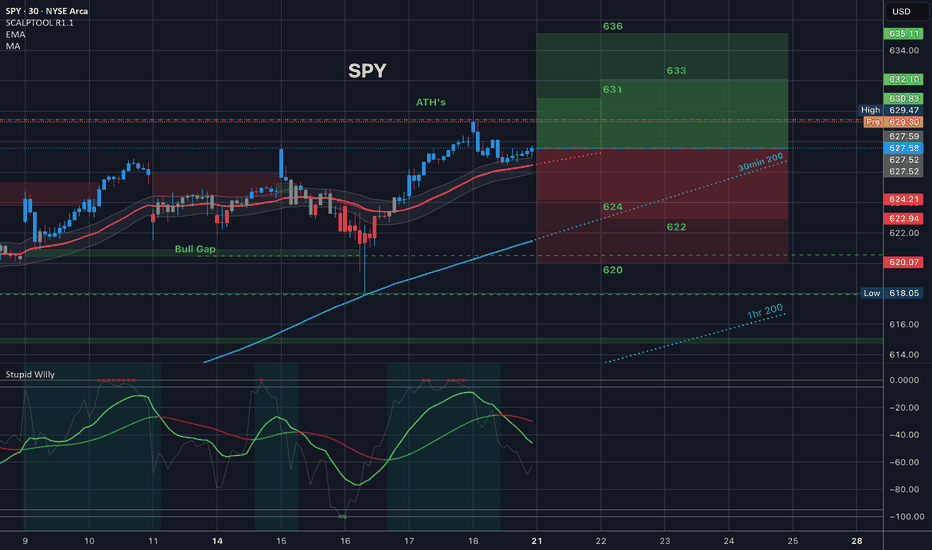

Today’s Trading range and everything in it. How are you playing it?

Today’s Trading range and everything in it. How are you playing it?

Today’s Trading range and everything in it. How are you playing it?

Today’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range for CPI inflation data and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. We have CPI in premarket tomorrow. This is the trading range. let's go.

Tomorrow’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. How are you playing it?

Tomorrow’s Trading range and everything in it. How are you playing it?