It wasn't that long ago that Dr. Burry tweeted about bitcoin head and shoulder pattern from the first bitcoin peak. Another bearish head & shoulder pattern has just broken the neckline on the right shoulder. This pattern on the daily fits closely with a larger Wyckoff / Fibonacci pattern I have been charting last year. Bearish sentiment and rotation to...

I don't know about you, but I got the Saturday Night Fever for VIAC. Since Archegos made its fatal misstep, VIAC has been under short pressure from the Shylock. Tax harvesting has relieved some of that pressure from shorts. Add market sentiment shifting to risk off appetite, We will likely see a retro stock like VIAC back in fashion this year. I'm not...

I had some great trades this month around the santa rally and FOMC. Thanks in large part to the great communities in and around fintwit / tradingview. Thank you all. I’m enjoying learning from all you experienced traders and macro analysts. Below is a review of some of my charts and analysis from the past month: The month started off with a very bearish...

Just about a year since gamestop so I thought I would update my visuals and post my charts for GME in review. My first chart was June 8 and I was learning how to chart triangles. The next chart I created was another sym triangle breakout. you can see how well that 250 price was a hard resistance. I started to expand my chart analysis to Wyckoff and found...

You can't throw a cpu chip without hitting someone that is complaining about how the market is overvalued. You just need to look at the buffet indicator to see the total market is over x2 overvalued. What most people are not looking at is why. This idea attempts to highlight semiconductors influence on the overall market and expansion of the options market...

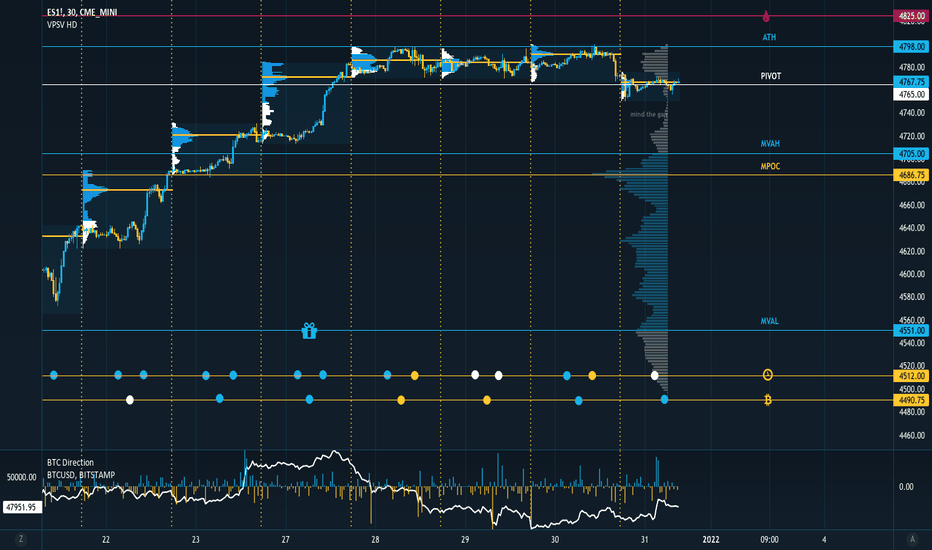

Past couple days have been mixed signals bringing the santa rally to new highs over night. The 20d 2std resistance was rejected at 4807.50 early this morning. I'm looking for support around 4786.75, yesterdays VAH, where I'm looking to enter a trade as low for the day and a break trend from another lower low. Should that trade stop out, I'll be looking to pivot...

Trade I'm looking for this morning. Overnight futures tapped the top of the 20d MA ~2std resistance. Looking for a retest of 478 to buy Jan5 480c Missed the entry yesterday, but the look of futures this morning there will be another chance.

Quick update on the market profile chart today. Some advice I picked up this weekend was to keep an eye on the AUDJPY carry trade so I added AUDJPY as a dot plot this morning. Gap up on futures last night and 3am BTD bought in but seems to be selling off into the Open. I set some targets for Bull/Bear outcomes for January Short term, I'm watching if...

Experimenting with Pines Script. The idea is to plot circles and lines where volume accumulates to generate a volume & support/resistance profile of the security. Some other ideas I plan to include are put/call ratio, volatility and skew for a total picture of where support and resistance will be found.

This chart is a general overview of the SPX for the past year, broken into quarters with a few croissant crumbs in it. Either bull or bear should respect the 20d MA and 2 standard deviation channel above and below. It is to help me measure risk and how well my trades will perform. If I’m buying short-term calls outside the blue line after DEC 28th, it's probably...

I could sense there was a correlation between SPX and BTC almost the entire month but couldn't explain it. It would seem they both have large options gamma pinning both of them to 4800/48,000 that expire today. Don't look now. Their prices are almost identical. I'm planning on doing a lot more research on it this weekend. We'll see how it plays out by the end...

Trading would be completely boring if there wasn’t a fintwit argument over market effects. Leading up to this week it was all about the santa rally which was muted the past week by a pinning effect of significant gamma in SPX expiring around the 4800 mark. The only topic of interest seems to be around the JPM quarterly collar trade. I recently pointed out a...

Not very much happening in terms of a continuation to the Santa Rally. We did see BTC recover from its recent decline and the 3am BTD brought the futures positive. VIX has been tame. Not much up. Not much going down. Slow grind to 4800 until DEC31. Consolidation. Theta Grind. It's a waiting game.

I’m really excited about the new year. In less than a month will be my first year anniversary since deciding to get involved in the stock market and learning to trade. But more importantly, it will be the anniversary of GameStop! Tickers like GME and AMC have evolved and thrived on the hope of a better tomorrow rather than succumbing to the oppression of...

Cautious Optimism best describes my feelings about how this santa rally will end. Santa Musk continues to mess with shorts as he unwinds his options Tranches. Is he done yet? who knows, but it's fun to watch. As for futures, a fairly balanced day yesterday. After the bull run we had, one should expect a cooling off period. If RSI on the 4hr bounces off 64.5...

TSLA goes up. Elon Sells. TSLA goes down. Elon Sells More. TSLA gets short squeezed to infinity. Elon Sells More. Stop trying to guess. Just buy the stock. A track record of success. He is literally going to the moon... Then Mars Lez Go.

Volatility Contraction Pattern Trade Closed I closed my Volatility Contraction Pattern trade yesterday before closing. 1 reason was that bitcoin started selling off at 12pm, and I’ll get to the reason later. SANTA RALLY Dec27 to Jan 3rd The Santa rally that started early (DEC20), continued into the overnight as the 3 am Buy the Dip crew continued...

Last week was a great week if you were a bull. TSLA and SPY squeezed past a bear market despite overwhelming fear and uncertainty. Santa Musk continues to sell past the original 10B he said he would, early speculation is he is at 15B and will continue to unwind . We could see more short squeezes as a driving factor. I've noticed a pattern start to emerge...